The owner of the current account instructs the bank to transfer funds using a payment order. fill out the 2022 form and form below. Choose a convenient format: word or excel.

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

| Why do you need a payment order Sample Fill out the document online | Tax office requirements for a payment order Procedure for filling out a payment order Frequently asked questions |

A payment order is issued, for example, for:

- Payments to counterparties for goods or services.

- Tax transfers.

- Repayment of loans.

- Transfers of payments under the agreement.

The procedure for filling out payment orders is established by the Ministry of Finance, since the documents are processed automatically. Usually the payment slip is needed in four copies. The document refers to strict reporting forms, form according to OKUD 0401060. Let's look at how to fill out a payment order.

Payment order fields in 2022: sample filling

It’s not difficult to fill out the document, the main thing is to prevent corrections. To avoid mistakes, fill out the payment order and simply enter your details.

Get a sample for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the sample you are interested in

- Fill out and print the document online (this is very convenient)

How to fill out a payment order

To begin, you need to specify:

- The date of the document and its number - it must be no more than six characters.

- Payment type. It can have the meaning “Urgent”, “Telegraph”, “Mail”. If you send a payment through a client bank, indicate the encoded value accepted by the bank. This field can also be left blank: in our example of a payment order (above) it is empty.

- Payer status - code from 01 to 20, specifying the person or organization that transfers the money.

- Payment amount. It must be indicated in words from the beginning of the line with a capital letter (kopecks - in numbers). In this case, “ruble” and “kopeck” are written without abbreviations.

Further, in the details of the payment order in 2022, information about the payer and recipient is indicated:

- TIN, checkpoint,

- Name of the organization,

- account number, bank name, BIC, etc.

After this, fill in the fields with additional codes:

- Type of operation - the payment order has code 01.

- Sequence of payments.

- Reserve field. Leave it blank.

- Code. For tax and non-tax payments you need to enter 0. If necessary, a unique accrual identifier (UIN) is entered in the same field - a code of 20 or 25 digits.

In 2022, the UIN code in the payment order is indicated only when paying a penalty, fine or arrears at the request of the Federal Tax Service, Pension Fund or Social Insurance Fund.

After that, fill out the bottom table in the document.

- In the “Recipient” field (field 104), enter the budget classification code, which shows the type of receipt to the budget: tax, trade fee, etc. KBK Directory - here >>

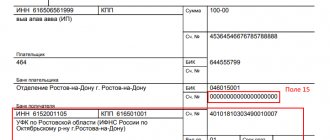

- In field 105, enter the OKTMO code. In the 2022 payment order it is indicated instead of OKATO.

- In field 106, enter the basis for the payment. The code consists of 2 letters, for example, OT - repayment of deferred debt. If the list of codes does not contain the payment you need, enter 0.

- In field 107, if the payment is tax, fill in the indicator of the tax period - how often the tax is paid: MS - monthly, CV - quarterly, PL - every six months, GD - annually. The date is written after the letter designation.

- In fields 108 and 109, indicate the payment basis number. You must enter the document number on the basis of which the payment is made and the date. Test yourself using the example of filling out a payment order.

- Field 110 (payment type) in the payment order in 2022 does not need to be filled in, since the KBK is indicated. Enter 0 in this field.

- The form is signed by the person whose signature is on the bank card.

The payment order is valid for 10 calendar days from the date of its preparation.

Payment form and its details

The payment order form (OKUD 0401060) was approved by Bank of Russia Regulation No. 762-P dated June 29, 2021.

This is one of the key changes in payment orders: from October 1, 2022, fields 101, 106, 108 and 109 are filled out in a new way, and from September 10, 2022, a new payment form is used. It is allowed to prepare the PP on paper or online, for example, using a special service of the Federal Tax Service or accounting programs. Whatever method the payer uses, the filling rules will not change. The only thing is that the programs fill in some of the details automatically, which significantly speeds up the process.

To make it easier to understand the order in which each field is filled out, it is assigned a number. This is a sample of the fields in a payment order in 2022:

The rules for filling out the payment form are given in Order of the Ministry of Finance No. 107n dated October 12, 2013. And Order of the Ministry of Finance No. 199n dated September 14, 2020 made adjustments to the procedure for filling out payment slips from October 1, 2022 - changed the order of filling out fields 101, 106, 108 and 109 (Federal Tax Service letter No. KCH-4-8 / [email protected] dated September 20, 2021 ).

Fill out a payment order online

You can fill out a payment order online in MyWarehouse. It's fast, free, and ensures you don't make mistakes.

To fill out a payment order online, you don’t need to worry about what to write in all the fields of the document. Just indicate the company, counterparty, amount and expense item. MySklad will do the rest: you will receive a finished document and can immediately print it.

Fill out online

Fill out the payment order online!

Register in the MoySklad online service - you will be able to: completely free of charge:

- Fill out and print the document online (this is very convenient)

- Download the required form in Excel or PDF

Filling out a payment order online through MySklad is easier than entering the data into the form yourself - you will save time and do everything without corrections or blots. You will receive the finished payment in convenient Excel and PDF formats: you can download it to your computer or immediately send it to your counterparty.

How to fill out a payment order at the request of the tax office in 2022

Filling out the payment order form at the request of the Federal Tax Service has its own peculiarities. For convenience, we have collected them in a table:

| Field | What to indicate |

| Reason for payment (106) | Enter "TR". This means that the debt is repaid based on the tax claim received. |

| Tax period indicator (107) | Here, indicate the payment deadline, which is noted in the Federal Tax Service's requirement. For example, if you pay tax for the 2nd quarter of 2022, indicate in the payment order form: KV.02.2017 |

| Document number (108) | Tax claim number. |

| Document date (109) | The date of the document requesting the Federal Tax Service is transferred to this field. |

Rules for filling out field 109

In field 109 “Document date” the date of payment is indicated. The field in question consists of 10 characters:

- the first 2 characters indicate the calendar day and take a value from 01 to 31 in accordance with the number of days in the month;

- The 3rd and 6th characters are separating characters and are filled with the symbol “.”;

- The 4th and 5th digits indicate the month and take values from 01 to 12 in accordance with the number of months in the year;

- The 7th to 10th digits indicate the year.

It is important to immediately note that field 109 “Document date” is interconnected with field 106 “Base of payment”. Its values directly depend on the values of this field.

From 01/01/2021, there were changes in the details of the payment order for the payment of taxes, including in field 106. From 05/01/2021, be sure to fill out field 15, which indicates the account number of the recipient’s bank (the number of the bank account included in the single treasury account (ECS)). From this date, the details of the Treasury accounts and the name of the recipient bank also change. The period from 01/01/2021 to 04/30/2021 is transitional. Those. The bank will accept payments with both old and new details. This follows from the letter of the Federal Tax Service of Russia dated October 8, 2020 No. KCh-4-8/16504.

For payments of the current period, when the TP indicator is indicated in field 106 “Basis for payment”, and the tax is paid in accordance with the declarations, the date of signing of the declaration submitted to the tax authority is entered in field 109 “Document date”. In case of voluntary repayment of tax payables, provided that they are discovered independently, 0 is indicated in field 109 (the value of field 106 is ZD).

In exceptional cases established by law, a specific date is entered in field 109 “Date of document”. This happens when field 106 “Basis of payment” has the value:

- TR - date of the tax authority's request;

- RS - date of the document in which the decision on installment plan was made;

- OT - date of the document corresponding to the decision to defer;

- RT - date of the document in which the decision on restructuring was made;

- PB - the date of the arbitration court’s decision to initiate bankruptcy proceedings;

- PR - date of the document on suspension of collection;

- AP - the date of the decision to bring or refuse to bring to justice for committing a tax offense;

- AR - date of the executive document;

- IN - the date corresponding to the decision to provide an investment tax credit;

- TL - the date of the arbitration court’s decision to satisfy the statement of intention to pay off the claims against the debtor.

In the case when an organization pays an advance payment for tax or finds it difficult to choose a value for field 109, it is allowed to indicate the value 0. This was confirmed by officials in the letter of the Ministry of Finance of Russia dated February 25, 2014 No. 02-08-12/7820.

The purpose of payment is incorrectly indicated in the payment order: how to correct it

You can clarify the purpose of the payment in several steps:

- Notify the counterparty that the purpose of the payment needs to be changed. You must obtain his written consent.

- Notify the bank and ask it to put an acceptance mark on the copy of the notice.

- Attach a notice with the bank's mark to the payment order.

- Receive a notification about a change in payment purpose from your bank and attach it to your payment slip.

Corrections cannot be made to the document, so figure out in advance how to fill out a payment order, or better yet, fill it out online.

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

FAQ

What to do if field 22 (code) is not filled in in the payment order?

Field 22 (unique accrual identifier) must be filled in when paying fines, penalties and arrears. But the tax office explained that this is not necessary - you can simply put 0 (letter of the Federal Tax Service of the Russian Federation dated March 13, 2017 No. ZN-4-1 / [email protected] ).

Is the checkpoint detail required or not in a payment order?

When transferring money to legal entities, it is not necessary to indicate the checkpoint (regulations of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P). But to determine the recipient and payer, it is better to enter it.

What are the differences between a payment order and a payment request?

The main difference is that a payment request is an application to the bank to withdraw money from the client’s current account. Thus, with an order you ask the bank to transfer money from your account to the counterparty, and with a demand - from the payer’s account to yours.

Where is the UIN indicated in the payment order?

In field 22. See our example of a payment order and instructions for filling it out here >>

Where is the “Payment code” field in the payment order?

This is field 110. You need to fill it out only when transferring money from the budget to individuals, for example, salaries to public sector employees. In this case, you need to put 1 in this column. If you don’t know how to fill out the remaining fields in the payment order, read our instructions >>

Where is the type of payment in the payment order 2022?

This is field 110, which is filled out only when transferring money from the budget to individuals.

Where to indicate the payer status of an individual entrepreneur in a payment order in 2022?

In field 101. If payment is made to the budget, enter a two-digit numeric code; in other cases, leave it blank.

See the remaining details of the payment order in 2022 here >>

Is the payment order form required or can we develop our own form?

Your own form will not work. The payment order form has been approved by the Central Bank. You can only use it. Be sure to look at our payment order. You can fill out 2022 here. Check with it to avoid mistakes.

What needs to be indicated in field 22 (UIN CODE) in a payment order in 2022?

The UIN code is the Unique Accrual Identifier. It consists of 20 or 25 digits. It is needed to transfer taxes and contributions upon request. The UIN is determined individually for each person. To find out your code, you need to receive an official requirement from the inspectorate or fund. The UIN is located in its lower part, next to the details.

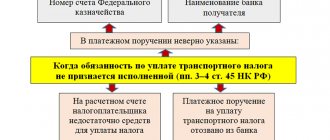

What to do if the order of payments in the payment order is indicated incorrectly?

If there is enough money in the account, the order of payments does not matter. If there are not enough funds to fulfill all orders, the bank will write off the amounts in the manner prescribed by law: the first payment in line is alimony and health payments, and tax debt is number 3. The full list is indicated in the Civil Code.

filling out a payment order for 2022 in a convenient format

Choose the option that is convenient for you: word or excel. The Ministry of Finance processes payment order forms automatically, so the order in which the document is filled out is important, and the format can be any.

Free payment order in excel

Free payment order in word

You can also fill out a payment order online in MyWarehouse. Just indicate the company, counterparty, amount and expense item. MyWarehouse will generate the document automatically.

Fill out online

Current payment order form

From a legal point of view, sending a payment order completed in accordance with the requirements to the bank serves as a legal basis for transferring funds from the applicant’s (client’s) account to the recipient’s account registered with the same or another financial institution. For such an order, paper or electronic format is used. It remains valid for ten calendar days from the date of preparation, and is filled out based on the current form approved by the Regulations of the Central Bank No. 383-P, the list of field numbering for which is fixed within the framework of Appendix No. 3 to the specified document.