Accounting for write-offs of medicines

The write-off of medicines in budgetary institutions has peculiarities in its documentation, and in accounting it is carried out according to the rules applied to other materials.

Inventory and materials are written off according to instructions developed by the organization. All financially responsible persons working with such values must confirm in writing that they are familiar with it.

Actually, I'm interested in the following - where to buy. Maybe one of the forum participants uses (produces) this nasty arsenic hydrogen at their enterprise and knows where to get a package or two of Mecaptide? And somehow without him there is no fountain. Carrying out pharmaceutical activities in gross violation of licensing requirements entails liability established by the legislation of the Russian Federation (clause 6 of the Licensing Regulations). A gross violation means the licensee’s failure to comply with one of the requirements provided for in clause 5 of the regulation.

First aid kit: purchase, account for, write off

In the future, it will be he who will be responsible for its safety and promptly inform the accounting department about used or unsuitable medicines. Medicines purchased to replenish the first aid kit must also be taken into account in subaccount 234. From an accounting point of view, the medicines contained in the first aid kit are valuables that must be taken into account.

The main tax department of the country in Letter No. ED‑4‑3/9486 dated June 16, 2011 emphasized: from the definition of the concepts of “substandard medicines” (clause 38 of article 4), “pharmacopoeial monograph”, “normative documentation”, “regulatory document "(Clause 19 - 21 of Article 4) it does not follow that medicines with an expired shelf life in the terminology of the legislation are considered to be of poor quality.

What documents are needed to formalize such a write-off? Is it possible to take into account the cost of written-off inventories in tax expenses?

The state-owned institution "Alpha" centrally purchased light bulbs for the warehouse. In July, 100 light bulbs were transferred from the warehouse to the storekeeper of one of the departments (price - 20 rubles per piece). Material supplies were transferred to the department on the basis of a demand invoice (f.

Accounting for purchases of first aid kits in public sector organizations

For your information, according to OK 034-2014 (CPES 2008), in government agencies and other public sector organizations, a first aid kit is classified as class. 21, referred to literally as: “Medicines and materials used in medicine. purposes" (which corresponds to code 21.20.24.170). This classifier, currently used, was introduced by Order of Rosstandart No. 14-st dated January 31, 2014 (as amended on February 20, 2020). Direct purchase of honey. funds (according to Cl. 21) are payable in relation to KOSGU code 341. Their further accounting is carried out using an account. 105 01.

A government agency can include car first aid kits on the account. 105 36 “Other mat. reserves." Despite the fact that it contains dressing materials, most experts do not recommend using scht for this purpose. 1,105,31,000 (“medicines, dressings”). Rationale: first aid kit - independent medical care. a product that is not classified as a dressing. materials. Meanwhile, to avoid disputes on this part, it is recommended to consolidate the accounting procedure in your own accounting policy. This right is designated by the Ministry of Finance of the Russian Federation in letter No. 02-05-10/39839 dated July 10, 2015. The first aid kit is written off at the end of its expiration date in the following way: according to DT 1 401 20 272 and CT 1 105 36 440.

The reason for writing off the first aid kit is in the write-off act

The medical organization wrote off the medications due to the expiration date. During an inspection, TFOMS recognized this as a misuse of funds and demanded that the money be returned to the budget and a fine be paid. According to the controllers, the violation was that the organization did not plan the need for medicines and did not take into account their expiration date...

In cases where no economic benefits are expected from the sale or further use of materials, they can be written off as having become unusable after their expiration date, as obsolete or as damaged. This rule applies regardless of whether the institution belongs to the healthcare sector or not. Accordingly, first aid kits should be accounted for on the balance sheet account 1,105,31,341.

If you have decided (or are required by law) to transfer unusable materials to a third-party organization for disposal or destruction, then to account for the costs associated with disposal (destruction), use the act of transfer of supplies to this organization.

In the inventory list of goods and materials, we recommend indicating the name, dosage form, dosage, unit of measurement, series, quantity, as well as information about the container or packaging, the name of the manufacturer of the medicines, and the expiration date of the medicines.

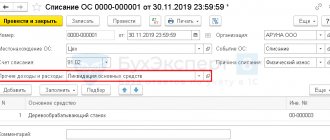

The 1C:Accounting 8 program implements a more careful approach - drawing up an act for each fact of writing off materials.

They recommend recording medicinal products for medical use that are subject to subject-quantitative accounting according to nomenclature units.

The fact is that specialists from regulatory agencies do not always agree with monthly frequency, and companies often have to defend the legality of this approach in court. Despite the existence of positive judicial practice (see, for example, Resolution of the Federal Antimonopoly Service of the Moscow District dated September 13, 2004 No. KA-A40/8081-04), sometimes it is better to use an approach that avoids litigation.

How to account for first aid kits for providing first aid to employees in a government institution? Which account (behind the balance) should it be accounted for and at what point should it be written off?

This time, the discussion among opinion leaders included questions about the procedure for reflecting expenses related to vacations, as well as the payment of one-time assistance for their recovery, when taxing profits.

In every organization that works with inventory items (hereinafter referred to as goods and materials), there comes a time when they need to be written off.

Accounting for medications requires special attention. It is drawn up with strictly regulated documents, which must be checked and controlled not only by the institution’s accountant, but also by the manager.

Directly list of honey. the funds that should be included in a first aid kit are determined by Order of the Ministry of Health and Medical Industry of the Russian Federation No. 325 (see link above).

Write off only bandages as expenses. As you can see, medications are not on this list. Moreover, medical products included in the list cannot be replaced. But, you see, it’s absolutely impossible to provide first aid, for example, in case of a heart attack with a bandage. At a minimum, the employee needs to measure their blood pressure and give them a validol tablet.

Thus, regardless of the presence of harmful production factors, the employer is required to have first aid kits in the organization. The source of purchase of medical first aid kits can be the organization’s own funds, as well as funds from the Federal Social Insurance Fund of the Russian Federation to provide financial support for preventive measures to reduce industrial injuries and occupational diseases of workers. The write-off of expired medicines is reflected by posting to the debit of account 7480 “Other expenses” and the credit of account 1330 “Goods”, while such expenses for tax purposes are recognized as expenses that are not deductible.

In the order, indicate the property subject to inventory and the reason for it. Otherwise, the order is drawn up in the same way as for an annual inventory.

Starting from version 3.0.69, the 1C:Accounting 8 program has implemented the ability to generate a printed form of an act for writing off materials, which is used to confirm the fact of expenditure of material assets.

Changes in requirements for first aid kits

Since September 2022, new requirements for the first aid kit at the enterprise have appeared; to be more precise, the new requirements relate to the contents of the first aid kit. The fact is that a new order came into force, which canceled the old order.

Previously, the first aid kit for employees was equipped according to order 169n dated 03/05/2011. From September 1, this order lost force due to the entry into force of the order of the Ministry of Health and Social Development dated September 18, 2020 No. 995n.

Starting from September 1, 2022, the first aid kit will be equipped according to another order.

The first aid kit is formed in accordance with the order of the Ministry of Health and Social Development dated December 15, 2020 No. 1331n.

The formation of a first aid kit according to order 1331n must be carried out from September 1, 2022. If the enterprise has a first aid kit for employees under an order that has expired, then it can be left until the end of the expiration date, but no later than August 31, 2025.

Did you buy a first aid kit using your personal injury contribution and don’t know if VAT can be deducted? The answer is in our review “Purchase of personal protective equipment at the expense of the Social Insurance Fund: what about VAT deduction” .

Instructions on how to write write-off acts correctly, sample form

At the same time, materials from inspections of the activities of organizations confirm that the formation of an act is mandatory.

The forum is intended to answer specific questions when something is not clear or a difficult situation has arisen.

The Moscow Federal Tax Service, in particular, confirmed that expenses in the form of the cost of expired medicines, as well as expenses associated with their destruction, can be taken into account for profit tax purposes, provided that they were incurred within the framework of business activities and documented confirmed (Letter dated March 12, 2012 No. 16‑15/).

Thus, medical devices with a useful life of less than 12 months are included in the inventory group.

How to draw up a write-off report for medications

From 01/01/2013, the forms of primary accounting documents contained in albums of unified forms of primary accounting documentation are not mandatory for use. At the same time, they can be used for accounting.

The situation caused by the spread of coronavirus infection in 2022 led to the additional purchase of masks, medical disinfectants, and antiseptics. According to the explanations of specialists from the Ministry of Finance, such preventive measures can be considered as labor protection costs.

Material supplies were transferred to the department based on the invoice requirement (). In the same month, the storekeeper issued light bulbs to the electrician according to the statement of issue of material assets for the needs of the institution (). Write-offs of first aid kits containing mandatory medications are carried out in the manner established by the organization’s accounting policy (for example, 100% of the cost of the first aid kit (medicines) when they are transferred to the sites).

These include both medical instruments and medical equipment, as well as dressings.

Correspondence of accounts: How to reflect in the accounting of a government (budgetary, autonomous) institution the acquisition and write-off of dressings for providing first aid to employees of the institution?..

The rest should take into account medications, including first aid kits, in subaccount 234 “Household materials and office supplies.”

Accounting for purchases of first aid kits in public sector organizations

For your information, according to OK 034-2014 (CPES 2008), in government agencies and other public sector organizations, a first aid kit is classified as class. 21, referred to literally as: “Medicines and materials used in medicine. purposes" (which corresponds to code 21.20.24.170). This classifier, currently used, was introduced by Order of Rosstandart No. 14-st dated January 31, 2014 (as amended on February 20, 2020). Direct purchase of honey. funds (according to Cl. 21) are payable in relation to KOSGU code 341. Their further accounting is carried out using an account. 105 01.

A government agency can include car first aid kits on the account. 105 36 “Other mat. reserves." Despite the fact that it contains dressing materials, most experts do not recommend using scht for this purpose. 1,105,31,000 (“medicines, dressings”). Rationale: first aid kit - independent medical care. a product that is not classified as a dressing. materials. Meanwhile, to avoid disputes on this part, it is recommended to consolidate the accounting procedure in your own accounting policy. This right is designated by the Ministry of Finance of the Russian Federation in letter No. 02-05-10/39839 dated July 10, 2015. The first aid kit is written off at the end of its expiration date in the following way: according to DT 1 401 20 272 and CT 1 105 36 440.

How to properly write off expired medications

When making a decision to classify property as one or another group of non-financial assets of the profile commission, it is necessary to be guided by the GHS “Fixed Assets”, as well as Instruction No. 157n. The assignment of property to fixed assets is carried out when the criteria listed in paragraphs are met. 7, 8 GHS “Fixed assets”, pp. 38, 39 Instructions No. 157n.

The Council of Ministers amends Appendix 1 to Resolution No. 948 dated December 31, 2019 “On the implementation of Decree of the President of the Republic of Belarus dated December 23, 2022 No. 475.”

Based on the results of the inventory, by decision of the commission, a protocol is drawn up on the list of expired medicines subject to write-off, which is approved by the management of the subject.