Interest calculation

The calculation of the interest paid on your own bill depends on the following factors:

- the amount on which interest is calculated;

- interest rate on a bill;

- the duration of the reporting month for which the calculation is made.

To determine the amount of interest on a bill for the reporting month, use the formula:

| Amount of interest on the bill for the reporting month | = | Amount on which interest is calculated | × | Interest rate | : | The number of calendar days in the period for which the interest rate is set (for example, 365 days or 366 days for the annual interest rate) | × | The number of calendar days in the reporting month during which the bill was in circulation and interest was accrued on it |

This follows from paragraph 8 of PBU 15/2008 and paragraphs 1 and 4 of Article 328 of the Tax Code of the Russian Federation.

The amount on which interest is calculated is usually the face value of the note.

The rate at which interest is calculated is indicated on the bill itself. If the rate is not specified in the bill, it is considered non-interest bearing.

This procedure follows from Articles 5 and 77 of the Regulations, approved by Resolution of the Central Executive Committee and Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

To correctly determine the number of calendar days in the reporting month during which the bill was in circulation and interest was accrued on it, you need to know:

- the date from which interest should begin to accrue;

- the date on which accruals should stop.

Start calculating interest for the reporting month from the day following the day the bill was drawn up, but not earlier than it was transferred to the counterparty (for the reporting month when the bill was transferred), or from the start of the reporting month (if the bill was transferred to the counterparty last month). If the bill itself indicates a later date from which interest is calculated, calculate it also from the next day (but not earlier than the bill was transferred to the counterparty).

The last day for interest accrual is:

- the last day of the reporting month in accounting or tax accounting (if the bill is in circulation on this date);

- the day on which the bill must be presented for redemption (the end of the bill's circulation period);

- the day on which the period during which interest accrues ends (if it is established in the bill and does not coincide with the date of its repayment).

This follows from paragraph 8 of PBU 15/2008, subparagraph 2 of paragraph 1 of Article 265 and paragraphs 1 and 4 of Article 328 of the Tax Code of the Russian Federation, Chapter V and Articles 5, 73 and 77 of the Regulations approved by the resolution of the Central Executive Committee and the Council of People's Commissars of the USSR dated August 7, 1937. No. 104/1341, and paragraph 19 of the resolution of the Plenum of the Supreme Court of the Russian Federation of December 4, 2000 No. 33 and the Plenum of the Supreme Arbitration Court of the Russian Federation of December 4, 2000 No. 14.

An example of calculating interest on an organization's own bill of exchange for the reporting month

On January 12, Alpha LLC (buyer) entered into an agreement for the supply of a consignment of goods with Torgovaya LLC (seller) for a total amount of 23,600 rubles. (including VAT – RUB 3,600). The contract provides for the buyer to secure the cost of goods with his own bill of exchange.

On the same day, Hermes shipped the goods, and Alpha issued a bill of exchange with a face value of 23,600 rubles. The payment term for the bill is upon presentation. The bill provides for accrual of 5 percent per annum from the date of its preparation.

On March 31, Hermes presented the bill for payment. On the same day, Alpha extinguished it.

Alpha's accountant calculated the amount of interest for each reporting month during the entire period that the bill was held by Hermes, starting from the moment of its transfer (from January 13 to March 31).

The amount of interest on the issued own bill was:

– for January: 23,600 rubles. × 5% : 365 days/year × 19 days = 61 rub.;

– for February: 23,600 rub. × 5% : 365 days/year × 28 days = 91 rub.;

– for March: 23,600 rub. × 5% : 365 days/year × 31 days = 100 rub.

Determination procedure

From the point of view of the procedure for calculating the remuneration of the bill holder, the bill is divided into two types:

- percentage. Contains a condition on the need to pay interest on the amount of the security;

- discount. The holder's income is the difference between the value of the security at the time of its acquisition and the redemption amount when presented to the holder.

If a bill is issued with a maturity date on a specified day or after a specified time interval, the moment of its full payment is known in advance. The parties can calculate the holder's income and formalize it in the form of a discount. Interest is not recorded in such a security.

To calculate bill interest, the formula is used:

Percentage = NV* SP* CD/ (365*100%)

Where:

- НВ - denomination of the bill;

- SP - the interest rate specified in the security;

- KD - the number of days of holding the bill;

- 365 is the number of days in a year.

If the bill does not indicate the rate of interest at which settlement is to be made, it will not be considered interest-bearing.

Payment term: upon presentation, but not earlier

Situation: when is it necessary to accrue interest on your own bill of exchange, transferred to a counterparty, with a maturity date of “at sight, but not before...”? The early date has not arrived.

Interest on a bill of exchange for which the payment term is specified “at sight, but not earlier than...”, is calculated from the day following the day indicated as the earliest date on which the bill can be presented for payment. It is explained like this.

Interest must be accrued on your own bill from the date of its transfer to the counterparty or a later date indicated on it (Articles 5 and 77 of the Regulations, approved by Resolution of the Central Executive Committee and Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341).

The Supreme Arbitration Court of the Russian Federation explained this procedure as follows. Interest must accrue after the date of the bill of exchange if:

- it contains a direct clause about this (i.e., the inscription “interest is calculated from such and such a date” indicating a specific date);

- The payment term for it is “on presentation, but not earlier than...” indicating a specific date.

This is stated in paragraph 19 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated December 4, 2000 No. 33 and the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 4, 2000 No. 14.

In any case, when calculating interest, do not include the day the bill was drawn up or the later date indicated on it for the calculation of interest. That is, the counting of the number of days begins from the day following one of the specified moments (but not earlier than the day the bill is transferred to the counterparty). This follows from Article 73 of the Regulations, approved by Resolution of the Central Executive Committee and Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

The procedure for calculating interest on bills and calculating the discount amount

The accrual of interest on a bill containing a clause on the accrual of interest is carried out in accordance with the letter of the Central Bank of the Russian Federation dated February 23, 1995 No. 26 “On operations of commercial banks with bills of exchange and changes in the accounting procedure for banking transactions with bills of exchange,” as amended by the letter of the Central Bank Bank of the Russian Federation dated February 21, 1997 No. 414 and telegram of the Bank of Russia dated May 24, 1996 No. 76–96.

Interest on a bill of exchange is calculated from the date the bill of exchange is drawn up, unless another date is specified, until the day the bill of exchange obligation is fulfilled for the calendar number of days of circulation of the bill of exchange. The calculation of the period for calculating interest does not include the day of drawing up the bill.

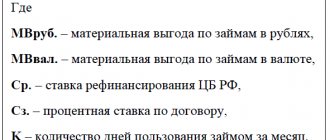

When calculating the amount of interest, the formula is used:

,

where I is the amount of interest; P – denomination of the bill; n – term of the bill in days; i – interest rate for calculating interest on the bill amount specified in the text of the bill.

In a bill of exchange with a payment term “at sight, but not earlier than a certain date,” interest is accrued from the date the bill is drawn up to the day no later than which the bill must be presented for payment.

Upon expiration of the period for presenting a bill of exchange for payment (one year from the date of drawing up for bills of exchange “at sight”, for bills of exchange “at sight, but not earlier than a certain period”, the period for presentation runs from this date), interest is accrued from the date of drawing up the bill of exchange to the day presentation of a bill for payment.

When a bill is presented to the Bank before the maturity date, the holder is paid the bill amount minus the discount for early receipt of the bill amount, and, if there is a clause on the accrual of interest, accrued interest for the actual number of days of circulation of the bill at the rate specified in the text of the bill.

The amount to be withheld in favor of the Bank as a discount for accounting is calculated. To calculate the discount for accounting, the interest rate for discounting bills of exchange approved by the Bank for bills presented earlier than the due date is applied.

The discount is calculated using the following formula:

D = N´(100% – C),

where D is the discount amount; N – denomination of the bill; C – discount rate for bills presented before the due date.

The accrual of interest on a bill containing a clause on the accrual of interest is carried out in accordance with the letter of the Central Bank of the Russian Federation dated February 23, 1995 No. 26 “On operations of commercial banks with bills of exchange and changes in the accounting procedure for banking transactions with bills of exchange,” as amended by the letter of the Central Bank Bank of the Russian Federation dated February 21, 1997 No. 414 and telegram of the Bank of Russia dated May 24, 1996 No. 76–96.

Interest on a bill of exchange is calculated from the date the bill of exchange is drawn up, unless another date is specified, until the day the bill of exchange obligation is fulfilled for the calendar number of days of circulation of the bill of exchange. The calculation of the period for calculating interest does not include the day of drawing up the bill.

When calculating the amount of interest, the formula is used:

,

where I is the amount of interest; P – denomination of the bill; n – term of the bill in days; i – interest rate for calculating interest on the bill amount specified in the text of the bill.

In a bill of exchange with a payment term “at sight, but not earlier than a certain date,” interest is accrued from the date the bill is drawn up to the day no later than which the bill must be presented for payment.

Upon expiration of the period for presenting a bill of exchange for payment (one year from the date of drawing up for bills of exchange “at sight”, for bills of exchange “at sight, but not earlier than a certain period”, the period for presentation runs from this date), interest is accrued from the date of drawing up the bill of exchange to the day presentation of a bill for payment.

When a bill is presented to the Bank before the maturity date, the holder is paid the bill amount minus the discount for early receipt of the bill amount, and, if there is a clause on the accrual of interest, accrued interest for the actual number of days of circulation of the bill at the rate specified in the text of the bill.

The amount to be withheld in favor of the Bank as a discount for accounting is calculated. To calculate the discount for accounting, the interest rate for discounting bills of exchange approved by the Bank for bills presented earlier than the due date is applied.

The discount is calculated using the following formula:

D = N´(100% – C),

where D is the discount amount; N – denomination of the bill; C – discount rate for bills presented before the due date.

Discount calculation

The calculation of the discount on a bill of exchange transferred to a counterparty depends on the following factors:

- the total amount of the discount (the difference between the face value of the bill and the value at which it was transferred to the counterparty);

- the number of calendar days remaining until the expiration date of the bill of exchange (that is, until the last day when it can be presented for payment);

- the duration of the reporting month for which the calculation is made.

To determine the discount amount on a bill for the reporting month, use the formula:

| Discount amount for the reporting month | = | Face value of the bill | – | The cost at which the bill was transferred to the counterparty | : | Number of calendar days remaining until the expiration date of the bill of exchange | × | The number of calendar days of the reporting month during which the bill was in circulation |

This calculation procedure follows from paragraph 8 of PBU 15/2008, paragraph 3 of Article 43 and paragraph 4 of Article 328 of the Tax Code of the Russian Federation.

Determine the number of calendar days remaining until the end of the circulation period, starting from the day following the day the bill was drawn up, but not earlier than it was transferred to the counterparty, until the day when its circulation period ends (Chapter V and Article 77 of the Regulations approved by the resolution Central Executive Committee of the USSR and Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341).

As a rule, the end of the circulation period (the last day on which the bill can be presented for payment, or any indication of this date) is indicated on the bill itself (Articles 1 and 75 of the Regulations approved by the resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341). For example, this could be the inscription “The bill is payable on the following date: December 23, 2016.”

To correctly determine the number of calendar days in the reporting month during which the bill was in circulation and the discount was taken into account, you need to know:

- the date from which you need to start distributing the discount;

- the date on which the distribution must cease.

Start calculating the discount for the reporting month from the day following the day the bill of exchange was drawn up, but not earlier than it was transferred to the counterparty (for the reporting month in which the bill of exchange was transferred), or from the beginning of the reporting month (if the bill of exchange was transferred to the counterparty last month) . Consider the last day of discount distribution to be:

- the last day of the reporting month in accounting or tax accounting (if the bill is in circulation on this date);

- the day on which the bill must be presented for redemption (the end of the bill's circulation period).

This follows from paragraph 8 of PBU 15/2008, subparagraph 2 of paragraph 1 of Article 265 and paragraphs 1 and 4 of Article 328 of the Tax Code of the Russian Federation, Chapter V and Articles 5, 73 and 77 of the Regulations approved by the resolution of the Central Executive Committee and the Council of People's Commissars of the USSR dated August 7, 1937. No. 104/1341, and paragraph 19 of the resolution of the Plenum of the Supreme Court of the Russian Federation of December 4, 2000 No. 33 and the Plenum of the Supreme Arbitration Court of the Russian Federation of December 4, 2000 No. 14.

An example of calculating the discount amount on an organization’s own bill of exchange for the reporting month

On January 12, Alpha LLC (buyer) entered into an agreement for the supply of a consignment of goods to Torgovaya LLC (seller) for a total amount of 118,000 rubles. (including VAT – 18,000 rubles). The contract provides for the buyer to secure the cost of goods with his own bill of exchange.

On the same day, Hermes shipped the goods, and Alpha issued a bill of exchange with a face value of 120,000 rubles. The payment deadline for the bill is March 31.

Alpha's accountant calculated the discount amount on the bill for January (from January 13 to January 31).

The number of calendar days remaining until the expiration date of the bill of exchange is 78 days (19 days + 28 days + 31 days).

For January, the discount amount on the issued own bill was: (120,000 rubles - 118,000 rubles): 78 days. × 19 days = 487 rub.

Bill of exchange: accounting and taxation by the drawer and holder of the bill

So, a financial bill is a bill purchased (issued) as a financial investment. That is, the original purpose of such a bill is to receive income from the placement of funds (by purchasing a bill), when an organization invests funds and subsequently receives additional income. As a rule, the drawer is a bank, but another organization that decides to raise borrowed funds can also act.

The holder of a financial bill is reflected in accounting as a financial investment according to the rules of the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n. According to paragraph 8 of PBU 19/02, financial investments are accepted for accounting at their original cost. The costs from which the initial cost of a financial investment is formed are stated in paragraph 9. The costs of acquiring a financial investment include: amounts paid in accordance with the agreement to the seller, amounts paid for information and consulting services related to the acquisition of these assets, remuneration , paid to the intermediary organization through which assets were acquired as financial investments, and other costs directly related to the acquisition of assets as financial investments.

Thus, in the debit of account 58 “Financial investments”, the cost of the bill should be reflected in the amount of money paid for its acquisition. Moreover, if the bill was purchased at a price below par, the difference (discount) can be reflected in accounting in two ways.

The first method is that the organization attributes the difference between the initial and nominal value of a security to financial results during its circulation period evenly, as income is due on it in accordance with the terms of issue (clause 22 of PBU 19/02). In this case, the corresponding account should be indicated as account 58, as this follows from the Instructions for using the Chart of Accounts. As a result, at the end of the bill’s circulation period, its original value will be brought to its nominal value.

The second method is to show income on the bill at the time of actual receipt, that is, at the time the bill is presented for redemption. The chosen method must be fixed in the order on the company’s accounting policy.

When choosing a method, it should be taken into account that the first option is not advisable for those organizations that do not intend to wait for the maturity date of the security, but plan to use the bill, for example, as settlements with suppliers and customers. In this case, the initially declared discount may not be received by the organization at all. This can happen when the cost of the purchased goods is equal to the original cost of the bill, that is, the amount of money paid by the organization when purchasing the bill. In this case, the organization will not only not receive a discount, but will also reflect the transfer of the bill at a loss, since the revalued value of the bill partially includes the discount.

At the moment the bill of exchange is presented for redemption, the financial investment is disposed of (clause 25 of PBU 19/02); accordingly, an entry is made in the accounting records to write off the value of the bill.

Payment term: upon presentation

Situation: how to determine the date when your own bill of exchange with a payment term “at sight” expires?

The expiration date of such a bill of exchange is the 365th (366th) day from the date of its preparation.

An organization is obliged to pay a bill of exchange upon presentation upon its presentation. Moreover, such a bill must be presented for payment within one year from the date of its preparation. Provided that this annual period has not been changed by the drawer or endorsers.

In this case, the bill does not have any inscriptions that shorten or extend its circulation period. Therefore, its circulation period is considered to be a calendar year - 365 or 366 calendar days, that is, all the days during which the bill can change hands or be in the ownership of any bill holder.

This procedure follows from Articles 34 and 77 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

Features of settlements using a bill of exchange “at sight”

The holder of a bill of exchange with a term “at sight” is obliged to present it for payment within a year from the date of its issuance, unless the Drawer has shortened this period or stipulated a longer period (in accordance with Articles 34, 35, 36 of the Regulations “On Simple and a bill of exchange", approved by the Decree of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated 08/07/1937 No. 104/1341 (hereinafter referred to as the Regulation). Thus, if the date of the bill of exchange was December 30, 2014, then it should have been presented for payment before December 30 2015 _

Upon expiration of the deadlines established for the presentation of a bill of exchange for the “at sight” period, the Billholder loses his rights against the Endorsers, the Drawer and other obligated persons, with the exception of the Acceptor (by virtue of Article 53 of the above-mentioned Regulations).

The drawer of a promissory note is obliged in the same way as the Acceptor of a bill of exchange (Article 78 of the Regulations). That is, in a promissory note the obligated person continues to be the Drawer. Consequently, in case of failure to present a promissory note within the established time period “at sight”, the Drawer loses its rights in relation to all obligated persons except the Drawer.

Upon expiration of the deadlines established for the presentation of a bill at sight, the Drawer loses its rights against the Endorsers, the Drawer and other obligated persons, with the exception of the Acceptor.

It should be noted that the rights in relation to the Drawer are retained by the Drawer during the limitation period established by Art. 70 Regulations, i.e. within 3 years from the date of payment. This period is established for the exercise of rights arising from the bill, and not for the protection of these rights; therefore, it is a preemptive period, and not a limitation period . Therefore, the expiration of three years from the date of payment extinguishes the very right to demand payment on the bill (clauses 25, 26 of the Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 25, 1997 No. 18). With the expiration of the preemptive periods, the substantive right to demand payment from the persons obligated under the bill of exchange ceases .

The court applies these deadlines regardless of the party’s application (clause 22 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 33, the Plenum of the Supreme Arbitration Court of the Russian Federation No. 14 of December 4, 2000 “On some issues in the practice of considering disputes related to the circulation of bills”).

The deadline established by Art. 70 of the Regulations is not subject to suspension or restoration (Resolution of the Ninth Arbitration Court of Appeal dated December 28, 2015 No. 09AP-53461/2015 in case No. A40-56017/15).

As follows from the explanations, the deadline for presenting the bill of exchange for payment was missed, the 3-year preventive period for the bill of exchange debt also expired, which entails a refusal to pay the bill amount.

Obligations must be fulfilled properly in accordance with the terms of the obligation and the requirements of the law, other legal acts, and in the absence of such conditions and requirements - in accordance with customs or other usually imposed requirements (Article 309 of the Civil Code of the Russian Federation). The obligation is terminated as a result of proper fulfillment (clause 1 of Article 408 of the Civil Code of the Russian Federation).

Thus, the use of an “overdue” bill of exchange in calculations, i.e. bills with an expired 3-year period for filing claims do not entail the transfer to a new Bill Holder (equipment seller) of the rights certified by the bill in connection with their termination, and therefore may be recognized by the court as improper fulfillment by the Buyer of its obligations to pay for the equipment.

Get expert advice

according to your situation and get expert advice.

Ask a Question

Ask a Question