Calculation period for 2022

To correctly calculate vacation, you need the Regulations from the Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the peculiarities of the procedure for calculating the average salary” (hereinafter referred to as Resolution No. 922).

According to paragraph 4 of Resolution No. 922, the calculation period for paid leave is 12 months that precede its start. We are talking specifically about calendar months.

That is, if an employee goes on vacation in February 2022, then the months from February 1, 2022 to January 31, 2021 are taken into the calculation period.

If there was parental leave in the billing period, the billing period can be replaced . In this case, take 12 months before maternity leave. This approach is reflected in the letter of the Ministry of Labor of Russia dated November 25, 2015 No. 14-1/B-972, as well as in paragraph 6 of Resolution No. 922.

All bonuses in the billing period are included in the calculation of vacation pay.

Erroneous actions of the accountant will be such as, for example, including in the calculation of vacation bonus payments to an employee, which:

- They were not provided for by the provisions of local regulations in force at the enterprise.

- They were accrued and paid to the employee not for work, but, for example, in honor of a professional holiday or as a reward for an anniversary.

- They are annual paid for the year that does not precede the calculation of vacation pay.

- The amounts of all monthly, quarterly, semi-annual and other bonuses accrued in the billing period.

IMPORTANT! Based on the information contained in paragraph 15 of Resolution No. 922, it is permissible to include in the calculation no more than four quarterly bonuses accrued and paid to an employee for the same indicator. A similar situation occurs with monthly and semi-annual bonus payments.

Summarizing all of the above, we can conclude that when performing an operation to calculate the amount of an employee’s average earnings, when calculating vacation pay, you should include exclusively:

- bonus payments provided for by local regulations in force at the enterprise

- bonus payments accrued and paid to an employee for work activities

- not exceeding 12 monthly, four quarterly, two semi-annual bonus payments, accrued during the billing period, for the same indicator

- daily bonus payment accrued and paid to the employee for the previous calendar year event

What payments are included in average earnings when calculating vacation?

In accordance with paragraph 2 of Resolution No. 922 and part 2 of Art. 139 of the Labor Code of the Russian Federation, the average earnings for calculating vacation pay include all payments that are provided for by the company’s remuneration system for the billing period.

If during the billing period the employee did not have wages or working days, then the average earnings are calculated for the 12 months that preceded the billing period. This situation may arise, for example, if the employee was on maternity or child care leave.

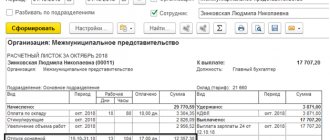

To calculate vacation pay for 2022, you can use a calculation note about granting vacation to the employee. This form combines both the vacation order and the calculation itself. The form of this calculation note can be downloaded for free here:

NOTE-CALCULATION ON PROVIDING LEAVE TO AN EMPLOYEE

The form of the order for the provision of leave or its calculation is not approved . The company has the right to develop it independently . Also, no one prohibits the use of unified forms.

In any case, the forms of accepted documents must be approved by order and included in the accounting policy.

The accountant calculates vacation days after signing the vacation order.

You can read about the preparation of this order in our article “Sample order for vacation in 2022.”

An employee can go on vacation according to the planned vacation schedule or in agreement with management.

For information about the schedule, see the article “How to draw up and approve a vacation schedule for 2020 ” (relevant in 2022).

How is the payment calculated?

After working for a full calendar year, you will need to calculate your average daily earnings in order to subsequently use this figure to determine the final amount. The result of the calculations must include the income received by the citizen over the last 12 months, divided first by the number of months in the billing period, and then by 29.4 (the average duration of one month). It is noteworthy that the latter indicator is calculated annually and is used as amendments to the Labor Code of the Russian Federation.

In practice, in most cases it turns out that the employee cannot work out the calendar year. This period usually includes sick leave, financial aid payments and bonuses. If we take all of the above amounts into the calculation of the average, they will significantly increase the final figure.

As a result, when asked whether various additional payments are included in the basic amount for calculating vacation pay, the answer is no. When deducting such amounts, the period that is taken as the main one for the calculation also decreases. To give an idea of the procedure for calculating vacation pay, we will give a practical example.

Formula for calculating vacation pay 2022

According to paragraph 9 of Resolution No. 922, the formula for calculating vacation in 2021 is as follows:

Average daily earnings for 2022 are calculated as follows:

Days worked include all days the employee worked. However, weekends and holidays are not excluded from days worked.

They subtract from days worked for which payment was already made based on average earnings. These are: business trips, vacations, days on sick leave and other reasons (clause 5 of Resolution No. 922, letter of the Ministry of Labor dated 04/15/2016 No. 14-1/B-351).

Paid non-working days in 2022, introduced by decrees of the President of the Russian Federation during the coronavirus period, are also not included in the calculation. This clarification was issued by the Ministry of Labor (letter dated May 18, 2020 No. 14-1/B-585).

This way you can check yourself and the correctness of calculating vacation payments to employees in 2022.

So, for each month worked they take 29.3 days . This is the accepted average monthly norm, which is calculated as follows:

(365 days – 14 holidays) / 12 months

If the month is not fully , taking into account clause 10 of Resolution No. 922, the number of days worked should be calculated using the formula:

This situation could arise when an employee was sick or on vacation, or did not work on those days that the President of the Russian Federation declared non-working due to the coronavirus pandemic.

should not take these non-working days when calculating the amount of vacation pay. This rule contains in subsection. e clause 5 of Resolution No. 922. In confirmation of the above, the Ministry of Labor issued a letter dated May 18, 2020 No. 14-1/B-585. Later, Rostrud published its letter dated July 20, 2020 No. TZ/3780-6-1, in which it confirmed the correctness of this position.

REFERENCE

June 24, 2022 was declared a non-working day, which was paid at the usual rate and should be taken into account in the standard working hours (letters of the Ministry of Labor dated June 17, 2020 No. 14-1/B-733, No. 14-1/B-727).

July 1, 2022 was declared a non-working day, which was paid as a non-working day (holiday) and must be taken into account in the standard working hours (paragraph 2, part 5, article 2 of the Law of the Russian Federation on the amendment to the Constitution of the Russian Federation of March 14, 2020 No. 1-FKZ, information from Rostrud dated June 15, 2020).

If your employees went to work on days when they were released from work, then these periods are taken into account in the billing period - in the general manner, as well as the amount of payment for them (letter of Rostrud dated July 20, 2020 No. ТЗ/3780-6-1 ).

Which payments are included in the calculation base and which are not?

Certain provisions of the labor code clearly indicate which days and payments are used when calculating vacation pay and which are not. In this regard, we will create a small table:

- employee salary;

- percentage of revenue;

- payment in kind;

- monetary allowances for employees of government agencies and municipalities;

- fees from media and cultural organizations;

- allowances and surcharges.

| Payments that are excluded from the base | Amounts to be taken into account |

|

Sometimes employees are paid bonuses that are permanent and secured by internal regulations. These payments are also subject to accounting when calculating vacation benefits.

Example of calculating vacation pay 2022

During the period of self-isolation in 2022, some employees took leave without pay.

Details about unpaid leave are set out in our article “ Leave at your own expense during coronavirus quarantine .”

However, such unpaid leave does not deprive the employee of the right to paid leave.

Let's look at the calculation of vacation in 2022 using an example.

EXAMPLE

Driver Mironov O.D. The next paid leave was granted for 14 days from January 11 to January 24, 2022.

This means that the billing period is from January 1, 2022 to December 31, 2020.

The amount of wage payments included in the calculation was 530,000 rubles.

During the pay period, the employee:

- was on paid leave - 7 days in February 2020;

- was sent on a business trip - from March 2 to March 29, 2022 and from October 1 to October 31, 2020;

- did not work on days declared non-working – from March 30, 2022 to April 30, 2022, from May 6 to May 8, 2020;

- June 24, 2022 and July 1, 2022 worked;

- I was sick and took sick leave – 7 calendar days in December 2020.

So, let’s determine the number of months fully worked by the employee: January, June, July, August, September, November 2022. Total - 6 months.

Let us remind you that we take June and July 2022 into account, because on days declared non-working, the employee went to work.

Number of days in months that are not fully worked:

- February 2022 – 22.23 days ((29 – 7)/29 × 29.3);

- May 2022 – 26.46 days ((31 – 3)/31 × 29.3);

- December 2022 – 22.68 days ((31 – 7)/31 × 29.3).

The average daily earnings is 2144.27 rubles (530,000.00 rubles / (29.3 × 6 months + 22.23 + 26.46 + 22.68).

Vacation pay amount:

2144.27 rub. × 14 days = RUB 30,019.78

What is included in the calculation?

Based on the Labor Code of the Russian Federation, each employee is entitled to vacation once a year. The period of paid annual leave lasts at least 28 days, however, depending on the profession, its duration may increase.

When there are 3 days left before the vacation period, funds must be credited to the employee. If the money was not received on time, and there was no written notice, then the employee can change the dates of his vacation or even postpone it, after agreement with management.

Calculating the amount of vacation pay is quite simple. All funds received from the employer during a 12-month period are divided by the number of days worked. This amount must be multiplied by vacation days. But there are also cases when the calculation changes.

The calculation becomes more complicated if the employee was absent from the workplace for some reason; there are many such cases:

- did not work because it was idle;

- was on a work trip;

- was on paid time off to care for a disabled child;

- was on sick leave or maternity leave;

- there was a strike in which he himself did not take part;

- the employee was released for other reasons, but at the same time received full or partial wages.

An example of calculating vacation pay 2022 based on the minimum wage

Next, let's look at the example of calculating vacation pay in 2022 based on the minimum wage. According to paragraph 18 of Resolution No. 922, I calculate vacation pay based on the minimum wage in the case when the average monthly earnings of an employee who full working hours for the billing period is less than the minimum wage.

Recalculation of vacation pay according to the minimum wage must also be done if the minimum wage has increased during the vacation.

EXAMPLE

Cameraman Sergeev S.V. from December 23, 2020, I was on vacation for 28 days, of which 9 days were in December, 19 in January 2022. Vacation pay was accrued from the average daily earnings - 419 rubles / day.

Average daily earnings:

- from the minimum wage 2022 – 413.99 rubles/day. (RUB 12,130 / 29.3);

- from the minimum wage 2022 – 436.59 rubles/day. (RUB 12,792 / 29.3).

The average daily earnings for vacation days in January 2022 are less than the minimum wage (419 rubles/day < 436.59 rubles/day). Additional payment of vacation pay up to the minimum wage – 334.21 rubles. ((436.59 rub./day – 419 rub./day) × 19 days).

Non-working days in May 2022 in average earnings

As Ministry of Labor specialists explained, average earnings will depend on whether a person was released from work from May 4 to May 7.

If released, this period must be excluded from the calculation period, and the salary for these days must be excluded from the average earnings.

If the employee worked from May 4 to May 7, these days are included in the pay period and the salary is included in the average earnings.

Details here:

How to calculate vacation pay taking into account non-working days and annual bonus

What to do with non-working days?

Everyone knows that in the periods from 03/30/2020 to 04/30/2020 and from 05/06/2020 to 05/08/2020. non-working days have been established (Presidential Decrees No. 206 of 03/25/2020, No. 239 of 04/02/2020, No. 294 of 04/28/2020). Despite the fact that employees did not fulfill their labor duties, during these periods, according to the Decrees, their wages are retained and must be paid by the employer.

But should it be taken into account in the future when calculating vacation pay?

Rostrud and the Ministry of Labor of the Russian Federation answered this question. Moreover, at first their opinions were completely opposite.

Thus, Rostrud on its information portal “Onlineinspektsiya.rf”, responding to incoming questions from users, adhered to the point of view that the retained salary for the period of non-working days should be included in the future in the calculation of average earnings. Since labor legislation does not provide for the concept of non-working days as a period of release of an employee from work.

In addition, the retained cash payment to employees has the status of wages - therefore, this payment must be included in the calculation of average earnings.

The Ministry of Labor, in letter No. 14-1-B-585 dated May 18, 2020, refers to subparagraph “e” of paragraph 5 “Regulations on the specifics of the procedure for calculating average wages” (approved by Russian Government Decree No. 922 dated December 24, 2007). This paragraph lists the periods and amounts accrued during this time that must be excluded when calculating average earnings.

According to the Ministry of Labor, the introduction of non-working days with retained earnings corresponds to paragraphs. “e” clause 5 of the Regulations, which means that this period and payment must be excluded when calculating average earnings.

However, at the moment, Rostrud agrees with the opinion of the Ministry of Labor, as evidenced by the answers to questions No. 131994 dated June 14, 2020 and No. 131953 dated June 12, 2020 on the portal.

Although letters and official responses from the Ministry of Labor and Rostrud are not normative acts and are only advisory in nature, they should nevertheless be followed, because the opinions of these departments are widely used in practice by labor inspectors during inspections.

Important:

1. If the organization had the right to continue working on declared non-working days, or employees, under an additional agreement to the employment contract, worked remotely (that is, the timesheet reflects working days), then this earnings and days do not need to be excluded when further calculating average earnings.

2. If the organization did not work during the period of self-isolation and employees were paid a retained cash payment (that is, the timesheet shows days as non-working days with pay), then in this case, in accordance with the position of Rostrud and the Ministry of Labor, non-working days and payments for them should be excluded from the calculation average earnings (that is, in situations where the employee did not actually work).

3. If the employer has already paid the employee vacation pay and, when calculating average earnings, mistakenly took into account payments on non-working days, then the vacation pay must be recalculated. And if recalculation results in an additional payment, then it must be paid to the employee and compensation must be calculated for each late payment day in the amount of 1/150 of the refinancing rate. When withholding recalculated vacation, you must obtain a withholding application from the employee.