What is work in progress?

This is a unique group of assets that no longer refers to materials, but also does not yet constitute a finished product. Accounting standards give them a clear definition. According to PBU, work in progress is products or work that have not passed all stages of the technological process, acceptance or testing. This also includes:

- incomplete products;

- unfulfilled orders;

- independently produced semi-finished products that are not classified as finished products;

- services and work not accepted by the customer;

- semi-finished products and processed materials;

- units, parts, assembly connections.

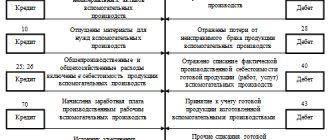

To account for the costs of the production process, active accounts 20–29 are used. Expenses are collected in debit, and they are written off (distributed) in credit. The balances on these accounts at the end of the month characterize the value of work in progress.

Features of accounting for work in progress

Synthetic accounting of production in accounting involves the use of such accounts in the Chart of Accounts as:

- $20$ “Main production”;

- $23$ “Auxiliary production”;

- $29$ “Servicing industries and farms.”

For analytical accounting, these accounts can be detailed for separate accounting by workshops, teams, types of products produced, works, services, etc.

For example:

- $20.1$ – Production of item A

- $20.2$ – Production of item B

or

- $20.1$ – Shop $1$

- $20.2$–Workshop $2$

etc.

The debit of these accounts reflects all expenses associated with this type of production, which include the cost of raw materials and supplies, the cost of paying production workers and other costs.

The credit of these accounts reflects the write-off of the generated cost of production to the debit of the accounts $43$ “Finished Products”, $40$ “Output of Products (Works, etc.)

If at the end of the period there are debit balances left on these accounts, then these balances represent an indicator of work in progress.

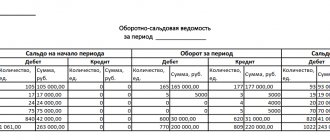

This indicator can be presented both in monetary terms and in quantitative and detailed analytical accounting of expense items in the debit of these accounts.

In the accounting of enterprises that produce products with a long production cycle or provide complex services, sales are recognized in two ways:

- in general, as finished products or work delivered to the customer;

- for individual stages of work performed or products manufactured.

As a rule, the first option is the most common. When recognizing sales under the second option, the account $46$ “Completed stages of work in progress” is used for synthetic accounting of work in progress.

The debit of this account records the cost of work stages paid by the customer and completed by the enterprise in correspondence with the credit of the $90$ “Sales” account. Upon completion of all stages, the cost paid by the customer is written off from the account $46$ to the debit of the account $62$ “Settlements with buyers and customers”.

Costs that reduce taxable profit include only direct costs that relate to finished products sold. Direct expenses that are part of work in progress, as well as finished but not sold products, do not reduce the taxable profit of the enterprise.

In accounting, work in progress can be reflected (Fig. 1):

Figure 1. Reflection of work in progress in accounting

Types of assessment

In accounting, data is reflected in natural and monetary measures. To accept or write off funds, you need to know their value. The assessment of work in progress is carried out using the following method:

- Actual costs incurred (for single production).

- Actual cost is the most reliable and common method. The volume of work in progress is determined. After which its quantity is multiplied by the average unit cost, thereby determining the actual production cost of all work in progress at the end of the month.

- Standard cost – applicable for serial and mass production of products. The accounting price per unit of work in progress is applied. Additionally, records are kept of deviations of the planned cost from the actual cost.

- For direct cost items - the price of a unit of work in progress is calculated by summing up the direct costs of its creation.

- WIP costs - the cost of work in progress includes only materials, raw materials or semi-finished products. The method is mainly used in material-intensive production.

The enterprise must choose the most appropriate method for assessing work in progress and write it down in its accounting policies. The balance of work in progress is assessed on the basis of primary documentation, and its size is determined after conducting an inventory at the end of the month.

Rules for filling out the WIP verification report form

The act form is developed at the enterprise and approved by order of the manager, with subsequent consolidation in the accounting policy. It can be based on the forms given in appendices Nos. 6–15 to the guidelines, approved. by order of the Ministry of Finance No. 49.

The act must indicate:

- Title of the document,

- link to administrative document,

- inventory start and end date.

It is recommended to summarize the results of the check in a table for the convenience of recording work in progress by quantity and cost. At the end of the act there must be signatures of all members of the inventory commission.

IMPORTANT! The absence of the signature of at least one member of the commission makes the act invalid.

The acts are filled out separately for each separate division of the enterprise.

You can use the WIP inventory report for free by clicking on the picture below:

Products with a long production cycle

Industrial production sometimes produces products that go through several stages of processing. At the same time, enterprises can recognize the fact of sale at different points in time: at certain stages of the work or after its complete completion. Usually the second option is used.

If the products are delivered in stages, then there is a need to use account 46. The debit indicates the parts of the work paid for by the customer and completed by the enterprise. After all stages are completed, the cost of the object accumulated in account 46 is written off to the debit of the “Settlements with customers and buyers” account.

Tax accounting of work in progress

For the purposes of calculating income tax using the accrual method, the taxpayer determines the composition of direct and indirect expenses independently in the accounting policy.

At the same time, the main criterion for including costs in direct costs is their direct connection with the production of goods, performance of work or provision of services.

The taxpayer has the right to classify individual costs associated with the production of goods (work, services) as indirect costs only if there is no real possibility to classify these costs as direct costs, using economically justified indicators.

The organization also independently establishes the procedure for distributing direct costs for work in progress and products manufactured in the current month (work performed, services rendered).

In this case, the expenses incurred must correspond to the range of manufactured products (work performed, services provided).

If it is impossible to attribute direct costs to a specific production process for the production of a given type of product (work, service), the accounting policy should determine the mechanism for distributing such costs using economically feasible indicators.

The established procedure should be applied for at least two tax periods.

Organization of WIP inventory

The specifics of the inventory are indicated in the accounting policy of the enterprise. With the exception of mandatory inspections, the following organizational issues are established regarding the planned calculation of the number of assets:

- list of property subject to the procedure;

- the total number of inventories that are planned to be carried out in the reporting period and their dates;

- composition of commissions;

- other information.

Mandatory inventory of work in progress is carried out in the event of damage or theft of work items in its composition, a change in responsible persons, and some other cases.

Regardless of the reasons for conducting the inspection, the process is carried out in accordance with the instructions of the Ministry of Finance (order No. 49). First of all, the manager issues and signs an order that contains information about:

- reasons for conducting the inspection;

- groups of property falling under the process;

- the composition of the commission participating in the inventory;

- start and end date;

- the period within which documents must be submitted to the accounting department.

The order is a kind of task for the inventory commission. It consists of accounting employees, administrative employees, and other specialists. A prerequisite is the presence of financially responsible persons. Representatives of an independent audit service may also be involved. The presence of each member of the commission is mandatory, otherwise the results of the inspection are considered invalid.

How is WIP inventory carried out in production?

At industrial enterprises, inventory of work in progress can be carried out both for individual objects and for their totality. The main points to pay attention to when taking inventory are the following:

- it is necessary to determine the actual quantity of all items in the nomenclature;

- it is necessary to establish the completeness of all work in progress items;

- you need to determine the balance of work in progress that relates to canceled or suspended orders.

The production process in a large enterprise involves a variety of operations, for which different areas of work can be organized. Accordingly, an inventory of work in progress should be carried out in the context of these areas, and for each of them a corresponding inventory list should be compiled, and then all the data obtained should be compiled into a general inventory sheet.

Procedure for carrying out inventory of work in progress

The chairman of the commission puts visas “Before inventory on date n” on all expenditure and receipt documents received for inventory. This is necessary to record data on property balances before starting the inspection. Financially responsible persons provide receipts stating that all primary documents have been submitted, incoming property has been capitalized, and disposed property has been written off as expense. After which an inventory of work in progress can be carried out.

They begin to calculate the actual availability of property. Information about its quantity is recorded in acts or inventories, which are compiled in at least two copies. The document is numbered, it indicates the date of the inspection, the date and number of the management order on its organization. Next, tables are compiled for each workshop and the location of work in progress objects. Once completed, the document is signed by members of the commission and financially responsible persons. The latter additionally provide a receipt stating that the verified volume of work in progress has been accepted for safekeeping.

PREPARATORY ACTIVITIES

Before carrying out an inventory of work in progress, it is necessary to carry out a number of preparatory procedures in order for the process to produce effective results.

1. Before starting the inventory, we check:

- availability and correctness of accounting in analytical accounting registers for each type of product, order, WIP object;

- availability of design and technological documentation, engineering survey results, design documentation, patents;

- whether semi-finished products can be used in production;

- provision of labor for hanging and moving large parts and assemblies, technically sound weighing equipment, measuring and control instruments, and measuring containers.

If the WIP inventory is planned, you need to organize preparatory work in the workshops , which will simplify the work of the commission. It is necessary to order that in workshops:

- parts and assembly units were placed in an order convenient for counting;

- signed, hung tags on racks, containers, parts;

- outdated designs and canceled orders were placed separately;

- removed defective parts and waste;

- delivered all unnecessary materials, purchased components and semi-finished products to warehouses;

- parts, components and assemblies, the processing of which was completed in the audited workshop, were transferred to the next technological stage.

2. We select a competent commission.

The inventory commission includes:

- technical specialists of general plant services (technologists, designers, controllers);

- employees of the financial and accounting service - an accountant of the production group, an economist or the head of the economic planning and production dispatch departments, an accountant-auditor;

- employees of the company's internal audit and security services;

- representatives of independent audit companies, competent experts.

An important point: limited time is allotted for inventory; errors are difficult to detect and correct, so it is necessary to provide a sufficient number of working commissions and performers. Inspectors must have a good knowledge of the technological process.

- We receive from financially responsible persons of production departments:

- the latest incoming and outgoing documents at the time of inventory, production reports for workshops;

- receipts stating that all documents on the movement of work in progress have been submitted to the accounting department or transferred to the commission.

- We instruct the members of the inventory commission about the purposes, volumes and procedure for conducting the inventory.

Inventory of unfinished construction

Inspection of capital construction projects is carried out for each structural element, type of work, equipment and its other components. In this case, the commission needs to find out:

- whether the WIP includes objects transferred for installation work, but not yet affected by them;

- what is the condition of the objects under conservation and the construction of which has been temporarily stopped.

Separate acts are drawn up for buildings that have been put into operation but not properly accepted. A similar measure is applied to objects whose delivery deadline has been delayed for some reason.

WIP inventory and industrial production

At enterprises of this type, the commission checks the availability of all materials, raw materials, as well as the completeness of units, reserves and installations. All unnecessary inventories are handed over from the workshop to the warehouse before inventory. For each separate division, an act or inventory is drawn up. Separate documentation is required for raw materials, materials and semi-finished products that have not been processed, but were located near workplaces. The WIP inventory does not include rejected items.

An inventory of work in progress at an industrial enterprise is carried out in order to check:

- availability of reserves, units, components, parts;

- quantity of unfinished products;

- completeness of units, components, parts;

- WIP balances for orders whose execution has been canceled or suspended.

Backlogs, components, assemblies and parts are counted, measured and weighed. The data is entered into the relevant acts or inventories.

Work in progress at an enterprise, which is a mixture of different raw materials or a heterogeneous mass, is characterized using two indicators: the total quantity and the portion attributable to each item in its composition. The calculation procedure is regulated by industry instructions, and in their absence, it is prescribed in the accounting policy.

The purpose and objectives of inventory of work in progress

The main purpose of the inventory of work in progress is considered to be to determine the actual presence of objects of work in progress, identifying unaccounted for defects, determining the completeness of products, determining the balances of canceled or suspended orders and calculating the cost of products that are in the stage of work in progress. In addition, the purpose of the inventory is to compare actual data with accounting indicators and identify factors influencing discrepancies in information.

In accordance with the goal, the following tasks should be solved during the inventory of work in progress:

- determination of the composition, structure and quantity of work in progress;

- drawing up inventory lists that will contain all the necessary information, including the name of the object or product, its quantity, degree of readiness and completeness, stage of production;

- identifying unaccounted for defects in production and determining its percentage of manufactured products;

- study and analysis of maps for the release of materials into production in order to identify the irrational use of the enterprise’s material resources;

- calculation of the cost of work in progress according to the method specified in the accounting policy and used in the organization.

Reflection of inventory results

Acts and inventories of inspections are submitted within the prescribed period to the accounting department. Inconsistencies discovered during the inventory between the data of primary documents and the actual availability of property must be reflected in the accounting accounts.

If excess work in progress is discovered, it should be capitalized at market value on the date of the inspection. Work in progress in accounting is listed on accounts 20–29. The amount is recorded in the debit of the account in which the surplus was discovered: Dt “Auxiliary production” Ct “Other income”.

Shortages or damage to work in progress are shown in the credit of production cost accounts. The accounting entries look like this: Dt “Shortages” Cht “Main production”, Dr. “Losses from damage to valuables” Cht “Main production”. If the detected shortage does not exceed the norm of natural loss, then its amount is attributed to distribution costs: Dr. “Main production” Ch. “Shortages”. Such write-off is carried out on the basis of the calculation recommended by the accounting policy.

Typical entries for inventory of work in progress

When conducting an inventory, the commission can receive several results, and for each of them the corresponding entries are generated. The most common ones are:

- if a surplus of work in progress items is identified

Debit 20 Credit 91/1 market value of surplus accepted for accounting

- if a shortage is identified

Debit 94 Credit 20 reflects the cost of the shortage

- shortages according to the norm and in excess of it are allocated to different accounts

Debit 20 Credit 94 shortage within normal limits attributed to production

Debit 73 Credit 94 shortage in excess of the norm is attributed to the culprit, if he is identified

Debit 91/2 Credit 94 shortfall in excess of the norm is charged to other expenses if the culprit is not identified

Reflection of shortages in excess of established standards

The accounting policy of an enterprise establishes certain standards, including a portion of property losses that are considered acceptable. In cases where the shortage occurs due to damage to the work in progress, there are two options for reflecting the results in accounting:

- If the culprits are identified, the shortage is restored at their expense. The accounting entries are as follows: Dt “Calculations for compensation of damage” Ct “Shortages”, Dt “Calculations for compensation of damage” Ct “Losses from damage to valuables”.

- If the court refuses to recover damages from the guilty parties, or they are not identified, then the shortfall is written off to the financial result: Dr. “Other expenses” Ch. “Shortages”.

- If property damage occurred due to an emergency or force majeure, then the procedure for reflecting losses is similar to clause 2.

Amounts of shortages in excess of the norm oblige the inventory commission to conduct an internal investigation in order to identify the perpetrators.

Work in progress in accounting occupies a special place in the assets of the enterprise. These are no longer raw materials and materials, but also not finished products. Controlling its quantity is as important as for any other property. In order to compare the data of primary documents with the actual availability of work in progress, inventories are carried out, as a result of which the indicators are adjusted, if necessary.

Inventory of work in progress and deferred expenses: regulatory documents

To properly organize and conduct an inventory of work in progress (WIP), you must be guided by:

- Order of the Ministry of Finance of the Russian Federation on the Regulations on accounting and reporting in the Russian Federation dated July 29, 1998 No. 34n. Paragraphs 26–28 of the order set out when and in what cases it is necessary to carry out an actual inspection, as well as how identified surpluses and shortages should be taken into account; paragraphs 63–65 define what applies to work in progress and deferred expenses;

- Order of the Ministry of Finance of the Russian Federation on Methodological guidelines for inventory of property and financial obligations dated June 13, 1995 No. 49. Clauses 3.27–3.35 of the order indicate the procedure for the commission to verify work in progress, deferred expenses and reflect the results in the drawn up act.