The organization took an inventory of the cash register and discovered that there was not enough money in it - this means there is a shortage. Maybe the cashier made a mistake in the calculations, but there is also a risk that the money was stolen. We will tell you in the article how to reflect the shortage in accounting, when and at whose expense to write it off, and what documents will be needed.

We talked about the opposite situation in the article “Excess cash in the cash register”

Cash inventory: when and why it is carried out

A lack of money in the cash register is usually noticed during an inventory count. The organization carries out this procedure in the order and within the time frame that it has determined. But sometimes checking is required:

- at the end of the year before preparing annual accounting reports;

- when hiring a new cashier or other financially responsible person;

- upon detection of theft, damage or abuse of money and other valuables from the cash register.

The organization's management can schedule inspections in advance or conduct them unexpectedly. As a rule, planned ones are approached more responsibly, but unscheduled ones help to find more violations. For example, if an unscrupulous employee “borrowed” money from the cash register for a while, then he may not have time to return it before an unexpected check.

The reason to start an unscheduled inspection will be customer complaints, inspectors’ demands, messages from other employees, or simply your own desire to make sure that everything is in order. There are no restrictions on the frequency of checks - they can be arranged at least every week, at least every day.

Inventory procedure

Before scheduling an event to count the organization’s property and assess the company’s financial obligations, a commission is convened. The absence of even one official included in the special council is the reason for the cancellation of the audit results. The composition includes representatives of the enterprise administration, accounting service, and other employees. The list of commission members is approved in advance on the basis of an issued order, which indicates the audit period and types of property. Inventory procedure:

- Setting the date for the recount of property.

- Checking existing values using a continuous or selective method.

- Drawing up an inventory sheet with entering data on the name of the product and its actual quantity.

- Displaying the final balance in monetary terms.

- Filling out a matching sheet to document shortages during inventory.

- Compilation of a report.

- Sending documentation to the head of the organization.

The reasons for conducting an inventory at the initiative of a company representative are the presence of data on theft, embezzlement, mis-grading, production of unaccounted for property, the fact of consumer deception, and deliberate destruction of goods. The main requirements for an audit include surprise, making up for shortages, getting rid of surpluses, and drawing up a matching sheet. The commission works in the presence of the director, manager, administrator, seller, merchandiser, cashier, storekeeper of the organization or their assistants. After the inventory, the manager has the right to assign a control check to check the correctness of the results.

How is the cash register inventory carried out?

To begin the inventory, management issues an order and appoints an inventory commission. Only for the annual inventory an order is not needed.

The cash register inventory includes checking cash, securities, strict reporting forms, transfers en route, monetary documents (airplane and train tickets, fuel cards, vouchers, etc.). In the order to conduct an inventory, you can designate specific objects of inspection.

The commission recalculates all cash in the cash register and checks whether the balance matches the amount indicated in the cash book. Additionally, they check cash reports, incoming and outgoing cash orders, entries in the cash book, etc.

Important! During the inventory checkout, the cash desk is closed; cash cannot be accepted or issued.

A financially responsible person must be present at the cash register inventory - usually a cashier. And before starting the check, the cashier must confirm that he has transferred all expenditure and receipt documents to the accounting department, capitalized the incoming valuables and wrote off the retired ones.

How to register a shortage

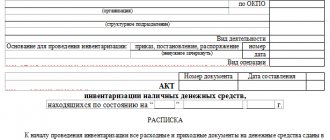

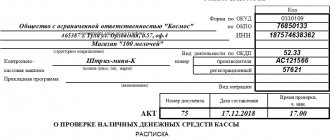

The results of the inventory are drawn up in the form of an inventory list (inventory act). You can develop the form yourself or use the standard INV-15 - it is suitable for processing the results of checking funds and monetary documents.

The act is usually drawn up in two copies - for the accounting department and for the cashier. But if the inventory is carried out due to a change in cashiers, you will need three copies at once - the accounting department, the old cashier and the new one.

If a shortage is found during the inventory, you need to:

- draw up a matching statement (if you use the INV-15 form, separate statements are not needed, since all the information will be in the act);

- receive a written explanation from the cashier or draw up a statement of refusal;

- conduct an internal investigation as part of the inventory commission to establish whether the cashier is to blame for the shortage, whether he committed illegal actions, and whether there are grounds for releasing him from liability.

When to go to court

You can recover a shortfall in an amount exceeding the employee’s average monthly earnings, even without his consent. To do this, you must file a claim with the district court at the defendant’s place of residence.

All inventory documents will be needed for the proceedings. The judge will check whether the inventory was taken correctly. As I said earlier, this plays an important role when making a decision. It is also necessary to stock up on all the documents drawn up during the official investigation.

If an employee agreed to compensate for losses voluntarily, and then stopped paying, they can also be recovered in court. Even if he quit.

How to hold a cashier accountable

This cannot always be done. To hold a financially responsible person liable, the following conditions must be met:

- document the shortage;

- prove the employee’s guilt - due to intent or negligence;

- prove that the employee committed unlawful acts or omissions that directly led to the shortage.

Article 239 of the Labor Code of the Russian Federation lists cases when it is impossible to hold an employee financially liable. For example, there was a fire, the cashier was attacked by robbers and threatened with weapons, the employer did not equip the premises in accordance with all the rules for storing cash.

The financial liability of the cashier can be full or limited. If an agreement on full liability is concluded with him, then the entire amount can be recovered (Article 244 of the Labor Code of the Russian Federation). If there is no such agreement, the cashier’s liability is limited to his average monthly salary (Article 241 of the Labor Code of the Russian Federation).

How to recover the amount of the deficiency

To recover money, the employer must issue an appropriate order. He has a month to do this after the commission establishes the exact amount of damage (it cannot be more than the average monthly earnings).

The order is drawn up in any form indicating all the necessary information and the signature of the manager. All persons affected by the order must also sign for familiarization.

Limited Liability Company "Yasno" Order

02.07.2021

№ 154

On the deduction from the employee’s salary of the amount of the shortage identified during the cash inventory

During the inventory of funds in the cash register, carried out on the basis of Order No. 43 dated June 25, 2021, a shortage of funds was discovered, which occurred through the fault of cashier M.M. Andreeva. Based on this and in accordance with Art. 238, 244, 248 of the Labor Code of the Russian Federation and the agreement on full financial liability dated August 12, 2019 No. 2,

I ORDER:

- Collect from Andreeva M.M. the amount of the shortfall in the amount of 4,500 (four thousand five hundred) rubles 00 kopecks.

- Chief accountant Ivanova P.K. withhold the amount of the shortage specified in clause 1 of this order from the salary of cashier M. M. Andreeva, starting from the current month, taking into account the restrictions provided for in Art. 138 Labor Code of the Russian Federation.

- Introduce the cashier to Andreeva M.M. with this order.

- I reserve control over the execution of the order.

Base:

- Inventory list of cash No. 2 dated June 26, 2021.

- Explanatory note from cashier M. M. Andreeva

The total amount of deductions from wages should not exceed 20% of each cash payment (minus personal income tax). For example, if a cashier’s salary before tax is 15,000 rubles, then no more than 2,610 rubles can be withheld at a time (Article 138 of the Labor Code of the Russian Federation).

If the employer does not have time to issue a collection order within a month, he will have to go to court. There are also legal proceedings when an employee refuses to compensate for damages after dismissal or does not agree to pay the balance of the shortfall, which exceeds his average salary. The period for filing a claim is one year from the date of discovery of the damage.

Accounting entries

Let's look at an example of how to reflect a shortage in accounting:

A shortage of 10,000 rubles was discovered in the store, this amount does not exceed the average monthly salary of the seller (30,000 rubles minus personal income tax). No more than 20% or 6,000 rubles can be withheld from his salary at a time.

| Debit 94 | Credit 41 |

| A shortage of goods in the amount of 10,000 rubles was revealed. based on inventory results | |

| Debit 73 | Credit 94 |

| An order was issued from the manager to collect the shortfall from the seller | |

| Debit 70 | Credit 73 |

| RUB 6,000 was withheld from the seller’s salary. to compensate for the shortfall in the first month | |

| Debit 70 | Credit 73 |

| 4,000 rub. withheld from the seller's salary to compensate for the shortfall in the second month | |

What to do if there is no one responsible and there is no one to collect money from?

If the organization was unable to identify the culprit of the shortage, then the entire amount of damage is written off as expenses. For writing off, they also issue an order - there is no strict form, so fill it out arbitrarily.

The order indicates the amount of the shortage of funds, as well as the grounds for write-off - these are documents from government agencies that confirm the absence of the culprit. For example, a resolution to terminate a criminal case, a certificate confirming the cause of the fire, etc.

The employer himself may refuse to withhold the amount of the shortfall from the employee (Article 240 of the Labor Code of the Russian Federation). Such a decision is formalized by an order to release the employee from financial liability.

How to reflect cash shortages in the cash book

There are no rules in the regulatory documents by which shortages must be reflected in the cash book. However, it is clear that it needs to be shown in column No. 5 “expenses”, and the basis will be the inventory act.

The order of reflection is as follows:

- Column 1 - date and number of the inventory report;

- column 2 - “Shortage”;

- column 3 - corresponding account 94;

- Column 5 - amount of shortage.

| Document No. | From whom it was received or to whom it was issued | Corresponding account number | Income, rub. cop. | Expense, rub. cop. |

| 1 | 2 | 3 | 4 | 5 |

| Balance at the beginning of the day | x | |||

| No. 21 from 07/02/2021 | Shortage | 94 | 4500 | |

So the balance at the end of the day will coincide with the actual one. If the cashier adds a shortage to the cash register, you will need to issue a PKO and make a record of the receipt.

Accounting and tax accounting of shortages

In accounting, shortages are displayed in the reporting period to which the date as of which you carried out the inventory belonged. Thus, the annual inventory affects the annual financial statements.

The postings for shortages at the cash register are as follows:

| Wiring | The essence of the operation |

| Dt 94 Kt 50 | We reflect the shortage at the cash register |

| Dt 73 Kt 94 | The amount of the shortfall is attributed to the guilty party |

| Dt 70 Kt 73 | The shortfall is withheld from the wages of the guilty person |

| Dt 50 Kt 73 | The employee deposited cash into the cash register to cover the shortfall |

| Dt 91 Kt 94 | The amount of the shortfall is written off as expenses (if it cannot be recovered) |

The amount of missing funds can be taken into account by the organization in expenses (clause 20, clause 1, article 265 of the Tax Code of the Russian Federation). In this case, the amounts of compensation received from the employee are recognized as part of non-operating income and are reflected on the date of recognition by the debtor or on the date of entry into force of the court decision.

Keep records of cash on hand, monetary documents, securities and financial statements in Kontur.Accounting. Draw up cash receipts and expenditures and prepare documents for inventory. In the service, you can also make payments to employees, submit reports via the Internet, and even connect integration with a cash register program. Try all the features of Kontur.Accounting during the test period - 14 days as a gift for all new users.

Customer Reviews

Gratitude from Volkova N.E. I express my gratitude to Vasily Anatolyevich for his professional and competent assistance in resolving the issue of protecting my consumer rights. As a result, I received decent compensation from. Thank you!

Volkova N.E. November 30, 2018

Gratitude from D.V. Ezhov, General Director of the SKA-Strelna hockey school The management of the SP-Strelna hockey school thanks the team of the Legal Agency of St. Petersburg for many years of fruitful cooperation and support of Russian children's hockey, dedication and professional approach.

We sincerely wish the employees of the Legal Agency of St. Petersburg great victories, professional success and inexhaustible vital energy!

Thanks to Mavrichev S.V. from Bars Dan A. I thank the wonderful Lawyer Sergei Vyacheslavovich Mavrichev for thorough, competent advice and human mutual assistance to all his clients who are in deep need of qualified and timely legal and psychological advice.

Leopard Dana A. 09/18/2018

Gratitude to Konstantin Vasilievich Solovyov I am very glad that I was accepted for a consultation with Konstantin Vasilievich Solovyov. An excellent, very competent lawyer. Please accept my gratitude for your excellent service. Thank you!

Valadze G.G. 08/17/2018

Gratitude from P.V. Greshina I would like to express my deep gratitude to the employees of your company - Sergei Vyacheslavovich Mavrichev and Konstantin Vasilyevich Solovyov for their enormous support, for their competent explanation and good attitude towards people. I wish you success and prosperity.

Greshina P.V. 03/23/2018

Gratitude from Loseva S.I. I express my deep gratitude to Sergei Vyacheslavovich (lawyer of the firm) for his very clear, accessible help in solving my problem (protecting rights as a consumer). This is the second time I have contacted you to solve my problems. Always everything......and in full.

With gratitude, Svetlana Ivanovna Loseva, 02/15/2019

Review by Sokolov M.Yu. I express my gratitude to your company, as well as Denis Yurievich Stepanov and Daria Valentinovna Kutuzova for their conscientious attitude to their duties.

With sincere respect, Sokolov M.Yu.

Thanks from Radhuan M.R. Dear Kavaliauskas Vasily Anatolievich. Let me express my sincere gratitude for the qualified legal assistance provided. Thanks to your professionalism, I was able to achieve a decision in my favor. I wish you further prosperity and professionalism.

Radhuan M.R. 06/08/2018

Gratitude from Kikkas V.P. Kikkas V.P. I am grateful to the Legal Agency of St. Petersburg for understanding the situation and timely assistance in my seemingly hopeless situation, personally to Denis Yuryevich Stepanov, I hope to continue to cooperate.

Kikkas V.P. 08.11.2018

Gratitude from Soboleva E.P. I would like to express my deep gratitude to Vasily Anatolyevich Kavaliauskas for his literacy, consultation and attention to the client who found herself in a difficult situation; as well as wonderful, sensitive administrators. I wish the company prosperity and good clients.

Sincerely, Soboleva Elena Petrovna. September 19, 2018