Various forms of legal relations that arise between market entities engaged in economic activities are regulated primarily by legal norms, as well as by the terms of the transaction concluded by the parties. One of the options allowed within the framework of generally accepted practice is the execution of agreements, according to which the entity undertakes the obligation to carry out trading operations carried out on its own behalf, but in the interests and at the expense of the second participant - for a certain remuneration. What is a commission agreement for the sale of goods in simple words, why is a standard sample needed, how does this scheme work between individuals and legal entities, and on the basis of what form is the documentation drawn up? Let's figure it out.

General overview

Based on the provisions enshrined in Article 990 of the Civil Code of the Russian Federation, the category of commission agreements includes civil transactions implemented with the participation of two parties - the commission agent and the principal. The algorithm looks simple - the first participant, based on the instructions of the second, undertakes to execute one or more trading transactions, for which he receives commensurate financial compensation. The regulatory provisions given by the legislator in Chapter 51 of the Civil Code of the Russian Federation do not impose special requirements on the forms used - it is enough to be guided by the general rules that are relevant for all types of legal relations.

In the process of drawing up the document, the basic principles and essential terms of the commission agreement are determined - for example, for the sale or purchase of product samples through intermediaries, the implementation of services for the application, or work under other schemes, it is allowed to determine the territorial location, duration of validity, the possibility of reassignment, and etc. The implementation procedure assumes that all expenses associated with the conclusion of transactions, as well as with the provision of remuneration to the commission agent, are assigned to the principal. This approach is determined by the fact that the actions performed by the intermediary party on its own behalf actually pursue the goal of satisfying the interests of the customer.

Order execution procedure

In paragraph 1 of Art. 992 of the Civil Code states that the order must be executed in accordance with the instructions of the principal. Such instructions are contained in the contract (for example, on the sale of goods at a certain price), but can be given by the principal after its conclusion.

It is recommended to agree in the contract:

- The form (oral or written) and method (telephone, email, etc.) of instructions.

- The form and procedure for the commission agent to submit a request to deviate from the instructions of the principal, as referred to in Art. 995 GK.

If the commission agent acts as an entrepreneur, then it is allowed to include in the text of the contract a condition on the possibility of deviating from the instructions of the principal without a request, but with subsequent notification of this to the principal.

In addition, there is always a chance that the commission agent will make a deal on terms that are more favorable than expected. In this case, the amount of additional benefit is distributed equally between the parties by law (clause 2 of Article 992 of the Civil Code).

However, the contract can also provide for other things, for example:

- the entire amount of the benefit remains with the commission agent;

- the entire amount of benefit is due to the principal;

- the benefit is distributed between the parties in proportions other than those required by law (30 and 70%, 40 and 60%, etc.).

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Main characteristics of the commission agreement

The characteristic features inherent in documents of this category include the following aspects:

- The subject of the agreement is the implementation of a certain type of transaction, either one or several, in which third parties become participants.

- Operations under instructions are carried out on behalf of the commission agent, but are aimed at satisfying the interests of the principal, and are paid by him in full.

- As part of the agreements reached, the executor is endowed with rights and obligations, which means that there is no need to issue an additional documentary power of attorney.

- The customer is obliged to pay the agreed remuneration for fulfilled obligations - the form does not provide for the possibility of providing such services free of charge.

- In commission agreements with the participation of the buyer and the commission agent in the calculations, the latter, despite his own status, is not responsible for the execution by third parties of concluded transactions. The exception is situations characterized by an imprudent choice of the subject, or a statement of guarantee for his actions.

- Evasion of a third-party counterparty from fulfilling initially accepted obligations obliges the contractor to collect evidence base materials and subsequent transfer of rights to the principal under such an agreement.

Another group of characteristic features is determined by the approach according to which the duty of the commission agent is to carry out commercial transactions only on terms that correspond to the interests of the guarantor in terms of profit. Based on this, the following rules become relevant:

- The sale and transfer of goods on the basis of a commission agreement at a price lower than the example initially stated in the agreement between the parties necessitates compensation for the difference - except in cases where the intermediary has evidence confirming the impossibility of selling at the appointed price, and the fact of sale itself helped to avoid losses for a large amount.

- The purchase by a commission agent of products whose cost is higher than the limit established by the contract entails the principal's right to refuse acceptance and subsequent compensation for expenses incurred.

- The conclusion of a transaction characterized by better commercial conditions than those initially agreed upon by the principal provides for the division of additional benefits between the parties in equal shares, unless otherwise specified in the draft commission agreement.

- Property assets received by the intermediary from the customer, or acquired at his expense, are considered the property of the latter, which ensures that he retains the risks associated with sudden death or damage. In this case, the executor’s responsibilities include compliance with storage rules, as well as liability for loss, partial absence or damage associated with the occurrence of material losses, which implies his guilt. During acceptance, the commission agent must conduct a comprehensive check to exclude the transfer of initially unsuitable goods, and take care to ensure proper conditions to prevent premature loss of quality characteristics.

Fulfillment of the stated obligations determined by the commission trade agreement provides for the provision of reports to the customer, as well as values received as a result of transactions. The form, as well as the list of information provided, is determined by the parties independently and agreed upon at the preliminary stage.

How commission trading is processed

In a simplified form, this diagram looks like this. The supplier (principal) gives his goods for sale to an intermediary (commission agent). In this case, the ownership of the goods does not pass to the latter. The commission agent sells the goods to the buyer, acting on his own behalf, but at the expense of the principal. As soon as the goods are sold, the principal ceases to be its owner. The commission agent reports to the supplier, gives him the proceeds for the goods and receives his remuneration.

So, how to arrange a commission correctly? Let’s say a certain company is going to sell a product to a store. First of all, the supplier and the store draw up a commission agreement, which states which of them is the commission agent, which is the principal, and also indicates that the first, on behalf of the second, will sell goods for a fee. It is also better to specify the amount of remuneration in the contract. This can be either a fixed amount for each product sold, or a certain percentage of sales. The law, namely Article 51 of the Civil Code of the Russian Federation, obliges the commission agent to report to the committent on sales. The deadlines for submitting the report are not regulated, but it is also better to write them down in advance. A commission agreement can be concluded for a specific period or be indefinite. Entrepreneurs themselves also decide whether to indicate the territory for its execution. A sample commission agreement can be downloaded from our library of document forms.

The commission agreement has been concluded. What's next? Then the goods are transferred to the store, which is accompanied by an act of acceptance and transfer of goods for commission and a TORG-12 invoice. You can download a sample transfer and acceptance certificate, as well as an invoice, on our website. An act of acceptance and transfer of goods for commission is required if this is specified in the contract. If there is no such condition, then an invoice is sufficient.

The shipment of goods has arrived safely at the store, and the commission agent begins selling. By law, the sale of goods must begin no later than the next day after its acceptance. After a certain quantity has been sold, or the reporting period specified in the contract has passed, the store draws up a commission agent’s report. It states how many units of the product were sold, at what price and what the reward amount was. As we wrote above, it is better to stipulate the deadlines for submitting the report in the contract, although this is not required by law. You can agree to provide it every week or every month. We have a sample commissioner's report on our website.

In addition to the report, it is recommended to draw up and sign an agreement on the provision of services between the parties. After all, by making transactions on behalf of the principal, the commission agent provides him with a service. A document is being drawn up about this. The amount in the act is the amount of the commission agent's remuneration for the reporting period.

Along with the report, the intermediary transfers the proceeds to the supplier and retains his commission. Another option is also possible when the committent takes all the proceeds and only then transfers the remuneration to the commission agent. Then the cooperation continues or ends.

If the principal is not satisfied with the commission agent’s report in any way, he must report this within 30 days from the date of receipt of the document. However, this period can be changed with the help of a preliminary agreement of the parties.

Automation greatly simplifies the commission trading process. The MoySklad service offers the optimal solution for both the principal and the commission agent. In the system itself, you can create a commission agreement, take into account the shipment and acceptance of goods, record sales of commission goods, and automatically generate commission agent reports. At the same time, in all created forms and reports, revenue for goods sold, commission agent's remuneration, VAT and other necessary amounts are instantly calculated.

Now let's see what the law tells us about special cases.

Commission trading: special cases

The commission agent sold the goods more expensive or cheaper than expected

Let's say the goods were selling so well that the store decided to raise prices on them. In this case, the commission agent managed to obtain additional benefits, which, by law, he must equally share with the principal. Unless, of course, other conditions are provided for in the contract. And here you need to pay attention to one important detail regarding the processing and payment of this money. According to the letter of the Ministry of Finance of Russia dated June 5, 2008 No. 03-03-06/1/347, before part of the profit is paid to the commission agent, the committent must display this entire amount in income that is subject to income tax. And only after that accrue what is due to the commission agent.

If for some reason the goods were not sold at the agreed price, and the store reduced it, then there are two possible scenarios.

- The store proved to the consignor that it did not have the opportunity to sell the goods at a higher price, and this move prevented even greater losses. In this case, the commission agent will not be required to return the difference.

- The store failed to prove that the price reduction was a necessary step. Then, alas, the commission agent will have to compensate the supplier for the loss.

By the way, it is not forbidden to include these cases in the commission agreement. In addition, you can add conditions to it that, before changing prices, the commission agent must ask permission from the principal.

The contract was not fulfilled

Let's say that part of the goods that the principal delivered to the store turned out to be defective, or the agreed quantity of goods was not delivered, or for some other reason the commission agreement cannot be fulfilled due to the fault of the supplier. In this case, the law requires the principal to still pay the commission agent remuneration, as well as reimburse expenses. If the commission agreement cannot be executed due to the fault of the store, then, in turn, it will have to compensate the principal for damages.

Subcommission

Let's imagine that the store has found another profitable point of sale of goods, which is managed by another company. In this case, he has the right to conclude a subcommission agreement with this company. Then the commission agent is responsible for the actions of the sub-commission agent to his principal, and for the second store he himself becomes the principal. And a few important notes. Subcommission is possible unless otherwise specified in the commission agreement. In this case, the principal does not have the right to enter into relations with the subcommissioner, unless, again, otherwise provided by agreement of the parties.

The commission agent did not sell a single product during the reporting period

If all the goods remain in the warehouses and shelves of the store, the store has the right to return them to the consignor. The return of the goods, as well as its receipt, is issued with a TORG-12 invoice.

The trade management service MoySklad will help to significantly facilitate the process of returning goods from the commission agent to the consignor. The system has special forms in which returns are registered, and the entered data is automatically transferred to all reports that are related to the execution of the commission agreement.

Legal regulations

Mediation agreements are subject to regulation in accordance with the provisions of the Civil Code, in particular those contained within the framework of Article 990 of the Civil Code of the Russian Federation. Legal standards do not limit the range of entities that can enter into such legal relationships, which makes it possible to conclude commission sales agreements, for example, for the sale of goods with both individuals and legal entities.

The terminology used defines the following participant statuses:

- Principal - a party acting as the actual customer, whose interests are satisfied along with the execution of the agreement.

- A commission agent is a performer who performs actions specified by contractual provisions on his own behalf, but in favor of the guarantor.

Registration of intermediary civil legal relations of this kind is possible using ordinary written form, provided that all key aspects that are significant from the point of view of achieving the desired goal are included.

Three types of intermediary agreements

The Civil Code offers three options for formalizing intermediary transactions: an agency agreement (Article 971 of the Civil Code of the Russian Federation), a commission agreement (Article 990 of the Civil Code of the Russian Federation) and an agency agreement (Article 1005 of the Civil Code of the Russian Federation).

Therefore, the first thing you need to focus on when talking about mediation is the choice of an appropriate agreement. Let's figure out in what cases it is necessary to conclude a contract of agency, in which - a commission agreement, and in which - an agency agreement. In fact, choosing a contract is quite simple. It all depends on the nature of the mediation. So, if it is intended to delegate to an intermediary the conclusion of transactions in which he will act on his own behalf (that is, he will be a party to the agreement without indicating mediation), then a commission agreement should be drawn up.

If it is required to conclude transactions directly on behalf of the principal (i.e., it is he, and not the intermediary, who will be a party to the agreement), then an agency agreement is drawn up. In this case, the intermediary is issued a corresponding power of attorney to conclude transactions. Also, an agency agreement is drawn up if the intermediary will perform any other legal actions on behalf of the principal - representing his interests in government agencies, signing documents, making commercial offers, issuing offers, etc. In other words, if the powers of the commission agent are limited to concluding transactions, then the attorney can perform any legal actions. But at the same time, the commission agent always acts on his own behalf, and the attorney - on behalf of the principal.

Draw up and print the agency agreement for free using a ready-made template

As for the agency agreement, the scope of its application is the widest. The powers of an agent may include performing both legal and actual actions. An agent can be transferred not only the right to conclude transactions and draw up shipping documents (legal actions), but also to search for counterparties, as well as ship or accept goods under concluded contracts (actual actions). Moreover, depending on the wording of the agency agreement, the agent can act both on his own behalf and on behalf of the principal-principal. That is, in this case, the legislator gave the parties the opportunity to flexibly customize the agreement for themselves.

Accounting

The specifics of how transactions carried out with the help of intermediary services are reflected in accounting depends on which party we are talking about. For the contractor, everything is quite simple - only the revenue received as remuneration and related to account 62 - “Settlements with buyers and customers” is indicated. Material assets acquired in accordance with the presented order are not the property of the commission agent under the contract, so this is an example of safekeeping (p. 002). If the property is received from the principal for further sale, then the sale is reflected in account 004 - “Goods accepted for commission.”

It is worth noting that the intermediary’s obligation is to pay VAT, exemption from which is possible only when providing services or performing work that is not subject to taxation in accordance with the Code. This list includes:

- Providing premises for rent to persons with foreign citizenship, as well as foreign organizations with official accreditation.

- Trade in medicines or funeral supplies in accordance with an official register approved by government regulation.

- Sale of products that are the result of folk crafts, except for goods belonging to excisable groups.

Which contracts are not commission

When drawing up an intermediary agreement (commission or agency), you need to remember that judicial practice has identified situations where the relations of the parties, in principle, cannot be formalized by such agreements. Thus, the subject of a commission agreement cannot be the collection of debt (clause 22 of Information Letter No. 85). Such an agreement will most likely be reclassified as a service agreement.

Also, a commission agreement is not suitable for formalizing relations between the parties if it provides for the conclusion by the commission agent of a transaction that has already been concluded on the date of signing the commission agreement (clause 6 of Information Letter No. 85). Let's explain with an example. The organization found a customer (buyer) and entered into an agreement with him to perform work (provision of services, supply of goods). Next, she looks for appropriate performers or suppliers for this contract. Draws up commission agreements with them, within the framework of which it undertakes to conclude (although in fact it has already concluded) an agreement for the performance of work (provision of services, supply of goods). This scheme of work is not intermediary, which means that in this case it is impossible to conclude a commission agreement (agency agreement).

There are other situations when it will not be possible to arrange intermediary transactions. Thus, if the commission agreement contains a condition that the commission agent must pay for the goods transferred to him regardless of whether it is sold or not, such an agreement can be re-qualified as a purchase and sale agreement (clause 1 of Information Letter No. 85).

In conclusion, let us consider such a situation as an advance by the commission agent to the principal against future receipts of funds from buyers of goods. In practice, tax authorities recognize this as one of the signs of substituting a purchase and sale agreement with a commission agreement (see, for example, letter of the Federal Tax Service of Russia dated July 13, 2017 No. ED-4-2 / [email protected] ). However, the Presidium of the Supreme Arbitration Court of the Russian Federation believes that such an advance is quite acceptable. But it must be considered as a commercial loan provided by the commission agent to the principal, and on such a loan it is necessary to accrue interest on the amount of the advance (clause 7 of Information Letter No. 85). Accordingly, this is exactly how such relationships should be formalized. That is, in the commission agreement you need to use the term “commercial loan” and state the obligation of the principal to pay interest to the commission agent for the use of money. In the event of a dispute, this will significantly strengthen the commission agent’s position.

Concept and form

In general, when considering the specifics of how the parties to a commission agreement should work, and how it differs from the same implementation agreement in practice, one can find much more examples from life than it seems at first glance. Mediation is carried out through three types of contracts - surety, commission and agency. All of them have certain specific differences associated with the nuances of legal regulation.

Subject of cooperation

Each documentary form of civil legal relations is characterized by the presence of essential conditions, the absence of which does not allow them to be considered officially concluded. In the case of the options under consideration, this aspect is the indication of the requirements for transactions, the conclusion of which is within the powers and responsibilities of the commission agent.

In order for the wording used to be correct, one of the possible solutions should be selected. First: download a ready-made sample commission agreement, with a commission act from the principal in agreement with the store or seller - the form is standard and is suitable in most situations. Second: independent drafting of the document, taking into account the restrictions on the powers and powers of the intermediary, as well as determining the time and territory for the execution of the order.

Commission agent on the simplified tax system - principal on the simplified tax system

If the commission agreement was concluded by companies, each of which applies the simplified tax regime (STS), then the commission agent, if questions arise about how to calculate taxes, must refer to Article 251 of the Tax Code of the Russian Federation. It directly states that when determining the tax base of a commission agent, property and funds received by him in connection with the fulfillment of obligations under a commission agreement are not taken into account as income. Income received to reimburse expenses incurred for the principal is also not taken into account. That is, only commission fees are considered income. Accordingly, revenue for goods sold is not counted as income. If the principal under the simplified tax system compensates the commission agent under the simplified tax system for any expenses, this money is also not subject to tax.

The date of receipt of income from the “simplified” intermediary is the date of receipt of remuneration from the principal into his account. If, under the terms of the contract, the commission agent withholds his remuneration from funds received from buyers, then the date of receipt of income is considered the day the money is received at the cash desk. It does not matter that the report may not have been signed yet, since advances are also included in the income of companies under the simplified tax system.

Expenses are recognized only after they are actually paid. Moreover, those expenses that are legally reimbursed by the principal (for example, for renting a warehouse where the goods are stored) are not considered expenses of the commission agent.

As for the principal, according to the letter of the Ministry of Finance No. 03-11-11/16941 dated May 15, 2013, his income is the entire amount received from the sale of goods, including commissions. Yes, in the scheme “commission agent on the simplified tax system - principal on the simplified tax system,” the remuneration paid by the principal, alas, cannot be attributed to his expenses, and tax will have to be paid on it. But! If the commission agent withholds his commission before transferring funds to the principal, the income will legally be equal to the amount that was actually received into the supplier's account. This means that if the committing company is on the simplified tax system, then it is better to specify exactly this option in the contract.

The day of receipt of income is the moment of receipt of funds to the current account or to the supplier's cash desk.

The principal under the simplified tax system is not obliged to issue an invoice for his goods, because The responsibility for drawing up this document rests only with the VAT payer.

Specifics

Speaking about the features of the legal relations under consideration, it is worth emphasizing once again that from the point of view of the form of employment, a commission agreement is a contract drawn up between the seller and the intermediary, on the basis of which the latter independently carries out trading operations in the interests of the former. The commission agent’s task is to find an interested buyer (if we are talking about the sale of goods), or a commercial offer for sale (for purchases), and formalize a transaction that meets the requirements stated by the guarantor. It is recommended to prepare a report on the work done in writing, based on the sample attached to the contract.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Deduction of VAT from the buyer's advance payment in an intermediary scheme

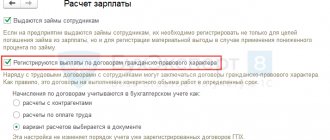

To register a VAT deduction from an advance payment transferred to Plotnik+ LLC, you need to create another document, Report of the commission agent (agent) on sales. In which you only need to fill in the Main and Cash tabs.

On the Cash tab in relation to the buyer of Plotnik+ LLC, information about the amount of the offset advance is indicated (Fig. 7):

- in the Payment report type field, select the payment option Advance offset;

- in the fields Date of event, Amount with VAT (rub.), % VAT, VAT (rub.) the date of shipment of the goods and the amount of the offset advance from the buyer, including VAT, are indicated.

Rice. 7. Registration of offset of advance payment from the buyer

As a result of posting the document Commission Agent (Agent) Sales Report with this filling option, the following transactions will be generated:

Tax accounting

Compensable expenses arising in the process of concluding transactions are not subject to income tax. The costs are related to other expenses of the guarantor. The cost of goods sold is included in the expense structure, and in cases where the principal is a VAT payer and the products are subject to this tax, the duty of the commission agent is to transfer the invoice.

Implementation period

Another condition is the period during which the items will hang in the store.

Example:

This agreement is valid for three months from the date of its signing by the parties. If, within the specified period, the Principal's goods are not sold in the Commissioner's store, the obligations of the Commissioner from clause 1.1. of this agreement are terminated.

Without a deadline in the contract, the rules will be as follows. The principal can cancel the commission and pick up the items by notifying the commission agent 30 days in advance - Art. 1003 of the Civil Code of the Russian Federation.

Arbitrage practice

Often the issue related to the calculation of value added tax is controversial. To protect the interests of each participant, experts recommend including in the structure of the agreement a condition according to which the customer pays for the services of the intermediary at the time of shipment of the products to the buyer. This formulation is a real judicial precedent, and made it possible to defend the interests of the payer in the proceedings regarding the additional assessment of mandatory fees. The court determined that the occurrence of the VAT base is determined by the moment of receipt of the remuneration, that is, actually after the delivery has taken place, and is not a basis for collecting additional tax.

Drawing up commission agreements for the sale of goods is a common practice that allows companies to save time and effort necessary to find new customers and markets.

Optimization of key business processes is an important factor in any business, which determines the demand for mobile automation solutions offered by . Number of impressions: 402