Shortage of money is a serious situation that can arise in any organization. The budget was not calculated, force majeure or some other problems. In this case, the company can obtain an interest-free loan from its founder.

Many people arrange this money through a loan agreement and simply deposit it into a current account or into the cash register. In this instruction, we will tell you how to reflect the receipt from the founder and the return of money in the future in the program.

We will consider two options:

- the money goes to the organization’s cash desk under a six-month contract;

- The funds are sent to the current account, and the loan term is for two years.

In both cases, an interest-free loan agreement is used.

The money is received at the cash desk for a period of six months

Let's start with the first option. To reflect such an arrival, you need:

- open the “Bank and cash desk” tab;

- find the “Cashier” section;

- select the “Cash Documents” tab.

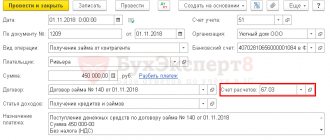

Now we create a document in the “Cash receipt” format. Select the type of operation “Receiving a loan from a counterparty”. We indicate the founder, organization as the counterparty and also enter the amount of money received.

Below is a tabular section in which you enter information regarding the contract. If the contract is new, then click the “Add” button and enter the data, indicating the document details.

Next, select the cash flow item; to do this, add a new item “Loan from the founder”. Due to the fact that the loan is short-term, choose account 66.03

For the amount of the loan you received, the posting Debit 50.01 and Credit 66.03 will be generated.

To return the money, you need to use the “Cash Withdrawal” document, which contains the operation to return the loan to the counterparty. To add it, we do everything described above, but in the tabular part you add the column “Type of payment” and indicate “Loan repayment”.

A reverse entry will be generated, where the debit will be 66.03 and the credit will be 50.01. Thus, mutual settlements will be closed if you return the entire amount received from the counterparty.

Key Features

Let's consider the basic rules for loan repayment:

- The money must be transferred within the time limits specified in the contract.

- If the loan agreement does not specify the terms, the lender may demand repayment of the funds at any time. The debtor is obliged to repay the debt within a month from the date the claim is sent by the lender.

- If the loan was issued in foreign currency, it must be repaid in rubles. The total amount is determined at the exchange rate valid at the time of the refund.

- The loan may be interest-free. However, this condition must be stated in the contract. If this is not done, interest will be charged.

Question: Is it necessary to issue a check with the attribute “expense” if an organization returns an interest-free loan to the founder - an individual by payment order through a current account to his bank card? View answer

IMPORTANT! The terms of the contract may be changed before the agreement is concluded. After the funds are transferred to the lender, the transaction is considered to have taken place. That is, its conditions cannot be changed.

Question: How to reflect in an organization’s accounting the repayment of an interest-free loan provided by the founder (LLC) by transfer of compensation (purchased goods)? The founder of a trade organization provided her with a short-term interest-free loan in the amount of 500,000 rubles. Subsequently, an agreement was signed to repay the obligation under the loan agreement by transferring compensation - purchased goods in the amount of 500,000 rubles. (including VAT), which corresponds to their market value. The actual cost of the transferred goods, equal to the cost of their acquisition for tax accounting purposes, is 450,000 rubles. (without VAT). View answer

Features of loan repayment with interest

If funds are provided at interest, this should be stated in the agreement. It also specifies the rate and payment procedure. If the document does not contain information about the rate, it is determined according to the Central Bank rate at the time of conclusion of the agreement. If the agreement does not specify how interest will be paid, it will be included in the monthly payment.

IMPORTANT! The interest received by the founder will be considered his income. Therefore they are taxed at 13%. Interest paid by the debtor will be considered his expenses. They reduce the tax base.

How to apply for loan coverage?

Refunds do not require additional paperwork. The entire procedure is carried out according to a previously drawn up agreement, in accordance with its provisions. The agreement continues until the last payment is made, after which the transaction is closed.

Question: How to reflect in the accounting of a borrower using the simplified tax system the receipt of an interest-free loan from the founder (legal entity), as well as its repayment? Under a loan agreement concluded on June 30 for a period of three months, funds in the amount of 400,000 rubles were received on the same day. View answer

On the date of the last payment, both the principal “body” of the debt and interest must be returned. If there is an unpaid amount, the creditor may apply various penalties specified in the agreement. Depending on the terms of the agreement, payments may be paid according to a schedule, in a lump sum. When covering a debt, the debtor must request paper that confirms the payment made. For example, this could be a check or bank statement.

We will set up any reports, even if they are not in 1C

We will make reports in the context of any data in 1C. We will correct errors in reports so that the data is displayed correctly. Let's set up automatic sending by email.

Examples of reports:

- According to the gross profit of the enterprise with other expenses;

- Balance sheet, DDS, statement of financial results (profits and losses);

- Sales report for retail and wholesale trade;

- Analysis of inventory efficiency;

- Sales plan implementation report;

- Checking of employees not included in the time sheet;

- Inventory inventory of intangible assets INV-1A;

- SALT for account 60, 62 with grouping by counterparty - Analysis of unclosed advances.

Order report customization

Issuing a loan to the founder

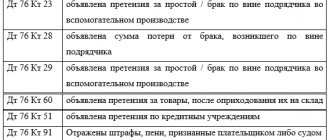

The issuance of a loan to the founder, if it is interest-free, is reflected by the posting:

- Debit 76 (73) Credit 50 ().

At the same time, the founder receives a benefit from interest savings (material), with which it is necessary to pay personal income tax. Account 73 is used if the founder is an employee of the company.

If the loan is with interest, then the issuance of money is formalized:

- Debit 58 (73) Credit 50 ().

When issuing a loan in the form of property:

- Debit 58 (73) Credit 01, 41, ...

Interest on the loan for the founder is reflected by the entry:

- Debit 76 (58.73) Credit 91.1.

The money is transferred to the current account for a period of 2 years

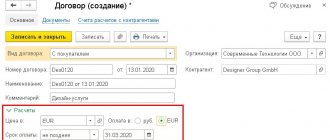

If the counterparty sends funds to the settlement account, then you need to indicate the receipt to this account. In this case, we will work with the “Receipt to current account” form. You can create a document manually if you go to the “Bank and Cash Office” section and select “Bank Statements” there. You can also download the document directly from the bank.

The document should look like “Receipt of a loan from a counterparty.” In it, select the organization of your founder, enter the amount you received into the current account and fill out the table and settlement account.

Since the loan is for a long term (2 years), we enter 67.03 in the settlement account.

A posting will be generated where the debit is 51 and the credit is 67.03, and the loan amount is also indicated.

We receive the posting Dt 51 Kt 67.03 for the loan amount

To display the refund in the program, you need the “Debit from the current account” form. Please note that the form must be in the form “Return of loan to counterparty in order for a write-off posting to be generated,

This is all you need to know about reflecting interest-free loans from a counterparty. The main thing is not to make a mistake when generating return documents and everything will be displayed clearly.

Still have questions? Book a consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Determining key conditions

Before reflecting the receipt of a loan in the company's accounting records, it is necessary to determine the basic conditions for the provision of borrowed assets. Please note the following:

- The period for which financial and material assets are provided for temporary use. If assets are transferred for use for a period of less than 12 months, then such receipts should be reflected in account 66 “Settlements on short-term loans”. If the organization plans to use loan capital for more than one year, then entries for loans received should be made using account 67 “Settlements for long-term loans.”

- Payment for the use of credit capital. Most companies, when turning to owners or shareholders for financial assistance, plan to receive an interest-free loan. However, the terms of the contract may stipulate a certain percentage - payment for the use of someone else's monetary or material assets. If such a condition is enshrined in the agreement, additional accounting entries will have to be made.

- The purpose for which the loan amount is planned to be spent. If the money is planned to be used for the acquisition, development or creation of an investment asset, then accounting entries for the calculation of interest are compiled using account 08 “Capital investments”. In other cases, postings are made in the usual manner.

Let us note that the receipt of borrowed money or tangible assets must be formalized in an appropriate agreement, in which the above conditions should be fixed.

Tax consequences

Since 2016, the legislator has considered receiving an interest-free loan an economic benefit. This benefit is determined in the amount of the Central Bank key rate in force during the settlement period. This period is considered to be a month.

In practice, this means that the borrower must pay monthly personal income tax in the amount of 35% of the loan amount, indexed by 2/3 of the Central Bank key rate.

Taxation example

For example, the founder took out an interest-free loan in the amount of 100,000 rubles on 1.01. 2022.

In January 2022, 7.75%.

100,000*7.75%*2/3*35%= 1,806 rubles. The borrower will have to pay this amount of personal income tax.

If the borrower is not a resident of the Russian Federation, the tax rate will be 30%.

Personal income tax is not levied if the loan was received for the purpose of purchasing or constructing housing, purchasing a room, a house, a plot of land for building a house, etc. In this case, the borrower must retain the right to a tax deduction. If the debtor has already exercised this right, the tax preference does not apply.

Thus, to apply this benefit, the tax agent should rely on a document confirming property rights to the above-mentioned objects and official confirmation of the right to a tax deduction from the Federal Tax Service.

In this case, the creditor company is a tax agent and is obliged to withhold personal income tax from the founder’s salary (if he is on the company’s staff) or from dividends.

What is considered material benefit?

Since 2022, changes have come into force regarding the recognition of interest-free use of a loan as a material benefit. They are enshrined in Federal Law No. 333-FZ of November 27, 2017, and fix two defining features of material benefit.

If at least one of them is present, then interest-free use of the loan is recognized as a material benefit:

- If the borrower is an employee of a business entity or is in another interdependent relationship (founder);

- If the borrower's failure to pay interest is financial assistance or satisfaction of the lender's obligations to the borrower (including for goods supplied, work performed or services rendered).

These rules also apply to loan agreements concluded before 1-1/2018 (letter of the Ministry of Finance dated 06/26/2018 No. 03-04-07/43786).

How to minimize tax expenses?

The monthly obligation of the borrower to pay tax on material benefits when using an interest-free loan is clearly stated in the law.

It is possible to minimize tax expenses by taking out a loan at minimal interest - slightly above 2/3 of the Central Bank key rate.

In this case, the company pays tax as for non-operating income. These incomes are subject to income tax, the base rate of which is lower - 20% versus 35 personal income tax. In addition, the interest-bearing loan agreement can be extended, making it indefinite.

Taking out an interest-free loan has very conditional benefits, which are offset by the tax burden or even lead to a minus.

Reporting when paying personal income tax on material benefits

Information about the material benefit received and the tax on it should be reflected in the declarations:

- 2NDFL (this type of material benefit is indicated under code 2610)

- Calculated according to form 6-NDFL.

Sometimes the tax agent does not have the ability to withhold money to pay taxes. This can happen if the borrower does not have an employment relationship with the company and does not receive dividends.

In this case, in addition to standard reporting for 2NDFL, it is necessary to inform the Federal Tax Service before March 1 of the year following the reporting year about the inability to pay the calculated tax.

This can be done by providing 2NDFL with sign “2”, and be sure to send this certificate to the debtor himself.