Welcome to complain

Any persons (individuals, legal entities, and including individual entrepreneurs) whose rights are violated by non-normative acts (concerning specific individuals) or actions (inaction) of employees of a lower-level Federal Tax Service have the opportunity to complain to a higher tax office.

Anyone who has discovered that tax laws have been violated has the right to apply. Specific reasons for appeal are an error in the calculation of taxes, a fine, refusal to take into account the required benefits, etc. All this is a reason to write a complaint to the tax office against the employer. This issue is regulated by separate provisions of Chapter. , 20 NK. In particular, this is Art. 137 - 140 which will help you navigate a specific situation.

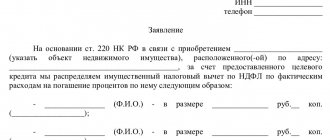

The structure of a written claim signed by the applicant (his representative) consists of the following elements:

- FULL NAME. and the place of residence of the individual who is complaining, or the name and address in the case of a legal entity.

- Actions (inaction) of tax authority employees or its non-normative act, about which there are protests.

- Name of the body violating the rights of the taxpayer.

- The person whose rights have been violated indicates the reasons why he believes so.

- Requests of the applicant.

- How convenient is it to receive the result of the analysis (paper by mail or electronically via the Internet or through the taxpayer’s personal account).

In addition, contact telephone numbers (fax), email address, and other data that will facilitate consideration are indicated here.

The attachments here will be documents that confirm the position of the author and the corresponding power of attorney when submitted through a representative. This is what a complaint to the tax office looks like: the sample can be used as a template.

Applications for LLC:

Form P11001: Application form for registration of a legal entity upon creation Form P12001: Application form for registration of a legal entity created through reorganization Form P13002: Application form for amendments to the constituent documents of a legal entity Form P14001: Application form for amendments to the information on the Unified State Register of Legal Entities legal entity not related to amendments to the constituent documents Form P15001: Form of notification of a decision to liquidate a legal entity Form P15002: Form of notification of the formation of a liquidation commission of a legal entity, appointment of a liquidator (bankruptcy trustee) Form P15003: Form of notification of the preparation of an interim liquidation order balance sheet of a legal entity Form P16001: Application form for state registration of a legal entity in connection with its liquidation: Form P16002: Application form for state registration of termination of a unitary enterprise in connection with the sale of its property complex Form P16003: Application form for making an entry on the termination of the activities of an affiliated legal entity faces:

How to serve

The subjects of the complaint, which are indicated above, are appealed to a higher tax authority (VNO). The relevant materials get there through the body that made or carried out the contested decision (action). Consequently, a complaint to the tax inspectorate against the organization is submitted to the body that violates the rights of the taxpayer. There are three ways to do this:

- Through the taxpayer’s personal account on the Federal Tax Service resource.

- Russian Post.

- By contacting the relevant territorial division of the Federal Tax Service in person or through a representative.

The violating authority transfers the claim plus all materials attached to it to a higher organization. Three days are given for this from the time of its receipt.

From the moment the injured person learns about the violation of his rights, he has a year to submit the necessary documents. A similar time (from the date of the controversial decision) is available for protesting decisions on liability for tax offenses that have entered into force, if they have not been challenged through an appeal. The appeal is described in a special article. It is used when arguing with a decision on liability for an offense or a refusal to do so that has not entered into force, which the fiscal authorities made in accordance with Art. 101 NK. An appeal to the Federal Tax Service occurs within three months from the date of resolution of complaints (including appeals) by a higher authority. If the time for appeal is missed for a valid reason, it is possible to restore it by filing a proper petition.

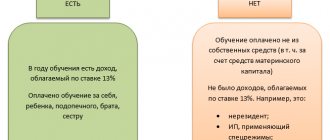

When can you start applying the deduction?

The question of obtaining a deduction will become relevant when the property is registered for a residential property or the taxpayer receives an acceptance certificate for a finished shared construction project. Until this moment, neither the registration of the right to land allocated for development (subclause 2, clause 3, article 220 of the Tax Code of the Russian Federation), nor the costs of paying interest on a mortgage (clause 4, article 220 of the Tax Code of the Russian Federation) do not allow one to exercise the right to deduction.

You can start applying the deduction in 2 ways:

- In the year when the right to a deduction appeared (without waiting for the end of the year), submit the package of documents collected on it to the Federal Tax Service at your place of permanent residence and a month later pick up a notice of the right to a deduction there to receive it from your employer already in the current year (p 8 Article 220 of the Tax Code of the Russian Federation). The form of this notification was approved by order of the Federal Tax Service of Russia dated January 14, 2015 No. ММВ-7-11/ [email protected] It is intended for issuance to a specific employer, whom the taxpayer will indicate in the application.

- Wait until the end of the year in which the right to deduction arose and submit a set of documents on it to the Federal Tax Service along with the 3-NDFL declaration for the corresponding year (clause 7 of Article 220 of the Tax Code of the Russian Federation). After checking the documents and declaration, the Federal Tax Service will return the tax accrued on it as a refund, and for the remaining amount, if desired, the taxpayer will give a notification of the right to a deduction for its use at the place of work. The declaration is submitted together with 2-NDFL certificates from all employers. Its verification will take 3 months (clause 2 of Article 88 of the Tax Code of the Russian Federation), and another month will be spent on procedures for tax refund (clause 6 of Article 78 of the Tax Code of the Russian Federation) and issuing a notification of the right to deduction (clause 8 of Article 220 of the Tax Code RF).

For information on how to fill out the declaration correctly, read the article “Sample of filling out the 3-NDFL tax return.”

Thus, the deduction begins to be applied from the year the right to it appears and is used in subsequent years, provided that there is income in them from which personal income tax is withheld. The deduction will be applied for the number of years necessary for its full use for the entire amount of expenses confirmed by documents (clause 9 of Article 220 of the Tax Code of the Russian Federation).

For pensioners, it is possible to use the deduction for 3 years preceding the year the right to it became available (clause 10 of Article 220 of the Tax Code of the Russian Federation). If in the year the right to deduction arose there was no income subject to personal income tax, then the deduction can be applied for in subsequent years (without limiting their number), but no later than 3 years from the end of the years for which the tax must be returned (letter from the Ministry of Finance of Russia dated June 11, 2014 No. 03-04-05/28218).

An employer who has received a notice of the right to a deduction will begin to use it from the month of receipt, but in relation to income for the entire year (letter of the Ministry of Finance of Russia dated September 25, 2015 No. 03-04-05/55051). If at the time of providing the notification for the current year, the tax has already been withheld and it is not possible to return the excess withheld amount at the place of work from the accrued tax for the year (the amount of deduction exceeds the amount of accruals), its refund will be carried out by the Federal Tax Service (letter of the Ministry of Finance of Russia dated July 15, 2014 No. 03 -04-05/34402).

Regardless of the method by which the deduction is applied, the right to use its balance (if the deduction is to be used for several years) must be annually confirmed with the Federal Tax Service in one of the following ways:

- Receive a notification for your place of work at the beginning of the year - upon application for the issuance of such a notification (clause 8 of Article 220 of the Tax Code of the Russian Federation).

- Submit a declaration to the Federal Tax Service and return the tax through it - according to the application for the return of personal income tax (clause 6 of Article 78 of the Tax Code of the Russian Federation), which indicates the account details for the tax refund. Submitting an application for the application of a property deduction is not necessary (letter of the Ministry of Finance of Russia dated November 26, 2012 No. 03-04-08/7-413). Its role is played by the declaration itself.

Since 2022, a simplified procedure for obtaining a deduction has been in effect. You can read more about this in the article.

How they view

The superior organization has a month to resolve protests from the moment they are received if they relate to decisions of tax authorities on liability for an offense or refusal to do so. If necessary, the period is extended (maximum by 30 days). For other protests, a similar period is 15 days, which will be extended in the same way. If there is no response to the claim within the specified periods, it will be appealed in court. Let us recall that in Art. 139.3 of the Tax Code there are cases when a protest is not considered.

When an act or action is appealed to a higher authority, it is suspended (until a decision is made on the claim only on the relevant application). Moreover, such a suspension is possible when an effective prosecution for a tax violation or refusal to do so is being challenged. The application is submitted together with a petition and a bank guarantee, which must comply with clause 5 of Art. 74.1 of the Tax Code and other conditions from clause 5 of Art. 138 NK. According to it, the bank undertakes to repay the obligatory payment under the controversial decision.

Is it possible to file a complaint anonymously?

The Federal Tax Service does not consider anonymous messages. Any person who contacts this service is required to provide personal information, so an anonymous complaint to the tax office is not the best way to convey information to the fiscal services. To maintain anonymity, you can call the tax service hotline, but you should not expect a quick review and action on this type of complaint.

The need for such a filing arises when a citizen, for example, wants to report his neighbors for renting out an apartment without paying taxes, or an employee wants to report his employer when he violates the law. In principle, the legislation does not indicate how to submit an anonymous complaint to the tax office and that an impersonal appeal will be taken into account. But fiscal officials can consider it on their own initiative. “Anonymous” is submitted in the following ways:

- by telephone helpline, the specific number depends on the region and is listed on the Federal Tax Service website in the “Contacts and Appeals” section;

- by visiting tax authorities in person;

- via the Internet.

If you need confidence in the consideration of the submitted document, do not hide - indicate your personal data.

Brief information for taxpayers

Order of the Federal Tax Service of Russia dated 06/09/2011 No. ММВ-7-6/ [email protected] (registered with the Ministry of Justice of Russia on July 11, 2011) approved new forms of messages sent to the tax authorities by taxpayers. New reporting forms apply from July 30, 2011. The procedure and formats for submission by organizations and individual entrepreneurs, as well as notaries engaged in private practice, and lawyers who have established law offices, messages provided for in paragraphs 2 and 3 of Article 23 of the Tax Code of the Russian Federation, in electronic form via telecommunication channels can be found on the website of the Federal Tax Service Russia in the section “State registration and accounting of taxpayers/Registration of taxpayers/Regulatory acts regulating issues of accounting of taxpayers.” By order of the Federal Tax Service of Russia dated August 11, 2011. No. YAK-7-6/ [email protected] (Registered with the Ministry of Justice of Russia on September 14, 2011 No. 21794) approved new forms and procedures for filling out documents used when registering and deregistering Russian organizations and individuals, including individual entrepreneurs , to the tax authorities. In the near future, organizations and individuals, including individual entrepreneurs, will be able to send to the tax authority a “Request for sending a certificate of registration with the tax authority and (or) notice of registration with the tax authority (notification of deregistration in the tax authority) in electronic form" in form No. 3-Accounting, in response to which they will receive the requested documents in electronic form via telecommunication channels in PDF format. With request form No. 3-Accounting, the procedure and formats for the tax authority to send a certificate of registration with the tax authority and (or) a notice of registration with the tax authority (notice of deregistration with the tax authority) in electronic form via telecommunication channels communications can be found on the website of the Federal Tax Service of Russia.