Application features

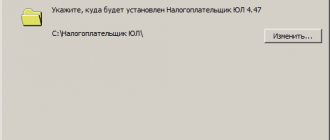

The program for filling out 3-NDFL for 2016 on the official website of the Russian Tax Service can be downloaded from the following link (shown with the index for Moscow):

Those who are required by law to independently declare their income are interested in the question: how to save the 3-NDFL declaration from the program

Federal Tax Service and, in principle, not to lose the entered data about yourself, your income, expenses (IP), as well as deductions.

So: its work is organized in such a way that when launched, the application automatically generates an “empty” declaration. And at any time you can:

- save the entered data to disk;

- load a previously saved declaration;

- form a new 3-NDFL.

Each time you open it next time, the title of the window will show the name you gave to the file with 3-NDFL for 2016.

EasePDF

A specialized PDF converter that supports two-way conversion and simultaneous processing of multiple documents. For convenience, ready-made templates are available. Source files can be easily downloaded, imported from Google Drive, Dropbox, OneDrive, or added via a link.

You can simply download the converted document to your local drive or save it to the cloud, and also share a link and QR code to it.

Try EasePDF →

Preservation

It is important to understand: the Federal Tax Service application works on such a principle that it will not allow information already entered into 3-NDFL to simply disappear. Even if you accidentally or on purpose:

- press Alt and F4 at the same time;

- click on the cross in the upper right corner of the window;

- Select File – Exit from the main menu.

In this case, when there are unsaved changes in the 3-NDFL file being filled out, the program will prompt you to save it to a file. If the answer is yes, you will be asked for the name and location of the saved file (if a name has not already been selected).

When you select the “File” option in the main menu, a submenu with the following content will appear:

| Possibilities of the “File” submenu | |

| Option | What gives |

| Create | Generates a new declaration. At the same time, if another declaration is open at the same time and changes are made to it, but not saved, a proposal to save them will appear. According to its internal structure, the program begins each start by creating a new declaration. That is, you can enter and change data in different 3-NDFL. |

| Open | Makes it possible to open a file with 3-NDFL, which was previously entered and saved. At the same time, if another declaration is open at the same time and changes are made to it, but not saved, a proposal to save them will appear. |

| Save | Allows you to save the active declaration to a file |

| Save as… | Will ask for the name and location of the file to save on your computer, laptop |

| Exit | Allows you to leave the program |

Note:

All these options are duplicated on the toolbar.

Now there is an important instruction for filling out 3-NDFL in the application from the Federal Tax Service: if, after selecting the Create/Open/Save options, you confirmed the request to save changes, but you did not enter the file name, the system will still display a dialog asking for the name and location on PC new file.

Not everyone knows that the “Declaration” program allows you to generate a file with the 3-NDFL declaration for 2016 for the tax office in electronic form. To then send it via:

- personal account of an individual on the official website of the Federal Tax Service of Russia;

- government services portal – www.gosuslugi.ru.

You can receive such a file with the xml extension suitable for sending. To do this, on the toolbar you need to click on the “xml file” button:

The second way is to select “Declaration” – “Export to xml”:

CloudConvert

Another multi-format converter that automatically detects content and offers the most suitable conversion options. You can use a local file or link as a source, or select one from the cloud.

CloudConvert is great for PDFs and offers several useful settings. Selecting specific pages, automatically creating bookmarks for subheadings, optimization, and even password protection are available.

Try CloudConvert →

Printout

Now about how to print the 3-NDFL declaration from the program

Federal Tax Service. The first way is through the “Declaration” submenu (see figure above).

| Possibilities of the “Declaration” submenu | |

| Option | What gives |

| View | Preview of the generated declaration in the form and volume in which it will be printed if “Print” is selected |

| Seal | Printing the selected 3-NDFL |

| Export | Moves the data of the current declaration to a file in a format approved by the Federal Tax Service for sending to the inspectorate via electronic channels |

| Check | Analysis of the generated declaration for completeness and compliance of the entered data |

The second method is how to print 3-NDFL from the program

. In the main application window, click “View” on the toolbar:

Then you will see a series of sheets of the 3-NDFL you formed for 2016.

If you select “Print” on the toolbar in the main program window, the 3-NDFL will be printed in its entirety. And in the “View” mode, you can select the pages you need to print if you click on the button with the image of the printer without a checkmark.”

As for the buttons with the image of floppy disks, they allow you to save printed pages into a file with the TIF extension: into one multi-page file or into each file one page at a time.

Keep in mind:

printed 3-NDFL forms contain a barcode and “+” symbols. This is normal for a so-called machine-oriented form. Simply put, these symbols are needed for the scanner to read information. The inspectorate has no right to refuse to accept such a declaration.

How to fill out the 3-NDFL declaration in your personal account on the tax website

Last update 2019-01-28 at 10:38

You can fill out form 3-NDFL on the tax website quickly and easily. The service independently calculates the refund amount and generates the form itself with the fields already filled out.

How to fill out 3-NDFL through “Personal Account”?

Any citizen can fill out 3-NDFL on the website nalog.ru, and also submit it along with documents online. To do this, you need to create an account - “Taxpayer Personal Account”.

How to create an account:

- Submit an application to any tax office in Russia - not necessarily at your place of registration.

- Receive the initial login and password in the registration card.

- Log in to your “Personal Account” under them and change your password.

Access to the service is also possible through an account on the State Services portal, if it is confirmed.

To fill out 3-NDFL online in your “Personal Account”, take the initial data.

Example 1

Belyaeva Tatyana Olegovna works as a nurse at the private clinic “Nevromed”. Her salary is 18,000 rubles per month. With the support of her parents, she bought a studio apartment in 2022 for 1,500,000 rubles and now wants to get a deduction for it. In 2022, she received bonuses and bonuses several times:

- in March - 5,000;

- in May - 5,000;

- in July - 4,000;

- in September - 6,000;

- in December - 10,000 rubles.

Before you start mastering the online service, you need to collect all the documents that you will need for it:

- certificate 2-NDFL for the past year - it is given by the accountant at the place of work;

- apartment purchase agreement;

- act of acceptance and transfer by the parties;

- payment documents - receipt, bank notice, receipt, etc.;

- documents for the apartment - about the ownership rights registered in Rosreestr;

- statement.

These papers must be on hand in order to correctly fill out the 3-NDFL tax deduction declaration in the “Personal Account”, as well as attach scanned copies of them.

Important!

When logging into your account, use the new version of the site - it has many more features and a user-friendly interface.

Step-by-step instruction

- Open the Federal Tax Service website and find the entrance to your Personal Account.

- Log in to LC. You can use an account on State Services.

- Check first whether you have an electronic signature. This can be done in your profile.

- There is a special subsection for obtaining electronic signature.

- To start filling out the declaration, find the section with life situations.

- Select filing a 3-NDFL declaration.

- Scroll down the page that appears and click on the “Fill in...” button.

.

Note!

On the same page you can send an electronic file of a declaration previously filled out in the program.

- On the page that opens, the system sequentially asks you to fill out 7 steps. The transition between them occurs with the “Next” button at the bottom.

- In the first step, the data has already been filled in; you just need to check it.

- Move on. Here you need to select the source of your declared income.

- Step 3 - deductions. Select from those proposed those that you plan to apply. If you are filing a return for tax purposes, do not enter anything at this stage. In our example, the declaration is submitted in connection with housing expenses. Selecting a property deduction.

- Proceed to entering income (step 4). Here you need to indicate the employer’s details, based on the 2-NDFL certificate.

Important!

If your employer has already reported your income to the tax office, it will appear in the system. Then you won't need to enter anything manually.

- After filling out the details, open the “Add Income” tab.

- Also take the size and income code from the certificate.

- Please enter the amount of tax withheld below. It is also indicated in 2-NDFL.

- Proceed to the next step. Here you enter information about the expenses incurred for the previously specified deductions.

- Here the system offers to attach supporting documents

- Next, the system generates a final declaration and shows the amount that can be returned for the declared deductions.

- All that remains is to confirm and send the report. Here you can add scanned documents if you have not done so before. To send, enter your email password.

- The report status is reflected on the declaration submission page in the LC.

Results

- Through the “Personal Account” you can fill out a 3-NDFL declaration to pay tax and receive a deduction.

- The finished declaration can be viewed , saved to your computer and printed.

- To send a report online, you need to issue an enhanced digital signature - also in your “Personal Account”.

, please select a piece of text and press Ctrl+Enter.

Source: https://NalogBox.ru/nalogovye-vychety/3-ndfl/kak-zapolnit-deklaratsiyu-3-ndfl-v-lichnom-kabinete-na-sajte-nalogovoj/

When there is no printer

A common problem is when the “Declaration” program for filling out 3-NDFL for 2016 is installed on the PC, but there is no printer. Is it possible to save the completed form for printing on another computer where the Federal Tax Service application is not installed?

There is no problem with this. Just in the “View” mode, click on the button with the image of a floppy disk. The print module will create a file with a TIF extension. It can be printed anywhere. Wherever it's convenient.

If you find an error, please select a piece of text and press Ctrl+Enter

.

Tax return 3-NDFL is filled out by the taxpayer using the form approved by the Federal Tax Service (Order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/). You can download it by following the link above (source - Federal Tax Service).

Tax return 3-NDFL is filled out by the taxpayer using the form approved by the Federal Tax Service (Order of the Federal Tax Service of Russia dated November 10, 2011 No. ММВ-7-3/ as amended by Order of the Federal Tax Service of Russia dated November 14, 2013 No. ММВ-7-3/). You can download it by following these links above (source: Federal Tax Service).

The tax return is filled out and printed according to certain rules. These rules are established by the Federal Tax Service (order of the Federal Tax Service of Russia dated November 14, 2013 No. ММВ-7-3/). You can download instructions for filling out form 3-NDFL by following this link.

Tax return through your personal account

New!

Free consultation with a lawyer on tax issues and other areas. Today, the Federal Tax Service of the Russian Federation provides all citizens with a convenient opportunity to submit a tax return through their personal account. This can be done using the nalog.ru resource.

The process significantly saves both the time and money of ordinary Russians - because from now on you can prepare and send the most important documents online, right from home and at any time of the day.

- How to issue a 2-NDFL certificate for a military personnel: via the Internet (ERC) and other methods. Sample application

The process of submitting a tax return for individuals

To submit a declaration directly through the website of the state tax service, the user needs:

In the future, you will need to have an electronic signature and a certificate for its verification key. If documents are submitted for the first time, an individual must go through the stage of generating this certificate.

To do this you need:

- in the window for filling out and submitting the 3-NDFL tax return, click on the line on the right Obtaining an electronic signature verification key certificate ;

- on the next page, select the tab The electronic signature key is stored in the secure Federal Tax Service system ;

- Click Generate a certificate request .

The system will ask you to enter a password. The user sets the secret code himself. Since it will be needed for further work with tax reporting, it must be remembered or written down somewhere. After entering the password, you must confirm the data and wait for the certificate itself to be received.

Having a key certificate, sending a document through the taxpayer’s personal account will not be difficult.

If the user already has a prepared declaration, it can be submitted by clicking the line Submit a generated declaration .

After clicking, the following dialog box will open, where you will need to select the year, attach a file with the document itself, confirm with the OK and Generate file to send .

After this, you should attach photographs or scans of all documents confirming the information in the completed declaration. This must be done using the Add document .

The system warns of a limitation - the total volume of downloaded files must be less than 20 Megabytes.

After downloading, the file must be signed by indicating the previously specified key password at the bottom of the window and clicking the Sign and send .

- Sberbank-online personal account service for tax refunds - methods and amounts

After waiting for a message that the sending was successful, the user can only monitor the process of desk verification of the submitted documents. This can be done in the same menu in the line Declaration in form 3-NDFL . The verification must be completed within the next three months.

This will be indicated by the status that appears during the check - Completed . At the same time, the overpayment amount may appear Overpayment/Debt

To transfer it to the citizen’s account, the user must submit a return application.

After clicking on the indicated button in the window that opens, you need to indicate the bank details for the transfer, save the changes and sign with an electronic signature. Within one month, the returned amount will be credited to the citizen’s bank account.

How to prepare a tax return - filing documents as an individual entrepreneur

Both individuals and sole proprietors can write a tax return in several ways. Firstly, you can fill out the template offered by the electronic resource nalog.ru by clicking Fill out a new declaration . Secondly, to create such reports they use a special program, which can be downloaded from the link.

To send reports, an individual entrepreneur should similarly go to his account, select the section with reports and fill out the proposed template or attach a ready-made document.

Having sent it, wait for the end of the desk check, print out the declaration in paper form, sign and stamp it.

Before the deadline for submission, the signed document with a stamp must be submitted to the Federal Tax Service office.

It is also possible to submit tax reports through the State Services website. To do this, go to the Taxes and Finance and select the Acceptance of tax returns . After clicking, the tax service section will open with detailed instructions on next steps. All stages of filling out the documentation will be similar to those listed.

Source: https://MoyNalog.info/instrukcii-po-lk/nalogovaya-deklaraciya/

For 2011:

Tax return 3-NDFL is filled out by the taxpayer using the form approved by the Federal Tax Service (Order of the Federal Tax Service of Russia dated November 10, 2011 No. ММВ-7-3/). You can download it by following this link (source: Federal Tax Service).

The tax return is filled out and printed according to certain rules. These rules are established by the Federal Tax Service (order of the Federal Tax Service of Russia dated November 10, 2011 No. ММВ-7-3/). You can download instructions for filling out form 3-NDFL by following this link.

How to open xml through browser

When you double-click on a file, in most cases it opens through a browser, and through the one that is designated as the default browser on a given computer (mostly Microsoft Edge for Windows 10).

But this setting is changeable:

- Confirm the action with the “OK” button.

- On the “General” tab, click “Edit” and select the desired browser or other application through which you want to open the file.

- Right-click on the file, calling up the context menu, find the “Properties” item (located at the bottom).

Example of information from invoices issued by persons specified in clause 5 of Article 173 of the Tax Code of the Russian Federation (Section 12)

Section 12 of the VAT return (also approved by order of the Federal Tax Service) is filled out only if an invoice is issued with the allocation of the tax amount by the following persons:

- persons who are not taxpayers of value added tax.

- taxpayers upon shipment of goods (work, services), sales operations of which are not subject to value added tax;

- taxpayers exempt from fulfilling taxpayer obligations related to the calculation and payment of value added tax;

Example information in xml format

For 2010:

Tax return 3-NDFL is filled out by the taxpayer using the form approved by the Federal Tax Service (Order of the Federal Tax Service of Russia dated November 25, 2010 No. ММВ-7-3/). You can download it by following this link (source: Federal Tax Service).

The tax return is filled out and printed according to certain rules. These rules are established by the Federal Tax Service (order of the Federal Tax Service of Russia dated November 25, 2010 No. ММВ-7-3/). You can download instructions for filling out form 3-NDFL by following this link.

How to restore a personal income tax return from an xml file?

I made a declaration in Taxpayer 2011 - saved it as xml and in the native format - but the original file was lost - how, in what program, can I convert the remaining xml into completed declaration forms?

I made a declaration in Taxpayer 2011 - saved it as xml and in the native format - but the original file was lost - how, in what program can I convert the remaining xml into completed declaration forms? Is there no Load from xml function in the Service?

No If you try to open it, it gives an error. A sign of a program's weakness. QuckPatent, but haven’t you tried it in the Taxpayer Legal Entity? documents-documents on personal income tax-2-personal income tax-download (red arrow) Not all, but many users of modern computer systems often encounter incomprehensible files in the XML format. Even fewer users know what kind of data this is and why it is needed.

Well, only a few understand which program to open an XML file.

Although everything in this matter is quite simple, nevertheless, sometimes problems arise. Let's see what's what.