The amount of profit received must be reflected in accounting and tax returns. Often the data from these reports is inconsistent. Their alignment will occur only in the future tense. As a result of such a difference, a portion of deferred tax arises, which will be paid in subsequent periods. This part is a deferred tax asset.

How is information reflected in the balance sheet on line 1180 “Deferred tax assets” ?

What is a deferred tax asset?

To understand what a deferred tax asset is, you need to understand the definition of deferred tax payable on a company's profits. It represents the obligations that the company will have in the future. Deferred tax usually arises as a result of poor business performance. The reason for its appearance is also problems with taxation.

That is, it is a conditional tax. It is calculated based on information from the enterprise’s reporting. It is equal to the amount payable in the current tax period. The methods for calculating amounts for tax and accounting reports differ, which is why a temporary difference appears. It can cause inconsistencies when taking into account the following indicators:

- Valuation of assets and liabilities of an enterprise.

- Determining the amount of income and losses.

How to calculate deferred tax asset ?

Deferred assets arise when the following circumstances exist:

- The presence of a tax difference of a temporary nature.

- Receipt of income in the future, on which tax will be paid.

It is important to calculate them correctly.

How is deferred tax assets inventoried ?

Types of differences that may arise during operation

Due to the fact that for accounting purposes all amounts of income and expenses are accepted, and for tax purposes only selectively, differences arise when calculating income tax. These differences can lead to either a tax decrease or an increase. Moreover, in both cases, the tax change can be either permanent or temporary . If such differences arise in the company, then the following entries are generated in accounting:

- Calculation of income tax, reflects the organization's debt to the budget D99 K68.04

- If there are differences that increase tax:

— constantly D99 K68

— temporarily D09 K68

- If there are differences that reduce tax:

— constantly D68 K99

— temporarily D68 K77

It must be taken into account that accounts 09 and 77 are subsequently closed with reverse entries.

| IMPORTANT! Temporary differences do not affect the company's net profit |

Let's look at what the differences look like using an example. Initial data:

revenue 150 thousand rubles, cost 50 thousand rubles, wage fund 20 thousand rubles, artificial fountain in the director’s office 30 thousand rubles, gratuitous receipt from the founder 50 thousand rubles, fines and penalties for taxes 30 thousand roubles.

| Index | Accounting | Tax accounting |

| Revenue | +150 | +150 |

| Cost price | -50 | -50 |

| Payroll fund | -20 | -20 |

| Fountain | -30 | — |

| Proceeds from the founders | +50 | — |

| Fines, penalties | -30 | |

| Profit before tax | +70 | +80 |

It turns out that according to accounting data, it would be necessary to pay less tax than required by tax accounting. Taking into account the differences, accounting data must be brought to the same level as tax accounting data.

It must be borne in mind that the amount of income tax for transfer to the budget is calculated as conditional income (that is, the profit before tax that is obtained according to accounting data), adjusted for all resulting differences. If everything is done correctly, the tax received by this calculation will coincide with the amount of tax according to the declaration.

Why are deferred tax assets required?

Tax assets are a method of reducing income taxation. To calculate them, you need to multiply the current tax amount by time intervals.

The temporary difference represents the totality of expenses and losses that make up the profit reported in the report. Instead of profits there may be losses. These indicators are the basis for creating a tax summary. Assets are formed in the following cases:

- using different methods for calculating depreciation;

- making tax payments in excess of the required amount. This is relevant if the overpayment was not returned to the company;

- the presence of a loss transferred to the account of subsequent periods;

- the appearance of accounts payable arising from the purchase of services or goods;

- application by the enterprise of the cash method of calculation.

Deferred assets must be accounted for correctly. This is required for the following purposes:

- Collection of accounting data.

- Collection of data for analysis.

- Possibility of generalized results of the enterprise's activities.

Having all the recorded data will help protect the company during tax audits.

Accounting and tax accounting in an organization

Any accountant probably knows that there are several types of accounting, the most common (and probably the most important) of which are accounting and tax.

Take our proprietary course on choosing stocks on the stock market → training course

Accounting is a reflection of the entire economic life of an organization through primary documents. When maintaining accounting records, all events that occur in the life of the company are taken into account. The purpose and outcome of operations in the field of accounting is the preparation of annual reports. The year-end financial report is prepared for:

- Internal users. Their role is played by the owners or top managers of the company. Based on the report data, they draw conclusions about the success of the organization during the year and make the necessary decisions

- External users. These include primarily creditors and tax authorities.

Based on the accounting report, the state of the organization and its development prospects are assessed. Reporting helps make important management decisions .

The main documents regulating accounting are the Law “On Accounting” and the Accounting Regulations (PBU).

Tax accounting is a system that is built on the basis of primary documents and summarizes information that is used to calculate the amount of taxes.

The lion's share of all tax accounting is the calculation of income tax. The main act that regulates this type of accounting is the Tax Code .

The main feature of tax accounting is that not all transactions reflected in accounting are accepted for calculating the amount of tax liabilities. Some expenses are not accepted at all, while others are rationed.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

How are deferred assets accounted for?

The assets in question are reflected in accounting in account 09 with the appropriate name. The loan correspondence may include the following accounts:

- account 68 “Calculations for tax collections”. This line reflects the existence of the disappearance of a tax asset. The amount should match the reduction in imputed accruals for the same period. A tax asset may disappear due to payment. Assets may not only disappear, but also decrease;

- account 99 “Profits and losses”. Write-off from the main account 09 occurs only when the asset is retired from circulation.

The debit correspondence is account 68 “Tax payments”. This line reflects the deferred asset. It will increase the amount of contingent income or loss for the reporting period.

IMPORTANT! Tax assets help reduce tax payments. This is due to overpayment of income tax for the reporting period. Assets may also be the basis for receiving compensation payments for overpayments.

Examples of calculations

EXAMPLE 1. At an enterprise, depreciation charges are determined using the reducing balance method. They amounted to 150,000 rubles. Income tax is determined in a straight-line manner. It is equal to 50,000 rubles. There are no other inconsistencies between the accounting and tax reporting data. The profit, before the tax was calculated, amounted to 300,000 rubles. The tax base is 400,000 rubles. The tax rate is 20%.

The accountant needs to calculate the difference between depreciation in tax and accounting documentation. It is equal to 100,000 rubles (50,000 rubles are subtracted from 150,000 rubles). The difference that has arisen has signs of being temporary. Reported amounts are compared through the depreciation process. The resulting difference is the reason for the emergence of a tax asset. This is due to the fact that the calculated tax base exceeds the profit before taxes are calculated in accounting documents.

The size of the deferred asset will be 20,000 rubles. To do this, the resulting difference is multiplied by the tax rate (100,000 rubles multiplied by 20%).

IMPORTANT! The accuracy of the calculations can be checked. The amount of income tax must correspond to the amount of tax specified in the declaration. The amount of deductions for profit must be determined on the basis of PBU 18/02.

EXAMPLE 2. Consider the situation with the data from the previous example. Let's check the correctness of the calculations. The size of the conditional expense will be 60,000 rubles. To obtain this indicator, you need to multiply the profit (300,000 rubles) by the tax rate (20%). The resulting 60,000 rubles are multiplied by the deferred asset of 20,000 rubles. The current rate of deductions to profit, according to the accounting report, will be 80,000 rubles.

Then you need to calculate the current tax that is indicated in the declaration. To do this, the tax base (400,000 rubles) is multiplied by the tax rate (20%). Result of calculations: 80,000 rubles. Both obtained indicators coincide. This means that the calculations performed were correct.

Introduction to PBU 18/02 – temporary differences

Published 06.11.2018 14:25 Author: Administrator In this article we will continue to look at the basics of PBU 18/02 and look at some of the nuances of temporary differences (we talked about permanent differences earlier in the article Introduction to PBU 18/02 - permanent differences). At the level of semantic understanding, in this case the rule works: “now we will pay more or less, but then, on the contrary, it’s a matter of time.” Thus, temporary differences arise in the presence of income and expenses that are accepted in accounting and tax accounting in different periods of time.

Important Features:

1. Temporary differences do not affect the company’s financial result, which is formed on account 99, but they affect the amount of income tax, which is formed on account 68.04.

2. To reflect deferred income taxes, there are special accounts: 09 (deferred tax assets) and 77 (deferred tax liabilities). The income tax amounts will be listed in these accounts, and when the time comes, they will be written off to account 68.04.

3. Temporary differences “defer” income tax into assets and liabilities, but in the future they will definitely be taken into account. Sooner or later there will come a time when the discrepancy “goes to zero.”

4. Temporary differences are accounted for for each type of asset and liability.

Account 09 “Deferred tax assets” can only be active, the balance is debit. When the time comes, we will write off this asset as debit 68.04 and thereby reduce income tax, i.e. we will receive a tax benefit.

In the reporting period, the deferred tax asset increases the amount of income tax (D-t 09 K-t 68.04), but then, as the temporary differences that arise are repaid, it decreases (D-t 68.04 K-t 09).

Analytical accounting of deferred tax assets is carried out by type of asset.

Account 77 “Deferred tax liabilities” can only be passive, the balance is credit. When the time comes, we will write off these obligations on credit 68.04 and thereby increase our obligation (income tax) to be paid. Analytical accounting of deferred tax liabilities is carried out by type of liability.

An organization can have balances for both account 09 and account 77 at the same time, but never for one analytical accounting object.

In the balance sheet (Form No. 1), deferred tax assets are shown as part of non-current assets, and deferred tax liabilities are shown as part of long-term liabilities.

The income statement (Form No. 2) shows changes in deferred tax assets and deferred tax liabilities that arose and were settled in the reporting period.

How it works in 1C: Enterprise Accounting 3.0

Let us recall that a deferred tax asset arises if in the reporting period the organization’s current income tax is higher, but in the next or subsequent periods it will be lower. "We'll pay less in the future"

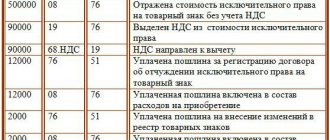

Example No. 1 . In January 2022, the organization purchased and put into operation technological equipment No. 1 worth RUB 140,000.00 (excluding VAT). The useful life (SPI) in the BU is conditionally 3 months, the useful life (SPI) in the NU is conditionally 6 months.

Let's look at the emergence of a deferred tax asset (DTA) and its settlement.

1. Appearance of a deferred tax asset:

BU 140000.00: 3 months * 20% = 9333.33

NU 140000.00: 6 months * 20% = 4666.66 (expenses in NU are lower, which means more profit, tax is higher than in BU)

SHE No. 1 9333.33 – 4666.66 = 4666.67 rubles.

As can be seen from the analysis of account 09, in the period from February to April, a deferred tax asset is accrued in the accounting system.

2. Repayment of the tax asset.

After the fixed asset is fully depreciated in accounting (accounting) (in the example, this is 3 months), repayment begins for the amount of depreciation deductions in tax accounting (TA). The ending balance goes to zero.

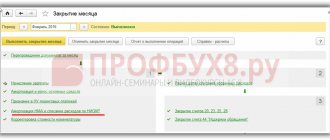

Let me remind you that the accrual and repayment of a deferred tax asset is carried out using the “Month Closing” operation. Here, using a calculation certificate, you can check the accrual and repayment of tax assets and liabilities.

Important:

If temporary differences arise for several objects of analytical accounting, then it becomes necessary to maintain object-by-object accounting outside the 1C program. Paragraph 3 of PBU 18/02 defines the maintenance of group accounting (by type of assets and liabilities), this accounting principle was introduced by the developers of 1C. However, tax authorities may require a breakdown of assets and liabilities. It is convenient to keep such records in Excel tables; the double entry method is not required.

Let's look at an example.

Example 2. In February 2022 the same organization bought and put into operation technological equipment No. 2 worth 50,000.00 (excluding VAT), SPI in BU - conditionally 4 months, in NU - conditionally 7 months.

BU 50000.00: 4 * 20% = 2500.00 rub.

NU 50000.00: 7 * 20% = 1428.57 rub.

SHE No. 2 2500.00 – 1428.57 rub. = 1071.43 rub.

As can be seen from the analytical accounting, the reflection is in the group “Fixed Assets” SHE No. 1 + SHE No. 2 = 5738.10 (4666.67 + 1071.43)

A deferred tax liability arises if in the reporting period the organization's current income tax is less, but in the next or subsequent periods it will be more. “We’ll pay less now.”

Let's consider an interesting case (as Olechka Shulova says).

Example 3. Organization in July 2022 purchased and put into operation technological equipment No. 3 worth RUB 230,000.00. (without VAT). The useful life (USL) in both accounting and tax accounting is set to the same - 12 months. But in tax accounting a depreciation bonus of 30% is applied.

Let's consider the emergence and repayment of a deferred tax liability (DTL).

The depreciation bonus will be 230,000.00 * 30% = 69,000.00 rubles.

In the first month of depreciation (in the example, August 2018), two events occur: the appearance of a depreciation bonus (RUB 69,000.00) and the write-off of 5,750.00 (69,000.00/12 months) {"Month closure" - "Depreciation and amortization" OS" - "Show transactions"}

Deferred tax liability (DLT) is accrued on the balance at the close of the month.

In the second month of depreciation (in the example, September 2018), the deferred tax liability is repaid.

BU 230000.00: 12 months * 20% = 3833.33 rub.

NU 230,000.00 – depreciation. bonus (230000.00 * 30%) = 161000.00;

161000.00:12 months*20% = 2683.33 rub.

IT 3833.00 – 2683.33 = 1150.00 rub. This amount will reduce the deferred tax liability monthly until it is completely written off.

In our example, at the end of 2022. the balance will be 8050.00 rub. At 7 months In 2022, the deferred tax liability will be extinguished in full.

In the annual reporting, the deferred tax liability will be reflected as follows: Form No. 1 (Balance Sheet)

Form No. 2 (Report on financial results)

If you are interested in accounting according to PBU 18/02, please write your questions and specific examples from practice in the comments. Let's figure it out together!

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

-1 Irina Plotnikova 12/17/2020 15:00 I quote Ramet:

Tell me how to reflect the write-off without repayment, what should be the postings?

Rameta, good afternoon.

Unfortunately, from 2022 the methodology for calculating temporary and permanent differences has changed. Changes have been made to the program along with legislation. It’s so easy to write off SHE, IT won’t work. Even if you use manual entries, the accounting will be incorrect. We need to consider the issue as a whole. We recommend that you purchase our income tax course, it is updated in accordance with the legislation. Moreover, today is the last day of the New Year's sale; pleasant discounts await you. Quote 0 Rameta 12/17/2020 12:45 Tell me how to reflect the write-off without repayment, what should be the postings?

Quote

+5 Goncharova Alina 11/26/2018 00:59 thanks for the article! Very helpful!

Quote

Update list of comments

JComments

How to reflect changes in deferred tax assets

Changes in assets are reflected in line 2450. The amount of changes must be established in accordance with PBU 18/02. To carry out calculations, you need to subtract from the debit turnover (account 09 “SHE”) the credit turnover (account 09 “SHE”).

The calculations do not use the loan turnover on account 09 with correspondence account 99. If the asset on the basis of which it appeared is eliminated, a write-off occurs. Taxes for current and subsequent periods are not reduced by the established write-off amount.

Increase

An asset that has increased expenses and income is reflected as follows:

- DT 09 “SHE”;

- CT 68 “Tax calculations”.

It is also required to indicate the content of the performed operation: accrual of IT.