From January 1, 2022, a new procedure for treasury services will come into force in the territorial bodies of the Federal Treasury (hereinafter referred to as TOFK). The reason for this will be the introduction by Federal Law No. 479-FZ of December 27, 2019 (hereinafter referred to as Federal Law No. 479-FZ) of amendments to the Budget Code and the entry into force of a number of other regulatory legal acts. This article will provide a brief overview of these changes.

From this date the following will come into force:

- newly introduced ch. 24.2 “System of treasury payments” , 24.3 “Treasury services” of the Bank of the Russian Federation ;

- Order of the Federal Treasury No. 21n dated May 14, 2020 “On the Procedure for Treasury Services” (hereinafter referred to as Order No. 21n);

- Order of the Federal Treasury dated 04/01/2020 No. 15n “On the Procedure for opening treasury accounts” (hereinafter referred to as Order No. 15n);

- Order of the Federal Treasury dated May 13, 2020 No. 20n “On approval of the Rules for the organization and functioning of the treasury payment system”;

- Regulations of the Ministry of Finance of the Russian Federation No. 63n, Central Bank of the Russian Federation No. 717-P dated April 10, 2020 “On the features of interaction of the treasury payment system with payment systems”.

What is a treasury account?

According to the rules of the Federal Code of the Russian Federation, opening an account with the treasury for a government contract is provided for participants in state and municipal procurement. In fact, this is the same personal account that is serviced in banking organizations and credit and financial services. But there are still differences: treasury details are used to receive and spend budget funds. Consequently, if a legal entity is a participant in the budget process, then this is a mandatory condition for it.

The regulations of the Central Bank of the Russian Federation indicate whether a current account and a treasury account are the same thing or not - these are different concepts. A checking account is a bank account for conducting transactions for commercial and non-profit organizations. Treasury is the number of the bank details, which is part of the single treasury account 40102 (242.14 Budget Code of the Russian Federation, 479-FZ dated December 27, 2019).

In purchasing activities, the use of a treasury special account is subject to the same requirements. If the customer receives budget funding to pay for the order, then payments should be made exclusively on it. Thus, balance sheet 40102 is the difference between the treasury and current account: using the first digits of the twenty-digit unique code, check the identity of the main bank details.

IMPORTANT!

It is impossible to receive money from the budget under government orders to a standard bank account. Such instructions are enshrined in the letter of the Ministry of Economic Development No. D28i-2613 dated September 11, 2015. The requirements are valid only for procurement participants operating under Law No. 44-FZ. For example, an autonomous institution operating under 223-FZ has the right to receive financing to a bank account.

Document forms for treasury operations

For treasury services, forms of orders for making treasury payments (operations) have been approved. Documents will be introduced in stages.

From 01.01.2021 to 31.12.2022, the following forms of orders apply (shown in Appendices 15 – 26 to Order No. 21n):

- application for cash expenses (f. 0531801);

- application for cash expenses (abbreviated) (f. 0531851);

- consolidated application for cash expenses (f. 0531860);

- return application (f. 0531803);

- application for receiving cash (f. 0531802);

- application for receiving funds transferred to the card (f. 0531243);

- application for provision of cash in electronic form;

- notification of clarification of the type and nature of payment (f. 0531809);

- notification of clarification of client operations in the form (f. 0531852);

- order of the financial authority with a transcript (f. 0531806);

- details of the order for the transfer of funds to Mir bank cards of individuals;

- notification of receipts in foreign currency (f. 0531452); and etc.

From 01/01/2023, documents will need to be filled out in a structured form according to the details given in Appendices 1 – 4 to Order No. 21n:

- details of the order to make a treasury payment (transfer);

- details of the order to make a treasury payment (refund);

- details of the order to make a treasury payment (providing cash, transferring to bank cards);

- details of the order to make a treasury payment (clarification).

Why is this necessary?

The key purpose of working through the treasury is to control the use of budget funds. TOFK employees check all stages of state and municipal procurement. It is necessary to open an account with the treasury in advance to avoid interruptions in financing. Budget funds will not be credited to the customer until the organization confirms its obligations. The basis is a state or municipal contract, certificates of completion of work or delivery notes.

Control by the Federal Treasury is a prerequisite for working with budget money. OFK employees control:

- government orders for the supply of goods, works or services, provided that the contract value is more than 100 million rubles and the conditions provide for the payment of an advance;

- contracts for the provision of contributions to the authorized capitals of organizations or their property, even if the contributions are sources of financing;

- agreements on budgetary subsidies for legal entities;

- Legal acts regulating the procedure for providing subsidies to recipients of budget funds;

- other contractual relations provided for by the terms of execution of government contracts and agreements of organizations.

If the documentation is incorrect, TOFK representatives will refuse to use budget funds. The transaction is rejected in the payment system. To receive funds, you will have to correct the identified shortcomings.

IMPORTANT!

The special account is used not only in procurement under 44-FZ and 223-FZ, but also in state defense orders. 275-FZ dated December 29, 2012 stipulates the difference between a treasury account and a special account for the State Defense Order: a special account for procurement is opened by participants with budget financing (PBS), and a special account for the state defense order is opened by the main executors and executors of the state defense order. The procedure for opening special purchasing accounts is regulated by the Federal Treasury, and details for the State Defense Order are regulated by Federal Law No. 275-FZ.

Pros and cons of treasury support

Treasury support of government contracts is an additional way to monitor their implementation. This makes the work of suppliers somewhat more complicated:

- To receive money to fulfill a government contract, the supplier needs to complete an additional package of documents.

- Representative offices of the Federal Treasury are not located in all cities. Therefore, suppliers from smaller communities may have to spend additional time traveling. But the solution to this problem can be electronic document management.

- Communication with treasury employees may not be prompt enough.

At the same time, treasury support of government contracts has a number of undeniable advantages:

- Transparency in contract execution. This is especially true for procurements that involve many co-executors and subcontractors;

- Unscrupulous suppliers prefer not to get involved with government contracts where treasury support is required;

- Guaranteed receipt of funds (the customer transfers advances to his treasury account in advance).

Who opens

Opening is necessary for several categories of government contract participants:

- To customers who are recipients of budget funds. For them, all operations regarding the receipt and expenditure of funds are carried out through the Federal Treasury. It is mandatory to open accounts for government institutions, budgetary and autonomous organizations.

- For customers, if payment for the order is made from the budget. Example: the customer is a company that is not a PBS; if government orders are financed from the budget, then a CS will have to be opened in TOFK.

- Executors of state defense orders. In relation to this category of performers, there are separate requirements regarding the opening of a special account with the financial company. Work on other accounts with state defense orders is not allowed.

- Securing the contract. According to the terms of government contracts, a special account is opened for the transfer of collateral. For example, the executor makes a security payment instead of a bank guarantee.

Where to open for state employees

Budgetary and autonomous institutions are opened in territorial branches of the Federal Treasury (TOFK). State employees belonging to the constituent entities of the Russian Federation have the right to open not only in the territorial branches of the treasury, but also in the financial bodies of the subject or municipal appointment. In such cases, the procedure for opening payment details is regulated by the federal or municipal financial authority itself (Part 3 of Article 30 83-FZ of 05/08/2010).

If TOFK has signed an agreement with the supreme executive body of a particular subject, then public sector employees can open an account in the treasury department. To do this, TOFK must receive confirmation from the local administration (Part 4, Article 30 83-FZ). For autonomous organizations, the higher authority is the founder (Part 3.1 of Article 2 174-FZ of November 3, 2006).

If the subject TOFK has not concluded an agreement on a special opening procedure, then the documents must be submitted according to the regulations provided for federal institutions (clause 37 of the Procedure approved by Order of the Federal Committee No. 21n dated October 17, 2016).

How to open: step by step instructions

The current procedure for how to work with the treasury for beginners and open an account is provided for by the order of the Federal Committee No. 15n dated 04/01/2020. If this is not observed, TOFK employees will refuse to create and maintain a special FC account.

IMPORTANT!

The opening of personal accounts for transactions with earmarked funds and mandatory treasury support is regulated by Order of the Federal Treasury No. 44n dated December 29, 2020. This standard describes the features of opening and closing, reserving and processing treasury settlement details for 2022 and the planning period 2022–2023.

The opening procedure is simple, but there are certain requirements and recommendations. Here is a step-by-step algorithm of actions.

Escort rules

FC exercises control according to strict regulations. The procedure and standards for treasury support for 2022 are described in Decree of the Government of the Russian Federation No. 1765 of December 30, 2018.

Financial transactions with target funds occur only after the territorial bodies of the FC open an account with the institutions of the Central Bank of the Russian Federation to account for the money of legal entities that are not participants in the budget process.

Contractors and suppliers receiving targeted money, for their part, must open personal accounts with the territorial bodies of the Financial Committee. Money will be received and debited from them.

To write off funds from the account for targeted needs, the organization, together with a payment order for payment, submits to TOFK the concluded contract and other papers confirming the expenditure obligations (acceptance certificate, invoice).

Tender support services from professionals

Protection from RNP, Exception from RNP, Complaint to the FAS, Turnkey tender support, Preparation of an application for a tender of any complexity, Development of technical specifications for 44 and 223-FZ, Analytics and audit, Personal training in government procurement

To get a consultation

Transferring the budget not to a treasury account to fulfill obligations, but to a bank account is permitted only in certain cases. For example, to fulfill the legal entity’s obligations regarding wages and other payments in favor of employees.

The duty of the contractor when exercising treasury control is to fulfill the conditions included in the contracts:

- opening a personal account in TOFK for financial movements on it;

- provision of information about performers (co-executors) to the Treasury body and the state customer;

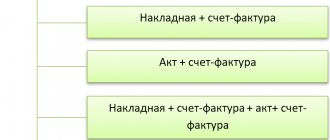

- submission to TOFK of documents determined by the rules for spending target money (invoices, acts, etc.).

Payment and settlement documents and documents confirming the occurrence of monetary obligations indicate the identifier of the government contract, the support of which is carried out according to the stated rules.

Thus, the Financial Corporation fully monitors the fulfillment of obligations and mutual settlements between the parties under them. Specialists of the territorial body have the right to request any documents confirming the fact and volume of supplies, the procedure for executing the contract and the intended use of money.

Explanations on the topic

| Main points | Document details | Download |

| Explanation of the procedure for opening and maintaining TOFK personal accounts | Treasury Letter No. 07-04-05/05-151 dated 02/10/2017 | |

| Security for the execution of the contract is deposited into the customer’s personal account | Letter of the Ministry of Economic Development No. D28i-2613 dated September 11, 2015 |

About the author of this article

Natalya Evdokimova Since 2022 - author and scientific editor of electronic journals on accounting and taxation. But until that time, she kept accounting and tax records in the public sector, including as the chief accountant.

Other publications by the author

- 2022.02.16ProvisionInstructions for filling out payment forms for participation in government procurement

- 2021.11.10 Procurement control Is it mandatory to plan purchases under 44-FZ based on the FCD plan

- 2021.11.09 Customer documents Table of CVR and KOSGU for public procurement

- 2021.10.11 Procurement controlLimits on budgetary obligations: how to accept and distribute for public procurement

Deadline for opening a personal account

5 (five) working days to check the submitted documents ; after this period, within 1 (one) working day, in the absence of grounds for suspension/refusal to open a personal account, it is opened.

A personal account is considered open from the moment an entry is made in the Treasury Personal Account Registration Book; upon opening, the organization is sent an Extract from the personal account, which indicates its details.