Chapter 19 of the Labor Code of the Russian Federation is devoted to vacations, article 114 of which guarantees employees the provision of annual vacations while maintaining their place of work and average earnings. Thus, vacation pay is subject to insurance contributions for pension, medical insurance and VNIM, since they are paid within the framework of labor relations (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation).

However, in addition to those provided for by labor legislation, employees may be provided with other types of leave. In this case, is the employer obliged to make contributions to such vacation pay? What changes in legislation in 2022 affected the calculation of vacation pay? What are the conditions and terms for paying insurance premiums from vacation pay? The answers to these questions are given in our article.

Do I need to pay insurance premiums on vacation pay in 2022?

Yes need. The fact is that, according to paragraphs. 1 clause 1 art. 420 Tax Code of the Russian Federation, clause 1, art. 20.1 of Law No. 125-FZ of July 24, 1998, the object of taxation of insurance premiums is all payments accrued to employees within the framework of labor relations, including vacation pay. Moreover, this applies to all types of leaves, including those provided for by the Labor Code and those established by the employer, for example, additional prenatal leave - clause 2 of the letter of the Ministry of Finance of the Russian Federation dated March 21, 2017 No. 03-15-06/16239.

In 2022, the above provision has not undergone any changes, therefore contributions must be calculated from the vacation pay amounts in the generally established manner.

However, there are holiday pay that are exempt from insurance premiums. These include payment for additional employee leave for sanatorium treatment. This type of vacation pay is not subject to insurance premiums for compulsory medical insurance, compulsory medical insurance, in case of accidents and accidents (clause 1, clause 1, article 422 of the Tax Code of the Russian Federation, clause 3, clause 1, article 8, clause 1, clause 1 Article 20.2 of Law No. 125-FZ, letter of the Federal Insurance Service of the Russian Federation dated March 14, 2016 No. 02-09-05/06-06-4615 (question 3). A similar conclusion is contained in the letter of the Ministry of Finance of the Russian Federation dated December 16, 2019 No. 03-15-05 /98120.

Please note that payment of the cost of sanatorium-resort vouchers to an employee, including for five years before he reaches retirement age, is subject to contributions for compulsory health insurance, compulsory medical insurance, in the event of accidents and injuries. The fact is that these payments:

- are made within the framework of labor relations, therefore they are subject to insurance premiums (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation, clause 1, article 20.1 of law No. 125-FZ);

- are not included in the number of non-contributory payments, according to Art. 422 of the Tax Code of the Russian Federation and Art. 20.2 of Law No. 125-FZ.

What are vacation pay?

According to the Labor Code of the Russian Federation, every person, in addition to the right to work (and social benefits at the same time), also has the right to a well-deserved annual rest. Since he does not perform his job duties on vacation days, it seems that he is not entitled to payment, but then it turns out that the choice is small: either never take a break from work, or accept a loss in salary. Therefore, the legislation provides for payments for the vacation period in the amount of average earnings.

Back to contents

What insurance premiums are paid from vacation pay?

Insurance premiums from vacation pay amounts are calculated in the usual manner (clause 2 of Article 425 of the Tax Code of the Russian Federation):

- on compulsory pension insurance - in the amount of 22 percent from payments not exceeding the maximum base (1,465 thousand rubles), 10 percent - from payments in excess of the base;

- for compulsory medical insurance - in the amount of 5.1 percent of all taxable payments;

- on OSS - in the amount of 2.9 percent on payments not exceeding the maximum base (966 thousand rubles).

In addition, vacation pay is also subject to accident insurance premiums (Clause 1, Article 20.1 of Law No. 125-FZ) at a rate of 0.2 to 8.5 percent, depending on the professional risk class assigned to the company.

Holiday pay insurance contributions should be accrued in full at the same time as wages.

When and how to pay in 2022?

The transfer must be made no later than the 15th day of the month following the month of accrual of vacation pay (Article 431 of the Tax Code of the Russian Federation, clause 3).

If the payment day coincides with a weekend or holiday, the payment order should be issued on the next business day following the transfer deadline.

For this type of tax burden, the day of payment of vacation pay or the date the employee starts rest does not matter.

The payment procedure is influenced by which company accrues them. If a separate division independently calculates payments, then the transfer of insurance premiums is carried out at its own location. If all actions are carried out by the head office, then it pays this type of deductions (Article 431 of the Tax Code of the Russian Federation, clause 11).

How holiday pay is assessed - example

Initial data:

Employee Klekovkina M.A. Irregular working hours are established. The collective agreement gives her additional leave of 8 days.

On April 5, the employee wrote an application for leave for a period of 36 calendar days from April 19, 2022. During this time, the accountant calculated the amount of vacation pay - 28,000 rubles. It is necessary to determine in what amount and within what period insurance premiums must be paid.

Let's summarize the initial data in a table:

| Duration of vacation | 26 days |

| Vacation start date | 19.04.2019 |

| Vacation pay amount | 28,000 rub. |

Calculation of contributions:

| Mandatory pension insurance | 28000*22%=6160 | 15.05.2019 |

| Temporary disability and motherhood | 28000*2,9%=812 | 15.05.2019 |

| Compulsory health insurance | 28000*5,1%=1428 | 15.05.2019 |

| Injuries | 28000*0,2%=56 | 15.05.2019 |

Important nuances

The calculation of insurance contributions is carried out in the month of accrual of vacation pay; this amount must be included in the taxable base for insurance premiums.

These rates are the basic rates for 2022, and there are also preferential rates for employers.

Such organizations include:

- using a simplified taxation system, UTII;

- carrying out pharmaceutical activities.

Relaxations are also provided for private entrepreneurs working on a patent.

The amount of vacation pay is a type of employee income that serves as the basis for calculating insurance premiums. Contributions are calculated from the accrued amounts at current rates and transferred to the required destination.

If you are late in paying your taxes, the Federal Tax Service will charge penalties for each day of delay.

If arrears are identified due to an understatement of the taxable base during a tax audit, the company is imposed a fine of 20% of the debt amount (Article 122 of the Tax Code).

If the contributions are correctly calculated and reflected in the report, then the employer will not face a fine.

If a gross error is made in the calculation, the director and chief accountant may be held administratively liable in the form of a fine in the amount of 5 to 10 thousand rubles.

Changes in payment of insurance premiums for vacations in 2022

First, when calculating insurance premiums in 2022, you need to take into account the increase in the base limit. According to the Decree of the Government of the Russian Federation dated November 26, 2020 No. 1935, it was:

- 1,465 thousand rubles - for OPS;

- 966 thousand rubles - for OSS.

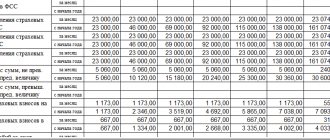

Secondly, by Law of April 1, 2020 No. 102-FZ Art. 427 of the Tax Code of the Russian Federation has been supplemented with a provision on the use by SMEs of reduced contribution rates for payments exceeding the minimum wage. The minimum wage in 2022 is 12,792 rubles (Federal Law No. 473-FZ dated December 29, 2020). The amounts of reduced insurance premium rates for this category of payers are as follows:

- for OPS - 10 percent;

- for compulsory medical insurance - 5 percent;

- at VNiM - 0 percent.

Monthly payments below the minimum wage are subject to contributions at the basic rates.

Contributions for injuries from any amount of payments are also charged at generally established rates.

Fixation of vacation pay in 2-NDFL

Vacation pay is subject to taxation. Therefore, they must appear in the 2-NDFL certificate as the employee’s income. Displayed in the month in which the funds were actually issued to the employee. For them you need to provide a separate line with code 2012.

Fixing compensation for unused vacation in 2-NDFL

When displaying compensation on a tax certificate, you must use the code. There is no special number for the payments in question. The following codes are allowed:

- 4800 (payment of compensation upon dismissal).

- 2000 (income related to wages).

- 2012 (vacation pay).

IMPORTANT! According to the explanations of the Federal Tax Service, code 2012 should be used. However, the use of other numbers will not be considered a serious error.

Correct reflection of vacation pay in accounting and tax documentation allows you to avoid problems during audits.

Conditions for applying reduced insurance premiums from vacations

According to paragraph 9 of the regulation on average earnings, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922, to calculate vacation pay, it is necessary to multiply the average daily earnings by the number of calendar days of vacation.

Average daily earnings are determined by dividing the base for vacation pay for the billing period (12 calendar months preceding the month the vacation began) by the number of days worked for the billing period.

Since the base for calculating vacation pay includes wages for days worked, the conditions for applying reduced contributions also apply to vacation pay.

According to Article 6 of the Law dated 04/01/2020 No. 102-FZ, payers are small or medium-sized businesses in accordance with the Law dated 07/24/2007 No. 209-FZ, in relation to the portion of payments in favor of each individual, determined based on the results of each calendar month as excess above the minimum wage, has the right to apply reduced rates of insurance premiums at a cumulative rate of 15 percent (for compulsory health insurance - 10 percent both within the base and above it, for compulsory insurance premiums - 0 percent, for compulsory medical insurance - 5 percent) - paragraphs. 17 clause 1, clause 2.1 art. 427 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of the Russian Federation dated January 26, 2021 No. 03-15-06/4313, dated September 21, 2020 No. 03-15-06/82431, 03-15-06/82436).

SMEs include medium, small and micro enterprises.

The criteria for SMEs are given in the table.

| Type of enterprise | Average number of employees | Income | Capital structure restrictions | Rule of law |

| Small business | No more than 100 people | No more than 800 million rubles | A minimum of 51 percent of the authorized capital must belong to individuals or organizations - SMEs. The share of organizations not related to SMEs should not exceed 49 percent, the share of the state, regions or NGOs - 25 percent | Clause 1 part 1.1 art. 4 of Law No. 209-FZ |

| Microenterprise | No more than 15 people | No more than 120 million rubles | ||

| Medium enterprise | No more than 250 people | No more than 2 billion rubles |

You can check whether you belong to an SMSP in a special register on the Federal Tax Service website.

The law does not provide any additional conditions regarding the conditions for applying the minimum wage to specific types of payments, therefore we believe that insurance premiums at a reduced rate are calculated as the sum of wages and vacation payments minus the minimum wage (12,792 rubles), multiplied by 15 percent of the total tariff.\

Basic rules for calculating personal income tax

The object of taxation is the totality of all vacation payments. According to the provisions of Letter No. 8-306 of the Ministry of Finance, these funds cannot be considered as a component of salary. For this reason, personal income tax on vacation pay is calculated separately from payroll tax.

When to make tax payments?

Vacation pay is issued to the employee three days before his vacation. At the same time, income tax is withheld on the basis of Article 226 of the Tax Code of the Russian Federation. The timing of tax transfer to the treasury depends on how vacation pay is calculated:

- Cash - on the day the funds are issued or the next day . For example, if the money was issued on Friday, the tax is paid on the same day or Monday.

- When withdrawing cash from an organization's account - on the same day . Payment of personal income tax must be carried out on the date of withdrawal of vacation funds from the organization’s account, regardless of when the money will be transferred to the employee.

- Transfer to a bank card or account from a company card or account - on the day of accrual.

IMPORTANT! Some accountants transfer tax before the deadline for issuing vacation pay, when they are recorded in the payroll. This order is considered erroneous.

In 2016, an amendment was made regarding the tax calculation procedure. In particular, now the transfer can be made until the end of the month in which vacation pay was paid.

Let's look at an example

The employee goes on vacation on September 16, 2022. The funds are issued to him in 3 days, that is, on September 13. Personal income tax is transferred to the treasury on the day the money is actually issued. If the responsible persons did not have time to make all the necessary accruals, they can be made until September 30, 2022. The amendment has significantly simplified the work of tax agents. Now you can avoid making payments to employees, maintain accounting and tax records, and transfer personal income tax to the treasury on the same day.

When is tax paid on compensation for unused vacation?

An employee must be granted leave after 6 months of work at the enterprise. If he quits without using his right to leave, compensation is due. It is also considered employee income and therefore subject to tax.

Compensation is issued on the day of dismissal. At the same time, tax is calculated. Funds are transferred to the country's budget on the last day of the month. The compensation paid must be indicated in the 2-NDFL certificate.

Insurance premiums from rolling holidays

In practice, an employee’s vacation days may fall in different months, and it happens that they fall in different reporting (tax) periods.

In this case, regardless of whether the organization divides vacation pay between vacation months in tax accounting, insurance premiums in accordance with paragraphs. 1 clause 1 art. 264 of the Tax Code of the Russian Federation relate to other expenses associated with production and sales and are taken into account in the period of their accrual. That is, the date of incurring such expenses is the date of their accrual (clause 1, clause 7, article 272 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated June 1, 2010 No. 03-03-06/1/362).

Thus, if an employee’s vacation falls in March and April 2021, the organization recognizes insurance premiums from them in tax accounting in March 2022.

Nuances of granting leave

Before we talk about what insurance premiums are charged on vacation pay, and whether they are charged at all, it is necessary to note how these paid days off from work are generally provided. Everyone knows that vacation is called annual calendar leave, but rarely does anyone think that it is so called because it is given only once a year. This also happens because enterprises often divide workers’ rest into several periods, usually two weeks or so.

Back to contents

Duration of calendar rest

In general cases, the law recommends the number of vacation days is twenty-eight, but if a manager wants to reward his employees, for example, with thirty days, this is not prohibited. In addition, a certain category of employees, for example, workers in the education sector, can rest much longer - due to the specifics of the profession and the structure of the work process. It must be remembered that, according to labor legislation, at least one part of the vacation must be at least two weeks - such a period is considered sufficient for proper rest.

Back to contents

Procedure for granting leave

To earn the right to paid holidays, you must first work a certain number of working days. As mentioned above, rest is considered annual, but for the first time you can take a break from your company and colleagues already six months after your first working day. Of course, this must be agreed upon with superiors and colleagues - usually organizations have already drawn up a vacation schedule for the whole year in January, and they are not very willing to change it. This is due to the accrual and issuance of funds for employees.

Back to contents