When can I return an item?

The relationship between buyer and seller does not always develop without problems. For example, a situation may arise when you need to return products, for which you will need a sample certificate of return of goods to the supplier. This can happen in the following situations:

- Poor quality purchase. The buyer has the right to legally return goods that do not meet the quality requirements established by the terms of the contract (agreement), in accordance with clause 2 of Art. 475 of the Civil Code of the Russian Federation, Law No. 2300-1 “On the Protection of Consumer Rights”.

- The delivery does not comply with the terms of the contract. If the seller mistakenly delivered more units of goods, the buyer returns the excess cargo (Article 466 of the Civil Code of the Russian Federation). Conversely, if the purchasing organization identifies a defect, it has the right to return the entire batch.

- Shipment of incomplete products. Based on Art. 480 of the Civil Code of the Russian Federation, the buyer has the right to demand a reduction in price or delivery of missing parts of the goods, otherwise - return the entire batch of incomplete products.

- Inconsistency of the product range with the terms of the sales contract. If the seller delivered products that differ from the specifications, then the receiving company can return the products or the entire batch (Article 468 of the Civil Code of the Russian Federation).

- Product delivery time is overdue. This may also be a reason to refuse the cargo. An exception is if the receiving party did not promptly notify the supplier of the refusal to accept products with an overdue delivery date. In this case, it will not be possible to return the products (Article 511 of the Civil Code of the Russian Federation).

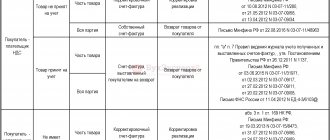

Return of goods by a VAT non-payer

If the seller and buyer use special modes (STS, UTII, etc.), invoices for sales and returns are not issued, and entries in the purchase and sales book are not made.

If the seller is located on OSNO, and the goods were sold to a company that is not a VAT payer, then when the buyer returns goods (both accepted and not accepted by him for registration), the supplier must issue an adjustment invoice for the cost of the goods returned by the buyer and register it in shopping book.

When the supplier registers an adjustment invoice drawn up when returning goods from a buyer who does not pay VAT (except for individuals), column 2 of the supplier’s purchase book reflects transaction code 16.

Thus, the seller registers the same invoice twice: the first time - in the sales book with code KVO 01 or 26, the second time - in the purchase book with code KVO 16.

What documents should I submit to return goods to the supplier?

Before starting the return shipment procedure to the seller, send him a written notice or simply a letter (Article 483 of the Civil Code of the Russian Federation) to coordinate the shipment. The procedure must be formalized to eliminate controversial situations.

IMPORTANT!

If the contract specifies the conditions for the return of products or the procedure is carried out on legal terms, then there is no need to draw up an additional agreement to the contract. In other cases, it is necessary to change the terms of the contract or conduct a separate transaction that details the conditions for the return of purchased products to the supplier.

The main document confirming the fact of return shipment of purchased products is the product return certificate. For registration, you can approve your own form, taking into account the specifics of the institution, or use the forms approved by Resolution of the State Statistics Committee of December 25, 1998 No. 132:

- TORG-2 (OKUD 0330202);

- TORG-12 (OKUD 0330212).

The act can be drawn up both in written and printed form. When drawing up the document, please indicate the required details:

- Date and place of document preparation.

- Full name of the counterparties participating in the return procedure.

- Detailed list of materials, products, products.

- Reasons for carrying out the return procedure.

- Link to a document confirming the buyer’s legal right to return the product. The results of an independent examination of product quality, a link to violated clauses of the contract, and specifications may be indicated here.

- Terms and conditions for the return transfer of materials (buyer’s requirements).

- Details and signatures of the parties, seals (if any).

Please note the rule: only managers or authorized representatives of the parties can sign the act. You can confirm your authority with a power of attorney of the established form (form M-2). The document is drawn up in the required number of copies, but not less than two (for the supplier and the buyer). Be sure to attach a return invoice, a letter of claim (accompaniment letter), and the results of an independent examination of product quality (if defective material is supplied) to the report.

Simplified mechanism for processing return transactions

Since 2022, the technology for processing the return of goods in tax accounting has been significantly simplified.

Look at what the supplier and buyer need to take into account in 2021-2022 when processing the return of goods:

From 07/01/2021 a new invoice form is in effect, incl. adjustment, as amended by the Decree of the Government of the Russian Federation dated 04/02/2021 No. 534. The update of the form was caused by the introduction of a goods traceability system. All taxpayers are required to use the new form, even if the goods are not included in the traceability system. We described in more detail the changes made to the invoice here.

You can download the new invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

The phrase “we fill out an invoice for the return to the supplier” has now acquired a different meaning and the question of how to issue an invoice when returning goods is easier to solve than it was before 2019.

How to write a return letter

There is no standardized form for a letter to return goods. Consequently, the document will have to be generated in any form. It is advisable to fill out the letter on the institution’s letterhead. Otherwise, you will have to enter all the registration data about the applicant company, that is, about yourself.

So, the structure of the letter to return goods must meet the following requirements:

- Applicant information. Indicate the name of the organization that received the defective product. Also write down the TIN and KPP, the legal and actual addresses of the company, if they differ. Be sure to include contact information, such as phone number, email address. Also indicate the responsible employee who can be contacted to resolve the issue. This will greatly speed up the solution to the problem.

- Recipient information. First, indicate the position of the manager, the name of the organization that violated the terms of delivery of the goods, full name. boss Enter the TIN, checkpoint, address and telephone number in the same order.

- The name of the document, for example “Letter to return goods” or “Claim”.

- Now describe the essence of your appeal. Start by indicating the details of the agreement (contract, agreement), the terms of which were violated. Then outline the recipient's obligations. That is, write down what the company was supposed to do under the contract. Next, you should write down the facts revealed as a result of the delivery (which is why you had to apply). For example, indicate that the product is of poor quality, the wrong product was delivered, or something else. Then outline your requirements. For example, to supply a high-quality product, replace non-conforming parts, product components, or other things. You can specify a specific period of time during which the defect should be eliminated.

- Attach copies of documents confirming the circumstances. Indicate supporting documentation in the form of a list of attachments to the letter for the return of goods. Be sure to include a receipt and invoice for returning the goods.

The letter is signed by the manager. It is not necessary to put a stamp.

An example of the procedure for returning goods

Let's look at the situation using a specific example. GBOU DOD SDYUSSHOR "ALLUR" entered into agreement No. 1 dated 01.08.2019 with LLC "Supply of goods" for the purchase of basketballs in the amount of 100 units in the amount of 60,000 rubles. Delivery time is until 08/31/2019. Payment - money 100% after delivery.

Supply of Products LLC supplied 100 balls on 08/02/2019. The accountant made the following entries:

- Debit 0 105 00 340 Credit 0 302 34 730 - sports balls are accepted for accounting in the amount of 60,000 rubles;

- Debit 0 302 34 830 Credit 0 201 11 000 - cash in the amount of 60,000 rubles. were transferred from the current account.

On 08/07/2019, it turned out that the seller supplied 30 soccer balls and 70 basketballs.

The accountant made entries for the return of goods to the supplier: Debit 0 302 34 830 Credit 0 105 00 440 - a return statement was drawn up in the amount of 18,000 rubles (the cost of one ball multiplied by the quantity = 600 rubles × 30 pcs.).

At the same time, the accountant prepared:

- A letter of claim in any form with a detailed description of the essence of the claim.

- Return invoice in form TORG-12, approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132 (OKUD 0310001).

- Certificate of return of goods to the supplier.

Partial return of goods before the buyer accepts it for accounting

Let's consider a situation where the buyer, upon acceptance of the goods, identifies a discrepancy with the specifications, but only part of the received goods is subject to return (not acceptance).

In this case, the buyer (letter of the Ministry of Finance dated May 12, 2012 No. 03-07-09/48):

- Registers in the purchase book the initial “shipping” invoice only for the cost of those goods that were accepted for accounting;

- The CSF received from the seller is not recorded either in the purchase book or in the sales book.

The seller registers his copy of the adjustment invoice in the purchase book and adjusts the VAT payable to the budget by the amount of tax on the value of the returned blanks accepted for deduction.

Sample return invoice to supplier

Each institution independently decides which forms of primary documentation to use in accounting: either unified forms, or developed and approved independently (Federal Law dated December 6, 2011 No. 402).

IMPORTANT!

When developing your sample invoice for returning goods to the supplier, make sure that all the necessary details are indicated in the document form. Otherwise, the document will be considered void.

Adjustment invoice: when issued

In business activities, there are often situations when the buyer and supplier agree to change the quantity or price of delivery. For example, a discount is provided for the entire batch of goods supplied during the year upon reaching certain purchase volumes. In this case, the shipping documents must be adjusted.

The supplier issues a corrective invoice if the following indicators specified in the primary shipping document have changed:

- price of goods (works, services);

- quantity of goods (works, services);

- both price and quantity changed at the same time;

- the buyer who is not a VAT payer returns the goods.

KSF form

If an error is found in the preparation of the primary shipping documentation, then it is necessary to issue a corrected invoice.

How to draw up a return certificate

The organization has approved its own form.

Step 1. We indicate the date and place of preparation, indicate the name and responsible persons of each party. We write down the document on the basis of which the return procedure is carried out. In our case, agreement No. 1 dated 08/01/2019.

Step 2. We indicate the item (cargo, item, product) that is to be shipped to the seller, and the basis. In our example, there is a contract for the supply of basketballs.

Step 3. We indicate the reason for the return and the results of the examination, if required (defects, low quality, defects).

Step 4. Now we write down the buyer’s conditions. In our case, the organization requires replacing soccer balls with basketballs.

Step 5. Then we write down the details of the parties, sign the act and certify with seals.

Processing and storage times

The Civil Code provides for specific deadlines for completing the procedure (Article 477 of the Civil Code of the Russian Federation):

- for products without an expiration date - no later than two years from the date of delivery;

- for goods with a specified expiration date - no later than the expiration of the stated period.

You will have to store documents confirming that the products were returned for at least 5 years. Based on Federal Law No. 402 of December 6, 2011, the organization must approve the procedure for storing accounting documents. Familiarize the person in charge with the approved procedure and sign it.