Accounting 10 in accounting - regulatory nuances

In the accounting of any enterprise, inventory accounting plays an important role. After all, the cost of the product/service and, as a consequence, the final result of the activity depend on how correctly the inventories are capitalized and then written off, according to Order No. 94n of October 31, 2000, it is used to summarize data on the quantity and movement of materials, raw materials, spare parts , fuel, containers, equipment, household supplies and other valuables of the organization, including those in processing and/or in transit.

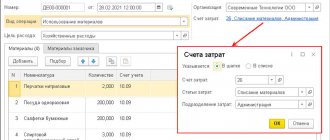

Accounting for materials on account 10 “Materials” is carried out at accounting prices using account. 15, 16 (clause 80 of order No. 119n dated December 28, 2001) or at actual cost (clause 62 of order No. 119n). The chosen method must be fixed in the accounting policy of the enterprise. Document flow can be carried out using unified forms or using your own forms if the latter contains all the necessary details. Write-off on account 10 (postings are given below) is carried out in one of the legally approved ways (clause 16 of PBU 5/01) - at the average cost, at the cost of each individual unit, using the FIFO method.

Thus, the 10th account in accounting provides accurate accounting and control over the movement of all current assets. In the balance sheet of the organization (form according to Order No. 66n dated 07/02/10) as of a given reporting date, the balances of inventories are reflected on line 1210 of Section II of the Asset. Analytical analysis of account 10 is carried out in the context of product names, batches, warehouses of the enterprise, and divisions.

Meaning of account for accounting

This position in the Chart of Accounts, referred to as “main production,” is intended to summarize data on the costs incurred in the process of creating goods, works or services. In more detail, this position is used to account for costs such as:

- creation of goods for industrial and agricultural purposes;

- carrying out geological exploration, industrial construction and other works;

- services related to the organization of transportation and communications;

- carrying out research and development work;

- repair and maintenance of highways.

The debit side of the company reflects direct costs associated directly with the company's main activities, as well as indirect costs and expenses of auxiliary production. In the first case, expenses are written off to accounts where production inventories, employee payroll, etc. are taken into account. If we talk about auxiliary production, then in this situation there is a write-off to account 20 from the credit part of position 23, referred to as “auxiliary production”.

If at the end of the reporting period there remains a certain balance at the designated position, then it reflects the value of work in progress. As for analytical accounting, it is carried out taking into account the type of costs and the type of products produced.

Subaccounts to the account 10

- 10.1 “Raw materials and materials” - to reflect main and auxiliary production materials, raw materials of the mining industry, agricultural products.

- 10.2 “Semi-finished products, components, parts, structures” - to reflect the inventories directly involved in the production of products.

- 10.3 “Fuel” – to reflect all types of fuel and fuels and lubricants.

- 10.4 “Container and packaging materials” - to reflect items and materials involved in the process of packaging, storage and subsequent transportation of products. This type of inventory is divided into returnable and non-refundable.

- 10.5 “Spare parts” - to reflect the inventories involved in the repair of equipment, machinery and other fixed assets.

- 10.6 “Other materials and materials” - to reflect the generated returnable waste - remnants of goods and materials that still have a certain value and can be sold or reused.

- 10.7 “Inventory for external processing” – to reflect inventive materials sent for external processing.

- 10.8 “Building materials” – to reflect building materials from developers.

- 10.9 “Inventory and household supplies” - to reflect items of technical or general economic use.

Note! Full transcript of the account. 10, including accounts 10.10 and 10.11 for accounting for special equipment and clothing, is given in order No. 94n.

“Main production”: account 20 in accounting

The organization's expenses that are allocated to carry out operations on the main types of activities should be attributed to a special accounting account 20 “Main production”.

It should not be assumed that such costs are associated only with production cycles. This accounting account is supposed to take into account the costs of selling products, performing work or providing services, which are enshrined in the constituent documentation as the main type of activity. In other words, Accounting Account 20 for Dummies is used to record expenses for the activities for which the company was created.

Count 10 – active or passive?

The mathematical characteristics of account 10 “Materials” show that the increase in the number of inventories occurs by debit in correspondence with production cost accounts - 20, 28, 29, 25, ; release of finished products/goods – , , 41, ; calculated – , 76, 67, 66, 71, 75, ; on capital accounting – 80, 86; and also the final ones – 91, 99, 97.

The disposal of inventories is carried out on the basis of supporting primary documentation for the credit of account 10 - in accounting, entries are generated in correspondence with accounts: 10, , 20, , 28, 29, 25, 26, 45, 44, 79, 80, 76, 94, 99 , , 97. Based on the above, account 10 is active, with the formation of a debit balance.

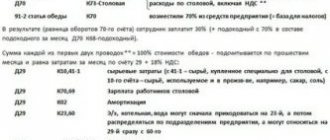

Why is account 20 used in accounting?

The credit of account 20 shows the return of materials and semi-finished products from production, as well as the write-off of accumulated costs for finished products.

According to PBU 10/99, the costs of manufacturing and bringing products to the buyer are grouped by elements:

- Material costs.

- Wage.

- Social wage accruals.

- Depreciation of fixed capital.

- Other expenses.

The enterprise establishes a more detailed list of cost items independently.

Typical transactions for account 10 “Materials”:

- D 10 K 60, 76 – MPZ arrived at the warehouse from the supplier.

- D 10 K 71 - purchased materials and equipment by an accountable person of the enterprise.

- D 10 K 75 – transferred by the founder of the MPZ as a contribution to the authorized capital.

- D 20 (23, 29) K 10 – reflects the write-off of inventories to the main production (auxiliary, servicing).

- D 25, 26, 44 K 10 – reflects the release of inventories for general production, general business needs, and selling expenses.

- D 94 K 10 – inventories written off due to shortage.

- D account 10 K 10 - postings of this kind are performed during internal movement of valuables.

Note! Account 10 is closed by writing off materials as expenses by generating an invoice request and filling out a cost account.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Methods for closing an account

First, you should remember the rule according to which the chosen closing method must be recorded in the company’s accounting policies. In general, there are closure methods such as:

- direct method;

- intermediate;

- direct sale of manufactured products.

Before you begin to close the designated account, you should determine the balance of work in progress.

So, if we are talking about a direct method, then its use is possible in a situation where the actual price of manufactured products is not yet known, and accounting for manufactured goods is carried out at conditional prices, for example, at planned cost.

At the end of the reporting period, the company adjusts the price of its products to the actual price. Thus, the direct method of closing in transactions is as follows:

- Dt 43

Kt 20 – correction of the cost of goods produced;

- Dt 90.02

Kt 43 – reflects the deviation of the actual price from the planned price.

It is important to remember that within the framework of this method it is not possible to account for manufactured products at actual cost during the reporting month.

As for the intermediate method, its application will require account 40, which takes into account the amount of deviation of the actual cost of goods produced from the planned one. The credit part should reflect the planned cost, and the debit part should reflect the actual cost.

At the end of the reporting period, the accumulated amount of deviations is proportionally written off to 43 and 90.02 positions. Thus, the accounting entries within this method will look like this:

- Dt 43

Kt 40 – posting of finished products at the planned price;

- Dt 90.02

Kt 43 – write-off of goods sold at planned cost.

Account 20 is closed at the end of the month with the following entries:

- Dt 40

Kt 20 – write-off of actual cost;

- Dt 43

Kt 40 – correction of planned cost to actual cost;

- Dt 90.02

Kt 40 - correction of planned cost to actual cost.

As part of the direct sales method, finished products are not taken into account in the warehouse, but are written off immediately from production.

Account 20: accounting entries

Let's look at typical accounting entries for recording operations related to core activities.

| Operation | Account debit | Account credit |

| Inventories were transferred to our own production | 20 | 10 |

| Salaries and insurance contributions of personnel directly involved in the main activities are included in the OP | 20 | 70 69 |

| Services of third-party companies are included in the costs of OP | 20 | 60 |

| Write-off of management expenses reflected | 20 | 26 |

| General production costs are written off to OP | 20 | 25 |

| Returns for reworking of finished products that were found to be defective are reflected. | 20 | 43 |

| Manufacturing defects identified prior to sale are sent for processing | 20 | 28 |

| Amounts of taxes and fees are allocated to production needs | 20 | 68 |

| Deficiencies and losses are reflected within the norms in the production process, without persons at fault | 20 | 94 |

| Downtime and claims against contractors | 20 | 76/2 |

| Semi-finished products are sent to the production process | 20 | 21 |

| The costs of auxiliary production are reflected in the OP | 20 | 23 |

| The goods were written off for the company's production needs | 20 | 41 |

| Reflects the report issued to the employee for production needs | 20 | 71 |

| The employee was compensated for costs associated with the production process (compensation for fuel and lubricants for the use of a personal car, for example) | 20 | 73 |

| Work in progress was accepted as part of targeted financing | 20 | 86 |

| Work in progress is reflected as a contribution to the authorized capital of the organization | 20 | 80 |

| Excess work in progress is taken into account | 20 | 91/1 |

| The share of deferred expenses was attributed to the OP | 20 | 96 |

general description

On account 10 Materials in the chart of accounts we collect “information” on remaining materials, raw materials, tools, spare parts , fuel, purchased semi-finished products, building materials (for developers).

If we need to find out all the “information” about what and how many materials we have at our disposal, then we can safely study account 10 using basic reports in the 1C program (turnover balance sheet, account analysis, account card).