What are dividends

Dividends are part of the net profit that is distributed among participants and shareholders. The following are recognized as dividends (clause 1 of Article of the Tax Code of the Russian Federation):

- any income distributed in proportion to the contributions of participants or shareholders and paid from the net profit of the organization;

- income from sources abroad, if they are recognized as dividends under the laws of a foreign state;

- the difference between the income received upon leaving the organization or upon its liquidation, and: for income tax - the actually paid cost of shares, interests or shares, taking into account cash contributions to the property;

- for personal income tax - expenses for the acquisition of shares, shares, shares.

Payments that do not relate to dividends are listed in clause 2 of Art. Tax Code of the Russian Federation.

Organizations that pay dividends to foreign participants should first look at the double tax treaty (if there is one). The concept of dividends in it may differ from the Tax Code of the Russian Federation. For example, under some agreements, dividends may not be distributed in proportion to contributions.

On May 12, an online course for advanced training “Income Tax. Complex issues in accounting and tax accounting, practical recommendations"

Take a course and receive a certificate of advanced training

What income is recognized as dividends?

Every year, companies, if their performance results are positive, distribute the profits received among persons owning shares or shares.

Most often, this is done in the form of dividends, and the decision on their size and timing of payments is made by the general meeting. Such a meeting may be annual or extraordinary; for joint stock companies this is a meeting of shareholders (clause 1 of article 47, subclause 10.1, 11 of clause 1 of article 48 of the law “On joint stock companies” dated December 26, 1995 No. 208-FZ, hereinafter referred to as law No. 208-FZ), and for an LLC - a meeting of participants (clause 1 of Article 28, subclause 7 of clause 2 of Article 33 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ, hereinafter referred to as Law No. 14-FZ).

According to paragraph 1 of Art. 43 of the Tax Code of the Russian Federation, a dividend is any income of a participant or shareholder if it is received from the company during the distribution of net profit in an amount proportional to the share in the authorized capital.

If a company received income from sources located outside of Russia, and such income falls within the definition of dividends in that country, then it will be recognized as a dividend in the Russian Federation.

In addition, dividends are recognized in accordance with clause 6 of Art. 269 of the Tax Code of the Russian Federation, and excess interest paid by a resident of the Russian Federation to a foreign company on controlled debt.

How to pay dividends

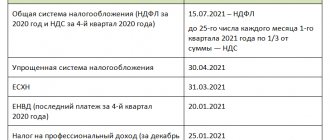

To pay dividends, you need to make an appropriate decision, determine the amount and sources for payment, and also make sure that the organization has the right to distribute profits. The rules are different for LLCs and JSCs. We have collected them in the table:

| Parameter | OOO | JSC |

| Payment decision | Accepts the general meeting of participants or the only participant | Hosts the general meeting of shareholders |

| Frequency of payments | Based on the results of the year or intermediate periods (quarter, half-year, 9 months) | Based on the results of the year or interim periods (quarter, half-year, 9 months) Restriction: the decision on payment is made no later than three months after the end of the interim period |

| Dividend amount | Proportional to the participants’ contributions to the authorized capital, but only when the charter does not provide otherwise | In the amount declared for shares of each category |

| Payment source | Net profit | Net profit |

| Deadline for payment | 60 days after the distribution decision | 25 working days from the date on which persons entitled to receive dividends are determined |

| Prohibition on payment of dividends |

|

|

What to do if interim dividends turned out to be more than net profit for the year, answered the experts at Kontur.School.

What is needed to pay dividends

In order for an organization to distribute net profit among the founders, a number of conditions must be met. Let's list the main ones:

- the organization has profit remaining after taxation. In case of losses, dividends cannot be paid;

- the authorized capital is fully paid;

- the value of net assets is greater than or equal to the authorized capital. Net assets refer to the difference between an organization's assets and its debts. Net assets are capital and reserves (indicated in the final line of section III of the balance sheet), increased by deferred income (indicated in line 1530 of the balance sheet) and reduced by the debt of participants to pay the management company (indicated in line 1170 of the balance sheet).

- the organization has no signs of bankruptcy.

Fill out and print your balance sheet using the current form for free

How to record dividends in accounting

The payment of dividends based on the company's performance for the reporting year is an event after the reporting date. It is disclosed in the explanatory note. Accounting entries will be made already in the payment period.

For dividends to individuals, the postings are as follows:

- Dt 84 Kt 70 (75) - dividends accrued;

- Dt 70 (75) Kt 68 - personal income tax is withheld upon payment;

- Dt 70 (75) Kt 51 - dividends paid;

- Dt 68 Kt 51 - transferred to the personal income tax budget.

For dividends to legal entities:

- Dt 84 Kt 75.02 - dividends accrued;

- Dt 75.02 Kt 68 - income tax is withheld upon payment;

- Dt 75.02 Kt 51 - dividends paid;

- Dt 68 Kt 51 - income tax is transferred to the budget.

You will need supporting documents: minutes of the general meeting of shareholders (participants) and an accounting certificate. We recommend that you do not neglect documents. Regulatory authorities pay a lot of attention to dividends. After almost every payment, the tax office sends a request: to whom it was paid and how, where the tax was withheld, when it was paid and asks to present an accounting certificate and the decision of the general meeting.

Calculate dividends and withholding tax taking into account current requirements

Try for free

How are dividend payments taxed?

Dividends paid by a JSC or LLC are not recognized as expenses for the purposes of calculating income tax. They are paid from net profit and are included in Art. 270 of the Tax Code of the Russian Federation, which lists expenses not taken into account for income tax.

The organization withholds personal income tax or income tax when paying dividends. Personal income tax - on dividends to individuals, income tax - on dividends to legal entities. But there are two exceptions: payment by a Russian organization through a depository and payment by a foreign organization. There is no need to pay insurance premiums in any case.

Tax on dividends to a legal entity

Income tax rates on dividends are presented in the table:

| Type of dividends | Bid | Base |

| Received by Russian organizations from Russian and foreign organizations | 13% - in standard cases; 0% - if the share of the deposit is 50% or more, and the continuous holding period is at least 365 days | clause 3 art. 284 Tax Code of the Russian Federation |

| Received by legal entities non-residents of the Russian Federation | 15%, unless another rate is established by a double tax treaty | clause 3 art. 284 Tax Code of the Russian Federation |

Income tax on dividends to Russian resident organizations is calculated according to the formula (clause 5 of Article 275 of the Tax Code of the Russian Federation):

N = K × CH × (D1 - D2), where:

- N - amount of tax to be withheld;

- K is the ratio of the amount of dividends subject to distribution in favor of the recipient of dividends to the total amount of distributed dividends;

- Сн - tax rate;

- D1 - the total amount of dividends to be distributed in favor of all recipients;

- D2 - the total amount of dividends received from other organizations (what changed in 2022?).

If the amount of dividends received, taxed at a rate of 13%, is greater than the amount of dividends paid (D1 < D2), then the withholding tax (N) will be negative. Then it is not calculated and is not reimbursed from the budget.

When dividends are paid to foreign legal entities non-residents of the Russian Federation, a rate of 15% or another established by international agreement is applied. The formula is simple (clause 6 of Article 275 of the Tax Code of the Russian Federation): N = Cn × D.

Dividends to foreign companies and non-resident individuals are taxed at a rate of 15%. A double tax treaty may provide for lower rates. They will need to be justified. To do this, the recipient of dividends confirms that he is a resident of the country with which the agreement is concluded.

Tax on dividends to individuals

Taxation of dividends with personal income tax is regulated by Art. 214 taking into account the provisions of Art. 226.1 Tax Code of the Russian Federation. And also Art. 210 Tax Code of the Russian Federation. The procedure for calculating and paying personal income tax depends on the legal form of the tax agent:

- JSC - calculates personal income tax in accordance with Art. 226.1 of the Tax Code of the Russian Federation and transfers it to the budget no later than one month from the date of payment of income to the shareholder (without a depository);

- LLC - calculates personal income tax in accordance with Art. 226 of the Tax Code of the Russian Federation and transfers the withheld tax no later than the day following the day of payment of dividends.

Dividend rates for individuals are shown in the table:

| Type of dividends | Bid | Base |

| Received by individual residents of the Russian Federation |

| clause 1 art. 224 Tax Code of the Russian Federation |

| Received by non-resident individuals of the Russian Federation | 15%, unless another rate is established by a double tax treaty | clause 3 art. 224 Tax Code of the Russian Federation |

The tax is calculated using the formula:

N = K × CH × (D1 - D2), where:

- N - amount of tax to be withheld;

- K is the ratio of the amount of dividends subject to distribution in favor of the recipient of dividends to the total amount of distributed dividends;

- Сн - tax rate;

- D1 - the total amount of dividends to be distributed in favor of all recipients;

- D2 - the total amount of dividends received from other organizations (what changed in 2022?).

When we calculate dividends, we do not provide deductions, that is, they are calculated separately. This applies to all types of deductions: standard, social, property, professional (letter of the Federal Tax Service dated June 23, 2016 No. OA-3-17 / [email protected] ).

Federal Law No. 8-FZ dated February 17, 2021 introduced changes to the calculation of personal income tax on dividends. The amount of income tax withheld from dividends received by a Russian organization is taken into account when calculating personal income tax, which must be withheld from dividends paid in proportion to the share of participation in such an organization to an individual who is a Russian tax resident (clause 3.1 of Article 214 of the Tax Code of the Russian Federation). Read more

If dividends are paid to a non-resident foreign individual, the formula is applied: Н = К × Сн × Д1.

Dividends to non-residents can be paid in foreign currency (Article 6 of Federal Law No. 173-FZ dated December 10, 2003, clause 1 of the Bank of Russia Information Letter No. 31 dated March 31, 2005). There is no need to issue a transaction passport. Expenses in the form of negative exchange rate differences are classified as non-operating expenses (subclause 5, clause 1, article 265 of the Tax Code of the Russian Federation).

At what rates are taxes on dividends calculated?

If we talk about income tax, then its rate in relation to dividends depends on who the recipient is - a Russian or foreign company (clause 3 of Article 284 of the Tax Code of the Russian Federation).

If income is paid to a foreign company, dividend tax is calculated at a rate of 15%.

If the recipient is a domestic organization, in most cases a rate of 13% is applied.

An exception is the payment of dividends to an organization that, on the day the decision on payment is made, has continuously owned for at least 365 calendar days:

- at least half of the share in the authorized capital of the company paying dividends;

- or depositary receipts giving the right to receive at least half of the total amount of dividends paid.

A 0% rate applies to such dividends.

Read more about this in the article “Conditions for applying the zero rate on income tax when receiving dividends .

The right to a zero rate must be justified. This must be done by the taxpayer who receives the dividends. To do this, he submits to the Federal Tax Service documents confirming the date of origin of ownership of the share in the management company or depositary receipts. He must submit the same documents to the agent company along with confirmation of their submission to the tax office.

ConsultantPlus experts explained in detail what conditions must be met in order for a zero rate to be applied. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Read about current income tax rates here.

The personal income tax rate depends on the status of the individual receiving the income (Article 224 of the Tax Code of the Russian Federation):

- For a resident of the Russian Federation, dividend tax is withheld at a rate of 13%;

- from a resident of the Russian Federation upon payment of dividends in the amount of 5 million rubles. and more per year - 15%;

- non-resident - at a rate of 15%.

For more information about calculating income tax on dividends, read the material “Is personal income tax levied on dividends?” .

Read about personal income tax for non-residents here.

NOTE! You can transfer personal income tax withheld from dividends of several “physics” participants in one payment. For more information, see the article “How to transfer personal income tax on dividends” .

Difficult situations in taxation of dividends

When paying dividends, unusual situations occur. For example, you decided to issue dividends in goods or the recipient refused dividends. With taxes, everything will not be so clear here. Let's look at popular questions.

Dividends from previous years

Many people are interested in whether dividends can be paid using retained and unpaid profits from previous years. You can, and in this case you don’t have to wait until the end of the quarter or year. But in the decision on payment, it is important to indicate for what year and in what amount the profit is distributed.

Personal income tax is withheld at the rate that is in effect on the date of payment of dividends.

Withdrawal from the founders

How to pay dividends if a participant left the founders and the share transferred to the company? The Tax Code of the Russian Federation states that this must be done proportionally. Before the distribution of shares among the remaining participants, dividends can be paid to them disproportionately to their shares only if the participants themselves decide so or such a procedure is provided for by the charter.

Amounts exceeding the amount of dividends proportional to the share are not recognized as dividends for tax purposes (letter of the Ministry of Finance dated July 30, 2012 No. 03-03-10/84). This indicates that the tax rate will change. If you pay dividends, then the rate is 13%, and if the payment is not recognized as dividends, the rate is 20%. This is especially important with non-resident individuals: the rate can increase from 15% to 30%.

The Ministry of Finance says that if the payments are not recognized as dividends, then they also do not need to be shown as dividends in 6-NDFL. Other rates may apply and deductions may apply. Therefore, the tax office is interested in how you pay dividends: proportionally or disproportionately.

Waiver of dividends

What should I do if a participant asks to replace dividends with a fixed monthly compensation? How to distribute dividends and what to do with personal income tax?

The Ministry of Finance believes that since the participant does not want to receive dividends, then he gave them to you. At the same time, he must pay personal income tax, even if he refused to pay (letter of the Ministry of Finance dated October 23, 2019 No. 03-04-06/81252). The action algorithm is as follows:

- On the day the participant refuses dividends, calculate personal income tax from the “refused” amount;

- Withhold personal income tax from the compensation amount monthly (you can reduce it by deductions);

- Do not charge insurance premiums.

Determine when dividends can be distributed without harming the company - make management decisions based on the numbers

Try for free

Refusal to pay the actual value of the share

The former participant may refuse to pay the actual value of the share upon leaving the company. The courts consider this as debt forgiveness (Resolution of the Federal Antimonopoly Service of the North-Western District dated May 16, 2012 No. F07-3024/12).

The Ministry of Finance repeatedly says in its letters that the cost of the share that was abandoned is included in the organization’s non-operating income (letter of the Ministry of Finance of the Russian Federation dated October 2, 2018 No. 03-03-06/1/70715, etc.). It would seem, why is this income if we have already paid tax once when we calculated net profit? But regulatory authorities think differently.

Incorrect details for dividends

The founder did not provide new details. Dividends were transferred to him, but due to incorrect details, the entire amount was returned to the account. At the same time, personal income tax was withheld and paid to the budget.

Paid tax can be refunded. To do this, reflect the return of dividends in your accounting records, reverse the withheld personal income tax and submit an updated calculation of 6-personal income tax. At the same time, send a tax application, an extract from the personal income tax register and a payment order for tax payment. Personal income tax can be offset against future payments or returned to the account (letter of the Federal Tax Service dated 02/06/2017 No. GD-4-8 / [email protected] ).

Crediting a loan against dividends

The organization issued a loan to the founding legal entity. It will be repaid by offset of dividends due. How to arrange this?

The amount offset against the debt must be indicated in the income tax return as dividends actually received (clauses 5.3, 6.3 of the Procedure, approved by Order of the Federal Tax Service dated September 23, 2019 No. ММВ-7-3 / [email protected] ):

- in non-operating income on line 100 of Appendix No. 1 to sheet 02. The data in this line is transferred to line 020 of sheet 02;

- in income excluded from profit on line 070 of sheet 02.

And all this must be shown on the day of signing the agreement on offsetting mutual claims.

Dividends in kind

Dividends can be paid not only in money, but also in property. Elena Danyakina, a tax consultant, spoke about the peculiarities of taxation and the cases in which this is permissible in the Kontur.School webinar “Dividends in 2022. How to calculate, distribute, and withhold taxes.”

In short, you can pay dividends with property. But to avoid disputes with the tax authorities, it is advisable to enshrine this in the charter or approve it in the decision of the general meeting on the payment of dividends. In order to then calculate income tax and adjust the financial result, the founders should determine the monetary value of the transferred property. Personal income tax on dividends in kind will be paid by the recipient.

Receiving dividends from a foreign organization

Dividends from any organization, including a foreign one, are taken into account as part of non-operating income (clause 1 of Art. , clause 1 of Article 250 of the Tax Code of the Russian Federation). However, if they are paid by a foreign organization, then the Russian company itself calculates and pays income tax (clause 2 of Article 275 of the Tax Code of the Russian Federation).

Income tax is reduced by the amount of tax that was withheld from dividends at the location of the foreign company, but only if this is provided for in an international treaty between the Russian Federation and that country.

How much credit can I receive? When paying income tax in the Russian Federation, a Russian organization can receive a credit in an amount not exceeding the amount paid in the Russian Federation. For example, if you paid 15,000 rubles from dividends abroad, and at the Russian tax rate the tax is 13,000 rubles, then you can only take 13,000 rubles as a credit, and the remaining 2,000 rubles cannot be offset and written off as income tax expenses ( Letter of the Ministry of Finance dated May 31, 2017 No. 03-12-11/3/33520).

Conditions for registration:

- there is an international agreement or treaty on the avoidance of double taxation;

- payment of tax abroad is confirmed by documents;

- simultaneously with the income tax return, a declaration on income received outside the Russian Federation is submitted;

- At the end of the period, your organization has no loss.

If you receive dividends in foreign currency, you must convert them into rubles at the rate of the Central Bank of the Russian Federation on the date of receipt (clause 5 of Article 210 of the Tax Code of the Russian Federation).

Dividends 2022: law, accounting, taxation

Dividends are usually understood as part of the profit according to accounting data remaining after taxation, which is distributed among the company's participants or shareholders. In civil law, the term “dividends” is used only in relation to payments to shareholders. Limited liability companies distribute net profit among their participants (clause 2 of article 42 of the Law of December 26, 1995 No. 208-FZ, clause 1 of Article 28 of the Law of 02/08/1998 No. 14-FZ).

Tax legislation clarifies the conceptual apparatus. So, in accordance with Art. 43 of the Tax Code of the Russian Federation, a dividend is recognized as absolutely any income received by a shareholder or participant from an organization during the distribution of profits remaining after taxation, including in the form of interest on preferred shares.

It is important that tax legislation recognizes as a dividend only that income that is accrued to a participant or shareholder during the distribution of net profit and strictly in proportion to its share in the authorized capital (clause 1 of Article 43 of the Tax Code of the Russian Federation).

Dividends for tax purposes also include any income received from sources outside of Russia, classified as such in accordance with the laws of foreign countries.

Dividends are the difference between the income received upon leaving the organization or upon its liquidation and:

- the actual paid value of shares, interests or shares, taking into account cash contributions to property - for income tax;

- expenses for the acquisition of shares, shares, shares - for personal income tax.

In accordance with paragraph 2 of Art. 43 of the Tax Code of the Russian Federation do not include the following as dividends:

- payments upon liquidation of an organization to a shareholder (participant) of this organization in cash or in kind, not exceeding the contribution of this shareholder (participant) to the authorized (share) capital of the organization;

- payments to shareholders (participants) of an organization in the form of transfer of shares of the same organization into ownership;

- payments to a non-profit organization for the implementation of its main statutory activities (not related to business activities), made by business companies whose authorized capital consists entirely of contributions from this non-profit organization.

It is important that the right to receive profit has those participants who own shares in the authorized capital of the company at the time the general meeting makes a decision on the distribution of profits (14-FZ of February 8, 1998; determination of the Supreme Arbitration Court of the Russian Federation of November 8, 2010 No. VAS- 14288/10).

In what form can payments be made?

Civil legislation allows dividends to be paid not only in money, but also in kind (Clause 1, Article 42 of the Law of December 26, 1995 No. 208-FZ, Article 28 of the Law of February 8, 1998 No. 14-FZ).

However, dividends in cash can be paid to shareholders exclusively by bank transfer, exclusively to the shareholder’s account! If for some reason the recipient does not have an account, then the money is sent by postal order (Clause 8, Article 42 of Law No. 208-FZ of December 26, 1995).

There are no such restrictions for LLCs. Dividends can be paid to LLC participants either through a cash register or to a bank account (Article 28 of Law No. 14-FZ dated 02/08/1998, Article 42 of Law No. 208-FZ dated 12/26/1995). Moreover, not only personally to the participant, but also, at his direction, to the accounts of third parties, both individuals and legal entities.

Who makes the decision to pay dividends and when?

The decision on the payment of dividends in a joint stock company is made by the general meeting of shareholders. As a rule, based on the results of work for the year. Payments based on the results of work for the first quarter, half a year, and nine months are not prohibited. But a decision on interim payment of dividends during the year can be made no later than three months from the end of these periods (clause 3 of Article 42 of Law No. 208-FZ of December 26, 1995).

A limited liability company distributes net profit by decision of the general meeting of its participants quarterly, once every six months or once a year. There are no restrictions on the time frame for making decisions (clause 1 of Article 28 of Law No. 14-FZ dated 02/08/1998).

Do not forget that all minutes of meetings of LLC participants and even decisions of the sole participant must be notarized, unless otherwise expressly provided by the charter (Presidium of the Supreme Court of the Russian Federation 12/25/2019; Ruling of the Supreme Court of the Russian Federation dated 12/30/2019 No. 306-ES19-25147).

Dividends are not paid when the value of the organization’s net assets is less than the authorized capital and reserve fund or becomes less than their size after the distribution of profits (clause 1, article 29 of the Law dated 02/08/1998 No. 14-FZ, clause 1 of article 43 of the Law dated 26.12. 1995 No. 208-FZ).

By the way, dividends will not be re-qualified in connection with the resulting loss for the year - no changes will be required in tax accounting (letter from the Ministry of Finance dated 10/15/2020 No. 03-03-10.90152, Federal Tax Service dated 10/19/2020 No. SD [email protected] ).

Dividend payment terms

In an LLC, dividends to participants and founders must be paid no later than 60 days from the date on which the decision to pay was made, unless a shorter period is established in the charter (Clause 3, Article 28 of Law No. 14-FZ dated 02/08/1998).

In accordance with Art. 42 of the Law of December 26, 1995 No. 208-FZ, the joint-stock company must pay dividends to nominal holders and trustees registered in the register of shareholders - professional participants in the securities market - within no more than 10 working days from the moment the recipients are determined. Moreover, the company can determine the recipients no earlier than 10 and no later than 20 days from the moment the decision on payment is made. A shorter period for paying dividends, just like in an LLC, can be established in the company’s charter.

Payments to other recipients of dividends in the joint-stock company must be made no later than 25 working days from the moment the recipients are determined. Also, JSC recipients can be determined no earlier than 10 and no later than 20 days from the moment the decision on payment is made. A shorter payment period can be established in the company's charter.

If a participant or shareholder does not demand payment within the established period, then he loses the right to these dividends completely, except in cases where he can restore this period.

What if you miss the payment?

If a participant or shareholder has not received dividends on time, then he has the right to receive them within three years, starting from the next day after the end of the dividend payment period, unless the company's charter provides for a longer period, but not exceeding five years (clause 9 of Art. 42 of the Law of December 26, 1995 No. 208-FZ, paragraph 4 of Article 28 of the Law of February 8, 1998 No. 14-FZ).

For the entire period of delay in payment of dividends, the recipient has the right to demand payment of interest based on the average interest rate on deposits published by the Bank of Russia for the corresponding periods at the location of the participant or shareholder (clause 1 of article 395 of the Civil Code of the Russian Federation and clause 16 of the resolution of the Supreme Arbitration Court of November 18, 2003 No. 19).

When calculating interest, the number of days in a year is taken to be 360, and in a month - 30 (clause 2 of the resolution of the plenums of the Supreme Court and the Supreme Arbitration Court of October 8, 1998 No. 13/14).

For late payment of dividends, a joint stock company is subject to administrative liability (Article 15.20 of the Code of Administrative Offenses of the Russian Federation).

Dividends declared (distributed) but not claimed by shareholders and participants must again be included in the organization’s retained earnings (clause 9, article 42 of the Law of December 26, 1995 No. 208-FZ, clause 4 of article 28 of the Law of 02/08. 1998 No. 14-FZ). When calculating income tax, do not take into account unclaimed dividends that were restored to net profit (clause 3.4, clause 1, article 251 of the Tax Code of the Russian Federation)

Dividend amount

Dividends are accrued in the following amounts.

In limited liability companies, it is proportional to the contributions of participants in the authorized capital, unless otherwise provided by the organization’s charter (Article 28 of Law No. 14-FZ dated 02/08/1998). It should be recalled here that for taxation purposes only that income accrued to a participant or shareholder during the distribution of net profit and strictly in proportion to his share in the authorized capital is recognized as a dividend (clause 1 of Article 43 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated July 30, 2012 No. 03 -03-10/84, dated June 24, 2008 No. 03-03-06/1/366 and the Federal Tax Service of Russia dated August 16, 2012 No. ED-4-3/13611).

In a joint stock company, dividends are accrued in the amount that is declared in relation to shares of each category. However, no more than recommended by the board of directors or supervisory board of the organization (Article 42 of the Law of December 26, 1995 No. 208-FZ).

Source of dividend payment

Dividends are paid from the organization’s net profit, that is, remaining after taxation (clause 2 of Article 42 of the Law of December 26, 1995 No. 208-FZ, clause 1 of Article 28 of the Law of February 8, 1998 No. 14-FZ).

Moreover, joint-stock companies determine their profit according to their financial statements (clause 2, article 42 of Law No. 208-FZ dated December 26, 1995). Although, for limited liability companies there are no such strict requirements in the legislation - controlling persons recommend doing the same (letters of the Ministry of Taxes dated 31.03.2004 No. 22-1-15/597, UMTS for Moscow dated 08.10.2004 No. 21-09/ 64877).

By the way, dividends can be paid from the profits of previous years, even if the organization had no net profit in the current year (letter of the Federal Tax Service dated October 5, 2011 No. ED-4-3/16389), since there are restrictions on the period of formation of the profit that will be allocated for the payment of dividends, there is no legislation (Article 43 of the Tax Code of the Russian Federation, paragraph 2 of Article 42 of the Law of December 26, 1995 No. 208-FZ, paragraph 1 of Article 28 of the Law of February 8, 1998 No. 14-FZ). The regulatory authorities adhere to a similar point of view (letters of the Ministry of Finance of Russia dated 08/24/2012 No. 03-04-06/4-256, dated 03/20/2012 No. 03-03-06/1/133, dated 04/06/2010 No. 03-03- 06/1/235).

Insurance premiums

Dividends are not subject to insurance premiums:

- for compulsory pension, social or medical insurance (Article 420 of the Tax Code of the Russian Federation);

- for insurance against accidents and occupational diseases (clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

Personal income tax (NDFL)

If dividends are received by individuals who have tax resident status, then the income they receive is subject to personal income tax. If the recipient does not have resident status, then personal income tax is assessed only when dividends are paid by Russian organizations.

As a rule, a tax agent calculates, withholds and transfers personal income tax to the budget. Only in the case where income in the form of dividends is received by a resident from sources abroad, must the taxpayer himself calculate and pay personal income tax to the budget.

The tax status of the dividend recipient must be determined based on the 12 months preceding the date of payment (clause 2 of Article 207, clause 1 of clause 1 of Article 223 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 9, 2007 No. 03-04-05-01/ 326).

If a tax resident received dividends from a source abroad, then he must calculate and pay personal income tax himself. The tax is subject to calculation on a progressive scale of rates (Article 224 of the Tax Code of the Russian Federation). The taxpayer has the right to reduce the accrued tax by the amount paid on income received in the country of location of the foreign organization - the source of payment of income, but only if Russia has concluded a double tax treaty with this country. If the calculation results in a negative value, then the resident has no right to reimburse the difference from the budget. (clause 1, clause 3, article 208, clause 1, article 209, clauses 1 and 2, article 214, clause 1, clause 2.1, article 210, clause 1, article 224 of the Tax Code of the Russian Federation, letter from the Ministry of Finance of Russia dated 05/26/2020 No. 03-04-05/43928).

The tax agent taxes dividends separately for each taxpayer (Article 214 of the Tax Code of the Russian Federation), applying the following personal income tax rates:

- 13 (15)% – when paying dividends to a resident;

- 5% – when paying dividends to a non-resident. If the recipient of dividends confirms that he is a resident of another country with which there is an international treaty for the avoidance of double taxation, which provides for the application of a different rate, then it is necessary to apply it (Articles 7, 210, 214 and 224 of the Tax Code of the Russian Federation).

It is necessary to withhold personal income tax when paying dividends to an individual, regardless of:

- whether this person has the status of an individual entrepreneur or not (letters from the Ministry of Finance of Russia dated April 10, 2008 No. 03-04-06-01/79 and dated July 13, 2007 No. 03-04-06-01/238);

- receives dividends himself or his heirs (letter of the Ministry of Finance of Russia dated October 29, 2007 No. 03-04-06-01/363);

- and even in the case when he refuses to pay in favor of third parties (letters of the Ministry of Finance of Russia dated October 23, 2019 No. 03-04-06/81252, dated October 4, 2010 No. 03-04-06/2-233).

Remember also that a resident’s income in the form of dividends is included in the set of bases in respect of which a progressive scale for personal income tax is applied. Income up to 5 million rubles. per annum is taxed at a rate of 13%. And for income exceeding this limit - the rate is 15%.

It is also necessary to take into account the fact that your organization receives dividends from other organizations.

If there was no such income, then personal income tax is calculated in the usual manner, as income in the form of dividends accrued to the resident and multiplied by the personal income tax rate (Article 214 of the Tax Code of the Russian Federation).

If the organization received dividends from participation in other organizations, then the income tax on dividends in favor of the tax agent organization can be offset against the personal income tax on dividends in favor of the participants. This can be done in relation to all dividends paid after December 31, 2022, regardless of the period for which they were accrued (Clause 4, Article 4 of Law No. 8-FZ dated 02/17/2021).

Before calculating the amount of offset (ZNP), the tax agent must determine the basis for offset (BZ) by comparing two bases: (BZ1) - the amount of dividends accrued to an individual and (BZ2) - the part of the amount of dividends received by the organization that falls on the individual recipient dividends. The values of BZ1 and BZ2 are compared with each other and the smallest of them is selected - this will be the basis for the test (BZ). The amount of income tax that will be credited is calculated as BZ multiplied by 13%.

The amount of personal income tax that the tax agent must withhold is determined as the amount of dividends accrued to a resident individual, multiplied by the personal income tax rate (13 or 15%), reduced by the amount of corporate income tax to be offset (ZNP) (Article 214 of the Tax Code of the Russian Federation, letter Federal Tax Service dated 03/30/2021 No. BS-4-11/ [email protected] , information from the Federal Tax Service dated 04/08/2021).

If during the year the organization pays dividends several times, then personal income tax on such income is calculated on an accrual basis, offset by previously withheld amounts (letter of the Federal Tax Service dated June 22, 2021 No. BS-4-11 / [email protected] ).

Personal income tax is withheld when paying dividends (clause 4 of article 226 of the Tax Code).

But there are some nuances with transfers to the budget.

A limited liability company must transfer personal income tax to the budget (clauses 4 and 6 of Article 226 of the Tax Code of the Russian Federation) no later than the day following the day:

- payment or transfer of dividends;

- payments of other income from which the amount of personal income tax must be withheld if dividends are paid in kind.

A joint stock company transfers personal income tax on dividends on shares of Russian organizations (clause 4 of article 214 of the Tax Code of the Russian Federation, clause 9 of article 226.1 of the Tax Code of the Russian Federation) no later than one month from the earliest of the following dates when:

- the relevant tax period has ended;

- the term of the last agreement based on the start date on the basis of which the tax agent - depositary pays income to the shareholder has expired;

- money is paid or securities are transferred.

Corporate income tax

If a Russian organization receives dividends from a foreign one, then it must independently pay tax on the profits received to the budget (clause 1 of Article 250 of the Tax Code of the Russian Federation) in the period when the income was received at a rate of 13% or 0%.

Income tax, unlike personal income tax, is not subject to reduction except in the situation where the tax was withheld from dividends in the country where the foreign company is located, but only if such a possibility is provided for by an international treaty with Russia (clause 3 of article 284, clause 1 of art. 275 of the Tax Code of the Russian Federation).

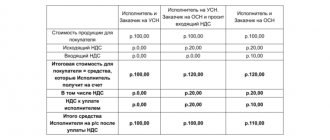

When paying dividends to legal entities, a Russian organization performs the duties of a tax agent, regardless of the taxation system applied.

When paying dividends to Russian organizations, income tax is calculated at a rate of 13 or 0%, and in the case of payments to foreign companies - 15% (Article 284 of the Tax Code of the Russian Federation).

It is important to remember that when calculating tax, you must use the rate that was in effect on the date of the decision to pay dividends (letter of the Federal Tax Service of Russia dated July 20, 2017 No. SD-4-3/14214, letter of the Ministry of Finance of Russia dated April 23, 2013 No. 03-03- 06/1/14035, decisions of the Presidium of the Supreme Arbitration Court dated June 25, 2013 No. 18087/12, dated November 29, 2012 No. VAS-13840/12.).

Typically, when calculating income tax on dividends due to Russian organizations, a rate of 13% is applied.

If an organization received dividends from participation in other organizations in the current or previous years, then such income can be taken into account when paying dividends to participants (Article 275 of the Tax Code of the Russian Federation).

Indicator D1 must include the total amount of dividends, which is subject to distribution in favor of all recipients, including foreign organizations and individuals - non-residents of Russia (Letter of the Ministry of Finance dated October 8, 2018 No. 03-03-06/1/72153).

Indicator D2 must include those dividends that were not previously taken into account when determining the tax base and were not included in the calculation of the indicator in previous periods (letters of the Ministry of Finance dated January 31, 2020 No. 03-04-07/6168, dated October 8, 2018 No. 03-03- 06/1/72153).

Take into account dividends received from both Russian organizations and foreign ones, minus withholding tax.

Remember that from 2022, in the D2 indicator, which is subtracted from the total amount of distributed dividends, do not include dividends:

- which are taxed at a zero rate for an international holding company that owns a share or contribution of more than 15% for more than a year;

- from foreign organizations that the company received through Russian organizations and to which it has the actual right, regardless of whether such dividends were subject to income tax for the recipient or tax was calculated on them at a rate of 0%

If the amount of dividends received by your organization is greater than or equal to what needs to be paid to you, then there is no need to withhold income tax (clause 5 of Article 275, clause 1 of clause 3 of Article 284 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated 08.10. 2018 No. 03-03-06/1/72153; dated October 8, 2014 No. 03-08-13/50680, letter of the Federal Tax Service of Russia dated October 29, 2014 No. GD-4-3/22332).

The amount of income tax must be withheld when paying dividends. The tax must be transferred to the budget no later than the day following the day of payment of dividends (clause 4 of Article 287 of the Tax Code).

On dividend payments to a foreign organization, income tax is calculated at a rate of 15% unless other rules are established by an agreement on the avoidance of double taxation with a foreign state (clause 3, clause 3, article 284, article 7 of the Tax Code of the Russian Federation).

A 0% rate when paying dividends can be applied if the recipient, a Russian organization, meets two conditions:

- on the date of the decision on the payment of dividends, for at least 365 consecutive calendar days it has owned at least 50% of the contribution or share in the authorized, share capital or fund of the tax agent or depositary receipts confirming the right to receive at least 50% of the total amount of dividends to be paid;

- she submitted to the tax agent documents confirming compliance with these conditions, including documents indicating the date of acquisition of the share, deposit, depositary receipts (clause 3 of Article 284 of the Tax Code of the Russian Federation).

If the source of payment of dividends is a foreign organization, then in order to apply the 0% rate, it is additionally necessary that this foreign organization is not registered in a state included in the list of offshore zones approved by Order of the Ministry of Finance dated November 13, 2007 No. 108n (clause 1, clause 3, art. 284 Tax Code of the Russian Federation).

From January 1, 2022 to December 31, 2023, dividends paid to a foreign organization that has independently recognized itself as a tax resident of the Russian Federation in accordance with clause 8 of Art. 246.2 of the Tax Code of the Russian Federation, subject to the following conditions:

- on the date of the decision to pay dividends, the foreign organization holds for at least 365 consecutive calendar days at least a 50% contribution or share in the authorized, share capital or tax agent fund or depositary receipts confirming the right to receive at least 50% of the total amount of dividends to payoff;

- a foreign organization receiving and paying dividends must not be registered in a state included in the list of offshore zones approved by Order of the Ministry of Finance dated November 13, 2007 No. 108n;

- dividends from a Russian organization are credited to the foreign organization's accounts in Russian banks.

From January 1, 2024, only dividends received by a Russian organization will be taxed at a 0% rate.

It is necessary to transfer corporate income tax to the budget depending on the type of dividends:

- the day after the payment of dividends, except for dividends on shares of Russian organizations, if it is unknown who the owner of the shares is (clause 4 of Article 287 of the Tax Code);

- on the 30th day, if dividends have been paid on shares of Russian organizations and it is unknown who the owner of the shares is (clause 11 of Article 310.1 of the Tax Code).

The tax on dividends in foreign currency must be converted into rubles at the official exchange rate of the Central Bank of the Russian Federation on the date of payment of the tax to the budget (letter of the Ministry of Finance dated December 13, 2019 No. 03-08-05/97735).

Dividend accounting

On the date when the general meeting of shareholders and participants decided to pay dividends:

D 84 K 75-2 – dividends are accrued to participants and shareholders who are not on the staff of the organization.

or

D 84 K 70 – dividends are accrued to participants, shareholders who are employees of the organization.

Russian organizations must fulfill the duties of a tax agent when paying dividends.

D 75-2 K 68 “Calculations for personal income tax” - personal income tax is withheld from dividends of a participant, shareholder who does not work in the organization;

D 70 K 68 “Calculations for personal income tax” - personal income tax is withheld from dividends of a participant, shareholder who is an employee of the organization.

If you pay dividends to a participant or shareholder - a legal entity, then withhold income tax from them:

D 75-2 K 68 “Calculations for income tax” - income tax is withheld from dividends of a participant, shareholder of a legal entity.

D 75-2 (70) Loan 51 (50) – dividends were paid in cash.

When property is transferred to pay dividends, the accounting procedure will depend on the type of asset being transferred.

accounting tax reporting taxes dividends

Send

Stammer

Tweet

Share

Share

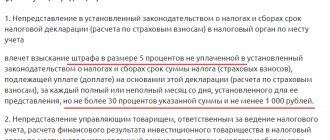

Dividends in the income tax return

If you pay dividends to Russian organizations, you need to submit an income tax return to the tax office. This also applies to tax agents using the simplified tax system. In addition to standard sheets, it includes:

- subsection 1.3 section 1, which shows the amount of tax payable to the budget, according to the tax agent;

- sheet 03 “Calculation of income tax withheld by the tax agent”, which is filled out for each decision on the distribution of dividends (in section “A” the tax on income in the form of dividends is calculated, in section “B” the amount of dividends paid to each shareholder is indicated ( participant).

Fill out, check and submit your income tax return online

Try for free

Let's look at filling out section “A” of sheet 03 using an example.

Example . JSC Omega is the sole founder of Sigma LLC. In December of this year, Omega receives dividends of 70,000 rubles.

In September of this year, Omega JSC accrued and paid interim dividends to its shareholders - 253,000 rubles. At the same time, 55,000 rubles were paid through the depositary, and 198,000 rubles were paid independently:

- 110,000 rubles - to a legal entity;

- 88,000 rubles for resident individuals.

In sheet 03 of the income tax return this is reflected as follows:

How to show dividends on sheet 03 of the income tax return

The amount of dividends for calculating tax (line 091) is determined as follows:

The total amount of dividends is 253,000 rubles, of which:

- legal entities - 110,000 rubles (43.478%)

- depositary - 55,000 rubles (21.739%)

- individuals - 88,000 rubles (34.783%)

The distributed amount of dividends is 183,000 rubles (253,000 - 70,000).

The declaration includes income tax on dividends to legal entities:

- 183,000 rubles × 43.478% = 79,565 rubles

- 79,565 × 13% = 10,343 rubles

If dividends are paid to a foreign company, then only the amount of accrued dividends is reflected in the income tax return. The Federal Tax Service also submits “Calculation of the amounts of income paid to foreign organizations and taxes withheld.” It is submitted within the same time frame as income tax returns - no later than 28 calendar days from the end of the reporting period (clause 4 of Article 310 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated October 10, 2016 No. 03-08-05/58776 ).

Dividends in 6-NDFL

When paying dividends to individuals, tax agents submit 6-NDFL calculations. An updated form has been in effect since 2022. For a detailed analysis of the changes, see the article “New form of calculation of 6-NDFL from 2021”.

In 6-NDFL, dividends are included in sections 1 and 2 of the calculation for the period in which the payment was made:

- in fields 110, 111 of section 2 - the full amount of dividends distributed in favor of individuals participating in the organization;

- in fields 140 and 141 of section 2 - the amount of personal income tax calculated on dividends (before it is reduced by the amount of income tax);

- in field 160 of section 2 - the amount of personal income tax calculated from dividends and reduced by the amount of income tax subject to offset when determining the amount of personal income tax payable on the basis of clause 3.1 of Art. 214 Tax Code of the Russian Federation;

- in fields 020, 022 of section 1, you must reflect the amount of personal income tax calculated from dividends and reduced by the amount of income tax subject to offset.

The amount of tax withheld for the last three months of the reporting period, specified in field 020 of section 1, must be equal to the sum of the values of all fields 022. That is, the amount of tax withheld in previous periods, despite the fact that the payment deadline came in the current period, in the new form in the first quarter of 2022 is not indicated. Therefore, the organization should reflect the dividends paid in December in section 2 of the 6-NDFL calculation for 2022.

The procedure for filling out 6-NDFL when paying more than 5 million rubles was discussed by the Federal Tax Service in a letter dated March 30, 2021 No. BS-4-11/ [email protected]

Dividends received by an individual, minus the amount of income tax to be credited, should be included in the “Amount of Income” field of the application “Information on income and corresponding deductions by month of the tax period.” Income code - 1010 (letter of the Federal Tax Service dated April 13, 2021 No. BS-4-11/4999).

Fill out the current form 6-NDFL with tips and checking against control ratios

Try for free

What's changed in 2022

In 2022, new forms of income tax declaration and calculation of 6-NDFL appeared, a progressive income tax rate was introduced, and the rules for calculating dividends changed.

Change No. 1. New rules for calculating D2

From 2022, indicator D2 (dividends received by the tax agent itself) excludes any dividends taxed according to the Tax Code of the Russian Federation at a rate of 0%, as well as dividends from foreign entities to which the Russian taxpayer has the actual right and which were exempt from taxation in Russia ( Federal Law of November 23, 2020 No. 374-FZ, paragraph 5 of Article 275 of the Tax Code of the Russian Federation).

Change No. 2. Increased personal income tax rates

The calculation of personal income tax on dividends will be made on an accrual basis from the beginning of the tax period (Federal Law No. 372-FZ dated November 23, 2020). Personal income tax rate on dividends:

- 13% - if the tax base for dividends does not exceed 5 million rubles inclusive;

- 15% - in relation to the tax base for dividends exceeding 5 million rubles.

From 2023, the totality of tax bases will be considered. If now we look separately at dividends, separately at wages - whether they exceeded or did not exceed, then we will look at the total amount.