A little history

In its letter dated July 17, 2013 No. AS-4-2/12722, the Tax Service for the first time regulated the work of commissions on the legalization of the tax base. The procedure applied to most major taxes: VAT, income tax, personal income tax, insurance fees, taxes under special regimes, as well as land, transport and property taxes.

However, at the beginning of this year, the Federal Tax Service canceled the rules regarding many payments (letter dated March 21, 2017 No. ED-4-15 / [email protected] FN). As for personal income tax and insurance contributions, the correctness of the formation of the tax base and the completeness of their payment still remained the subject of the work of the commissions. And on July 25, 2022, letter No. ED-4-15/ [email protected] , in which the Federal Tax Service presented updated rules for the functioning of “salary” commissions.

Goals and objectives

The main goal of tax base legalization commissions is to encourage people to pay more personal income taxes and insurance premiums. Of course, we are not talking about bona fide payers (agents), but about those who hide the facts of economic activity or do not fully reflect them in accounting, and also submit unreliable reports.

The commission is given certain tasks. They boil down to identifying facts of violations in the activities of an organization or entrepreneur that are associated with:

- with failure to register labor relations with employees;

- with payment of “gray” wages;

- with payment of wages less than the minimum wage or subsistence level;

- with late payment of personal income tax and/or insurance premiums;

- with the submission of false accounting and/or tax reporting.

Stages of the commission's work

Conducting a direct commission meeting with the participation of a taxpayer or agent is one of the stages in the work of the tax authorities to legalize the tax base. It is preceded by the following work:

- selection of candidates;

- carrying out analytical and control measures in relation to them;

- sending them letters that should encourage them to independently solve the problem: making changes to the statements, paying off debts, and so on.

If the taxpayer has not taken action on his own, material is prepared for consideration and a commission meeting is held. But the work on legalizing the tax base does not end there. After the meeting, the tax authorities will monitor the performance indicators of the persons invited to the commission. If violations are not eliminated, they may be summoned for a conversation to local government bodies, and some entities - to the regional administration.

I received an invitation to the commission. Can I ignore it?

The consequences of failure to appear without good reason are varied: a repeated call to a meeting, the emergence of an additional criterion for conducting an on-site inspection or inclusion in the audit plan as a matter of priority.

One of the main consequences of ignoring an invitation to a commission is bringing to administrative responsibility under Article 19.4 of the Code of Administrative Offenses of the Russian Federation. To attract the head of an organization who neglects invitations to the salary commission - in the amount of 2,000 to 4,000 rubles. At the same time, such a fine can only be collected in court. Tax authorities have the right only to draw up a protocol on the identified violation (subclause 5, clause 2, article 28.3 of the Code of Administrative Offenses of the Russian Federation) and submit the document to the court, which will decide on prosecution (clause 1 of Article 23.1 of the Code of Administrative Offenses of the Russian Federation).

It is almost impossible to bring the head of a company or entrepreneurs to administrative responsibility for failure to attend a meeting of the interdepartmental salary commission. The commission is not a controlling body, but a coordinating body, which means it does not have the authority to give orders and make demands. However, we should not forget, let alone ignore, other possibilities of the commission. So, she can schedule an on-site inspection; include the enterprise in the list of unscrupulous organizations; demand from local authorities a revision of rental rates for municipal property, etc.

The commission also has the opportunity to transfer the dossier on an intractable company to departments whose competence includes conducting inspections of the activities of organizations and entrepreneurs. In particular, these are the prosecutor's office, the Ministry of Internal Affairs, and Rostrud. Accordingly, the commission can create increased attention from inspection bodies of any level to the activities of the organization. Therefore, theoretically, you may not go to the meeting, but you must provide justification for the valid reasons for non-attendance.

How is the selection made?

Tax inspectorate specialists analyze the data at their disposal regarding the activities of the taxpayer or agent regarding the payment of personal income tax and insurance premiums. At the same time, the candidates for the commission meeting risk being:

- Tax agents who:

- have personal income tax debts;

- reduced the volume of tax transfers by more than 10% compared to the previous period;

- pay wages below the average level for the type of activity in the region.

- Individual entrepreneurs who:

- have a low personal income tax burden;

- claimed professional deductions amounting to more than 95% of income;

- reflected sales revenue in the VAT return, and zero income in the 3rd personal income tax return;

- did not submit the above-mentioned declarations for the reporting period.

- Payers of insurance premiums who:

- reduced the amount of contributions for the reporting period by more than 10% while the number of employees remained unchanged;

- reduced the number of employees by more than 30% compared to the previous period;

- have arrears in paying contributions;

- in previous periods, contributions were calculated at an additional rate of 6 or 9%, but in the reporting period other rates were applied.

- Payers in respect of whom:

- there is information from foreign countries about receiving income that should be subject to personal income tax in Russia;

- there is information obtained from requests from citizens, organizations, control agencies and other sources about their taxable income.

Why is a commission created?

The main candidates for visiting the salary commission are companies and individual entrepreneurs whom the tax authorities suspected of using “gray” wage schemes and issuing salaries “in envelopes”. If suspicions have not yet been confirmed, inspectors will not rush into an on-site inspection. First, the alleged violator will be called to the commission and asked to correct the situation on his own. Also, those whose guilt is no longer in doubt will be called to the commission, but the amount of hidden income is so small that it is ineffective to order an on-site inspection.

Tax authorities draw information about possible schemes not only from their own sources (calculations, declarations, etc.), but also from requests from citizens, organizations and regulatory agencies. Also, employees of the Federal Tax Service take into account information from competent foreign sources about residents of the Russian Federation who receive income abroad.

Analysis stage

So, the candidates have been selected, and now tax officials will have to analyze their activities in terms of personal income tax and insurance contributions. To do this, they analyze a variety of information, including:

- received as part of a tax audit in accordance with Article 93.1 of the Tax Code of the Russian Federation;

- data from open information resources, registers and databases maintained by the Federal Tax Service;

- information obtained from the Internet and the media;

- information from credit institutions, as well as law enforcement agencies, customs, licensing, Pension Fund and other funds, municipal authorities, the Central Bank, Rostrud and others;

- information contained in complaints on behalf of citizens and legal entities;

- information provided by employees or shareholders of the audited organization.

All information found is used for analysis in the following areas:

- Basic accounting data and other information that gives a general description of the object of analysis.

- Organizational balance.

- Salary level and fulfillment of the obligation to pay personal income tax.

- Fulfillment of the obligation to pay insurance premiums.

- Entrepreneurs' reporting.

Having assessed the activity of the subject, tax specialists draw conclusions about the level of its tax risk. If an organization or individual entrepreneur is selected to appear at the commission, a calculation of its tax burden will also follow.

A chance to voluntarily close all questions

Before inviting a taxpayer or agent to the Federal Tax Service, he may be sent an information letter inviting him to independently analyze his activities in terms of the tax burden for personal income tax and insurance contributions, including determining the tax base and deductions. If the subject comes to the attention of the commission due to a debt, it will be asked to repay it. If the reason was distorted tax and accounting reporting, the subject will have a chance to make changes to it.

The letter must set out the facts of violations that were identified during the previous analysis. As well as questions that Federal Tax Service specialists want answers to.

Among other things, the taxpayer (agent) may be asked to:

- pay off debt;

- conduct an independent risk assessment (order of the Federal Tax Service of the Russian Federation dated May 30, 2007 No. MM-3-06/ [email protected] );

- calculate personal income tax and insurance premiums based on real income;

- adjust the base for personal income tax and insurance premiums, clarifying professional deductions and the amount of non-taxable income;

- submit updated declarations and calculations.

The subject is given 10 working days from the date of receipt of the letter to take action. The letter itself must be sent no later than a month before the expected date of the commission meeting.

As a reaction, the taxpayer or agent can pay the debt, provide updated documents or reasoned explanations of the fact that he did not commit any violations and, accordingly, there is no reason to call him to the commission.

Consideration of the activities of organizations and individual entrepreneurs at a commission meeting

The activities of the taxpayer, tax agent, and insurance premium payer at the commission meeting are considered on an individual basis.

In this case, the representative of the organization (or individual entrepreneur) is invited to: – provide explanations on the identified facts and inconsistencies;

– clarify the activities carried out (or planned to be carried out) in order to improve financial and economic performance indicators and prevent violations of the legislation on taxes and fees.

Based on the results of the review, the commission formulates recommendations for eliminating violations committed during the formation of the tax base, the base for calculating insurance premiums, as well as for taking measures aimed at attracting the payer to pay debts on personal income tax and insurance premiums.

For example, it might be suggested:

submit updated calculations in Form 6-NDFL and calculations for insurance premiums for previous tax periods, in which it is necessary to clarify reporting indicators, including the costs of insurance premium payers to pay for insurance coverage, amounts not subject to insurance premiums, the amount of additional tariffs for insurance premiums and the amount of contributions calculated according to these tariffs, the number of employees in whose favor income is accrued;

- transfer the amount of debt for personal income tax and insurance premiums, taking into account penalties;

- take measures to eliminate negative trends in subsequent reporting periods.

Recommendations must contain a specific deadline for eliminating violations in accounting that resulted in an understatement of the tax base for personal income tax and the base for calculating insurance premiums.

The recommended period is 10 working days from the date of consideration of the payer’s activities at the commission meeting. Based on the results of consideration of the payer’s activities at the commission meeting, a protocol must be drawn up, which records:

– recommendations for the taxpayer;

– the deadline for eliminating violations (distortions) in accounting that resulted in an understatement of the tax base for personal income tax and the base for calculating insurance premiums.

The recommended form for the minutes of the commission meeting is given in Appendix 9 to Letter No. ED-4-15/ [email protected] .

Information on the results of the work of the “salary” commission can be sent to law enforcement, regulatory and other bodies (for example, internal affairs bodies, territorial bodies of the Federal Migration Service, State Tax Service, etc.) for decision-making in accordance with their competence.

If employers pay wages below the subsistence level or minimum wage, information about such employers is sent quarterly to the tax authorities for appropriate measures to be taken:

– at the territorial level – to local governments;– at the regional level – to the labor and employment authorities of the constituent entities of the Russian Federation and State Labor Inspectorate for the constituent entities of the Russian Federation.

Call to a meeting

If the deadline has expired and the subject has not taken the necessary measures, the Federal Tax Service will send him a notice of summons to a commission meeting. This can be done in different ways: in person, by registered mail, electronically via TKS. In the latter case, receipt of the call must be confirmed within 6 working days from the date of sending. Otherwise, the Federal Tax Service may block bank accounts.

Having received the notification, the payer (agent) will see not only the exact time and place of the meeting, but also a detailed description of why he is being called. Accordingly, it is worth considering your line of behavior and preparing documents.

The organization or another representative of the organization, acting on the basis of a power of attorney, can go to a meeting of the commission on legalization of the tax base.

What to do if you receive a notification from the tax office?

According to paragraphs. 4 paragraphs 1 art. 31 of the Tax Code of the Russian Federation, the tax authority has the right to call taxpayers (payers of fees or tax agents) on the basis of a written notification to give explanations in connection with the payment (withholding and transfer) of taxes and fees or in connection with a tax audit, as well as in other cases related to their compliance with the norms of the Tax Code of the Russian Federation, in particular, within the framework of meetings of “salary” commissions.

The notice states:

– a detailed description of the purpose of calling the taxpayer (fee payer, tax agent);

– date and time of appearance;

– address of the inspection and office number where you need to appear.

Notification of the call from the Federal Tax Service can be transmitted in one of the following ways:

– to a representative of the organization in person against signature;

– by registered mail;

– in electronic form via TKS. In this case, it is necessary to send a receipt of receipt of the notification to the Federal Tax Service Inspectorate via TKS within six working days ( clause 5.1 of Article 23 of the Tax Code of the Russian Federation ). If this is not done, the inspectorate may block the organization’s bank accounts ( clause 2, clause 3, article 76 of the Tax Code of the Russian Federation ).

The interests of an organization can be represented by its head or a representative acting by proxy ( clause 1 of Article 26 , clause 1 of Article 27 , clause 1 of Article 29 of the Tax Code of the Russian Federation ).

Review Process

There is no single procedure for holding a meeting - in each case it is held individually. However, in any case, the invited person should have the opportunity to explain the reasons for his violations, as well as talk about what he has done or plans to do to eliminate them.

As a result of the review, the commission will make recommendations. If they are associated with distortion of accounting data, the time frame within which they must be eliminated will be determined. In addition to paying off the debt and submitting updated reports/calculations, the entity may be advised to take measures to prevent similar violations in the future.

The essence of the recommendations and the deadlines for correcting distorted data should be reflected in the minutes of the commission meeting. Its findings can be sent to law enforcement agencies, the Federal Migration Service, the Labor Inspectorate and other bodies.

Is it possible not to show up?

The absence of an invited subject at the meeting will be reflected in the minutes. If this is due to valid reasons, the meeting may be postponed. If not, then it will take place without a “defendant”. In this case, the violator may be fined under Article 19.4 of the Code of Administrative Offenses of the Russian Federation in the amount of 500–1000 rubles for a citizen and 2000–4000 rubles for an official.

If the invited person did not appear (did not send his representative) and at the same time, according to the reporting data, no positive changes are planned in his activities, then other measures may be taken in relation to him:

- summons to a commission under municipal authorities (or regional, if we are talking about unitary enterprises or joint-stock companies with the participation of government agencies);

- pre-test activity analysis;

- on-site inspection.

If you don’t come to the meeting of the “salary” commission

The failure of a taxpayer, tax agent, or insurance premium payer to appear is recorded in the minutes of the commission meeting.

If a taxpayer (tax agent, insurance premium payer) fails to appear at a commission meeting for a valid reason, the meeting may be postponed. In this case, the notification is sent again in the form approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-2 / [email protected] .

In case of failure of duly notified payers to appear at the commission without a good reason, they will be subject to mandatory liability measures provided for in Art. 19.4 Code of Administrative Offenses of the Russian Federation .

According to Part 1 of Art. 19.4 of the Code of Administrative Offenses of the Russian Federation, disobedience to a lawful order or requirement of an official of a body exercising state supervision (control), state financial control, an official of an organization authorized in accordance with federal laws to exercise state supervision, entails a warning or the imposition of an administrative fine:

- on citizens - in in the amount from 500 to 1,000 rubles;– for officials – from 2,000 to 4,000 rubles.

In addition, in relation to payers who did not appear at the commission meeting without good reason and whose reporting data does not indicate a positive change in their financial condition, the following measures may be taken:

- repeated call to the interdepartmental commission at local governments;

- a call to the interdepartmental commission under the administrations of the constituent entities of the Russian Federation (in relation to state and municipal unitary enterprises, joint-stock companies with the participation of capital of the Russian Federation of the corresponding constituent entities of the Russian Federation or municipalities);

- carrying out pre-test analysis in the prescribed manner;

- preparation of materials for scheduling an on-site tax audit.

After commission

So, the subject visited the commission and received a protocol with recommendations. Now his activities will be under the supervision of the tax authority, which will monitor whether there are positive dynamics.

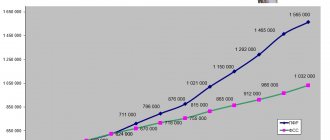

At the same time, once a quarter the Federal Tax Service will monitor:

- updated declarations/calculations with increased amounts of personal income tax and insurance contributions;

- dynamics of debt repayment;

- dynamics of the number of employees;

- the amount of wages paid to employees;

- tax burden.

In relation to debtor employers and those who pay wages below the minimum, control will be carried out monthly.

If it is revealed that the payer or agent does not show any positive dynamics and has not provided any explanations about this, then information about him will be sent for a pre-audit analysis. As a result, the subject has a great chance of being included in the on-site tax audit plan.

Tasks of the salary commission

Many employers lower wages to reduce the tax burden. This is done as follows: the employment contract sets the minimum wage, but in fact the employee’s earnings can significantly exceed the specified value. As a result, the company partially evades paying taxes. It is to prevent this offense that the salary commission exists. Let's take a closer look at its tasks:

- Legalization of actual earnings.

- Legalization of the relationship between employer and worker.

- Elimination of wage debt to workers.

- Equalization of wages across the industry.

- Full payment of taxes by the company.

- Legalization of “black” and “gray” wages.

Question: How can I find out whether wages correspond to the average wages by industry for tax control purposes? View answer

The salary commission bases its actions on the average salary in the industry. She has the right to receive information about the salary paid by the company. To improve the efficiency of its activities, the commission can cooperate with the labor inspectorate, tax inspectorate, trade union organizations, and internal affairs bodies. Every quarter the commission organizes meetings, the results of which are transmitted to the regulatory authorities. The employer may then be held liable for the offence. The final goal of the salary commission is to increase employee salaries and eliminate “shadow” earnings. Insurance premiums also increase automatically.

IMPORTANT! The activities of the salary commission are based on industry average salaries according to OKVED. This is the average salary in a particular area, which significantly exceeds the minimum wage.

It should be noted that the activities of these commissions are not aimed at increasing wages, although this may ultimately occur. In this case, the “target” is to identify “gray schemes”, that is, salaries “in envelopes”, when the tax base is deliberately reduced and the state receives less personal income tax and insurance contributions.