General provisions of accounting policies in trade

Regardless of the specialization of a trading company (for example, wholesale or retail), the accounting policy (hereinafter - UP) must contain some introductory information:

- the applied taxation system;

- methods of organizing accounting and tax accounting;

- possible deviations from generally established accounting rules allowed by regulations (for example, small businesses can apply a simplified procedure for reflecting expenses on loans and borrowings in accounting and reporting, and also not apply retrospective adjustments if errors are detected);

- information about the used accounting accounts, accounting and tax registers;

- other similar provisions formulated on the basis of generally established accounting rules and methods.

In addition to the listed data, the UP of a trade organization should separately disclose the procedure and methods used by this particular organization for accounting for goods, trade margins, transportation and procurement costs (hereinafter referred to as TPP) and the nuances of taxation associated with them.

NOTE! For accounting and taxes, an enterprise can have two separate unitary enterprises or one common one. In the information below, the mandatory points for UE are considered taking into account both BU and NU.

Accounting policy for special regimes

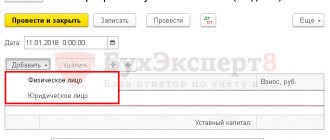

Legal entities under special regimes must keep accounting records. The accounting policy for UTII and other taxation regimes provides for accounting with the approval of a chart of accounts and forms for recording business transactions. All approved forms must have mandatory details.

The scope of the financial statements will depend on whether the company is a small business or not. Recognition of a company as a small enterprise allows the use of simplified reporting forms, reducing the number of accounts and accounting regulations used. All this should be reflected in the accounting policies.

If a company has the status of a small enterprise, then it is allowed to conduct accounting according to a simplified scheme (clause 4 of article 6 of law No. 402-FZ).

If an individual entrepreneur keeps records of physical indicators to confirm taxation, then, according to clause 2 of Art. 6 of Law No. 402-FZ, he doesn’t have to keep any accounting records at all. An enterprise or individual entrepreneur must reflect its choice in its accounting policies.

Determining the procedure for accounting for goods and trade margins

Goods in trade organizations can be taken into account:

- at actual cost;

- at sales prices.

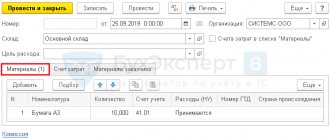

Accounting is always kept on account 41, but in the first case, goods go to it at the purchase price, and in the second - at the sales price. In this case, the trade margin on goods accepted for accounting is calculated by posting Dt 41 Kt 42.

When selling goods, the share of the markup corresponding to the goods sold is reflected by posting Dt 90 Kt 42 reversal to form the correct amount of the financial result.

IMPORTANT! Trade mark-ups are allowed only to retail trade enterprises. If the company has both sales options, the UP must determine the procedure for dividing goods into those intended for wholesale or retail sale, indicating the accounting methodology for each group, or establish the accounting method for all goods at actual cost (without using account 42).

In the work of wholesale trade organizations, a moment often arises when goods have already been shipped from the warehouse, but have not yet reached the buyer (for example, they are transferred to a transport company or transferred to an intermediary for sale). For such goods, a separate account 45 “Goods shipped” is provided. The posting for actual release from the seller’s warehouse looks like this: Dt 45 Kt 41.

If account 45 is used, upon completion of the sale (receipt of goods to the buyer), the writing off of goods from account 45 occurs in the same way as writing off from account 41: Dt 90 Kt 45.

Basic provisions of tax accounting under OSNO

Accounting and tax accounting in Russia are different, so the policy also needs to reflect the main tax provisions. Let's consider the main points for business on OSNO.

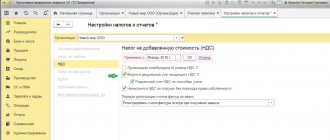

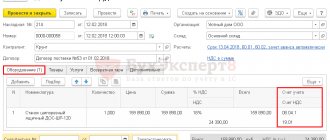

VAT

- Indicate in this section the moment of determining the tax base upon receipt of an advance payment - on the day of shipment or on the day of receipt of payment. The selected moment can apply both to all operations as a whole, and to individual ones. This should also be included in your accounting policies. Provide information about separate VAT accounting if not all transactions are taxed or you combine two tax regimes.

- Decide on the application of the “5% rule”. It is possible to refuse separate VAT accounting when the share of expenses on transactions not subject to VAT is no more than 5% of total income. When applying this rule, open a separate sub-account for VAT accounting, a separate register, or independently develop your own version of the division.

- Determine the base in proportion to which general business expenses will be distributed. This could be revenue, direct expenses, or your own choice.

- Determine the period for calculating VAT for deduction - a month or a quarter. If you generate information about activities on a monthly basis, the monthly option is preferable; otherwise, the quarterly option.

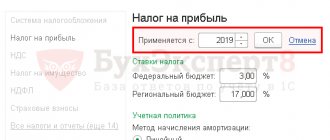

Income tax

If you work for OSNO, you pay income tax, the calculation procedure of which also needs to be reflected in the policy.

- Indicate in which registers tax information is collected - tax or accounting with additional details.

- Select the reporting period - month or quarter.

- Select the division's profit share distribution base if you have branches. There are 2 bases to choose from: ½ share of the branch in the total average number of employees + ½ share of a separate division in the total residual value of depreciable property;

- ½ share of the branch in the general wage fund + ½ share of the separate division in the total residual value of depreciable property.

The income tax rate is 20%. 3% is intended for the federal budget, and 17% for the regional budget. The selected base is responsible for how much tax is payable to the regional budget.

Property tax

Owners of property of different categories determine the tax base for each of them. As a rule, such a need arises if the property is located in different constituent entities of the Russian Federation. For tax accounting purposes, you need to choose how to keep separate records: on special tax registers, separate sub-accounts, or in another way.

Accounting for income and expenses

Choose a recognition method. Most organizations use the accrual method. The cash method is not available to all organizations - clause 1 of Art. 273 Tax Code of the Russian Federation. Manufacturing companies with a long technological cycle can choose how to distribute income across reporting periods:

- proportional to costs;

- in equal shares according to the number of periods;

- by any other reasonable means.

You will also have to resolve issues regarding R&D, assignment of claims and rental income. For example, rental income can be recognized as both sales and non-sales income, depending on the company’s activities. R&D expenses are written off as other expenses or as the cost of intangible assets.

Direct and indirect costs

Approve a list of expenses, which ideally will be identical to the list for accounting. Select a method for allocating costs to work in progress. Costs that cannot be attributed to a specific type of product must be distributed according to the selected base. Indicate this basis in the accounting policy.

Inventory accounting

Decide how their cost will be formed - taking into account additional acquisition costs or without them. Indicate the expenses that will be included in the purchase price.

Select the valuation method for sales: unit cost, FIFO, average cost. Similar methods are proposed for writing off goods.

Depreciation

For tax purposes, depreciation is calculated only using the linear and non-linear methods. The Tax Code of the Russian Federation also provided for “depreciation bonuses” - a one-time write-off of part of the cost of property. The use of accelerating and decelerating coefficients is allowed. You must reflect all this in the UE.

Important! If the depreciation procedure in accounting differs from the tax one, differences arise between them. They make life much more difficult for non-professional accountants.

Accounting policy is an important document. It is needed not only to show it to the tax authorities when they come with an audit. First and foremost, a policy helps you standardize your record keeping. Secondly, with a professional approach - to save on taxes. The cloud service Kontur.Accounting already has accounting policy options for different tax regimes and their combination. You don’t have to think through and approve your accounting policies - our specialists have already done it for you. The first 14 days of use are provided free of charge to everyone.

Method of writing off cost of goods sold

The cost of goods sold is written off using methods that are also suitable for other groups of inventories:

- according to FIFO;

- average cost;

- the cost of each unit.

Read more about methods for estimating inventories here.

The choice of method depends on the specifics of the goods being sold. An enterprise can choose any one, as well as several for different product groups. However, all selection results must be written down in the UE.

Since 2022, FAS 5/2019 “Inventories” has come into force, the norms of which must be taken into account when drawing up accounting policies. ConsultantPlus experts explained in detail how to do this correctly. To do everything correctly, get trial access to the system and go to the review material.

Results

Starting from 2022, UTII will be abolished throughout Russia.

This means that accounting policies for tax purposes for 2022 will have to be revised. Since UTII cannot exist as an independent tax system and is always combined with the simplified tax system or OSNO, taxpayers will automatically be transferred to the applicable system. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for containers and packaging

Many products require specific packaging for transportation, storage and sale. In this case, packaging can:

- have properties more suitable for packaging materials (for example, a reusable cardboard box);

- have properties that are more suitable for an object of fixed assets (for example, packaging equipment: special containers, pallets, containers for liquid and bulk products in which goods are packaged by the manufacturer/supplier so that the acquirer subsequently sells the goods from the same container);

- have the property of being inseparable from the product at the time of sale (for example, a glass bottle).

Depending on which of the listed groups containers and packaging belong to, it can be counted as:

- MPZ (on a separate subaccount of account 10 or 41),

- an object of fixed assets (on account 01), with a division into purchased and produced on its own;

- goods (on account 41), and in most cases the cost of packaging is included in the selling price of the goods.

Reusable containers are classified into returnable and non-returnable. Moreover, according to agreements between the supplier and the buyer, the transfer of expensive packaging can occur with a deposit.

The selected options for the use and accounting of containers must be detailed in the accounting policies of the trading organization.

In addition, in appropriate cases, the accounting for transportation costs associated with reusable containers is additionally specified separately.

A sample accounting policy for a trade organization using the general taxation system was prepared by ConsultantPlus experts. Read the document after receiving trial demo access to the system, and check whether you took into account all the nuances when drawing up the UE for 2022. It's free.

Basic provisions of accounting under OSNO

Reflect in your accounting policy the main points related to accounting:

- The person responsible for accounting. Usually such a responsibility is assigned to the chief accountant, but Art. 3 Federal Law No. 402 offers other options, for example, outsourcing accounting.

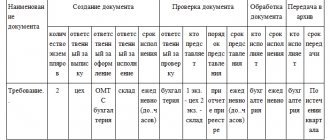

- Primary forms. You can use standard document forms or develop your own.

- Method of calculating depreciation. PBU 14/07 and PBU 6/01 offer 4 options for calculating depreciation of fixed assets and 3 intangible assets.

- Limit on the value of fixed assets. Assets that, by all indications, belong to fixed assets, but cost less than 40,000 rubles, you can recognize as part of the inventory (clause 5 of PBU 6/2001).

- Revaluation of fixed assets. The legislator allows for the revaluation of fixed assets and intangible assets. Whether you get involved with this or not is up to you. But know that once you have re-evaluated, you are obliged to do it regularly, but not more than once a year.

- Accounting for inventory items. In this section, you establish the procedure for assessing inventories and their write-off for production, the procedure for procuring materials, and assessing finished products. Decide whether you will count materials on accounts 15 and 16, or limit yourself to only account 10.

- Income and expenses. Reflect which income and expenses relate to the main activities and which to other activities.

- Materiality criterion and recognition of significant errors. You can determine which reporting indicators are subject to disclosure. For example, if the size of the indicator is 5% or more of the balance sheet currency, it is subject to disclosure. It’s the same with errors - you independently choose the threshold of their significance (clause 3 of PBU 22/10).

The list is not closed. You can include other information that is important for your goals and activities in your accounting policy.

Procedure for accounting for transport costs

The procedure for accounting and distribution of TZR for accounting purposes is determined by FSBU 5/2019.

The costs of delivering materials and other supplies to the organization are included in the TRP if they are paid separately from the contract price of the purchased supplies. They are taken into account in one of the following ways: directly in the actual cost of inventories, as part of variances, or, if the organization is trading, in selling expenses.

The costs of delivering inventories to customers are not included in the inventory. They are accounted for as sales expenses in account 44 “Sales expenses”.

The trading company chooses the accounting method itself and necessarily reflects it in the UP.

IMPORTANT! For tax purposes in trade, there is a unified procedure for recording and distributing goods and materials. It is set out in Art. 320 Tax Code of the Russian Federation.

more about it in the article “Distribution of transport costs for the remaining goods” .

Procedure for accounting for sales expenses

For trading companies, the list of costs that can be attributed to selling expenses is significantly expanded compared to enterprises engaged in manufacturing. At the same time, there are such expenses for which you should decide on accounting options, disclosing them in the UP:

- Costs for delivery of goods to the warehouse of a trading company during purchases. This type of TZR can be taken into account:

- in the cost of goods (more on this in the previous section);

- as part of sales expenses on account 44 (if, according to business conditions, it is advisable to take such expenses into account separately from the purchase price of goods).

In this case, the costs of delivering goods to customers are considered selling expenses in any case.

NOTE! TKR included in the cost of goods are taken into account for tax purposes upon the sale of this product, and TKR reflected in the cost of sales are accepted for tax purposes one-time in the amount received by calculation for a certain period.

- Writing off sales expenses after a period (usually a month) can occur in 2 ways:

- in the amount accumulated during the period in full;

- with the distribution of the accumulated amount of expenses: the part related to the goods actually sold is written off, and a balance is formed on the 44th account, corresponding to the share of expenses attributable to the balance of goods in the warehouse.

- The costs of packing and packing goods on your own have the same accounting options as the costs of delivering goods to the warehouse:

- included in the cost;

- included in selling expenses.

To learn about what determines the difference in accounting for goods and materials and transportation costs for sales, read the material “Are transportation costs direct or indirect costs?”

Making changes to accounting policies

Ensure that accounting policies comply with applicable laws and make timely amendments. It is allowed to either completely rewrite the document or introduce additional points by order. You are required to make changes in 3 cases:

- tax or accounting legislation has changed;

- operating conditions have changed;

- The company has developed new accounting methods that increase the quality and transparency of information.

The manager has 3 months to approve the accounting policy. The changes come into force from the beginning of the reporting year (clause 14 of PBU 1/2008) and may affect other documents, for example, a chart of accounts, primary registers, etc.

Nuances of VAT accounting

In terms of VAT, the UP of a trading enterprise should include at least:

- Application (or non-application) of VAT exemption on the list of goods in accordance with Art. 149 of the Tax Code of the Russian Federation. As well as the procedure for maintaining separate accounting for groups of goods with different VAT taxation.

Read more about this in the article “Which goods not subject to VAT are enshrined in the Tax Code” .

- If there are transactions taxed at a rate of 0% (in particular, exports), the procedure for maintaining separate accounting for goods taxed at a rate of 0% and taxed at regular rates.

ConsultantPlus experts explained in detail how to keep separate records of “input” VAT when combining taxable and non-taxable transactions. If you do not have access to the K+ system, get a trial demo access and go to the material for free.

3. Basic aspects of document flow, for example:

- principle of invoice numbering;

- the procedure for maintaining records of received and issued invoices, the purchase book and the sales book (for example, the method of entering data by department).

Accounting policy when combining simplified taxation system and UTII

When combining the simplified tax system and UTII, the importance of accounting policies increases. In 2022, when combining special regimes, the company must keep separate records of income, property, and other obligations (clause 7 of Article 346.26 of the Tax Code of the Russian Federation). If this cannot be done, then the distribution is made in proportion to the share of income in the volume of revenue (clause 8 of Article 346.18 of the Tax Code of the Russian Federation).

Read about the conditions and options for combining tax regimes in the article “Features of combining the UTII and simplified tax system regimes at the same time.”

From 2022, all activities will automatically be transferred to the simplified tax system and there will no longer be a need to divide income and expenses.

The accounting policy describes the procedure for maintaining the types of accounting used.

The rules for drawing up accounting policies are as follows:

- accounting methods are selected that will operate in all divisions of the company;

- accounting methods during the tax period must remain unchanged;

- the rules are approved by order of the head;

- if the selected rules do not allow the preparation of reliable reporting, this is reflected in the explanatory note to it with appropriate justification.

The specific accounting option is determined based on the volume of subsequent accounting work. The newly created organization must prepare and approve its accounting policies within 90 days from the date of registration.

It should be understood that tax authorities begin their audits with constituent and accounting documents. Accounting policies are the most requested document during an audit. It is also in demand during arbitration proceedings. Arbitration is guided by the accounting methods specified in this document.

Let us note that the accounting policy rules developed by the taxpayer (in case of ambiguities in legislative acts) are interpreted in his favor (Clause 7, Article 3 of the Tax Code). He has the right to develop and include in it a methodology for calculating a particular indicator used for accounting or calculating tax.

In the sections of the accounting policy, you need to indicate the sub-accounts for which the company will be accounted for for each type of taxation. It is also necessary to provide a methodology for allocating costs for different types of activities. The division can be carried out in proportion to the amount of income for each type of activity.

Certain questions regarding inventory

The nuances that will need to be included in the UE will depend on the specifics of the trading activity. For example:

- Those who sell food products need to stipulate in the UP that the frequency of inventory is more frequent than for those who sell non-food products. It is necessary to provide for nuances associated with such specific issues as natural loss rates. In addition, it is necessary to establish a procedure for promptly identifying and writing off expired goods that have lost their consumer properties.

More details about this can be found in the article “Procedure for writing off expired goods .

- For pharmacy organizations, it is necessary to provide in the UP both the procedure for identifying and writing off medical products by expiration date, and compliance with certain conditions for the storage and release of certain goods.

More about the nuances of pharmacy trade - in the material “Rules for accounting in a pharmacy (nuances)” .

Nuances of accounting for individual transactions from 2022

Innovations that must be taken into account when drawing up accounting policies for accounting purposes for 2022 are the following:

- From 01/01/2022, PBU 6/01 “Accounting for fixed assets” will no longer be in force, and fixed assets accounting will be regulated by two new FSBUs 6/2020 and 26/2020. Read more about them here.

Find out what changes to make to the accounting policy in accordance with the new Federal Accounting Standards in ConsultantPlus. This material will help you navigate the innovations of FSBU 6/2020; this article will help you navigate FSBU 26/2020. Trial demo access to the system is provided free of charge.

- From 01/01/2022, FSB 27/2021 “Documents and document flow” will become mandatory.

For details, see the material “How to work in the new FSBU 27/2021 “Documents and document flow in accounting””.

- From 2022, lease transactions must be accounted for in accordance with FAS 25/2018 “Lease Accounting”, approved by Order of the Ministry of Finance of Russia dated October 16, 2018 No. 208n.

ConsultantPlus experts explained in detail how an organization can switch to rental (leasing) accounting according to the new FSBU 25/2018. Get trial demo access to the K+ system and upgrade to the Ready Solution for free.

Accounting policy of individual entrepreneurs on the simplified tax system

Income accounting

There is no need to fully indicate the formation of the revenue part of the tax base in accordance with the Tax Code. Accounting policy of individual entrepreneur simplified tax system “income”, sample may include:

- what is classified as income from main activities and what is classified as other (when separately accounting for different regimes, for example, simplified tax system and UTII, a procedure for their distribution is needed);

- accounting for advances;

- other necessary points (for example, the procedure for adjusting the tax base - correcting errors, returning advances and erroneous payments, etc.).

For the accounting policy of individual entrepreneurs on the simplified tax system “income”, which provides for tax accounting, it is enough to additionally write off clauses on the write-off of expenses that reduce the base (the method of their distribution is especially important if there is separate accounting) - contributions, sick leave at the expense of the employer and accounting for sales tax. Since expenses under the simplified tax system of 6% do not affect tax obligations, it makes sense to enter further points into the document only when maintaining full-fledged accounting records.

Therefore, we will further take the individual entrepreneur’s accounting policy “income minus expenses” as a basis.

Fixed Asset Accounting

The accounting policy includes information about the accounting of fixed assets. What they indicate:

- the procedure for determining the initial cost (the amount of actual acquisition costs);

- which objects are accounted for as inventories, and which are included in fixed assets;

- whether the service life of the previous owner is taken into account, or the depreciation rate is determined by the classifier;

- the procedure for writing off the cost, including in case of partial payment of property.

Indicate the method of calculating depreciation (linear or non-linear), as well as whether special coefficients or depreciation bonuses are applied.

This section is also important in the accounting policy of individual entrepreneurs on OSNO, since depreciation of fixed assets reduces tax liabilities.

Materials accounting

Describe the procedure for determining the cost of raw materials and materials. Are transportation and procurement costs included in the cost (or are they taken into account separately). How to write off:

- at average cost;

- at the cost of each unit;

- at the cost of the first acquisition in time (FIFO).

You can specify which documents serve as the basis for write-off.

Goods accounting

The document indicates how the cost of goods is formed and whether transport costs are taken into account. How to write off:

- at average cost;

- by unit cost;

- using the FIFO method.

You can describe in detail the methodology for determining the amount of expenses for goods included in the tax base.

Expenses

In the section you can indicate how other costs are formed (for example, for fuel and lubricants). When accounting separately, it is necessary to describe exactly how the taxpayer distributes expenses (including staff salaries, contributions, sick leave) between different regimes.

Losses

Since, with a simplified tax system of 15%, losses from previous years can reduce the tax base, you can prescribe the procedure for their accounting (maintaining a separate register, if there is one). Next, indicate how they are taken into account when obtaining annual profit. The accounting policy of individual entrepreneurs on the simplified tax system, a sample for “income minus expenses,” can be downloaded below.