Any business activity involves expenses. You have to spend money on diverse processes and purchases: those needed for the production of products, equipment maintenance, the purchase of raw materials, packaging, and transportation. And also on management processes, not to mention wages. This multifactorial nature of costs indicates the need for their classification and separate accounting.

Let’s understand the concept of “overhead costs”, clarify which costs can be attributed to them and how to recognize them in financial accounting.

How are overhead expenses different from core expenses?

What is overhead

Not all costs in production go directly into the product and can be directly planned and taken into account in its cost. Nevertheless, the funds spent turn out to be absolutely necessary for the manufacture of products, their sale, promotion on the market, as well as the management of the organization itself.

The most accurate definition of overhead would be “everything else.” This type of costs is not highlighted in a separate article in the Tax Code of the Russian Federation; naturally, their structure is not spelled out there either. In accounting, it is also impossible to clearly differentiate them.

NOTE! The law establishes a list of overhead costs only in the construction and medical industries. All other enterprises must determine overhead costs themselves, fixing this in their accounting policies.

overhead costs, accepted in business, implies expenses that cannot be attributed directly to technological production processes, accompanying the production process, but not included in the cost of work and raw materials. Another name for overhead costs is indirect costs . They are indicated when planning and drawing up estimates for both the company as a whole and individual structural divisions.

How to calculate the cost of production taking into account overhead costs ?

Why consider overhead costs?

The most obvious goal is planning future profits, which are affected by all the costs incurred by the entrepreneur. But in terms of overhead costs, this poses certain difficulties. If potential direct costs can be fairly accurately calculated for specific types of products, then it is quite difficult to determine how many indirect costs will result and how they will be distributed when, for example, expanding production or signing a certain contract.

IMPORTANT! To adequately determine the cost of a product, it is necessary to take into account and distribute overhead costs in proportion to direct expenses - calculate production costs .

What costs are included in the list of direct costs?

Direct production costs depend primarily on the type of product being created (for example, material-intensive or not) and most often consist of:

- costs of raw materials, components, and other materials necessary for the production of products;

- expenses for remuneration of personnel directly involved in the implementation of work to create certain products;

- insurance premiums accrued for the remuneration of personnel directly creating products.

If it is possible to organize accounting with attribution to a specific type of product, then the following can also be taken into account as part of direct expenses:

- depreciation of equipment used in production;

- energy costs;

- Third-party company services.

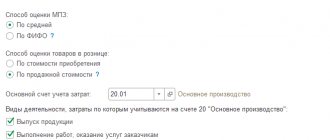

The collection of direct expenses is carried out on accounting accounts in relation to the costing units of production allocated to them (orders or redistributions):

- 20 - for main production;

- 23 - for auxiliary production;

- 29 - for service production.

The list of costs for these accounts, as a rule, is made general, detailing only the part of material costs, among which can be identified:

- basic materials (raw materials, components);

- semi-finished products of own production;

- auxiliary materials;

- returnable waste.

It is allowed to evaluate work in progress using direct costs. Read more about this in the article “Work in Progress in Accounting.”

What is included in overhead costs

Indirect costs can be roughly divided into 4 main groups:

- Management costs:

- his salary;

- money spent on training, certification and advanced training of management.

- Contents: purchase of computers, office supplies, expenses for office needs, including communication services.

- Expenses associated with the process of organizing production:

- maintenance repairs of structures, buildings, premises, equipment belonging to the organization;

- costs of transport owned by the company;

- payment of rent for warehouse premises and/or office;

- waste of money due to downtime, defects, etc.;

- money that needs to be spent on maintaining fixed assets.

- Personnel costs:

- social tax contributions;

- payments to social security and other funds;

- equipment of household premises, canteens, showers, etc.

- Non-production costs:

- advertising expenses;

- payment for consultations and examinations;

- payment of utility bills, etc.

Cost of finished products, works, services: criteria for assigning costs to account 109 00

To account for operations to form the cost of finished products, work performed, services provided, account 109 00 is intended (clause 124 of the Instructions, approved by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n, hereinafter referred to as Instruction No. 157n).

Costs are grouped into the following groups:

- direct costs directly attributable to the cost of finished products, works, services - account 109 60;

- overhead costs for the production of finished products, works, services - account 109 70;

- general business expenses - account 109 80.

1.1. Direct costs are directly included in the cost of manufacturing a unit of finished product, performing work, providing a service (account 109 60). These are expenses directly related to the provision of a specific type of product, work, or service.

Direct costs may include:

- salaries of key personnel;

- accruals for wages of key personnel;

- the cost of inventories completely consumed in the manufacturing process of a unit of finished product, work, or service;

- depreciation of fixed assets used in the process of manufacturing finished products, work, services.

When producing one (single) type of finished product, work, or service, all costs directly related to the production of finished product, performance of work, or services are considered direct costs.

Example. The budgetary institution produces one type of finished product - cottage cheese with a fat content of 9%.

All costs associated with the production of this type of finished product (staff wages, charges for wages, utilities, cost of consumed materials, etc.) are debited to account 109 60.

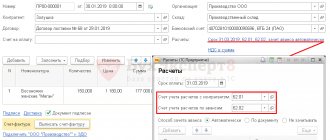

1.2. Overhead costs are expenses that cannot be directly attributed to specific types of products, works, and services. Overhead costs (account 109 70) are distributed monthly to the cost of finished products sold, work rendered, services (account 109 60) in proportion to the established bases through calculated coefficients.

More on the topic: Accounting for the rental of part of a building in institutions in 2018

Overhead costs may include:

- remuneration of general institutional personnel;

- accruals for wages of general institutional (administrative and economic) personnel;

- utility and business expenses (costs of materials and items for current business purposes, office supplies, inventory and payment for services, including costs of current repairs, etc.);

- expenses for business trips and official travel;

- wear and tear of soft equipment in auxiliary departments;

- depreciation (wear and tear) of fixed assets not directly related to the production of products, performance of work, or provision of services.

Example 1. A budgetary institution is engaged in the production of two types of finished products - cottage cheese with a fat content of 9% and cottage cheese with a fat content of 18% (for the production of these types of finished products, one set of inventories is used - milk, sourdough).

All costs associated with the production of these types of finished products (staff wages, accruals for wages, utilities, cost of consumed materials, etc.) are debited to account 109 70.

At the end of the month, account 109 70 indicators are distributed to the cost of each type of product (account 109 60) in proportion to the established base.

Example 2. A budgetary institution is engaged in the production of two types of finished products - bread and sweets (different sets of inventories are used for the production of these types of finished products).

Costs directly related to the production of bread (cost of consumed inventories, bakers' salaries, accruals for bakers' wages) are charged directly to the cost of a specific type of finished product (bread) - to the debit of account 109 60.

Costs directly related to the production of sweets (cost of consumed inventories, confectioners' salaries, accruals for payments for confectioners' wages) are charged directly to the cost of a specific type of finished product (candy) - to the debit of account 109 60.

Costs not associated with the production of a certain type of finished product (utilities, salaries of general institutional personnel, accruals for payments for wages of general institutional personnel) are classified as overhead costs - in the debit of account 109 70. At the end of the month, account indicators 109 70 are distributed to the cost of each type products (account 109 60) in proportion to the installed base.

1.3. General business expenses are expenses for management needs not directly related to the production process (the process of providing services, performing work).

More on the topic: Reorganization: reflection in the accounting of budgetary institutions

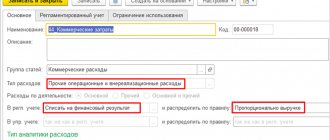

General business expenses are divided into:

- Distributed - subject to distribution to the cost of finished products sold, work rendered, services (account 109 60);

- Not distributed - subject to attribution to the increase in expenses of the current financial year (account 401 20).

Example 1. A budgetary institution is engaged in the production of two types of finished products - cottage cheese with a fat content of 9% and cottage cheese with a fat content of 18%.

Costs not directly related to the production of these types of finished products (salaries of management personnel, accruals for payments for wages of management personnel, utilities for the administrative building, cost of office supplies for management personnel, etc.) are classified as general business expenses - in the debit of the account 109 80.

At the end of the month, account 109 80 indicators are distributed to the cost of each type of product (account 109 60) in proportion to the established base.

The choice of the method for calculating the cost of a unit of production (volume of work, service) and the base for the distribution of overhead costs between the objects of calculation is carried out independently by the institution or founder and is an element of the accounting policy.

Overhead distribution options

IMPORTANT! Recommendations for the distribution of overhead costs from ConsultantPlus are available here

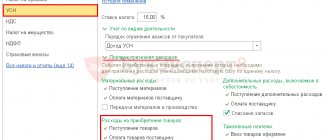

Despite the difficulties of planning indirect costs, this is a necessary procedure that can be carried out in several ways:

- The "working wage" method. If the main production employs a large number of workers, especially if manual labor predominates, overhead costs can be calculated in proportion to the wage fund for their labor.

- The “sales volume” method is advisable to use if automated processes predominate in the company. You can distribute income in proportion to machine hours.

- The unit of production method is applicable when direct costs significantly exceed indirect costs. Then we can take as a basis the ratio of direct costs per unit of goods to the total amount of direct costs.

- Direct counting method. Indirect expenses are summed up separately for each expense item.

- Combined methods are applicable in large companies with a complex structure, where several types of products are produced. For example, you can account for manufacturing overhead on the payroll basis, and general business overhead on the basis of unit cost.

EXAMPLE OF CALCULATION. Avtokoleso LLC is engaged in the transportation of goods. The staff wage fund is 8 million rubles per year. The overhead cost ratio in 2016 was 80%, that is, 6 million 400 thousand rubles. The company decided to reduce overhead costs, for which it fired several people. At the same time, the wage fund decreased by 20%, which means that the overhead costs of Avtokoleso LLC for 2022 can be planned in the amount of 5 million 120 thousand rubles.

Is there any provision for rationing of overhead costs ?

Why divide costs into direct and indirect?

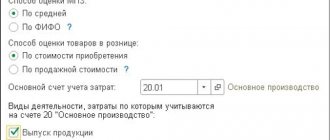

When calculating income taxes, direct and indirect expenses reduce the tax base, but at different times.

Therefore, it is necessary to divide expenses into direct and indirect in order not to make a mistake with the moment of recognizing expenses as expenses. That is, correctly determine the tax base and calculate the tax.

The tax base can be reduced by the amount of direct expenses only after the sale of products in the production costs of which they are taken into account. That is, their amount for the current month must be distributed between work in progress and products manufactured during the month (work performed, services provided).

You can write off only that part of direct expenses that falls on finished, shipped and sold products (Articles 318, 319 of the Tax Code of the Russian Federation).

Indirect expenses are written off to reduce the tax base in the month in which they were incurred, that is, without reference to sales.

Therefore, sometimes there is a temptation to expand the list of indirect expenses as much as possible and reduce the list of direct ones - in order to pay less income tax. However, it is better not to do this, but try to divide your expenses into direct and indirect so that you don’t have to pay more later.

Procedure for calculating overhead costs

Planning and accounting of all expenses, including overheads, is carried out in a certain order:

- The total amount of costs for general business activities of the company is calculated.

- The amount of overhead costs that will need to be included in the estimate per unit of each type from the product range is determined.

ATTENTION! It is necessary to take into account the legal limits for overhead costs for specific items and the standards defined by the company's internal regulations.

Legal limits regarding overhead costs

The law determines the composition and limits of overhead costs in the construction and medical industries.

Construction overhead

In this industry, overhead planning is especially important. An estimate is drawn up, which indicates the average costs for the industry, which are included in the cost of construction products or services.

Cost rationing in the construction industry is regulated by the Methodological Guidelines for determining the amount of overhead costs in construction, approved by the Resolution of the State Construction Committee of Russia (separately for regions of the Far North and equivalent regions). These documents define the coefficient that must be applied to determine overhead costs for a particular construction activity, and also clarify the scope of its application. The wage fund for construction workers is taken as the base. The distribution of coefficients is carried out according to the following main types of construction:

- industrial;

- agricultural;

- transport;

- housing;

- energy;

- related to water management;

- in the field of nuclear energy;

- restoration work;

- major repairs;

- other types.

FOR YOUR INFORMATION! Overhead costs according to construction standards must be applied at the stage of drawing up estimates, as well as when paying for work performed.

Medical overhead

The standards and composition of overhead costs in the medical industry are regulated by Order of the Ministry of Health and Medical Industry of Russia No. 60 dated March 14, 1995. According to the provisions of this order, the cost of medical care must include all annual costs of a medical institution:

- salaries of all types of personnel, except medical personnel, with all accruals;

- expenses for the purchase of furniture, stationery, household goods (everything, except medicines and dressings);

- means for repairs.

The basis is the wage fund of medical personnel providing specific medical services, based on a coefficient of 1.5.

IMPORTANT! Typically, overhead costs are significantly higher in medicine than in construction.