PBU 05/01 “Accounting for inventories”: basic provisions

One of the main Russian regulations for regulating the accounting of inventories is PBU 05/01 (approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n). It, in particular, provides a definition of MPZ (clause 2 of PBU 05/01). They represent assets:

- involved in the production of goods, performance of work or provision of services as raw materials or supplies;

- intended for sale (finished products, goods purchased from a supplier);

- used to meet the needs of the enterprise.

Inventory accounting units can be:

- stock item number;

- the consignment;

- group of homogeneous materials;

- another unit of accounting determined by the organization and allowing to ensure the reflection of reliable information about inventories, as well as to establish control over their availability and movement.

IMPORTANT! The norms of PBU 05/01 do not apply to work in progress balances, although data on them is included in line 1210 “Inventories” of the balance sheet form.

For information on how work in progress balances are included in line 1210, read the article “Main production in the balance sheet (nuances)” .

The key issues discussed in PBU 05/01 are the assessment of inventories when accepting them for accounting and disposal, as well as the rules for reflecting data about them in accounting records.

Results

From 01/01/2021, most organizations must introduce the norms of the new accounting standard FSBU 5/2019 into their work. Reporting for 2022 will be prepared in accordance with them. FSBU is not used in the public sector, and “kids” will be able to choose whether or not to use it in their work. In addition, the standard itself offers various concessions to organizations that keep records in a simplified way.

The replacement of the old PBU with the new FSBU led to significant changes in inventory accounting. The changes affected work in progress, which previously did not belong to the concept of “inventories,” the assessment of inventories, the procedure for their write-off, and the rules for disclosing information about inventories in reporting.

Sources:

- Order of the Ministry of Finance of Russia dated November 15, 2019 No. 180n “On approval of the Federal Accounting Standard FSBU 5/2019 “Inventories””

- Accounting Regulations “Accounting for Inventories” PBU 5/01

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

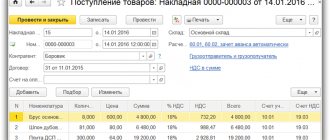

Accounting for the capitalization of inventories according to PBU 05/01

The procedure under consideration involves the acceptance of inventories for accounting at their actual cost, consisting of the costs of purchasing or manufacturing materials minus VAT and other taxes, which are returned by the state (unless otherwise provided by law).

Here are examples of costs that form the actual cost of inventories purchased from a third party:

- payment under the supply agreement;

- expenses for consulting services provided during the acquisition of inventories;

- customs duties;

- taxes that are not refundable from the budget;

- intermediary remuneration;

- fare;

- expenses for insurance of inventories, etc.

In general, eligible costs can include any costs that are associated with the purchase of inventory from a supplier.

The actual cost of inventories produced independently is determined based on the actual costs associated with the release of the corresponding stocks. Accounting and formation of these costs is carried out in the manner established by the accounting policy for calculating the cost of manufactured products.

If a company conducts accounting according to a simplified scheme, it can:

- Evaluate purchased inventories at the supplier's price, including associated costs as expenses immediately as they are implemented (clause 13.1 of PBU 5/01).

- Being a micro-enterprise, immediately upon acquisition, include in expenses the cost of inventories used in the normal activities of this enterprise (clause 13.2 of PBU 5/01). This method is also available to other organizations with simplified accounting, but only in a situation where their activities do not generate significant inventory balances.

- Immediately write off as expenses all expenses for the purchase of inventories for management needs, including their cost determined by the supplier (clause 13.3 of PBU 5/01).

If the materials and materials do not belong to the company, but it disposes of them in accordance with the terms of the contract, the materials are taken into account in the assessment provided for in this contract.

Valuation of reserves upon disposal according to PBU 05/01

Another inventory accounting procedure regulated by PBU 05/01 is their assessment upon disposal. It can be carried out based on:

- from the cost of a unit of material stock;

- average cost of inventories;

- the cost of the very first purchased inventories - using the FIFO method.

If inventories are used by a company in a special manner or are not interchangeable in normal use, they can be valued based on the cost of each unit of inventory.

If the accounting policy defines a specific method of accounting for inventories for the reporting year, only this method should be used during the corresponding period. The method of accounting for inventories is selected based on its applicability to the activities carried out by the legal entity.

The assessment of inventories that do not relate to goods, which are recorded at sales value, as of the end of the reporting period is carried out in the same way as is used when disposing of the corresponding inventories.

We write off inventories - what has been updated

The new standard requires inventory to be written off at a specific point in time. It could be:

- recognition of sales revenue;

- making other write-offs of inventories;

- lack of prospects for economic benefits from further use;

- impossibility of use in statutory activities - for non-profit organizations.

In this case, expenses should reflect the book value of inventories. For each of these cases, costs will be taken into account separately.

The methods for writing off inventories remain the same as those currently in effect and are enshrined in PBU 5:

- at the cost of each unit;

- at average cost;

- at the cost of the first inventory received by the organization - the FIFO method.

The chosen method must be fixed in the accounting policy.

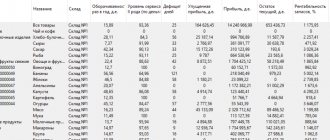

Reflection of inventories in financial statements according to PBU 05/01

PBU 05/01 also regulates the procedure for reflecting information about inventories in accounting reports. Inventories should be reflected in it in accordance with a classification that takes into account the method of their use in economic activities.

As of the end of the reporting year, inventories are shown on the balance sheet at cost, which is established based on the methods used to evaluate the corresponding reserves.

Materials and equipment that are obsolete or have lost their marketable appearance or have become cheaper are reflected in the balance sheet at the end of the year minus the reserves provided for the reduction in the value of inventories. The corresponding reserve is formed at the expense of financial results by the amount of the difference between the market value and the actual cost of inventories if the second indicator is higher than the first. This norm may not be followed by companies that conduct simplified accounting (clause 26 of PBU 5/01).

Inventory that is in transit or transferred to the consumer as collateral, the rights to which have been transferred to the legal entity, are reflected in accounting based on the assessment provided for in the contract, with further clarification of their actual cost.

The following must be included in inventory accounting:

- methods for assessing MPZ in relation to their groups or varieties;

- information about the consequences of changes to these assessment methods;

- the cost of inventories pledged as collateral;

- the amount and movement of reserves for reducing the cost of materiel.

For information on how management accounting for inventories is organized, read the article “Management accounting of inventories (nuances).”

Has the new PBU 5/2012 “Inventory Accounting” been adopted?

Procedures related to accounting for inventories may be regulated not only by Russian, but also by international reporting standards. First of all, it is worth noting that the legislator made an attempt to adapt IFRS standards to financial and economic legal relations in Russia by developing the draft PBU 5/2012, which was supposed to establish new inventory accounting standards - instead of those defined in PBU 05/01 - taking into account international standards.

However, this project was never adopted. Nevertheless, in 2015, the Russian Ministry of Finance introduced one of the IFRSs into the Russian Federation, regulating the handling of inventories.

The new FSBU 5/2019 brings the standards of IFRS and RAS closer together.

A ready-made solution from ConsultantPlus will help you rebuild the materials accounting algorithm when applying FSBU 5/2019. Get trial access to K+ for free and proceed to the material.

Read about what Russian and international standards have in common and what distinguishes them in the article “RAS and IFRS - main similarities and differences.”

Inventory accounting according to IFRS: governing legislation

We are talking about the adoption of International Standard (IAS) 2 “Inventories”. It was put into effect by order of the Ministry of Finance of the Russian Federation dated December 28, 2015 No. 217n; its text in Russian is given in Appendix 2 to this order.

In this legal regulation, reserves are understood as assets that:

- held for sale in the ordinary course of business of the firm;

- are manufactured in production for the purpose of further sale;

- are in the form of raw materials or materials that are used by the company in production or in the provision of services.

Inventories in IFRS also mean:

- goods purchased by the company for the purpose of further resale;

- finished products;

- remains of work in progress, which are subject to further use by the company during production.

By analogy with the procedures discussed above, regulated by Russian PBU 05/01, we will consider which standards of IFRS 2 can be applied to assess the value of inventories and generate reports on inventories.

Valuation of reserves according to IFRS

In accordance with IFRS 2, inventories should be measured at the lower of the following:

- cost;

- net potential selling price.

As for the cost, it should include the following costs:

- for the purchase of inventories;

- their processing;

- other costs incurred by the company in order to ensure the current location and condition of inventories.

In turn, the costs of acquiring assets include:

- purchase price of the stock;

- duties;

- non-refundable taxes;

- fare;

- costs associated with loading and unloading;

- other costs that are directly related to the purchase of inventories.

In this case, discounts and other reasons for reducing costs must be deducted from the cost of purchasing inventories.

Regarding processing costs, they should include:

- salaries of employees engaged in production;

- various overhead costs when processing raw materials.

Other costs that are taken into account when determining the cost of inventories may include, in particular, the costs of developing certain products for certain customers. Sometimes the cost structure of inventories may include borrowing costs - this procedure is regulated by separate IFRS standards.

Net potential selling price in IFRS is the estimated selling price of an asset in the ordinary course of business less estimated costs of completion and sales.

When inventories are sold, their carrying amount is recognized as an expense in the period in which the firm receives revenue from the related sales. The amount for any write-down of inventories to their net potential selling price, as well as any loss of inventory, must be recognized as an expense within the period in which the write-off or loss was recognized. Amounts for any reversals (of previously written-off inventories) due to an increase in net potential selling price should be recognized as a reduction in the amount of inventories recognized as expenses within the period in which the reversals were made.

Separate standards for determining the cost of inventories are established in IFRS 2 for companies providing services, as well as for farming organizations (paragraphs 19, 20).

When calculating the cost of goods according to IFRS, the following accounting methods can be used:

- on regulatory costs;

- retail prices.

The first method involves looking at typical levels of inventory consumption, labor, efficiency, and productivity - but these can be revised based on market conditions.

The second method is more suitable for retail, an area characterized by frequent changes in the structure of inventories, as well as revenue indicators for their sales or products manufactured using materials.

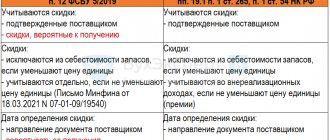

How the assessment rules have changed

The main innovation of the federal standard is that now inventories will have to be assessed twice - upon receipt and after recognition. Moreover, in the first case, the rules for valuing different types of reserves will differ significantly from each other.

Valuation of inventories at recognition

All inventories must be recognized at actual cost. But what will shape it?

Inventories excluding finished goods and work in progress

For the bulk of inventories, the actual cost will be the amount of expenses aimed at acquiring assets, delivering them, and bringing them to a condition suitable for use or sale.

If inventories are received free of charge or settlements with their supplier are made in non-cash terms, then the inventories will have to be measured at fair value. In the first case - supplies received free of charge. In the second - the transferred property. This value is determined by IFRS 13 Fair Value Measurement.

Important! Costs associated with storage will no longer form the actual cost of inventories, except in cases where storage is one of the cycles of the technological process.

Work in progress and finished goods

The actual cost of these types of inventories is formed by the following costs:

- material;

- for wages;

- social security contributions;

- depreciation.

In accounting, a business entity must divide all costs into direct and indirect. The procedure for such division is best provided for in accounting policy. Direct costs will be attributed to specific products, and indirect costs will have to be distributed by type. Methods of distribution should also be reflected in accounting policies.

Nuances of recognizing inventory upon receipt

For certain categories of business entities, the FSB determines the nuances of recognizing inventories.

- Organizations that keep records in a simplified way have the right to recognize values without taking into account discounts and deferment conditions.

- Retail companies will be able to recognize goods at sales price with separate accounting for markups.

- For trading enterprises, funds spent on the procurement and delivery of goods to central warehouses are taken into account in sales costs.

Valuation of inventories after recognition

We have already become acquainted with the first quantity, let’s deal with the second. Net realizable value is the price less the estimated costs of producing, preparing for sale and selling inventory.

If actual cost exceeds net realizable value, inventory is impaired. This usually happens over time, due to obsolescence, etc. In this case, the organization is required to create a reserve for the amount of the specified excess. The book value will be formed from the actual cost of inventories minus the reserve.

For organizations with simplified accounting, creating a reserve is not necessary.

Inventory reporting in accordance with IFRS

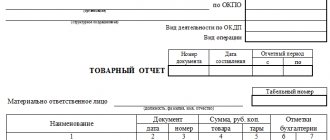

IFRS requires firms to disclose when reporting inventories:

- the principles of the adopted accounting policy regarding the valuation of inventories, as well as the formula for estimating their cost;

- the total cost of all inventories for inventories, as well as specific types of inventories that are used in the organization;

- the carrying amount of inventories, which are accounted for at fair value, but less costs to sell;

- the size of inventories, which are recognized as expenses within the reporting period;

- amounts for any write-offs of the cost of inventories that are recognized as expenses within the reporting period;

- amounts for any reversals of write-offs that are recognized as a decrease in inventory, which is reflected as an expense within the reporting period;

- obligations or events as a result of which the write-off of the cost of inventories was restored;

- the book value of inventories that were pledged as a means of fulfilling the company’s obligations.

Fair value in the context of IFRS 2 is the price that a firm would receive to sell an inventory or pay to transfer a liability in an orderly transaction with a counterparty at the time the asset is measured.

Read about who in the Russian Federation has the obligation to prepare financial statements under IFRS here .

How to reliably disclose information about reserves in reporting

The amount of information that must be disclosed in the financial statements regarding reserves is large. In addition to the book value at the beginning and end of the reporting period, it is necessary to reflect information regarding:

- reconciliation of inventory balances at actual cost and impairment at the beginning and end of the reporting period and inventory movements for the same period;

- the reasons that led to the restoration of the reserve;

- the book value of assets for which the organization has restrictions, for example collateral;

- methods for calculating the cost of inventories, and if they change in the new reporting period, it is necessary to disclose information about the consequences of such a change;

- advances and deposits transferred to suppliers, carriers and inventory processors.