Accounting for financial results of transactions is reflected through a set of records made throughout the reporting period. The profitability indicator of economic activity is formed by comparing information on income and expense items in accounting. In order for the financial result to be correctly determined, income postings and cost records are recorded in the context of all receipts and expenses - results for ordinary activities, indicators of the operating and non-operating work of the enterprise (that is, a set of subaccounts of 90 and 91 will be involved). Additionally, taxes and losses from the impact of emergency events are taken into account.

Determination of financial result - postings

The results of cost-income items are summed up at the end of each month. As a result, you can see intermediate profit values. At the end of the year, the final balance and financial result are calculated, transactions are made in such a way as to reset account 99, the balance on it cannot be left at the end of the year. What an accountant needs to do in order to display the financial result in accounting - the entries must reflect the transfer of income and documented costs to accounts 90 and. Then the income and expense sub-accounts are closed to account 99.

For example, Globus LLC purchased travel equipment in the amount of 780,000 rubles. (VAT included in the amount of 130,000 rubles), payment was made by bank transfer. This month, the company sold goods worth 540,000 rubles. (VAT 90,000 rubles), cost price is 285,000 rubles. In the reporting period, production costs for wages, insurance contributions, and depreciation amounted to RUB 85,000. How to reflect the financial result - the posting will be compiled at the end of the month in conjunction with other correspondence:

- D-t 41 – K-t 60 – 650,000 (780,000-130,000) – purchased tourist equipment received and capitalized;

- through the debit movement of account 19.3 and the credit of account 60 in the amount of 130,000 rubles. the amount of VAT on the supply of tourist equipment has been fixed;

- According to the bank statement, payment was made under the agreement in the amount of 780,000 rubles, in accounting these funds are entered in debit 60 with simultaneous crediting of account 51;

- for the amount of 130,000 rubles. the debit turnover on account 68/VAT is entered to reset the credit movement of account 19.3 - the previously taken into account VAT is accepted for deduction;

- In order for the financial result to be determined, the posting must reflect income from the sale of goods in the past month, for this the cost of equipment shipped to customers in the amount of 540,000 rubles. is recorded on account 62 as a debit movement, and on account 90.1 is entered as a credit;

- At this stage, the financial result from the sale has not yet been generated; the posting must separately record VAT equal to 90,000 rubles. – account 90.3 is debited and account 68/VAT is credited;

- in order for the financial result to be reliably reflected, the posting must reduce the income received by the cost of the shipped products - this is done by recording D-t 90.2 - K-t in the amount of 285,000 rubles;

- when money is received from customers, correspondence is generated with debit 51 and credit turnover on account 62 in the amount of sales of 540,000 rubles;

- the financial result from the sale of products, transactions are formed by reflecting the entire complex of income and expense transactions, so it is necessary to show production costs - account 44 is indicated on the debit side, and accounts , , will be entered on the credit side (the total amount of costs written off is 85,000 rubles);

- production costs are charged to cost by recording debit 90.2 and credit 44 in the transaction amount of 85,000 rubles.

In order to determine the financial result from the sale of products, the posting at the end of the month is drawn up with the participation of subaccount 90.9, this will close the balances on the subaccounts of account 90. Then the accountant makes entries:

- debit turnover of account 90.1 in combination with credit movement on 90.9 in the amount of 540,000 rubles. writes off revenue to profit;

- expenses in the form of VAT adjust profit downward by 90,000 rubles. – account 90.9 is debited, and the credit movement is reflected in account 90.3;

- debit of account 90.9 and credit turnover on account 90.2 in the amount of 285,000 rubles. show that profit is reduced by the cost of goods sold;

- D-t 90.9 – K-t 90.2 – 85,000 rub. – adjustment of the revenue base due to production costs;

- the balance of debit 90.9 is entered into credit 99, the transaction amount is 80,000 rubles. (540,000-90,000-285,000-85,000) – the financial result from the sale of products has been determined, the entry shows the difference between the total income and costs of operations performed for the past month, the entry reflects the profit received by the enterprise from sales transactions.

How the financial result from the sale of products is written off - posting is carried out after the end of the year. It is necessary to compare the amounts of turnover on account 99 in debit and credit, the resulting result is transferred to account 84.

The considered example involved indicators of profitability and costs for ordinary activities. Additionally, similar correspondence can be generated in accounting for other areas of the company’s work - in this case, all entries will be compiled with the participation of subaccounts of account 91. And when the financial result is identified, the posting is made by movement to accounts 99 and 91.9. Income tax reduces profit - an entry is made in debit 99 and credit 68. Adjustments may arise due to the influence of extraordinary expenses, which are written off to the debit of account 99.

Sales of finished products after cost formation

Sales of finished products in the next month after their release are processed in the same way as sales of products during the month of production. The only difference is the correct reflection of the amount of expenses in the document entries.

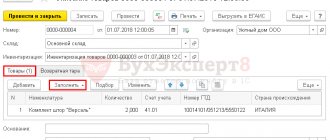

Postings according to the document

If the sale of products is carried out after the formation of the actual cost, i.e. in subsequent months, then the amount for posting Dt 90.02.1 Kt will be equal to the actual cost of the product.

The document generates transactions:

- Dt 90.02.1 Kt - write-off of product costs using the Average (the write-off method is specified in the PDF accounting policy).

- Dt 62.01 Kt 90.01.1 - revenue from the sale of finished products: in accounting accounting, including VAT;

- in NU excluding VAT.

Control

Let's check the calculation of cost of goods sold PDF:

Study in more detail the formation of the cost of manufactured sandals “Megan”

Income tax return

In the income tax return, the amount of proceeds from the sale of products is reflected as income from sales:

Sheet 02 Appendix No. 1:

- page 010 “Proceeds from sales - total”, including: page 011 “... revenue from the sale of goods (works, services) of own production.” PDF

The cost of goods sold is reflected in direct expenses:

Sheet 02 Appendix No. 2:

- page 010 “Direct costs related to goods sold (work, services).” PDF

How to write off the shortage as a financial result - postings

Detected shortages are written off to the perpetrators, but if the perpetrators are not found, the suspended amounts in the accounting are transferred to expenses. Shortages within the framework of natural loss norms are also subject to write-off. How the financial result is reflected - postings are made with the participation of account 94, which, upon closing, transfers its balance to account 91.

For example, after conducting an inventory, they discovered a shortage of a diesel generator worth 55,990 rubles, the amount of depreciation charges amounted to 12,000 rubles. The perpetrators have not been identified, which is documented. In this case, the financial result from other activities – postings – will appear:

- D-t 02 – K-t 01 – 12,000 rub. – accumulated depreciation charges are written off;

- D-t 94 – K-t 01 – 43,990 rub. (55,990 – 12,000) – the missing asset is written off at its residual value;

- D-t 91.2 – K-t 94 – 43,990 rub. – the shortage is included in the expense base;

- debit turnover on 91.9 in combination with credit movement on 91.2 in the amount of 43,990 rubles. reflects the formation of the financial result, postings record the zeroing of the balance of income and expense subaccounts;

- On the debit of account 99, the amount of 43,990 rubles is recorded, at the same time a credit entry is made on account 91.9 - the shortage led to the formation of a loss.

Accounting: ownership has not passed to the buyer

Record the shipped products on account 45 “Goods shipped”:

- at actual cost - if the organization accounts for finished products in account 43 “Finished products” at actual cost;

- at standard cost - if the products are accounted for in account 43 “Finished products” at standard cost, and the actual costs of their production are reflected in account 40 “Product Output”.

Keep accounting of shipped products on the basis of the primary accounting documents presented to the buyer (Article 9 of the Law of December 6, 2011 No. 402-FZ). When transferring (shipping) products, make the following entries:

Debit 45 Credit 43 – finished products were transferred to the buyer.

This procedure follows from the Instructions for the chart of accounts (accounts 43, 45).

To determine the cost of finished products that need to be reflected on the credit of account 43, use one of the valuation methods:

- at the cost of each unit of inventory;

- FIFO;

- at average cost.

The choice of method for estimating the cost of sold finished products is fixed in the accounting policy for accounting purposes. This is stated in paragraph 16 of PBU 5/01, paragraph 73 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and letter of the Ministry of Finance of Russia dated November 16, 2004 No. 07-05-14/298.

If the organization that ships the products is a VAT payer, at the time of shipment (transfer) of the products to the buyer, charge VAT (clause 3 of Article 38 of the Tax Code of the Russian Federation). Reflect the amount of accrued tax in accounting as follows:

Debit 76 subaccount “VAT on products, the ownership of which is transferred to the buyer in a special order” Credit 68 subaccount “Calculations for VAT” - VAT is charged, payable to the budget on shipped products, the ownership of which is transferred to the buyer in a special order.

For more information about this, see How to reflect in accounting the amount of VAT charged to the buyer when selling goods (own products), if the ownership of these goods (own products) has not transferred to the buyer.

After ownership of the shipped products passes to the buyer, record the proceeds from the sale in your accounting records. At the same moment, write off as expenses the cost of products sold and sales expenses (subparagraph “d”, paragraph 12 of PBU 9/99, paragraphs 211 and 212 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, p 7 and 9 PBU 10/99).

Record sales revenue as follows.

If the organization sold finished products for cash, make the following entry in accounting:

Debit 50 Credit 90-1 – revenue for finished products sold for cash is reflected.

If the organization sold finished products for cashless payment, make the following entry:

Debit 62 Credit 90-1 – revenue for finished products sold by bank transfer is reflected.

The procedure for recording sales of finished products in accounting when paying by credit card is similar to the procedure for recording such transactions when selling goods. For more information about this, see How to reflect retail sales of goods in accounting.

Write off the cost of products sold as expenses in an order that depends on how the organization accounts for finished products: at actual cost or at standard cost.

If finished products are accounted for at actual cost, reflect them in expenses using the following entry:

Debit 90-2 Credit 45 – the actual cost of finished products sold is taken into account as expenses.

If finished products are accounted for at standard cost, reflect them in expenses using the following entry:

Debit 90-2 Credit 45 – the standard cost of finished products sold is taken into account as expenses.

This procedure follows from the Instructions for the chart of accounts.

For information on how to reflect sales expenses as expenses, see How to reflect sales expenses of finished products (works, services) in accounting.

Simultaneously with the recognition of revenue and expenses, reflect the amount of VAT charged to the buyer as expenses:

Debit 90-3 Credit 76 subaccount “VAT on products, the ownership of which is transferred to the buyer in a special manner” - VAT is charged on shipped products.

This is stated in paragraphs 203, 206 and 212 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, paragraphs 7 and 9 of PBU 10/99 and the Instructions for the chart of accounts.

For more information about this, see How to reflect in accounting the amount of VAT charged to the buyer when selling goods (own products), if the ownership of these goods (own products) has not transferred to the buyer.

Finished products are usually sold in containers. For information on how to take it into account when selling products, see How to record transactions with containers when selling your own products.

Financial result profit – postings

At the end of the month, the company received revenue in the amount of 525,000 rubles, the cost of goods shipped was 305,000 rubles, VAT was 70,000 rubles. The amount of additional costs amounted to 2500 rubles. What will be the financial result from sales - the posting of the total amount will appear only after the income and expense sub-accounts are closed:

- the revenue formed the credit balance of account 90.1, it is subject to write-off by debiting account 90.1 with simultaneous crediting of account 90.9 in the amount of 525,000 rubles;

- when the cost of sold assets is reset to zero, correspondence D-t 90.9 – K-t 90.2 is drawn up in the amount of RUB 305,000;

- decrease in profit due to VAT in the amount of 70,000 rubles. reflected by the entry D-t 90.9 – K-t 90.3;

- the financial result from the sale of products has been determined - a posting with a debit movement in account 90.9 and a credit entry in account 99 in the amount of 150,000 rubles. (525,000-305,000-70,000);

- Other expenses in the amount of RUB 2,500 were included in the loss. – D-t 91.9 – K-t 91.2;

- the resulting loss from related expenses is reflected in the entry D-t 99 – K-t 91.9 – 2500 rubles;

- The financial result from the sale of products is written off - the posting is made in the amount of 147,500 rubles. (150,000-2500) between debit 99 and credit 84.

Accounting: ownership has passed to the buyer

If the ownership of the product has been transferred to the buyer (i.e., a sale has occurred), income and expenses from such an operation are recorded in account 90 “Sales”. The basis for this is the primary accounting documents drawn up during the sale of products (Article 9 of the Law of December 6, 2011 No. 402-FZ).

Sales income will be revenue from the sale of finished products. Reflect it on the credit of account 90-1 at the time of transfer of ownership of the product to the buyer (subject to other conditions for recognizing revenue in accounting).

For more details, see How to determine the amount of revenue from the sale of finished products.

You can sell finished products both in cash and by bank transfer, as well as using plastic cards.

If the organization sold finished products for cash, make the following entry in accounting:

Debit 50 Credit 90-1 – revenue for finished products sold for cash is reflected.

If the organization sold finished products for cashless payment, make the following entry:

Debit 62 Credit 90-1 – revenue for finished products sold by bank transfer is reflected.

The procedure for recording sales of finished products in accounting when paying by credit card is similar to the procedure for recording such transactions when selling goods. For more information about this, see How to reflect retail sales of goods in accounting.

Such rules are established by the Instructions for the chart of accounts, subparagraph “d” of paragraph 12 of PBU 9/99 and paragraph 211 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

At the time of revenue recognition, reflect in accounting the costs associated with the production and sale of products (clause 18 of PBU 10/99). These will be:

- actual cost of production;

- selling expenses.

Reflect them in the debit of account 90-2.

This is stated in paragraphs 203, 206 and 212 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, paragraphs 7 and 9 of PBU 10/99 and the Instructions for the chart of accounts.

Write off the actual cost of products sold as expenses in the order that depends on how the organization accounts for finished products: at actual cost or at standard cost.

If finished products are accounted for at actual cost, reflect them in expenses by posting:

Debit 90-2 Credit 43 – the actual cost of finished products sold is taken into account as expenses.

If finished products are accounted for at standard cost, reflect them by posting:

Debit 90-2 Credit 43 – the standard cost of finished products sold is taken into account as expenses.

This procedure follows from the Instructions for the chart of accounts.

To determine the cost of finished products that need to be written off as expenses (i.e., the cost that will be reflected in the credit of account 43), use one of the valuation methods:

- at the cost of each unit of inventory;

- FIFO;

- at average cost.

The choice of method for estimating the cost of sold finished products is fixed in the accounting policy for accounting purposes. This is stated in paragraph 16 of PBU 5/01, paragraph 73 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and letter of the Ministry of Finance of Russia dated November 16, 2004 No. 07-05-14/298.

For information on how to reflect sales expenses as expenses, see How to reflect sales expenses of finished products (works, services) in accounting.

This procedure follows from paragraphs 203–206, 212 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, Instructions for the chart of accounts (accounts 40, 43, 90).

If the organization that sells the product is a VAT payer, charge this tax at the time of its transfer to the buyer. Reflect the accrual of VAT in the debit of account 90-3:

Debit 90-3 Credit 68 subaccount “Calculations for VAT” - VAT is charged on the sale of finished products.

This procedure follows from the Instructions for the chart of accounts (accounts 68, 90) and paragraph 212 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

If the organization has received a partial (full) prepayment on account of a future delivery, make the following entries in accounting:

Debit 51 (50) Credit 62 subaccount “Settlements for advances received” - partial (full) prepayment was received from the buyer for the upcoming delivery of finished products;

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT” – VAT is charged on the amount of the advance received;

Debit 62 subaccount “Settlements for shipped finished products” Credit 90-1 – revenue from the sale of finished products is reflected;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” - VAT is charged on sales proceeds;

Debit 62 subaccount “Settlements for advances received” Credit 62 subaccount “Settlements for shipped finished products” - prepayment is credited;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances received” - the amount of VAT previously accrued and paid from the amount of the advance received is accepted for deduction.

This procedure is provided for in the Instructions for the chart of accounts (accounts 51, 50, 62, 90).

Finished products are usually sold in containers. For information on how to take it into account when selling products, see How to record transactions with containers when selling your own products.

Financial result loss – posting

Losses are recorded when the level of costs exceeds the amount of proceeds in all areas of activity of a business entity.

So, for the main activity, this will be reflected in an entry with a debit of 99 and a credit of 90.9; in relation to other types of activities, correspondence is drawn up between a debit of 99 and a credit of 91.9. When the financial result is written off, the posting records the uncovered loss with the entry D-t 84 - K-t 99. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.