In 2012, a pilot project was launched in which the Social Insurance Fund pays sick leave directly to the employee, bypassing the employer. Let us remind you that from 2022, all regions will switch to direct payments.

Changing the procedure for payments from the Social Insurance Fund affects the reporting of insurance premiums. We'll tell you how to reflect direct payments in the DAM report.

RSV: direct payments

Government Decree No. 294 dated April 21, 2011 (as amended on November 13, 2019) establishes the “Direct Payments” project and defines new rules for the interaction of policyholders with the Social Insurance Fund on the issue of reimbursement for insured events.

The transition to the new order is happening in stages. From 2022, it is expected that all regions will switch to direct payments, providing for the following benefit payment algorithm:

- the insured person (employee) provides the employer with documents confirming the fact of his illness (except for cases of occupational diseases and work-related injuries) or maternity (maternity benefits, child care benefits, for registration in early stages of pregnancy, at the birth of a child) and the corresponding statement;

- the employer transfers the received documents to the Social Insurance Fund within 5 calendar days;

- within 10 calendar days, the Social Insurance Fund transfers the benefit to the employee (in this case, child care benefits, starting from the 2nd payment, are made from the 1st to the 15th of the month).

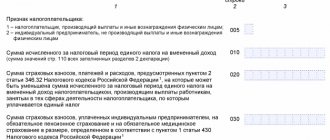

Control over the calculation and payment of insurance premiums is entrusted to the Federal Tax Service. Employers submit calculations of insurance premiums (DAM) quarterly. The current report form and instructions for working with it were approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected]

We will tell you whether direct payments are recorded in the DAM in 2022.

How many lines with number 030 in the report on insurance premiums

The current form of the report on insurance premiums, submitted to the tax service on the 30th day of the month following each quarter of the year, contains the order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11 / [ email protected] (as amended by the department order dated 15.10 .2020 No. ED-7-11/ [email protected] ). The form includes 3 sections dedicated to:

- the final figures of calculations, which provide 10 annexes disclosing the details of the consolidated assessments of contributions on income paid to employees;

- information submitted for peasant farms, to which there is only one attachment reflecting data for each member of the peasant farm;

- personal information on the calculation of contributions for each of the employees.

Section 2, concerning existing peasant farms, is filled out by them only once - at the end of the year (clause 3 of Article 432 of the Tax Code of the Russian Federation), and they do not use other sections of the report. Other employers, when forming the calculation of contributions, must necessarily enter data into sections 1 and 3, but out of the 10 appendices to section 1, not all will be filled out with them, since in addition to those that are required to be submitted, there are also those that are filled out only if there is information to be entered.

Line number 030 is present in each section of the report and in each of the appendices provided in it, except for appendix 6 to section 1. That is, the total number of lines with this number in the report is 17.

ConsultantPlus experts spoke about the nuances of filling out each line of the DAM. Get trial access to the K+ legal reference system and check for free whether you filled out the report correctly.

Direct payments: how to reflect in RSV

Resolution No. 294 does not introduce any changes regarding the first three days of illness: they are still paid for by the employer. This payment relates to non-taxable insurance premiums in accordance with subparagraph. 1 clause 1 art. 422 of the Tax Code of the Russian Federation.

But taking into account the fact that part of the benefit is transferred to the personal account of the insured employee, and for such calculations the offset system is not applied, direct payments to the Social Insurance Fund are not subject to reflection in the DAM.

Financial assistance in the form of RSV

Financial assistance paid to employees in an amount of no more than 4,000 rubles is not subject to insurance contributions on the basis of subparagraph 11, paragraph 1 of Article 422 of the Tax Code of the Russian Federation.

Amounts of financial assistance provided by employers to their employees that do not exceed 4,000 rubles per employee per billing period are not subject to insurance premiums.

Accordingly, financial assistance not exceeding 4,000 rubles is reflected in Appendix 1 and Appendix 2 of the DAM on the following lines:

- 030 subsections 1.1 and 1.2 of Appendix No. 1;

- 040 subsections 1.1 and 1.2 of Appendix No. 1;

- 020 application No. 2;

- 030 application No. 2.

Direct payments: do you need to fill out Appendix 3 of the RSV?

Order No. ММВ-7-11/ [email protected] introduces the procedure for filling out the DAM.

Clause 2.5 of the Procedure indicates that insurance premium payers participating in the implementation of the pilot project do not fill out appendices 3 and 4 to section 1 of the DAM: these sheets are required by employers who paid benefits from their own funds. In fact, in the 3rd quarter of 2022, many organizations and individual entrepreneurs operate on the basis of direct payments.

As a result, Appendix 3 of the DAM for direct payments is not filled out.

How to reflect sick leave in RSV-1

According to the procedure for filling out the reporting form RSV-1, the amounts of insurance premiums for insurance in connection with temporary disability and maternity are prescribed in Appendix 2 to Section 1.

Line 060 displays accrued contributions from the beginning of the year on an accrual basis , including for the reporting period (quarter) with a monthly breakdown. Line 070 records benefits that have been accrued since the beginning of the year on an accrual basis, including for the reporting period (quarter) with a monthly breakdown.

According to clause 11.14 of the Procedure, line 080 indicates the amount of compensation from the Social Insurance Fund in the column that corresponds to the month of receipt of the actual compensation. For example, if expenses are compensated by the fund in April, then this is displayed in the column for the first month of the 2nd quarter.

Line 090 of Appendix No. 2 indicates the amount calculated using the following formula : accrued contributions minus expenses for the payment of temporary disability benefits plus the amount of compensation received from the Social Insurance Fund for the reporting period.

According to the above calculations, either a negative or a positive value can be obtained. The employer should take into account that if the difference is negative, then he does not need to put a minus in front of the number.

The sign of the resulting difference is indicated using the numbers 1 or 2. If the value is set to “1”, this indicates that the contributions are more than the costs of insurance compensation for workers, “2” - the employer’s costs are more than the accrued contributions. Accordingly, if the value according to the formula for line 090 is negative, then the number “2” is entered.

If the amount is positive, this means that the employer must make an additional payment to the budget; if it is negative, then he will be reimbursed from the budget.

If the employer remains in debt, then he fills out one of the lines: 110, 111, 112, 113. When he has an overpayment, then fill out lines 120, 121, 122, 128. At the same time, these lines are not filled in: that is, the employer can or must budget, or overpay into it.

If there is a discrepancy between the data from the DAM report and the financial statements, accountants often have questions about whether the form has been filled out correctly. Typically, a discrepancy arises between the actual state of affairs and the figure indicated in column “090”.

For example, if the Fund has already reimbursed the employer for expenses, and when filling out the reporting form it turned out that the company owes the Social Insurance Fund a larger amount than in reality (after all, reimbursed expenses are added to accrued contributions), then there is no error in this. The employer will have to pay only accrued contributions to the budget , and not the amount from the final line 110 or 90 of the DAM report.

If the costs of temporary disability benefits were taken into account by the employer last year, and the employer received compensation in the current year, then the report is also filled out in the standard manner.

In the above formula, it does not matter for what period the employer received compensation; it is taken into account in the month of actual receipt. This position is confirmed by the explanatory letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 2022. A similar conclusion can be drawn based on the analysis of Art. 34 of the Tax Code, which provides for the offset of expenses for temporary disability and maternity benefits against upcoming payments.

Most accounting programs today are configured to automatically check all ratios and prevent you from filling out lines incorrectly. But if the employer fills out the reporting independently, then the control ratio is given in the Federal Tax Service Letter of 2022 No. GD-4-11 / [email protected]

Sample document: an example of filling out the RSV with sick leave can be found here.

Also, the employer can always find out whether taxes have been paid correctly by ordering a reconciliation of calculations from the Federal Tax Service. If the accounting data matches the reconciliation results, then there is nothing to worry about.

Procedure for filling out the DAM for direct payments

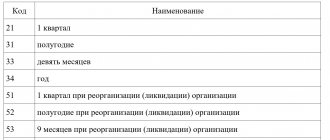

At the end of the 3rd quarter of 2022, the calculation will be submitted for a reporting period of 9 months.

Here is a convenient algorithm for working with mandatory sections of the DAM:

| Stages | RSV sheet | Content |

| Title | Basic information about the payer of contributions | |

| Section 3 | Information about employees and payments in their favor. In fact, the initial data for the entire calculation | |

| Appendix 1 to section 1 | The payer's tariff code is entered. Please note: the Federal Tax Service in letter dated 04/07/2020 No. BS-4-11/ [email protected] informs that SMEs that have the right to apply reduced contribution rates from 04/01/2020 must indicate code 20 until the code directory established by Order No. is updated. ММВ-7-11/ [email protected] | |

| Subsection 1.1 of Appendix 1 to Section 1 | Calculation of contributions to compulsory pension insurance, incl. for the last three months of the reporting period | |

| Subsection 1.2 of Appendix 1 to Section 1 | Calculation of contributions for compulsory medical insurance, incl. for the last three months of the reporting period | |

| Appendix 2 to section 1 | Calculation of contributions to OSS (VNiM), incl. for the last three months of the reporting period | |

| Section 1 | In the context of BCC, the total amounts of contributions payable for 9 months are indicated, incl. accrued for July, August and September 2020 |

Number indicated in the pension insurance system

Line 010 indicates all employees registered in the OPS system. This category includes persons who have an individual SNILS certificate number. You must obtain an insurance number upon first employment or earlier. Enterprises may employ persons who do not receive wages and for whom, accordingly, contributions are not calculated. Employees include:

- Persons caring for a child on special leave.

- Performing civil military duty, while maintaining a job.

- Employees are on leave without pay.

The number of persons specified in subsection 1.1 is duplicated in the section on individual accounting. Persons registered in the OPS system are indicated in line 160 of section 3. The section is filled out for all persons based on the data of the last 3 months. Employees who do not belong to the insured, but are on the payroll, are indicated with characteristic 2.

How to fill out the RSV for direct payments to the Social Insurance Fund: example

Fregat LLC provides watercraft for rent, is a micro-enterprise and has three employees.

The company's accountant was on sick leave from August 10 to August 21 (12 days) due to the illness of her child:

- the employer paid for 3 days of illness in the amount of 3,000 rubles;

- The FSS paid for the remaining 9 days - 9,000 rubles.

Monthly salary of employees:

- director Pimenov - 50,000 rubles;

- manager Foklin - 40,000 rubles;

- accountant Ulyanov - 30,000 rubles. (in August – 18,000 rubles due to temporary disability).

Art. 5 of Federal Law No. 102-FZ dated 04/01/2020 allows the use of reduced insurance premium rates for SMEs from 04/01/2020. For Fregat LLC, the tariffs for 2022 are as follows:

| Insurance type | In the 1st quarter of 2020 | In 2-4 quarters of 2020 | |

| Salary within the minimum wage of 12,130 rubles. | Salary above the minimum wage | ||

| OPS | 22% | 10% | |

| Compulsory medical insurance | 5,1% | 5% | |

| OSS (VNiM) | 2,9% | 0% | |

Direct payments: how to fill out the RSV - calculations

Let's calculate the total amounts of payments in favor of employees of Fregat LLC and accrued contributions:

| Worker | Pimenova | Focklin | Ulyanova | Total for all employees | ||

| Salary for 1st quarter 2020 | 150 000,00 | 120 000,00 | 90 000,00 | 360 000,00 | ||

| Contributions for the 1st quarter 2020 | OPS 22% | 33 000,00 | 26 400,00 | 19 800,00 | 79 200,00 | |

| Compulsory medical insurance 5.1% | 7 650,00 | 6 120,00 | 4 590,00 | 18 360,00 | ||

| OSS 2.9% | 4 350,00 | 3 480,00 | 2 610,00 | 10 440,00 | ||

| Salary for 2nd and 3rd quarters 2020 | Part not exceeding the minimum wage of 12,130 rubles. | 72 780,00 | 218 340,00 | |||

| Part exceeding the minimum wage | 227 220,00 | 167 220,00 | 95 220,00 | 489 660,00 | ||

| Incl. Sick leave in the DAM with direct payments (payment for 3 days of sick leave at the expense of the employer is not subject to contributions) | — | — | 3 000,00 | 3 000,00 | ||

| Contributions for 2nd and 3rd quarters 2020 | From a part not exceeding the minimum wage | OPS 22% | 16 011,60 | 48 034,80 | ||

| Compulsory medical insurance 5.1% | 3 711,78 | 11 135,34 | ||||

| OSS 2.9% | 2 110,62 | 6 331,86 | ||||

| From the part exceeding the minimum wage | OPS 10% | 22 722,00 | 16 722,00 | 9 222,00 | 48 666,00 | |

| Compulsory medical insurance 5% | 11 361,00 | 8 361,00 | 4 611,00 | 24 333,00 | ||

| OSS 0% | 0,00 | 0,00 | 0,00 | 0,00 | ||

| Total payments to employees for 9 months of 2020 | 450 000,00 | 360 000,00 | 258 000,00 | 1 068 000,00 | ||

| Base for calculating insurance premiums | 450 000,00 | 360 000,00 | 255 000,00 | 1 065 000,00 | ||

| Insurance premiums accrued for 9 months 2020 | OPS | 71 733,60 | 59 133,60 | 45 033,60 | 175 900,80 | |

| Compulsory medical insurance | 22 722,78 | 18 192,78 | 12 912,78 | 53 828,34 | ||

| OSS | 6 460,62 | 5 590,62 | 4 720,62 | 16 771,86 | ||

The data for each of the last three months of the reporting period deserve special attention:

| Worker | Pimenova | Focklin | Ulyanova | Total for all employees | ||

| Total payouts | for July | 50 000,00 | 40 000,00 | 30 000,00 | 120 000,00 | |

| for August | 50 000,00 | 40 000,00 | 21 000,00 | 111 000,00 | ||

| for September | 50 000,00 | 40 000,00 | 30 000,00 | 120 000,00 | ||

| Incl. non-taxable benefits | for August | — | — | 3 000,00 | 3 000,00 | |

| Contributions (monthly) | With part of payments within the minimum wage | OPS 22% | 2 668,60 | 8 005,80 | ||

| Compulsory medical insurance 5.1% | 618,63 | 1 855,89 | ||||

| OSS 2.9% | 351,77 | 1 055,31 | ||||

| From the part above the minimum wage | OPS 10% | 3 787,00 | 2 787,00 | 1,787.00 (July, September) 587,00 (August) | 8,361.00 (July, September) 7,161.00 (August) | |

| Compulsory medical insurance 5% | 1 893,50 | 1 393,50 | 893.50 (July, September) 293,50 (August) | 4,180.50 (July, September) 3 580,50 (August) | ||

| OSS 0% | 0,00 | 0,00 | 0,00 | 0,00 | ||

| Total | OPS | 6 455,60 | 5 455,60 | 4,455.60 (July, September) 3,255.60 (August) | 16,366.80 (July, September) 15,166.80 (August) | |

| Compulsory medical insurance | 2 512,13 | 2 012,13 | 1,512.13 (July, September) 912.13 (August) | 6,036.39 (July, September) 5,436.39 (August) | ||

| OSS | 351,77 | 1 055,31 | ||||

What is included in the contents of lines 030 of the calculation of insurance premiums

What is included in line 030 of the calculation of insurance premiums? Does this line have the same content in each section and appendix? A detailed examination of the report form shows that the information entered in line number 030 varies depending on where exactly it is located. Line 030 is used to reflect the following information:

- in sections 1 and 2 - the total amount of contributions to compulsory pension insurance payable for the reporting (calculation) period;

- in Appendix 1, depending on its specific subsection:

- 1 and 1.2 - the total amount of income under labor and civil contracts accrued in favor of employees, taking into account amounts not subject to contributions;

- 3.1, 1.3.2, 1.4 - the total amount of income not subject to contributions;

- in Appendix 2 (as well as in the subsections of Appendix 1) - the total amount of income not subject to contribution (compensation, financial assistance, etc.);

- in Appendix 3 - the total amount of expenses for maternity benefits, the number of recipients of such benefits and the number of paid days for them;

- in Appendix 4 - the amount of maternity benefits intended for victims of the Chernobyl accident, the number of recipients of such benefits and the number of paid days for them;

- in Appendix 5 - the amount of income that allows in certain situations listed in paragraph 5 of Art. 427 of the Tax Code of the Russian Federation, take advantage of reduced tariffs;

- in Appendix 7 - the amount of income in the form of grants, allowing in certain situations listed in paragraph 7 of Art. 427 of the Tax Code of the Russian Federation, take advantage of reduced tariffs;

- in Appendix 8 - the code of the type of activity carried out by an individual entrepreneur on a patent, when reflecting information about an entrepreneur using reduced tariffs for contributions;

- in Appendix 9 - the name of the foreigner (or stateless person) when reflecting information about him when using the right to a reduced rate of contributions to OSS;

- in Appendix 10 - the names of the student who receives income during training that is not subject to contributions in accordance with subparagraph. 1 clause 3 art. 422 Tax Code of the Russian Federation;

- in Appendix 1 to Section 2 - the patronymic name of the member of the peasant farm in respect of whom data on accrued contributions is submitted;

- in section 3 - the calendar year for which personal information is generated.

Thus, the information that falls into line number 030 may be different and will be entered either directly (simply by entering the corresponding number or word) or in compliance with certain rules. The latter includes information reflected:

- in section 1 as the total amount of contributions payable - it will have to be deciphered monthly in lines 031–033 of the same section;

- in Appendices 1 and 2, where the amounts of income entered into this line are shown in 5 values: not only monthly, but also including accruals for periods from the beginning of the last quarter and from the beginning of the reporting year.

In the latter case, filling out line 030 may present certain difficulties associated with the correct interpretation of the contents of the fields proposed in the report for indicating the corresponding amounts. To better understand this procedure, consider an example of filling out line 030 for calculating insurance premiums, which requires entering 5 amounts into it.

RSV direct payments: sample filling

The finished calculation of Fregat LLC for 9 months of 2022 looks like this: