To account for VAT calculations, use account 68 “Calculations for taxes and fees” and account 19 “Value added tax on acquired assets”. A special subaccount 68.VAT is created for account 68. The credit of this account records accrued VAT, and the debit reflects the tax paid and amounts reimbursed from the budget. Account 19 in accounting is used to reflect input tax received from suppliers, but not yet reimbursed from the budget. Sub-accounts are also opened for account 19 “Value added tax on acquired values” depending on the type of values received.

VAT postings. Basic Rules

Enterprises in their economic activities face VAT when selling products, goods, providing services, performing work to their customers and contractors (and then it is necessary to charge VAT on their cost), as well as when purchasing goods, works, services from suppliers (taking VAT as a deduction ).

In general, VAT calculation on sales will look like this:

Debit 90 Credit 68 (if account 90 “Sales” was used when selling the asset).

Debit 91 Credit 68 (if the sale was carried out through account 91 “Other income and expenses”).

As we can see, VAT payable to the budget actually accumulates in the credit of account 68.

When we purchase a product, we have the right to reimburse the tax from the budget. In this case, the rules for accounting for VAT are as follows: the tax is allocated from the purchase amount and is accounted for in account 19 “VAT on purchased assets.” The wiring looks like this:

Debit 19 Credit 60 - VAT on purchased assets is reflected.

Debit 68 Credit 19 - VAT is deductible.

Thus, the refundable VAT is collected in the debit of account 68. And as a result, the amount of tax to be transferred to the budget is formed, defined as the difference between debit and credit turnover on account 68: if credit turnover is greater than debit, then the difference must be transferred to the budget, if vice versa - the difference is subject to compensation by the state.

We talk about typical transactions related to the deduction of VAT in the special material “Posting “VAT accepted for deduction”: how to reflect it in accounting?” .

Return selected

In a situation where the decision to refuse compensation is declared invalid by the court, the company has the right to return the interest paid. Although controllers do not agree with this opinion. In letter No. 03-07-08/281 of the Ministry of Finance of Russia dated September 27, 2011, officials considered the situation when, according to the application procedure, an enterprise received the amount of VAT from the budget. However, based on the results of the audit, the Federal Tax Service decided to refuse a tax refund and charged interest on this amount, which was paid by the company. Subsequently, this inspection decision was canceled by the higher-ranking Federal Tax Service, and the money was transferred back to the company’s account, but without withheld interest, since the Ministry of Finance explained that the return of fine amounts is not provided for by tax and budget legislation.

However, one can argue with civil servants. The fact that there is no regulation in the code for transferring interest does not mean that the company cannot receive it. To achieve justice, the organization will have to go to court again.

Typical VAT entries for purchased assets

VAT on purchased assets and services is accounted for using the following entries:

Debit 19 Credit 60 - reflection of the “input” VAT on purchased fixed assets, intangible assets, materials, goods, capital investments, works, services. Posting is done based on the received invoice.

Debit 68 Credit 19 - reflection of VAT deductible on inventories and services, including in the case of confirmation of the fact of export. Posting is done on the basis of invoices, and when confirming exports, after submitting the documents listed in Article 165 of the Tax Code of the Russian Federation to the Federal Tax Service and receiving the appropriate decision.

See also “What are VAT tax deductions?” .

In some cases, “input” VAT cannot be deducted.

For more information about situations when VAT deduction is impossible, and how to take it into account for tax purposes, read the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

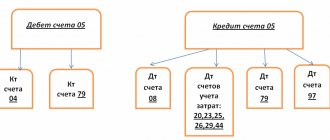

In accounting, tax that is not deductible is written off to cost or financial results accounts:

Debit 20 (23, 25, 26, 29, 44) Credit 19 - write-off of VAT on acquired assets and services that will be used in transactions not subject to VAT. The posting is made on the basis of an accounting calculation prepared by a certificate.

Debit 91 Credit 19 - write-off of VAT on other expenses if the invoice from the supplier was not received, lost or filled out incorrectly.

See also the material “What are the grounds and how to write off VAT on 91 accounts?” .

Debit 20 (23, 29) Credit 68 - restoration of VAT previously claimed for reimbursement of inventories and services used for transactions not subject to VAT. The basis of the posting is again a reference calculation.

For reasons for VAT restoration, see this material.

If you have made an advance payment to the supplier, you can see what transactions should be made for VAT in the Ready-made solution from ConsultantPlus experts. Get a free trial access to K+.

Typical entries for accounting for VAT on sales

Debit 90 Credit 68 - VAT accrual on sales of assets, works, services. The basis of the entry is the outgoing invoice.

Debit 76 Credit 68 - accrual of VAT on advances received. The basis is an advance invoice.

Debit 68 Credit 76 - reflection of the offset of VAT on advances upon completed shipment (performance of work, provision of services). The basis is the issued invoice.

Debit 08 Credit 68 - accrual of VAT on construction and installation works carried out in-house. The basis is an accounting certificate.

Debit 91 Credit 68 - VAT accrual for gratuitous transfer of assets. The posting is made on the basis of the issued invoice.

Debit 68 Credit 51 - VAT debt has been repaid. The basis is a bank statement.

If you have received an advance from the buyer, you can see what entries should be made for VAT in the Ready-made solution from ConsultantPlus experts. Get a free trial access to K+.

Reflection of advance transactions in the declaration: postings, restoration

In accounting, VAT is charged on the advance received from the buyer using the following entries:

To reflect the accrual of VAT on advance payments, the chart of accounts provides a subaccount “VAT on advances received (prepayments)” to account 62 “Settlements with buyers and customers” and account 76 “Settlements with various debtors and creditors”. This allows:

- keep in accounting data on advances received and VAT on them (according to Kt 62, 76);

- in the balance sheet, reflect the amounts of advances received (excluding VAT, accounted for on the Dt of the relevant accounts) as accounts payable.

Please note that the previously received advance payment at the time of sale of goods (services or work) is counted towards the prepayment amount. An invoice is issued for the shipped product (service or work). On the date of offset of advances, the company accepts for deduction VAT on advances received. Please note that the deduction is made in the amount of tax calculated on goods (services or work) shipped for which advances were received. It is understood here that if VAT on advances is charged at a rate of 20/120%, and the product (service or work) is shipped at a rate of 10%, then VAT on advances received is credited at a rate of 10/110%.

In the VAT return, the advance received is reflected in section 3 on line 070 in column 3, and the amount of tax on the advance is reflected in column 5.

The deduction of VAT on advances received is reflected in section 3 of the declaration on line 170 in column 3 for the tax period in which the goods were shipped.

Reflection in accounting of VAT on the advance paid to the supplier is reflected by postings.

Account 19 is used for the purpose of separating VAT from an advance, when the issuance of an advance and the deduction of VAT are separated in time. If advance VAT on the reporting date is not accepted for deduction, then the tax reflected in account 19 is recorded in the balance sheet as a current asset separately from the “receivables” for the transferred advance payment.

To separate VAT from advances issued, you can use separate subaccounts “VAT on advances issued (prepayments)” to account 60 “Settlements with suppliers and contractors” or to account 76 “Settlements with various debtors and creditors”. Thereby:

- the accounting stores data on advances paid, including VAT (according to Dt 60, 76);

- the balance sheet shows “receivables” (minus VAT accounted for in the KT of the relevant accounts) in the form of advances issued.

VAT on advances received, accounted for under Dt 62-VAT (76-VAT), is not indicated in the balance sheet, as well as VAT on advances issued, accounted for under Kt 60-VAT (76-VAT). In the balance sheet, tax amounts are reduced by the “debtor” in the form of advances issued and the “creditor” in the form of advances received.

Reflected in account 19 from the advance VAT issued, which was not accepted for deduction by the end of the reporting period, must be included in the balance sheet. This VAT is indicated in line 1220 “VAT on acquired assets.”

Advances issued are not reflected in the VAT return, but the tax on these advances accepted for deduction is indicated in section 3 on line 130.

Please note that for the advances listed by the suppliers, the buyer acts according to the following scheme:

1) receives an invoice for the advance payment, records it in the purchase book, and accepts the advance VAT for deduction;

2) after shipment of goods (services, works), records the shipping invoice in the purchase book;

3) indicates the previously registered advance invoice in the sales book, thus recovering VAT from the advance payment issued.

Kontur.VAT+ allows you to avoid discrepancies in the quotas and reconciles invoices for transactions with advances for all quarters.

Find out more

Regarding the recovery of VAT from an advance received, the situation is as follows. The seller, having received an advance payment, charges VAT on it. Having sold the goods (service, work), he draws up an invoice for the sale and accepts VAT from the previously received advance for deduction. That is, in this case the term “restoration” is incorrect to use. The seller records an advance invoice in the sales book, and later, after shipment of the goods (service, work), an invoice for sales. At the same time, the seller registers an invoice for the advance payment in the purchase book, thereby deducting advance VAT. Oh, that is, the deduction, VAT on the advance received is not limited, the main thing is that the deduction is declared in the quarter in which all the conditions for the deduction are met.

If VAT is calculated by tax agents

Example 1. Lease of state property:

Debit 20 (23, 25, 26, 44) Credit 60 (76) - accrual of costs for renting state property.

Debit 60 (76) Credit 68 - VAT accrual from the tax agent.

Debit 19 Credit 60.76 - accrual of input VAT specified in the agreement.

Debit 68 Credit 51 - reflection of VAT transferred to the budget.

Debit 68 Credit 19 - VAT on rent to be refunded at the time of tax payment.

See the material “ Tax agent for VAT in transactions with state property ” for more details.

Example 2. Services provided by a foreign company on the territory of the Russian Federation:

Debit 44 (20, 25, 26) Credit 60 (76) - a reflection of services provided by a foreign company to a Russian organization in the Russian Federation.

Debit 19 Credit 60 (76) - accounting for VAT paid on the income of foreign legal entities.

Debit 60 (76) Credit 68 - VAT withholding from a foreign partner.

Debit 68 Credit 51 - VAT paid by the tax agent.

Debit 68 Credit 19 - VAT of the tax agent to be deducted after its payment.

See also the material “ How can a tax agent deduct VAT when purchasing goods (work, services) from a foreign seller .”

VAT on advances received

Flamingo LLC received an advance payment from the buyer in the amount of 98,000 rubles against the upcoming delivery of goods. The amount of VAT intended for restoration to the budget: 98,000 * 18/118 = 14,949 rubles.

VAT on advances received transactions::

| Dt | CT | Operation description | Amount, rub. | Document |

| 51 | 62 | Receipt of advance payment | 98 000 | Payment order |

| 76(advances) | 68(VAT) | VAT charged on advance payment | 14 949 | SF issued |

After the sale has taken place, that is, the goods have been shipped to the buyer, or after canceling the transaction and returning the advance payment, this VAT can be deducted.

VAT on transaction advances:

| Dt | CT | Operation description | Amount, rub. | Document |

| 68(VAT) | 76(advances) | VAT is presented for deduction to the budget | 14 949 | Book of purchases |

Typical VAT transactions when returning goods

From 2022, postings for returning goods depend on how the return occurs: within the framework of the original contract or as a resale under another contract, and does not depend on whether the goods returned are of high quality or defective.

If the item is returned under the original contract, the postings will be as follows.

Important! ConsultantPlus warns If you are returning a product for which “input” VAT was previously deducted, the tax must be restored. This is done on the basis of the seller's adjustment invoice or primary documents on the reduction in the value of goods shipped, whichever came first. See K+ for more details. Trial access is available for free.

From the buyer:

Debit 60 Credit 76 - adjustment of settlements with the seller.

Debit 76 Credit 41 - return of defective goods to the seller.

Debit 76 Credit 68 - restoration by the buyer of VAT previously accepted for deduction, attributable to the cost of the return.

From the seller:

Debit 62 Credit 90.1 - reversal of revenue.

Debit 90.2 Credit 41 - reversal of cost.

Debit 90.3 Credit 19 - reversal of accrued VAT on returned goods.

Debit 68 Credit 19 - deduction by the seller of VAT on the returned goods.

In case of reverse sale, taxation will be the same as for a regular sale, only the buyer and seller change places.

Example. Postings when returning goods of proper quality from ConsultantPlus The organization received 100 units of goods worth 120,000 rubles, including VAT - 20,000 rubles. Of these, 10 units were returned to the supplier for 12,000 rubles, including VAT - 2,000 rubles. You can view the entire example in K+, getting free full access.

VAT recoverable

Input VAT or VAT refundable (deductible) is the amount paid to the supplier as part of the purchased goods. In delivery documents, the tax amount is shown separately, on a separate line.

The same company purchases its goods from the supplier Panda LLC at a wholesale price. Let's assume that a batch of goods purchased earlier for the amount of 156,000 rubles was sold, including VAT - 23,797 rubles.

Posting for VAT reflection:

| Dt | CT | Operation description | Amount, rub. | Document |

| 41 | 60 | The received goods have been capitalized | 132 203 | Invoice |

| 19 | 60 | VAT allocated for deduction | 23 797 | Invoice received |

The following transactions are accepted for VAT deduction:

| Dt | CT | Operation description | Amount, rub. | Document |

| 68(VAT) | 19 | Amount claimed for deduction | 23 797 | Book of purchases |

In this way, you can calculate the amount of tax that Orion must pay to the budget. This amount is calculated as “VAT accrued” minus “VAT deductible”. This difference is equal to 36,000 rubles. — 23,797 rub. = 12,203 rub.