Documents to confirm the zero VAT rate

To confirm the zero VAT rate when exporting goods, the following documents are required (clause 1 of Article 165 of the Tax Code of the Russian Federation):

- a contract (a copy thereof) with a foreign person for the supply of goods outside the Customs Union;

- customs declaration (its copy) with the corresponding marks of the customs authorities;

- copies of transport, shipping and (or) other documents with appropriate marks from customs authorities.

This list of documents is exhaustive.

Registers of customs declarations

Starting from the fourth quarter of 2015, instead of transport and shipping documents, exporters can submit their electronic registers to the tax inspectorates. The forms, formats and procedure for compiling such registers are approved by Order of the Federal Tax Service of Russia dated September 30, 2015 No. MMV-7-15/427 (hereinafter referred to as the Order) (Part 4 of Article 3 of Federal Law dated December 29, 2014 No. 452-FZ).

“Electronic” registers do not replace all documents that must be submitted to confirm the application of the zero VAT rate. In particular, a contract with a foreign company for the supply of goods must be submitted on paper (Clause 19, Article 165 of the Tax Code of the Russian Federation).

In addition, during a desk audit, the tax inspectorate has the right to request transportation documents, information from which is included in the registers. And also request the necessary documents if the information on export operations received from customs authorities does not correspond to the data contained in the “electronic” registers. Documents will need to be submitted within 20 calendar days after receiving the request. They must have Russian customs marks (clauses 15–18 of Article 165 of the Tax Code of the Russian Federation). If the exporter has not fulfilled the inspection requirement (in whole or in part), the justification for applying a 0 percent tax rate in the relevant part is considered unconfirmed.

At the moment, 14 registers have been approved, depending on the type of export transactions performed (clause 15 of article 165 of the Tax Code of the Russian Federation, clause 1 of the Order). Each register is “linked” to the corresponding subparagraph or paragraph of Article 165 of the Tax Code of the Russian Federation, as one of the documents confirming the right to apply the zero VAT rate.

The “electronic” register must contain information about the size of the tax base to which the zero VAT rate applies. The tax base is determined for each transaction, confirmed by documents, the details of which are reflected in the register.

What is a certificate of conformity and when is it needed?

A Certificate of Conformity (CC) is a document issued by a specially accredited body based on the results of laboratory tests. In other words, this is evidence that the products comply with the declared technical regulations and quality standards. The presence of a certificate of conformity for a particular product is a guarantee of its safety for the consumer. But not all products are subject to mandatory certification. The list of items for which this document is required is specified in the Decree of the Government of the Russian Federation No. 982 dated December 1, 2009 “List of goods subject to mandatory certification and declaration.”

It is necessary to certify goods not only for their legal sale, but also for smooth customs clearance.

A document of equal legal force—a declaration of conformity (DC)—is also drawn up to confirm product compliance with established standards. The register of declarations of conformity of the Eurasian Economic Union allows you to check its availability. But there are some differences in these documents:

- the certificate is issued on a special form, and the DS is on A4 sheet. Both of them have registration numbers and their data is entered into the electronic register of RosAccreditation;

- Both documents are stamped and signed by the head of the body that carried out the accreditation, but the DS still bears the stamp and signature of the recipient of the document.

How do you know what type of paper to get? Refer to Government Decree No. 982. If the product is included in the list of goods subject to declaration of conformity, a DS is issued. If the product is on the certification list, a certificate is issued.

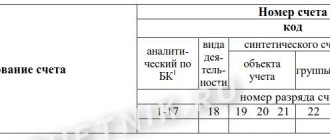

Register No. 5

Registry form No. 5 is given in Appendix No. 5 to the Order. Here is the tabular part of the register:

| N p/p | Registration number of the customs declaration (full customs declaration) | Tax base for the corresponding transaction for the sale of goods (works, services), the validity of applying a tax rate of 0 percent for which is documented (in rubles and kopecks) | Code of the type of vehicle by which goods were imported into the territory of the Russian Federation or exported from the territory of the Russian Federation | Transport, shipping and (or) other document confirming the export of goods outside the Russian Federation or the import of goods into the territory of the Russian Federation | Note | ||

| Document type | Number | date | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

Section VI of Appendix No. 15 to the Order is devoted to filling out register No. 5. The following information is indicated in register columns No. 5:

- in column 1 - the serial number of the corresponding operation for the sale of goods (works, services);

- in column 2 - registration number of the customs declaration (full customs declaration) for the corresponding operation for the sale of goods (work, services);

- in column 3 - the tax base for the sale of goods (work, services), the validity of applying a tax rate of 0 percent for VAT for which is documented;

- in column 4 - codes of types of vehicles by which goods were imported into the territory of the Russian Federation or exported from the territory of the Russian Federation;

- in column 5 - types of transport, shipping or other documents (CMR, bill of lading, railway waybill, air waybill, TIR Carnet, shipping order, sea waybill, other document) confirming the export of goods outside the Russian Federation or the import of goods into the territory of the Russian Federation for the corresponding sale goods (works, services);

- in column 6 - the numbers of the documents indicated in column 5. If the number is missing, “b/n” is indicated;

- in column 7 - the dates of the documents indicated in column 5;

- in column 8 - other information related to the transaction, the details of the documents for which are reflected in register line No. 5. This is the type, number and date of the document submitted simultaneously with the VAT return, with the exception of the documents specified in columns 2, 5 - 7 For example, agreement (contract) No. 5-VAM-1991 dated May 21, 2015. If several documents are indicated, column 8 reflects the type, number and date of each document, separated by the sign “;”.

How to fill out column 4

Column 4 of register No. 5 indicates the codes of the types of vehicles with which goods were exported from the territory of the Russian Federation, by type of transport in accordance with Appendix No. 3 of the Decision of the Customs Union Commission dated September 20, 2010 No. 378.

In addition, in the declaration for goods in the first subsection of column 25 “Mode of transport at the border” the code of the type of vehicle is indicated in accordance with the classifier of types of transport and transportation of goods (subclause 25, clause 15 of section II of the Instructions for filling out customs declarations and customs declaration forms , approved by the Decision of the Customs Union Commission dated May 20, 2010 No. 257). That is, when filling out column 4, you can use the information from column 25 of the goods declaration “Mode of transport at the border”.

Features of DT design

The Federal Customs Service of the Russian Federation is globally improving, automating and simplifying the preparation and completion of declarations. The first step was the abolition of paper submission of DT and the opening of electronic declaration centers. The next step will be the centralization of all electronic declarations on a single declaration server, from where they will be distributed automatically to the EDC and customs posts according to predetermined distribution conditions.

Powers will be distributed between customs: electronic customs will be assigned the execution of procedures such as export, import and free customs zone. Customs offices of actual control will deal with issues related to actual control: opening/closing of transit procedures, document verification, inspection/inspection of goods and vehicles, registration of other procedures, etc. In addition, there will be a shift in the emphasis of customs control to post-release control.

Thereby, the number of EDCs will be reduced and the registration of DT will be fully automated and independent.

Taxes and duties of the batch that is declared must be paid in full in order to obtain the right to sell on the domestic market.

Filling out the customs declaration of imported goods is regulated by the Customs Code of the EAEU, as well as the Federal Law “On Customs Regulation in the Russian Federation”.

How to fill out columns 6 and 7

Column 6 of Register No. 5 indicates the numbers of transport, shipping or other documents confirming the export of goods outside the Russian Federation for the corresponding sale of goods (work, services). Column 7 indicates the dates of these documents. Regardless of the type of transport, if there is no number on the document, “b/n” is indicated in the register.

International waybill

With regard to filling out columns 6 and 7 of the international consignment note (hereinafter referred to as CMR), the Federal Tax Service of Russia notes the following.

The consignment note must contain the place and date of its preparation (Article 6 of the Convention on the Contract for the International Carriage of Goods by Road (CMR), concluded in Geneva on May 19, 1956, hereinafter referred to as the Convention). However, the Convention does not provide for a universal form of CMR. The CMR number can be indicated in the upper right corner, and the date of its completion (registration) and the name of the locality where the CMR was compiled can be indicated in column 21 “Compiled on/date”.

Railway consignment note

In the column “Consignment note No.” the shipment number assigned by the carrier is indicated (clause 3.3 of the Rules for filling out transportation documents for the transportation of goods by rail, approved by order of the Ministry of Railways of Russia dated June 18, 2003 No. 39 (hereinafter referred to as the Rules). In the column “Calendar stamps, documentation acceptance of cargo for transportation" on the reverse side of the original waybill and waybill, as well as on the front side of the spine of the waybill and receipt of cargo acceptance, a calendar stamp "Documentary registration of acceptance of cargo for transportation" is affixed, which indicates the date of documentary registration of acceptance of cargo for transportation (p 3.10 of the Rules) The consignment note must also contain the shipment number and the date of conclusion of the contract of carriage (Article 15 of the Agreement on International Rail Freight Transport of November 1, 1951).

In this regard, the register should indicate the shipment number and either the date of documentary registration of acceptance of the cargo for transportation, or the date of conclusion of the contract of carriage.

Shipping order and bill of lading

In column 7, when exporting goods by sea, river, mixed (river-sea) transport, the date of the transport, shipping or other document (bill of lading, sea waybill or any other document) confirming the fact of acceptance of the goods for transportation and the order for shipment is indicated.

The bill of lading must include the time and place of issue of the bill of lading, as well as the date of acceptance of the cargo by the carrier at the port of loading (Article 144 of the Merchant Shipping Code of the Russian Federation dated April 30, 1999 No. 81-FZ). Appendix 8 to Order No. 182 of the Ministry of Transport of Russia dated July 09, 2014 provides a recommended sample of an order for the shipment of export cargo, which contains the columns “Date of loading” and “Date of issue of the order.” Therefore, if there is no date on the document confirming the fact of acceptance of the goods for transportation, or in the order for shipment, the date of acceptance of the goods for transportation is indicated in column 7 of register No. 5.

Timing and cost

Our company provides comprehensive support to the client and, in addition to filing a customs declaration, provides the following services:

- allocation of a specific customs clearance specialist for supplies under a foreign trade contract, consulting on all customs issues

- preliminary review and approval of customs transport and shipping documents

- recommendations on HS codes for goods

- preliminary calculation of customs value and amount of advance customs payments

- registration of the Customer at customs (if necessary)

- document flow with the place of registration

- drafting DT and related documents

- information and consulting services as part of the delivery

- organization of customs clearance

- provision of information according to the requirements of customs authorities

- representation of the Customer's interests in the customs authorities of the Russian Federation

- organization, if necessary, of preliminary customs inspection of goods and vehicles before submitting the DT

- preparation and execution of TD under the seal of the customs representative

- control of write-off of customs duties and customs clearance fees

- and other services depending on the place and mode of customs clearance. For example, receiving a vehicle and processing cargo at a temporary storage warehouse.

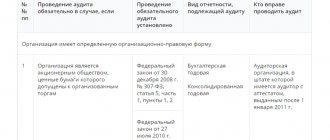

| Type of work | Prices (excl. VAT) |

| Carrying out operations at customs and declaring goods for one batch in IM 40 mode: | from 5,000 rubles |

| Carrying out operations at customs and declaring, in relation to each subsequent consignment of goods in the import mode, if there are several consignments of goods in one vehicle (IM 40): | from 4,000 rubles |

| Registration of each additional sheet of DT, starting from the 5th (fifth) product in IM 40 mode: | from 450 rubles |

| Conducting customs operations and declaring goods of one consignment in export mode (EC 10): | from 3,000 rubles |

| Carrying out customs operations and customs clearance for goods of the same consignment (other regimes): | from 10,000 rubles |

| Payment (additional payment) of any types of customs duties under one customs declaration on behalf and on behalf of the Customer, during customs declaration of the Customer’s goods, using the Customs Representative’s own funds through terminal payment using a customs card/online service of the ROUND payment system. | from 3% of the documented payment amount (additional payment), but not less than 1,000 rubles |

| Assistance in obtaining a Declaration of Conformity with the CU TR for goods, as well as other permitting documents for customs. | discussed individually |

The cost of customs clearance services for diesel cargo in TAISU-TB is optimal and is calculated on an individual basis. The deadline for issuing a customs declaration (CD) is within 1 day.

The TAISU-TB company provides a full range of services for registration of TD and customs clearance of imported cargo. Our branches are located throughout the country from Vladivostok to Kaliningrad, and our specialists have extensive experience and are ready to take on all issues regarding the declaration and import of goods. For each client we assign a personal specialist.