Can a foreigner be an individual entrepreneur in Russia?

Yes it is possible. Thus, in accordance with Federal Law No. 115 of July 25, 2002, when staying on the territory of the Russian Federation, foreigners are endowed with the same rights as Russians.

According to Federal Law No. 129 of August 8, 2001, state registration of a foreign individual entrepreneur is carried out according to documents about his place of residence (“registration”). This may be a residence permit in Russia (RP) or a temporary residence permit (TRP).

In addition to a foreigner who is a tax resident, a non-resident of the Russian Federation can officially open an individual entrepreneur and start a business . However, if the latter does not have temporary registration, this cannot be done.

You will find the specifics of hiring foreigners with temporary residence permits and residence permits in another article.

What to do after receiving individual entrepreneur status

After registering as an individual entrepreneur, a foreign citizen will have to:

- Pay taxes and fees on time in accordance with the chosen taxation system, as well as insurance premiums for yourself.

- Contribute personal income tax and insurance premiums to the budget for employees hired by him under an employment or civil contract.

- Submit reports in accordance with the chosen taxation system.

- Submit reports for your employees.

- Register with the Social Insurance Fund if employees are hired under an employment contract (under GPC agreements it is not necessary to register with the Social Insurance Fund).

- Purchase and register a cash register (online cash register), if the selected type of activity requires its use.

Please note that opening a current account and obtaining a seal are not the responsibility of the individual entrepreneur, but can significantly facilitate the process of conducting business and relationships with counterparties.

Requirements for opening

State registration of a foreign person as an individual entrepreneur is carried out when the foreign person provides one of the following documents to the local tax office:

- Residence permit (residence permit) in the Russian Federation. According to this document, a foreigner chooses any suitable region of the Russian Federation for doing business.

- Temporary residence permit (TRP) . Non-residents with a temporary residence permit are registered as individual entrepreneurs only in the region of the Russian Federation where this document was issued.

Otherwise, registration of individual entrepreneur status by a foreigner is the same as for citizens of the Russian Federation. However, first a foreign citizen receives a temporary residence permit or temporary residence permit. In this case, he goes to the following authorities:

- territorial branch of the Main Department of Migration Affairs of the Ministry of Internal Affairs at the place of registration;

- MFC;

- by mail.

After issuing a temporary residence permit or temporary residence permit, in accordance with clause 3 of Art. 8 Federal Law No. 129 of August 8, 2001, upon state registration as an individual entrepreneur, a foreign citizen applies to the Federal Tax Service of the Russian Federation at the place of temporary registration . At the same time, it performs the following actions:

- Provides the tax inspector with the appropriate package of documents.

- Selects the direction of business activity according to the OKVED classifier.

- Selects a suitable individual entrepreneur taxation system.

- Pays the state fee for state registration of individual entrepreneurs.

A visa is not a document that replaces a residence permit or temporary residence permit; as a result, without them - only with a visa permit - a foreigner cannot open an individual entrepreneur.

Open an individual entrepreneur for a non-resident: registration with the Federal Tax Service

Can a non-resident foreigner open an individual entrepreneur in principle? Russian legislation does not prohibit this. To open an individual entrepreneur, a foreign citizen (as well as a stateless person) must be an adult and legally reside in Russia. In this case, you will need to provide the Federal Tax Service at your place of residence:

1. A copy of a document certifying the right to temporarily or permanently reside in Russia (subparagraph “e”, paragraph 1, article 22.1 of the Law on State Registration of 08.08.2001 No. 129-FZ).

Such documents may be:

- temporary residence permit (in particular, a mark indicating the address of temporary residence is placed on it);

- residence permit (it contains a registration stamp).

It should be borne in mind that the provisions of Art. 22.1 of Law No. 129-FZ does not contain exceptions for citizens of Belarus or other EAEU countries regarding the need to provide these confirmations. Despite the fact that such citizens have the right to work and live in Russia with virtually no restrictions on their passport, to open an individual entrepreneur they must obtain a residence permit.

2. An original or a copy of a document confirming the person’s residential address, if the identity document does not contain data on the address (subparagraph “g”, paragraph 1, article 22.1 of Law No. 129-FZ).

3. A copy of the person’s identity document, and, if necessary, a copy of the document containing information about the place and date of his birth, if the identity card does not contain such data (subclauses “c”, “e”, paragraph 1, article 22.1 of Law No. 129-FZ).

4. Document confirming payment of the state duty for individual entrepreneur registration. The state duty is 800 rubles, the same as for Russian citizens.

5. Application in the prescribed form P21001. Since November 25, a new application form has been in effect (order of the Federal Tax Service of Russia dated August 31, 2020 No. ED-7-14 / [email protected] ).

If necessary, a document confirming the absence of a criminal record is submitted if a person intends to conduct activities according to the list approved by Decree of the Government of Russia dated April 16, 2011 No. 285 (educational, medical services, work with children, etc.).

By the time a set of documents for individual entrepreneur registration is compiled, it is desirable that the foreigner has a Russian TIN. Formally, it is not required to obtain the status of an entrepreneur, but tax authorities may insist on the need to obtain it. To obtain a TIN, a foreigner will need (letter of the Federal Tax Service of Russia dated December 29, 2006 No. ШТ-6-09/ [email protected] ):

- residence permit or temporary residence permit (with appropriate marks of registration in Russia);

- passport;

- if registration is only at the place of stay - also a detachable part of the Notification of Arrival form with a mark from the Ministry of Internal Affairs.

Within 5 days, the Federal Tax Service must issue a certificate with a TIN.

Documents for registration of individual entrepreneurs can be submitted to the Federal Tax Service in person, as well as by mail, or through the mediation of the MFC or a notary (note that if you apply to the MFC and the notary, the state fee is not paid). You can also register through State Services, but this will require a qualified digital signature (state fees are also not paid). To obtain a signature, you will need an INN, as well as SNILS (subparagraph “a”, paragraph 1, article 18 of the Law of 04/06/2011 No. 63-FZ). To obtain SNILS, you will need to visit the Pension Fund of the Russian Federation, presenting an identification document, residence permit or temporary residence permit and fill out an application from the insured person.

For stateless persons, the procedure for registering an individual entrepreneur is similar, except that they need to confirm their lack of citizenship with an appropriate document.

In fact, the list of documents for registration of an individual entrepreneur by a non-resident foreigner is generally the same as that provided by a Russian citizen. The only difference is that a foreigner needs to confirm that he can temporarily stay or reside in Russia, and also take the time to obtain a Taxpayer Identification Number (TIN) and, if necessary, SNILS.

If a document is drawn up in a foreign language, for example, a passport, it must be translated into Russian, and the translation must be notarized.

For settlements with counterparties (employees, contractors), it is advisable for a foreigner who has become a Russian individual entrepreneur to open a current account.

Documents from non-residents

When registering as an individual entrepreneur, a foreigner provides the following documentation to the Federal Tax Service of the Russian Federation:

- application for state registration of a foreign individual as an individual entrepreneur (form P21001);

- a copy of your personal passport, birth certificate and other documentation indicating the specific place and date of birth;

- RVP stamp or copy of residence permit and originals of such documents;

- receipt of payment of state duty.

The foreigner sends the necessary documentation to the Federal Tax Service by a valuable letter or brings it in person. In a separate receipt, the tax inspector indicates the date of receipt of the certificate of state registration of the individual entrepreneur and the list of documents that he receives from the applicant for consideration.

A foreign citizen undergoes state registration as an individual entrepreneur only after full legalization of the necessary documentation. Along with the original documents, foreigners submit to the Federal Tax Service annexes with an accurate translation of all information into Russian.

Structure and rules for filling out the application

First, when registering as an individual entrepreneur, a foreigner fills out an application on form P21001. In such a situation, the applicant performs the following actions:

- Fills out the application in a Word document in capital letters and in this 18-point font - Courier New. If filling out the document manually, the applicant uses a pen with black ink and writes in capital block letters.

- On page 1 of the application, fill out your full name, TIN, gender, date, place of birth and citizenship.

- On page 2 indicates the address of the place of registration and data from your personal passport.

- Sheet A of the application reflects the OKVED codes by which he will engage in small business.

- On Sheet B indicates the procedure for issuing documentation and your contacts. The applicant fills out the “full name” and “signature” fields only manually, with a pen with black ink and under the supervision of a tax inspector when submitting an application for state registration.

After filling out, the foreigner prints out application P21001 in 1 copy. Double-sided printing of such a document is prohibited.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 350-29-87Moscow

Registration of individual entrepreneurs for foreign citizens - algorithm of actions:

- Decide what types of activities you will be engaged in and, depending on this, select the appropriate OKVED codes - the main one, as well as additional ones.

- Choose the optimal tax system. If you do not want the tax office to automatically assign a DOS to your individual entrepreneur, you should submit an application for the application of the simplification at the registration stage.

- Pay the state fee - the amount for opening an individual entrepreneur in 2022 is 800 rubles. (stat. 333.33 Tax Code). Check the details with the registration authority of the Federal Tax Service.

- Collect all the necessary documents, if necessary, translate into Russian, carry out the translation. Do not make mistakes, corrections or inaccuracies when filling out forms - this may lead to refusal to register your business.

- If you submit documentation through a representative, do not forget to have it certified by a notary. If you are going to visit the Federal Tax Service in person, do not sign the registration application in advance - only in the presence of a tax inspector.

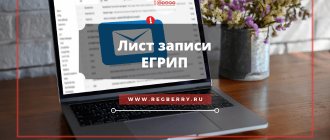

- If all the documents are in order, you will receive in your hands a sheet about making the appropriate entry in the Unified State Register of Legal Entities, a certificate of registration of a citizen as an individual entrepreneur. The law allows 3 working days for registration.

- Funds – information is transmitted by the tax authorities independently.

- Statistics - receive a letter about the assignment of codes.

- Current account and stamp are available upon request.

Conclusion - in this article we examined in detail whether and how a foreign citizen can open an individual entrepreneur in Russia? As you can see, there is nothing complicated in this process; the main thing is to submit all the required documents without errors, so as not to be refused by the registration authority. After creating a business and having permissions or licenses, if necessary, you can safely carry out the activity.

How to register: procedure

Selection of activities

When registering as an individual entrepreneur, a foreigner selects the main type of activity according to OKVED-2 (OK 029-2014 (NACE Rev. 2)). However, it must be taken into account that for certain permitted types of activities it is necessary to first obtain a separate license. In Art. 12 Federal Law No. 99 of May 4, 2011 provides a complete list of such works.

In addition, a foreigner may not engage in business in all types of activities. In Art. 14 Federal Law No. 115 of July 25, 2002 and other similar legal acts indicate the following areas of labor activity prohibited for foreigners:

- civil service;

- defense and military-industrial complex;

- work in a bank;

- work on the securities market;

- sale of various medicines;

- sale of alcoholic beverages;

- trade in weapons, various types of ammunition, aviation and military equipment;

- organization of various gambling games;

- power supply.

Each type of activity from OKVED has its own insurance tariff, tax and tax rate, possible benefits and the need to provide additional certificates

What taxes must be paid and is it possible to choose the simplified tax system?

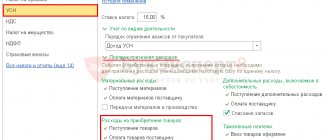

For 1 month. After submitting an application for state registration of an individual entrepreneur or on the same day, the foreigner submits to the Federal Tax Service a notification about choosing one of the following taxation systems:

- General (OSNO).

- Patent (PSN).

- Simplified (USN).

- UTII (Unified tax on imputed income).

- Unified Agricultural Tax (Unified Agricultural Tax).

The table below provides a comparative description of each taxation system for a foreign individual entrepreneur.

| Comparative characteristics | BASIC | Unified agricultural tax | simplified tax system | UTII | PSN |

| Tax rate | Income tax – 20% (sometimes 0-30%), VAT – 0, 10 and 20%, property tax – 2% (IP), personal income tax – 13, 30%. | 6% | 6% (for the simplified tax system “Income”), 15% (for the simplified tax system “Income – expenses”) | 15% | 6% |

| Object of taxation | Amount of income, profit, property | The amount of profit minus costs | Profit (for the simplified tax system “Income”) or profit minus the corresponding expenses (for the simplified tax system “Income - expenses”) | Imputed income | Potential profit |

| Restrictions | No | Only for agricultural and fish processing plants, if the share of revenue is 70% or more of total income | 100 employees maximum, revenue up to 60 million rubles. | No more than 100 employees, the list of services provided is limited by the legislation of the Russian Federation. | The list of activities is limited by the legislation of the Russian Federation. |

| Taxes paid | Personal income tax, VAT, land, transport, trade tax, property | Unified Agricultural | Unified, land, transport tax, trade tax | Unified, land, transport tax | Patent price, land, transport tax |

When choosing the required tax regime, you need to keep in mind the difference between residents and non-residents of the Russian Federation. After all, a tax non-resident is a foreigner who has lived in Russia for at least 6 months. for 1 year. A non-resident individual entrepreneur of the Russian Federation pays personal income tax equal to 30% to the budget, while a resident pays only 13%.

Payment of state duty

According to Part 6, Clause 1, Art. 333.33 of the Tax Code of the Russian Federation, when opening an individual entrepreneur, a foreigner pays a state duty in the amount of 800 rubles. A sample form and a blank receipt for payment of the duty should be downloaded from the Federal Tax Service website. This can be done absolutely free.

Submission of documents

The collected documentation must be taken to the Federal Tax Service at the place of registration (or to the MFC). If all is well, then 3 days after submitting the documents, the foreigner will be given a Certificate of State Registration of Individual Entrepreneurs and a notification with statistics codes. From this moment you can start working.

Opening a current account

According to Russian legislation, after undergoing state registration as an individual entrepreneur, a foreigner is not required to open a new current account. This should be done only when carrying out transactions with your official partners and clients for amounts over 100,000 rubles.

A foreigner opens a current account for an individual entrepreneur in any Russian bank. A foreign citizen notifies the tax authority about opening a new bank account for an individual entrepreneur within 7 days after registration.

When opening a current (bank) account, a foreigner provides the bank with the following documentation:

- Certificate of state registration of individual entrepreneurs.

- Notification of taxpayer registration.

- Photocopy of TIN.

- Extract from the Unified State Register of Individual Entrepreneurs.

If, when carrying out business activities, payments are made only in cash, then a bank account does not need to be opened. After obtaining the status of an individual entrepreneur, in order to successfully run a business, a foreigner should order the production of a company seal.

Is a company seal required?

A foreign individual entrepreneur does not have to issue a company seal unless absolutely necessary . However, for example, when opening a bank account, bankers require such a seal. This case is an exception to the rule, but you should be prepared for it.

You can make an individual entrepreneur stamp at any stamp manufacturing company. In order to order an individual entrepreneur stamp, you must provide the following documents to this office:

- Original and photocopy of the Certificate of state registration of an individual as an individual entrepreneur.

- Copy of INN IP + original.

- Personal passport (original).

The cost of making a seal is 500-1500 rubles. The price of the service can be found in the price list from the manufacturer.

How to open a bank account for a non-resident individual entrepreneur

The procedure for opening an account is generally similar to the procedure for an individual entrepreneur with Russian citizenship. In general, the following is expected to be provided to the bank:

- documents confirming the right to stay or reside in Russia (similarly, this could be a residence permit or temporary residence permit, as is the case with an application to the Federal Tax Service, Pension Fund);

- applications for opening a current account in a form approved by the bank;

- cards with signatures and seal (if available);

- passport (other identification document);

- certificates with TIN number (they may also ask for SNILS);

- notifications about registration of individual entrepreneurs with the Federal Tax Service;

- if necessary - licenses and other permits issued by the individual entrepreneur for conducting activities;

- extracts from the Unified State Register of Individual Entrepreneurs, certified by the signature of the Federal Tax Service;

- information about statistics codes for individual entrepreneurs.

At its discretion, the bank may request other documents.

Reasons and grounds for refusal of registration

A Federal Tax Service employee refuses to register a foreign individual as an individual entrepreneur in the following situations:

- when not all documents are provided to the tax officer;

- if the submitted documentation is completed incorrectly (with typos, errors, edits);

- if the documents are not certified by a notary;

- if a foreigner has previously received individual entrepreneur status in the Russian Federation;

- if the period for declaring a foreign individual entrepreneur bankrupt has not yet expired;

- if there is a previously adopted court decision to terminate the current activities of the individual entrepreneur forcibly;

- if there is a court order prohibiting a foreigner from engaging in commercial activities in his native country and on the territory of the Russian Federation.

After state registration of documentation that does not inspire confidence among officials, the foreigner is sent an official response by mail in writing indicating all the violations committed.

Foreign citizens who do not open an individual entrepreneur, but simply find employment in the Russian Federation, need a work patent or permit. About the difference between a patent and a permit, also about the procedure for hiring foreign citizens in the Russian Federation, notification of employment, obtaining a work permit and employment of foreign citizens, about foreign highly qualified specialists, about the features of registering an LLC with a foreign founder We talked about it in our other materials.

In what form can you open a business in Russia?

There are several organizational and legal forms for doing business in the Russian Federation, but two of them are the most popular:

- individual entrepreneur (IP) - an individual who has received the right to independent entrepreneurial activity;

- limited liability company (LLC) is a legal entity that acts independently on its own behalf, and not on behalf of the founders.

There are analogues of these legal forms in many countries. For example, in the USA these are Sole proprietorship (IP) and Limited Liability Company (LLC). If we talk about micro and small businesses, their representatives in Russia most often choose the form of individual entrepreneurial activity.

This form has certain restrictions on types of business, which are available only to legal entities. But at the same time, it is easier for an individual entrepreneur to work in an organizational sense, he has more tax benefits, lower fines, and less interest from inspectors. An individual entrepreneur is not limited in the amount of income received and the number of employees, therefore he is a full-fledged business entity.

Rights and obligations in the Russian Federation

According to paragraph 3 of Art. 62 of the Constitution of the Russian Federation, foreigners are endowed with the same rights and responsibilities that residents of the Russian Federation have. As a result, the rules for doing business and hiring foreign employees are no different from the procedure established for citizens of the Russian Federation.

In accordance with Part 1 of Art. 23 of the Civil Code of the Russian Federation, any adult citizen, including foreigners, has the right to open an individual entrepreneur . However, he cannot register a new legal entity (company).

A foreigner can open an individual entrepreneur in the Russian Federation if he has an official residence permit or temporary residence permit. The laws of the Russian Federation do not limit the activities of a foreign individual entrepreneur in any way, with the exception of prohibited types of economic activity from OKVED. A foreigner can engage in small business in Russia under the conditions established for citizens of the Russian Federation.

Who are non-residents of the Russian Federation

Non-resident status is established based on the criteria given in Article 207 of the Tax Code of the Russian Federation. In particular, this is a stay in the country for less than 183 days within 12 months. In this case, the months must go one after another. If a person is outside the Russian Federation for a number of reasons, these periods will not be included in the calculated period. Consider these reasons:

- Study or treatment abroad for no more than six months.

- Travel to offshore hydrocarbon fields.

- Business trips (this paragraph applies to military personnel and government officials).

The list of reasons under consideration is specified in paragraphs 2.1 and 3 of Article 207 of the Tax Code of the Russian Federation. A person’s stay in Crimea from March 18 to December 31, 2014 will also be considered as being in the Russian Federation. Short-term departures (up to 6 months) from the state are also not taken into account in calculations.

Types of activities that are allowed for foreigners in the Russian Federation - individual entrepreneurs

A foreign citizen registered in the Russian Federation as an individual entrepreneur has the same rights as an individual entrepreneur who has Russian citizenship. Based on this, it is clear that the list of types of entrepreneurial activities will be the same as those permitted for Russian citizens. It is worth remembering that certain types of activities will require a license. Their list is presented in Law No. 99-FZ of May 4, 2011 (Article 12). This law also defines the types of activities that are prohibited for individual entrepreneurs. These include:

- Public service;

- Banking activities;

- Defense;

- Sales of medicines;

- Arms trade;

- Stocks and bods market;

- Gambling;

- Providing electricity.

What is the difference from registration of individual entrepreneurs by citizens of the Russian Federation

According to Art. 4 of the Law of the Russian Federation No. 115-FZ, foreigners enjoy rights in the Russian Federation on an equal basis with Russian citizens. As a result, the main difference between registering an individual entrepreneur by a foreigner and opening an individual entrepreneur by a citizen of the Russian Federation is:

- a set of documents provided to the inspection of the Federal Tax Service of the Russian Federation;

- certain types of individual entrepreneur activities prohibited for foreigners.

As a result, a foreigner, along with a citizen of the Russian Federation, has the right to open an individual entrepreneur in Russia. However, to do this, he needs to comply with legal restrictions for starting a business in the Russian Federation.

Procedure for registering an individual entrepreneur as a foreigner in Russia

Important! Any type of activity that is aimed at making a profit is a business activity and is subject to registration. To carry out commercial activities in Russia, an individual private enterprise, the subject of which is an individual, or a business company, the subject of which is a legal entity, can be formed.

Quite often, an individual entrepreneur is chosen to conduct commercial activities, since this form allows you to avoid complex registration procedures, as well as conduct simplified accounting, work without hiring employees, and manage your income independently. It should be remembered that paperwork in the Russian Federation is carried out only in Russian, and if contracts are concluded with foreign companies, then the documents must have a notarized translation into Russian.