What is VAT on imports?

According to current Russian laws, all imported goods, works, and services are subject to value added tax. The taxpayer does not provide exceptions by category. The following are required to calculate and pay the value added tax to the treasury:

- VAT payers are firms and businessmen on OSNO;

- tax agents and entities exempt from VAT in Russia;

- taxpayers applying preferential tax regimes.

Exemption is provided only for categories of imported products. For example, medical products are completely exempt from import tax. Medical products imported into Russia are not subject to VAT under clause 2 of Art. 150 Tax Code of the Russian Federation.

Imports are subject to general tax rates. Is it 10% or 20%. It is not difficult to determine indirect taxes when importing goods. If imported products are sold within our country at a VAT rate of 20%, then the import tax will be at a rate of 20%.

IMPORTANT!

The amount of import VAT is allowed to be deducted. Only companies and individual entrepreneurs paying it in Russia have the right to declare a tax reduction. If a company is a VAT non-payer within our country (special regime or exemption), then it is not entitled to deductions.

The procedure for reporting imports in the VAT return largely depends on the country of the importing supplier. The purpose of input goods also plays a significant role. That is, operations for which the taxpayer purchases imported products are important.

VAT on goods from EAEU countries

If the supplier-importer belongs to the EAEU countries, then the recipient of the import VAT is the local tax office. The calculated tax is paid to the treasury no later than the date of submission of the special declaration. The regulations explain what date to enter in the import VAT declaration - no later than the deadline for submitting the report. That is, if you declare imports for December 2021 before 01/20/2022, also transfer the import tax until 01/20/2022.

Calculate the tax on imports from EAEU countries using the formula:

Amount = tax base × tax rate,

Where:

- tax base - the cost of imported products, taking into account all excise taxes.

Take into account excise surcharges if you import excisable goods. Determine the basis for calculation at the time the goods are accepted for accounting.

The tax rate is either 10% or 20%.

For reference: as of January 1, 2015, the EAEU includes: Russia, Belarus, Kazakhstan, Kyrgyzstan, and Armenia.

VAT on goods from other countries

If importers are not part of the EAEU zone, then the import tax will have to be transferred to the customs authority. The tax is calculated using the same formula. It is necessary to multiply the tax base by the current VAT rate. But in this case, the tax base is determined differently.

Tax base for calculating VAT when importing from other countries:

NB = TS + TP + AS,

Where:

- CU is the customs value of goods or products imported from countries outside the EAEU. Determined based on information from the customs declaration;

- TP is the amount of customs duties paid for the import of products into the territory of our country. The amount of taxation is established by regulations;

- AC - the amount of excise taxes and contributions that were included in the cost of products. Provided that excisable goods are imported.

ConsultantPlus experts discussed how to fill out a VAT return when importing. Use these instructions for free.

Tax base of indirect tax

When considering the general case, the tax base of indirect tax is determined on the basis of the cost of goods purchased. If we are talking about goods that are the result of work performed under a contract, the value is determined by the transaction price payable by one of the parties to the supplier for the goods. At the same time, the tax base may be increased by certain expenses (unless otherwise provided by the inclusion of these expenses in the transaction price), for example, such as:

- sum insured;

- costs of delivery of goods;

- the cost of packaging, including the cost of packaging materials.

Important! The tax base for indirect taxes includes the amount of excise taxes that are payable on excisable goods.

When selling or receiving excisable goods, the tax base is determined as:

- estimated cost of sold excisable goods;

- volume of excisable goods sold in their natural form;

- a combined tax rate that includes a percentage rate and a flat rate rate.

How to calculate VAT on import of services

When purchasing services from a foreign supplier, calculations are made in a special manner. For example, sometimes the buyer acts as a tax agent. Responsibilities arise if foreign services are sold on Russian territory. The Russian buyer transfers payment to the supplier immediately minus VAT. And the tax itself is transferred to the state budget.

The tax amount from payment to the supplier is transferred to the Federal Tax Service simultaneously with payment for services to the importer. Please take into account the specifics of filling out a payment order. BCC for enrollment in field 104, enter 182 1 03 01000 01 1000 110. Payer status (field 101) - enter 02.

Do not forget to report to the Federal Tax Service, that is, reflect the VAT on imports in the quarterly report on value added tax. File a regular return for the quarter in which the agency tax was withheld. The due date is the 25th day of the month following the reporting quarter.

Package of necessary documents

Before filling out the declaration report, prepare the documents necessary to complete and confirm import transactions. List of required documentation:

- agreements, contracts or agreements on the basis of which imports of goods, works, services are made;

- invoices, invoices accompanying the delivery;

- transport declarations, if the cargo is transported by a transport company;

- payment documents (payment orders, checks, receipts, money orders, bank statements, currency conversion certificates, etc.);

- customs declarations and certificates confirming import and payment of customs duties;

- excise tax declarations when importing excisable products;

- other.

Controllers have the right to request other supporting documentation.

For those who fill out reports for the first time, questions arise regarding the reflection of the customs declaration for imports in the VAT declaration: it is shown in section 8 “Information from the purchase book on transactions recorded for the expired tax period”, on line 150. This is the registration number of the customs declaration assigned reporting during inspection by customs authorities.

Read more: “How to find out and indicate the registration number of the customs declaration”

General rules for filling out indirect tax returns

- The pages of the document are numbered consecutively; the serial number of the page is entered starting from the title page, regardless of the presence or absence of sections.

- Fields of any values are filled in from left to right, starting from the first familiarity.

- Free spaces in the fields are filled with a dash or the value “0”.

- Text values are filled in capital block letters, cost indicators are indicated in full rubles.

- The use of corrective means is not allowed in the declaration; corrections are made in pen and signed by the taxpayer.

- The declaration must not be sealed with any means that could damage the paper.

In accordance with the current procedure for filling out a declaration, the day of submission of the declaration to the tax authorities is recognized as:

- the date of receipt of the document by the inspectorate when presented in person by the taxpayer or his representative;

- date of sending the declaration by registered mail with an inventory as an attachment by mail;

- date of sending the declaration using a telecommunication channel, if there is confirmation of such sending (receipt of receipt of the document in electronic form).

How to fill out a declaration

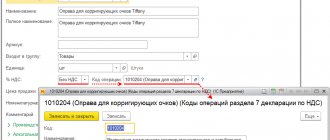

When importing goods from outside the EAEU countries, fill out the declaration report in accordance with the generally established procedure. For example, a VAT declaration when importing goods from China (as well as from other countries except the EAEU) is filled out using form KND 1151001. Please note that the import operation itself is not reflected in the declaration.

IMPORTANT!

The value added tax declaration form (form KND 1151001) and the procedure for filling it out were approved by Order of the Federal Tax Service No. ММВ-7-3 / [email protected] dated 10/29/2014. Starting with reporting for the 3rd quarter of 2021, an updated quarterly report form is used (Federal Tax Order No. ED-7-3 / [email protected] dated March 26, 2021). But the tax authorities plan to change it too - a new reporting form will be introduced starting with reporting for the 1st quarter of 2022. Order No. ММВ-7-3 / [email protected] explains which line of the VAT declaration reflects the application for the import of goods and payment of indirect taxes - in section 8: line 020 reflects the application number, and line 030 - its date .

Read more: “VAT return: instructions for filling out”

To report import value added tax on EAEU goods, use a special declaration form - KND 1151088, approved by Order of the Federal Tax Service of Russia No. SA-7-3 / [email protected] dated September 27, 2017. Form structure:

| Title page | To be filled in anyway. |

| Section No. 1 | To be completed if during the reporting period:

|

| Section No. 2 | Issued if excisable goods are imported, with the exception of ethyl alcohol from all types of raw materials. |

| Section No. 3 | Formed by taxpayers who import ethyl alcohol from all types of raw materials, including denatured ethyl alcohol, raw alcohol, wine, grape, fruit, cognac, Calvados, and whiskey distillates. |

Instructions on how to fill out a VAT return for imports from EAEU countries.

Title page

The title page of the report is filled out according to standard rules. In the header of the page we indicate the TIN and KPP of the reporting organization. Individual entrepreneurs enter only the Taxpayer Identification Number (TIN) (the checkpoint is not filled out).

The adjustment number in the primary report is 0. If you are submitting a corrective report, please indicate the serial number of the adjustment.

Fill out the tax period in accordance with Appendix No. 1 to the procedure approved by Order of the Federal Tax Service of Russia No. SA-7-3 / [email protected] dated September 27, 2017. For example, when filling out a declaration for January, enter 01, February - 02, and so on. If the organization is in the process of reorganization, then enter 71 - code for January, 72 - February, 73 - March, and so on until code 82 - December.

Enter the reporting year in standard mode. For example, for 2022 reporting, enter “2021” in the field, and for 2022 reporting, enter “2022.”

The Federal Tax Service Inspectorate code to which the declaration is submitted is specified in the registration documents issued when registering the taxpayer.

Enter the location code in accordance with Appendix No. 2 to the filling procedure.

Please indicate the full name of the taxpayer. Individual entrepreneurs indicate their full name. Middle name is entered if available.

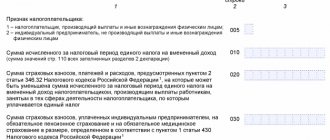

Section 1

In the first section of the declaration calculation we reflect the amounts of value added tax calculated on goods imported to Russia. Fill in the lines:

| Line number | What to indicate |

| 010 | OKTMO - enter the code according to the all-Russian classifier. |

| 020 | KBK - 182 1 0400 110. |

| 030 | Amount of taxes to be paid. Calculated by summing the values of the lower lines of section No. 1 (031-035). |

| 031 | The amount of tax not indicated in lines 032-035. Fill in after lines 032-035. |

| 032 | VAT on processed products. |

| 033 | Tax on goods resulting from work. |

| 034 | Collection from goods received under a trade credit agreement, under a goods exchange contract. |

| 035 | VAT on leasing payment. |

| 040 | Cost of goods exempt from taxation. |

Section 2 and 3

The second section is filled out by importers of excisable products, except for ethyl alcohol and its derivatives. Several sections No. 2 are drawn up in the declaration at once, if the BCC and OKTMO for which fees are credited differ. The first part of the section reflects OKTMO, KBK and the amount of excise tax payable to the budget. In the second part of the section, the amount of tax is distributed for each type of excisable goods imported into the territory of the Russian Federation.

The third section must be completed if ethyl alcohol and its derivatives are imported into Russia. The filling rules are similar to section No. 2. In the first block we reflect OKTMO, KBK and the amount of excise tax. If there are several OKTMO or KBK, we create a separate section No. 3 for each code. In the second block of the section we detail the excise tax amounts for each type of imported alcohol.

How and where to submit

Tax officials explain where the indirect tax return is submitted - the report is sent to the territorial inspectorate of the Federal Tax Service. Submit a declaration to the Federal Tax Service at the place of registration or location (in this case, code 400 is indicated on the title page). Completed and verified reporting is submitted simultaneously with a package of documents certifying the fact of import operations. Here are the papers provided along with the resulting report:

- bank account statement confirming cash flow;

- agreement between importer and supplier;

- all commodity and transport registers (waybills, invoices);

- agency or guarantee agreement;

- statement on indirect taxes;

- application for transfer of VAT and excise taxes to the budget;

- other documents as required by the Federal Tax Service.

The declaration is provided in electronic form. All accompanying forms are sent to the inspection in scanned form. If the inspector requires forms for reconciliation, you will have to bring the original documents legalizing the import of goods to the Federal Tax Service office.

Filling example

Let's look at how to fill out a declaration when importing goods from the Republic of Belarus. Ppt.ru LLC imports goods from Belarusian organizations.

For December 2022, the accountant of Ppt.ru LLC calculated indirect taxes on a 10 kg batch of smoking tobacco purchased from a Belarusian organization and imported into the Russian Federation. Tax amount for December 2021:

- VAT - 10,000 rubles;

- excise tax - 38,060 rubles.

Ppt.ru LLC fills out the title page and sections 1 and 2 of the declaration.

Who pays indirect tax

Legal entities and individuals pay indirect taxes on goods that are their property and imported into the territory of the Russian Federation from the territory of member states of the Customs Union. As a rule, indirect taxes are levied by tax authorities, with the exception of excise taxes on labeled goods, which are levied by the customs authorities of the Russian Federation.

Important! Exemption from VAT taxpayer obligations, as well as the use of special tax regimes (for example, simplified tax system or UTII), does not relieve organizations and private entrepreneurs from the obligation to pay indirect taxes when importing goods into the territory of the Russian Federation.

Postings

Transactions for calculating tax payments are attributed to account 68 of accounting. Reflect in your accounting the following entries for indirect VAT taxes:

| Contents of operation | Debit | Credit |

| Customs VAT calculated | 19 | 76, 68 |

| VAT charged | 90, 91, 76, | 68 |

| VAT is accepted for deduction | 68 | 19 |

| Tax withheld by tax agent | 60, 76 | 68 |

Which form to use

The form and procedure for submitting a declaration on indirect taxes in the KND form 1151088 was approved by Order of the Federal Tax Service of Russia No. SA-7-3 / [email protected] dated September 27, 2017. Appendix No. 1 contains the form, Appendix No. 2 contains the rules for filling it out. The remaining annexes specify the coding procedure for imported products.

Responsibility for failure to submit a declaration

If you didn’t submit your declaration report on time, expect a fine from the inspectors. An individual entrepreneur or organization will be fined 5% of the amount of unpaid tax in overdue reporting for each month of delay (full and incomplete).

The fine is not less than 1000 rubles and more than 30% of the total tax amount.

Punishment is also provided for the person responsible. The administrative fine for the director or chief accountant will be 300-500 rubles.

IMPORTANT!

Submitting a value added tax update does not relieve the taxpayer from the penalty for delaying the initial report.