Who can sign primary accounting documents

The list of persons who have the right to sign primary accounting documents is approved by the head (clause 14 of the Regulations on accounting, approved by order of the Ministry of Finance dated July 29, 1998 No. 34n; information of the Ministry of Finance No. PZ-10/2012).

The chief accountant may not be included in the specified list. If the list of such persons is not approved, this means that only the manager must sign all primary accounting documents.

And this does not contradict any norms, because:

- accounting (financial) statements are considered prepared after they are signed by the head of the economic entity (Part 8, Article 13 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”). The signature of the chief accountant is not mandatory;

- tax reports (declarations) submitted to the tax office are signed either by the head of the organization or an authorized representative of the organization (citizen or other organization);

- invoices issued both on paper and electronically must be signed by the head of the organization. A paper invoice is signed by the chief accountant, but the Tax Code of the Russian Federation allows the right of signature to be transferred to other persons (Article 169 of the Tax Code of the Russian Federation).

The job description of the chief accountant, however, must indicate what documents he has the right to sign. As a rule, these are accounting registers, accounting certificates, internal reporting, etc.

The right to sign is transferred on the basis of an order for a company or a power of attorney on behalf of the organization (clause 6 of article 169 of the Tax Code of the Russian Federation, part 3 of article 14 of the Federal Law of April 6, 2011 No. 63-FZ “On Electronic Signature”).

Read in the berator “Practical Encyclopedia of an Accountant”

Mandatory details of accounting documents

In what cases does this raise questions?

If there is a position of chief accountant in the staffing table and such an employee works in the organization. When the document contains two visas and the manager’s signature is on both positions, inspection agencies and partner companies have questions. Such documents include invoices and delivery notes.

If counterparties ask to redo the papers, then regulatory authorities in most cases will require evidence of the legality of such actions. To deduct VAT, you must send to the Federal Tax Service the original invoice signed by the chief accountant (clause 6 of Article 169 of the Tax Code, letter of the Ministry of Finance No. 03-07-09/42854 dated 08/27/2014). To confirm the right of one signature of the director for the accountant, it is necessary to submit a special order. Otherwise, you will have to go to court and prove that you are right.

If a managerial person performs the functions of a chief accountant, then a deduction on an invoice signed by the same person will be accepted (resolution of the Federal Antimonopoly Service of the North Caucasus District No. F08-6533/2008 in case No. A53-2656/2008-C5-14 dated 10.29. 2008, resolution of the Federal Antimonopoly Service of the North Caucasus District in case No. A53-17547/2008-C5-23 dated 06/03/2009).

Who can be an authorized person

An authorized representative of the company may be:

- employee of the organization, including the chief accountant;

- an employee or manager of a company who is an authorized representative.

The authorized representative is vested with the authority to represent the interests of the company in tax legal relations (Article 27, paragraph 3 of Article 29, paragraph 5 of Article 80 of the Tax Code of the Russian Federation).

From January 1, 2022, the authority to receive an electronic signature for signing documents and reporting on behalf of the company is removed from the authorized representative. This right remains only with its director or another person who can act on behalf of the organization without a power of attorney. This is provided for by Federal Law No. 476-FZ of December 27, 2022 (amended to Article 18 of Law No. 63-FZ).

How to obtain credentials

If, when transferring powers and taking office, the manager assumed not only his immediate responsibilities, but also accounting, he has the right to endorse all categories of documents independently. A separate power of attorney or order is not required for this.

In the same way, the right of an individual entrepreneur to sign for the chief accountant is established: if his commercial activities do not provide for the presence of a chief accountant, the financial documentation is signed by the entrepreneur or his authorized representative (clause 3 of Article 7 402-FZ of December 6, 2011).

Bank documents

The chief accountant may not have the right to sign bank documents (clauses 7.5, 7.6 of the Bank of Russia Instruction No. 153-I dated May 30, 2014).

The right to sign them belongs to the sole executive body of the client (the head of the organization). This right can also be granted to other employees - on the basis of an administrative act or power of attorney.

Legal entities draw up a card in form No. 0401026, which is approved by Instruction No. 153-I.

A card with sample signatures and seal impressions is filled out when opening a current account. It is valid until the bank account agreement is terminated or until this card is replaced with a new one.

You will have to change the card in the following cases:

- replacement or addition of at least one signature;

- replacement or loss of seal;

- changing the full name of the person indicated on the card;

- changing the name, organizational and legal form of the organization;

- early termination or suspension of powers of management bodies.

Thus, hiring a chief accountant without the right to sign will not affect the bank card in any way.

If, in the event of the director’s absence, such a right is granted to the chief accountant, he will first have to issue an order about this, and then replace the bank card during the director’s absence.

When does the director have the right to sign papers for the chief accountant?

The accounting law states whether the general director can sign for the chief accountant - yes, the general director has the right to endorse documentation for the chief accountant (Part 1 of Article 7 402-FZ). The head organizes accounting in the institution and has the right to sign all papers. These rights do not need to be further documented.

This is confirmed by the legislation on joint stock companies and limited liability companies. The regulations stipulate whether the director has the right to sign documents for the chief accountant - yes, the general director, without a power of attorney, acts on behalf of the organization and in its interests (clause 2 of article 69 208-FZ of December 26, 1995, clause 3 of article 40 14 -FZ dated 02/08/1998). That is, the sole executor has the right to issue orders and sign any documentation of the organization, including accounting.

The General Director has the right to sign all organizational papers. The Civil Code stipulates whether the chief accountant can sign documents for the general - not always (Clause 1 of Article 845 of the Civil Code of the Russian Federation). The chief accountant has the opportunity to sign the invoice by proxy or order granting the right to sign. But the chief accountant does not have the right to sign financial and settlement documents - only the second signature is available to him. Payment orders and settlement papers are the first to be endorsed only by the general director (Instruction of the Central Bank of the Russian Federation No. 28-I dated September 14, 2006, letter of the Association of Russian Banks No. A-02/5-245 dated May 14, 2007, letter of the Central Bank of the Russian Federation No. 31-1-6/1244 dated June 14, 2007).

Manager's right

It is a well-known fact: the right of the head of an organization to sign documents is absolute. To confirm it, no additional powers of attorney or orders are needed. It is enshrined in a number of federal laws and regulations. Here are some of them:

- Federal Law-14 “On LLC” speaks about this in Art. 40-3. The manager can, among other things, make transactions on behalf of the Company, i.e. sign not only internal, but also external documents. Here it is also appropriate to recall Art. 53 of the Civil Code of the Russian Federation, from which it follows that contracts on behalf of the company are signed by its management.

- Federal Law-402 “On Accounting” in Art. 9 says that one of the required details of the primary document is the signature of the person who made the transaction. The regulations on accounting and reporting, approved by Order No. 34n dated July 29, 1998, directly assert the right of the manager to conduct personal accounting, in case of controversial situations, make sole decisions regarding accounting, and also approve the list of persons authorized to sign accounting documents (v. 14), i.e. in fact, he may reserve the right to sign them alone.

However, managers often delegate their signing rights to other employees or third parties. In the company, according to Art. 65.3 clause 3 of the Civil Code of the Russian Federation, there may be several managers. In such cases, the right of first signature and division of powers is prescribed in the Charter.

How to fill out a sample signature card for a bank?

What to do if your document contains two visas

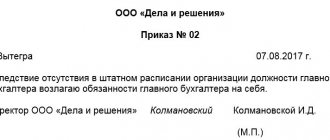

The authority to sign organizational documentation is determined by the constituent documents and orders. 402-FZ specifies what to do if the director and chief accountant are the same person, how to sign documents - it is required to issue an order stating that the general director takes over the accounting (clause 3 of Article 7 402-FZ).

In this case, there will be no problems with signing reports. Accounting reports are accepted if you have a manager’s visa (Article 13 402-FZ, Resolution of the Arbitration Court of the Far Eastern District No. F03-6116/2018 in case No. A73-8993/2018 dated 02/05/2019). The chief accountant does not sign the balance sheet and other final forms (Order of the Ministry of Finance No. 57n dated 04/06/2015). Only the general director signs the tax returns. And on the card of sample signatures for the bank, a dash is placed next to the details of the second person.

About the author of the article

Zadorozhneva Alexandra

Accountant

In 2009, she graduated with a bachelor's degree from the Faculty of Economics of Southern Federal University, majoring in economic theory. In 2011, she completed her master’s degree in Economic Theory and defended her master’s thesis.

Other articles by the author on gosuchetnik.ru

How to transfer signing rights

Responsibilities for accounting procedures are assigned to the manager in the employment agreement or job description attached to it. The question arises whether an order is needed for the general director to sign all types of documents for the chief accountant. There is no strict algorithm established by law. As a general rule, an administrative act should be issued to assign the duties of the chief accountant to the manager. If the head of an individual entrepreneur or a person engaged in private practice keeps records independently, a separate administrative act or power of attorney for actions is not required - clause 2 of Art. 7 Federal Law No. 402. Such entities sign papers independently in the absence of a chief accountant position.

If there is a chief accountant in the institution and the first person needs to sign settlement papers instead of him, an order should be developed to give the director the right to sign for the chief accountant and approved. The local administrative act includes the following details:

- date, number;

- list allowed for visa;

- grounds for redistribution of powers;

- reference to legislation;

- Full name, position of the employee who has the right to sign, that is, the manager.

If there is a need to sign papers in reverse format, can the chief accountant sign documents for the general director? Such cases arise if the manager is on vacation, a business trip, or absent due to illness. An administrative act must be drawn up.

The administrative act is signed by the first person of the enterprise.

Documents for days when the chief accountant was on vacation or sick leave

Documents that an accountant signs while on vacation or sick leave can be accepted for accounting and tax purposes. The chief accountant is not required to work during rest or illness. But no one suspended him from work. Therefore, the powers of the chief accountant will remain, even if the responsibilities are transferred to another employee. This means that the documents signed by the chief accountant will be legal (appeal ruling of the judicial panel for civil cases of the Supreme Court of the Republic of Sakha (Yakutia) dated January 14, 2015 No. 33-4778/2014).

But other dangers arise for the company. Labor legislation prohibits involving an employee at work during illness or vacation. Violations may result in a fine of up to RUB 50,000. (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). And in the case of sick leave, they will also reduce the chief accountant’s disability benefits.