The concept of financial assistance, its general characteristics and procedure for registration

Financial assistance is a monetary payment to an employee of an organization, which is made on the basis of a decision made by the management of the company due to the occurrence of an event that is associated with the need for payment.

Neither the Labor Code of the Russian Federation nor other regulations governing labor relations contain an exhaustive list of such events. Formally, financial assistance can be paid when an employee experiences any situation that the organization’s management associates with the need for payment. As a rule, provisions on the procedure and grounds for payment of financial assistance are enshrined either in local acts of the enterprise or in a collective agreement. However, this does not mean that in the absence of local regulation, the employer does not have the right to pay financial assistance, since making such payments is his prerogative. At the same time, the employer has no obligation to pay money to employees if there is no regulation of the procedure for making payments in the organization.

Application for financial assistance in connection with the birth of a child

One of the happiest, but also financially costly events in an employee’s family is the birth of a long-awaited offspring. A caring employer has the right to share the joy and, to some extent, the costs of his employee.

The reasons for financial support, which may well include the birth of a baby, are listed in the relevant local regulatory act of the organization, for example, a collective agreement. Even if such a document has not been adopted by the company, the law does not prevent an employee from asking for financial assistance from his superiors, and the employer from satisfying this request, or, indeed, from refusing.

You need to contact the employer by writing and submitting an application in his name, where you need to indicate the reason for providing assistance and justify it with documents. The application form will be standard, accepted for this company. The main thing to remember when submitting this document is the need to attach a copy of the child’s birth certificate to it, this will become documentary evidence of this fact for accounting and management.

IMPORTANT! We are not talking about a benefit paid at the birth of a child without fail. In addition to this legally defined payment, the employer can award the happy father or mother an amount in excess of social guarantees.

The amount is determined by the employer, but the employee can indicate a certain figure in the application. The employee will receive it based on the order signed by the manager.

How to apply for financial assistance?

The procedure for registration and payment of financial assistance to workers is not fixed at the legislative level, however, based on the general provisions of the Labor Code of the Russian Federation and other acts in the field of regulation of labor relations, we can come to the conclusion that:

- payment can be made on the basis of an application from the employee, a memo from the employee’s immediate superiors, or without such documents, based on the will of the organization’s management;

- the decision to make payments is made by the employer, i.e. an administrative act is required that expresses such a will (order, instruction);

- a clear payment procedure can be established in local documentation or a collective agreement.

Attention! Sample from ConsultantPlus See a sample of the Regulations on the payment of financial assistance to employees of the organization.

Application for financial assistance due to a difficult life situation

The employer has the right to provide financial support to employees in any ups and downs of life, although it is not obliged to do so. His good will should be reflected in the local documentation of the organization: the law allows you to determine the parameters of such assistance independently, the main thing is not to contradict the Labor and Tax Code of the Russian Federation. What employers and employees should remember in connection with financial support:

- payment of assistance cannot be permanent, this payment is one-time and individual in nature;

- exceeding the amount of 4000 rubles. per year leads to mandatory deduction of interest from it to social funds;

- the amount to be paid is determined solely by the employer and cannot be disputed.

The employer should be notified of life difficulties that require financial support to overcome in writing. The application is submitted to the head of the organization. It must explain the reason for the request for help, supporting it with documentary evidence. The employer can offer help to the employee himself, but it is still better to write a statement.

The amount is calculated depending on the expenses incurred to overcome difficulties (these, of course, need to be confirmed).

A difficult life situation is one in which, as a result of poverty, the life of an employee or his family may be disrupted. The law includes the following circumstances:

- the appearance of a dependent relative over 65 years of age or the employee reaching this age;

- difficulties in finding a job for an able-bodied family member (assigning him the status of unemployed);

- the presence of small (minor) children or one child in the family;

- disability of one of the family members.

Some employers do not allow difficulties to be described in the application, limiting the applicant to the vague wording “due to difficult financial situation.”

Sample application for financial assistance due to a difficult life situation

To the General Director of Kolovrat LLC, Anton Leonidovich Evstigneev, from the caretaker Liliya Nikolaevna Rusinskaya

STATEMENT

I ask you to provide my family with the financial assistance necessary to prepare my three children for the start of the school year.

I am attaching to the application:

- certificate of family composition;

- certificate of a mother of many children;

- cash receipts for stationery and school uniforms.

08/18/2016 /Rusinskaya/ L.N. Rusinskaya

In what cases can financial assistance be paid?

The following types of financial assistance are distinguished:

- one-time (one-time) or periodic;

- expressed in cash (rubles) or in kind, in particular medicines, things, etc.

- associated with certain events in the employee’s current activities (for example, going on another paid leave), with negatively characterized events (for example, the illness of a relative of an employee) or with positively characterized circumstances (for example, the birth of an employee’s child).

The grounds for payments include:

- employee retirement due to age;

- birth of children;

- employee's wedding;

- employee illness;

- illness of his family members;

- death of a relative;

- another paid vacation.

Since the payment procedure may differ in different organizations, and in some companies it is not fixed at all, we will next consider the most typical methods of obtaining financial assistance.

Regulatory regulation

Financial assistance is a one-time social payment related to certain circumstances:

- the birth of a child;

- marriage;

- treatment;

- difficult financial situation;

- emergency, etc.

Financial assistance for vacation, if it is specified in an employment or collective agreement as an element of remuneration and is related to the performance of labor functions of employees, is not material assistance in its essence. Rather, it is a one-time payment for vacation, paid in the form of financial assistance.

BOO

Material assistance provided for in an employment contract as part of the organization’s remuneration system is reflected in accounting in the same way as the salary of the employee to whom it was accrued (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n).

In other cases, material assistance is accounted for in account 91 “Other income and expenses” (clause 12 of PBU 10/99, Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n).

WELL

Material assistance provided for in an employment contract, collective agreement, local regulations and related to the employee’s performance of work duties is included in wage costs (clause 25 of article 255 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated September 2, 2014 N 03-03-06/ 1/43912, dated 09/24/2012 N 03-11-06/2/129).

In other cases, financial assistance cannot be taken into account in expenses (Clause 23, Article 270 of the Tax Code of the Russian Federation).

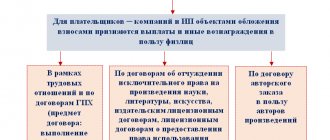

Personal income tax and insurance premiums

Financial assistance for vacation over 4,000 rubles. for the calendar year is subject to personal income tax and insurance contributions (clause 28 of article 217 of the Tax Code of the Russian Federation, clause 11 of clause 1 of article 422 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated October 22, 2013 N 03-03-06/4/44144).

The date of receipt of income for personal income tax accounting purposes is the date of payment of financial assistance (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

The deadline for transferring personal income tax is no later than the next day after its payment (clause 6 of article 226 of the Tax Code of the Russian Federation).

The deadline for transferring insurance premiums is until the 15th day of the next calendar month (clause 3 of Article 431 of the Tax Code of the Russian Federation, clause 4 of Article 22 of Law No. 125-FZ).

How is financial assistance paid? Consolidation of the payment procedure in local acts of the organization

Part 2 art. 5 of the Labor Code of the Russian Federation stipulates that labor relations can be regulated in various ways, in particular, through the adoption of collective agreements, agreements or local acts. Regarding the procedure for paying financial assistance, the following options are possible:

- a collective agreement is adopted regulating the procedure for paying financial assistance;

- a local act is approved, which sets out the procedure and grounds for payments;

- this issue is generally ignored (which also does not contradict the law).

The procedure for adopting local acts is enshrined in Art. 8 Labor Code of the Russian Federation. The right to their acceptance by the employer is established by Part 1 of Art. 22 Labor Code of the Russian Federation. They may also establish the rights and obligations of the employer and workers, as follows from the provisions of Art. 20 Labor Code of the Russian Federation.

It is possible that such rights and obligations may also be established regarding the need for payment by the employer and the possibility of employees receiving amounts of financial assistance. At the same time, compliance with the local act adopted at the enterprise is mandatory for both parties to the labor relationship.

A local act is an administrative document drawn up by the employer, therefore, when adopting it, the company’s management, as a rule, focuses on its rights, but not its obligations. This is understandable, since it is unprofitable to force yourself into a framework by prescribing obligations to pay amounts of financial assistance to employers. It is much more profitable from the manager’s point of view to leave this issue vague, without fixing specific obligations, but nevertheless leaving the possibility of payments at his own discretion.

In this regard, workers who want to consolidate the procedure for paying financial assistance will achieve more effective results if they initiate a negotiation procedure with the aim of adopting a collective agreement.

Other grounds

Financial assistance for other reasons. An employer can provide assistance to its employees for any other reasons, for example: on the occasion of the death of his brother/sister; for vacation; in connection with marriage; due to a long illness.

Amounts of such material assistance are not subject to personal income tax and contributions to funds only within the limit of 4,000 rubles per employee per tax (settlement) period (clause 28 of article 217 of the Tax Code of the Russian Federation; subclause 11 of clause 1 of article 422 of the Tax Code of the Russian Federation; subclause 12 Clause 1, Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ).

In the 2-NDFL certificate (order of the Federal Tax Service of Russia dated January 17, 2022 No. ММВ-7-11 / [email protected] ), which the tax agent is obliged to submit to the Federal Tax Service at the end of the year no later than April 1 (clause 2 of Art. 230 of the Tax Code of the Russian Federation), not all financial assistance should be reflected, but only according to the available corresponding codes 2710, 2760, 2762, as well as deductions from it - 503, 508 (order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] ).

For example, for financial assistance provided to an employee in connection with the death of a close relative, a code is not provided; accordingly, these amounts do not need to be indicated in the 2-NDFL certificate.

The tax agent is obliged to submit Form 6-NDFL to the Federal Tax Service based on the results of each quarter no later than the last day of the month following the corresponding period, and for the year - no later than April 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation) (order of the Federal Tax Service of Russia dated October 14 2015 No. ММВ-7-11/ [email protected] ).

Financial assistance, for which codes are provided, is reflected both in the first section and in the second. The date of receipt of income in the form of financial assistance is the date of its payment to the employee (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). For example, assistance in connection with a marriage was accrued by order of the manager in January 2022 in the amount of 15,000 rubles, and paid on payday February 7, 2022. On the same day, personal income tax was withheld and transferred from her. The date of receipt of income will be February 7, 2022.

Due to the fact that some financial assistance is income subject to insurance premiums, it should be reflected in the quarterly calculation of insurance premiums (Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11 / [email protected] ), which the employer submits to the Federal Tax Service no later than the 30th day of the month following the billing period (clause 7 of Article 432 of the Tax Code of the Russian Federation). And also in Form 4 - FSS (Order of the FSS of the Russian Federation dated September 26, 2016 No. 381), which the employer submits quarterly to the FSS on paper no later than the 20th day or in the form of an electronic document no later than the 25th day of the month following for the reporting period (clause 1 of article 24 of the Federal Law of July 24, 1998 No. 125-FZ).

As a rule, material assistance is non-productive in nature, and these expenses cannot be justified, economically justified expenses (Clause 1 of Article 252 of the Tax Code of the Russian Federation). That is why its amount does not reduce the income tax base if the organization applies OSNO (clause 23 of Article 270 of the Tax Code of the Russian Federation), and is not taken into account in expenses when applying the simplified tax system “income minus expenses” (clause 2 of Article 346.16 of the Tax Code of the Russian Federation) . An exception is financial assistance for vacation, provided that it is enshrined in an employment or collective agreement and depends on the amount of wages and compliance with labor discipline (letter of the Ministry of Finance of Russia dated September 2, 2014 No. 03-03-06/1/43912). But insurance premiums calculated from financial assistance in excess of the limits can be included in expenses for all organizations (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation and subclause 7, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Reflection of financial assistance in section 1 of form 6-NDFL for the first quarter

| Line code | Name | Sum |

| 020 | Amount of accrued income | 15,000 rub. |

| 030 | Amount of tax deductions | 4000 rub. |

| 040 | Amount of calculated tax | 1430 rub. |

| 070 | Amount of tax withheld | 1430 rub. |

Reflection of financial assistance in section 2 of form 6-NDFL

| Line code | Name | Row exponent |

| 100 | Date of actual receipt of income | 07.02.2018 |

| 110 | Tax withholding date | 07.02.2018 |

| 120 | Tax payment deadline | 08.07.2018 |

| 130 | Amount of actual income received | 15,000 rub. |

| 140 | Amount of tax withheld | 1430 rub. |

Securing the procedure for paying financial assistance in a collective agreement

By virtue of Art. 40 of the Labor Code of the Russian Federation, a collective agreement is a legal act that regulates various relations within the company. It is concluded between employees and the employer, through representatives, through collective bargaining (Chapter 6 of the Labor Code of the Russian Federation).

Part 1 art. 41 of the Labor Code of the Russian Federation, which determines the content and structure of the collective agreement, does not exclude that such a document may also stipulate the employer’s obligations to pay financial assistance and the procedure for such payments.

If, when adopting a local act, the employer acts independently (in some cases, the opinion of the trade union is taken into account, by virtue of Part 2 of Article 8 of the Labor Code of the Russian Federation), then the collective agreement is adopted through active discussion of its content by representatives of both parties to the labor relationship, which implies that in such In the document, the rights of employees to receive financial assistance will be reflected in more detail. In addition, employees can independently initiate the procedure for conducting collective bargaining, and the employer does not have the right to refuse to participate in them.

It is advisable to reflect in the contract the detailed procedure and cases of payment of financial assistance, which will allow regulating these legal relations.

List of documents that may be necessary to obtain financial assistance for an employee

Since the issue of payment of financial assistance is not regulated at the legislative level, there is no mandatory package of documents that must be submitted to the employee in order to receive the payment. At the same time, collective agreements and local acts may establish such a list.

Since financial assistance is paid due to the occurrence of various events in the employee’s life, documents must confirm the fact of their occurrence. The main document is an application or memo. On their basis, the procedure for issuing financial aid is initiated.

What additional documents are required to be provided depends on the situation:

- If an employee applies for financial assistance in connection with the birth of a child, he must provide a birth certificate.

- If an employee gets sick and needs money for treatment, a doctor’s report and/or a medical commission will be required, as well as other documents confirming the presence of the disease.

- If an employee goes on vacation and therefore wants to receive financial assistance, evidence of going on vacation can be a vacation schedule or an order from the employer. Management already has these documents, so in such a situation it is advisable to submit only an application for payment.

- If a family member of an employee has died, it is necessary to provide the employer with a death certificate or a court decision recognizing the family member as deceased.

How is the allocation of financial assistance in an organization formalized?

To allocate financial assistance, the manager must issue a special order. An application written in any form is required from the employee who needs help. Supporting documents should be attached to it, which can be a birth or adoption certificate of a child, a death certificate of a family member, etc.

In the payment document, in the column “Base of payment”, the accounting department must indicate the number and date of the manager’s order to allocate financial assistance. If payments are made in tranches rather than in a lump sum, such a link should be included in each payment document.

Application for financial assistance and its sample, memo (memorandum)

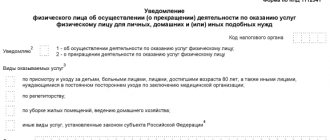

In order for the employer to learn that an event has occurred in the employee’s life that may serve as a basis for payment of financial assistance, the employee needs to notify him about it. Notification is made on the basis of an application.

The application form is not fixed by law, but can be provided in a local act or collective agreement. The legislation also does not contain any requirements for the application.

A sample of such a document might look like this:

To the Director of Iris LLC

Petrov T.N.

From senior manager

Karpova T. G.

Statement

I ask you to provide me with financial assistance in the amount of 5,000 rubles. due to the need to purchase medications to treat detected kidney disease.

Attachment: a copy of the conclusion of the medical commission of the BUZ "Moscow City Clinic" dated 07/12/2020 No. 127-ZK, a copy of the prescription dated 07/12/2020 No. 129571, issued by doctor R.V. Anisimova.

07/12/2020 Karpov T. G. /Karpov/

The application is submitted in 2 copies. One copy is marked with the date of delivery and the signature of the person to whom the application was transferred, and the second copy is transferred to the employer.

The second way to notify the employer of the occurrence of a certain event related to the need to pay financial assistance is a memo, drawn up, for example, by the employee’s immediate supervisor.

A sample memo might look like this:

To the Director of Iris LLC

Petrov T.N.

From the head of the sales department

Ignatieva T.V.

Service memo

I would like to bring to your attention that on July 12, 2020, senior manager Karpov T.G. gave birth to a child - a daughter, Karpova V.T. I ask you to consider the possibility of providing Karpov T.G. with financial assistance in the amount of 5,000 rubles.

Ignatiev T.V. /Ignatiev/ 07/12/2020

Application for financial assistance in connection with the death of a relative

The grief that comes to a family not only has an emotional impact on all relatives, but also, as a rule, makes a significant hole in the budget. The employer, taking care of the staff, can help the bereaved employee a little financially. In this case, the funds are paid from the organization’s profit fund; these expenses have tax benefits.

To do this, the organization’s local regulations must stipulate this possibility and its regulations. For this purpose, a special Regulation may be created or the relevant information should be contained in the employment contract or collective agreement. Usually, not only the employee who has lost a loved one has the right to such a payment, but also, conversely, his relatives if the employee himself has died.

The first document required for the accrual of this type of financial assistance is the employee’s request, drawn up in the form of an application. In addition to the request for one-time financial support, the text must indicate:

- Full name of the manager (general director);

- all employee data (position and full name);

- degree of relationship with the deceased (close relatives in connection with whose death financial assistance is provided are brothers and sisters, children or parents of the employee);

- you can indicate the amount that the employer is asking for (it cannot be more than two months’ salary);

- a list of documents confirming relationship and death attached to the application;

- date, painting with transcript.

ATTENTION! It does not matter whether the amount of assistance is indicated in the application; in any case, the manager enters it into the Order, on the basis of which it will be calculated.

Sample application for financial assistance in connection with the death of a relative

To the General Director of Zarathustra LLC, Nikipelov Roman Olegovich, from the manager of the supply department, Anatoly Petrovich Rostovsky

STATEMENT

I ask you to provide me with financial assistance in connection with the death of a close relative - Rostovsky’s brother Mikhail Petrovich.

I am attaching to the application:

- certificate of family composition;

- death certificate of Rostovsky M.P.

06.20.2017 /Rostovsky/ A.P. Rostovsky

Is it possible to receive financial assistance without documents?

Receiving financial assistance without documents is possible only if the decision is made by the employer on his own initiative. If the initiator of the request for the transfer of financial assistance amounts is an employee, the application is a mandatory document. In the event that an employee’s immediate superior requests payment of financial assistance, an official memo is a mandatory document.

The decision to issue financial assistance can be made by the employer without documents proving the occurrence of a particular event in the employee’s life. Their presence, as a general rule, is not necessary (unless otherwise stated in a local act or collective agreement). At the same time, the employer may refuse payment due to the lack of proof of the occurrence in the employee’s life of an event that is cited as the basis for payment of financial assistance.

Sample order for provision of financial assistance

Payment of financial assistance is made on the basis of an order from the employer. Its form is not fixed by law. At the same time, it can be determined by the provisions of a local act or a collective agreement.

The order can be issued in the following format:

LLC "Iris"

Moscow

ORDER

About payment of financial assistance

07/12/2020 No. 124-ls

In connection with the illness of the chief manager of the operating department of Iris LLC, Irakov R.V., confirmed by the documents submitted by him (copy of the conclusion of the medical commission of the Moscow City Clinic dated July 12, 2020 No. 127-ZK, copy of the prescription dated July 12, 2020 No. 129571 ),

I ORDER:

Pay Irakov R.V. financial assistance in the amount of 5,000 rubles.

The payment of financial aid should be made together with the payment of the next salary for August 2022.

Reason: application of R.V. Irakov dated July 12, 2020, copy of the conclusion of the medical commission of the Moscow City Clinic dated July 12, 2020 No. 127-ZK, copy of the prescription dated July 12, 2020 No. 129571

Director of Iris LLC Vasiliev O.V. /Vasiliev/

Application for financial assistance in connection with treatment, surgery

An employer who values his employees, of his own free will or at their request, can help them financially if they need funds for treatment or surgery.

The law of the Russian Federation does not limit the amount of compensation for funds spent on treatment; the only limit is related to the amount not subject to taxes and contributions to social funds - the amount of such assistance should not exceed 4,000 rubles. per year for 1 person. In any case, the decision to authorize the payment, as well as the amount, is made by the employer.

Since this assistance is of an individual nature, it is not included in the employee compensation system. It is paid from the profit fund or unused funds for expenses.

An employee application is required to provide this assistance. In it, in addition to the usual details - “header”, title of the document, requests for financial assistance - you need to indicate the event due to which the employee urgently needs funds or compensation for expenses. There is no need to go into detail, describing the diagnosis and expenses; this information is provided in the documents attached to the application.

The decision to assign payment or refuse remains with the manager. If the decision is positive, an order is issued and funds are credited.

Sample application for financial assistance in connection with treatment or surgery

To the General Director of Fizkultprivet LLC, Alexander Rostislavovich Samodelkin, from the teacher of the chess section, Leonid Alekseevich Ferzenko

STATEMENT

In connection with the injury received as a result of a road traffic accident, I ask you to provide me with financial assistance for the expensive treatment ahead of me, including surgery.

I am attaching the following documents to the application:

- certificate from the traffic police about the accident;

- a copy of the sick leave certificate;

- a prescription issued by the attending physician;

- cash receipts for purchased medications;

- contract for paid surgical intervention;

- extract from the medical record.

06.25.2017 /Ferzenko/ L.A. Ferzenko

Purpose of payment when paying out financial assistance

When transferring amounts of financial assistance, you must indicate the purpose of the payment in the payment order. In addition, you should refer to information about the order on the basis of which the amount is paid.

For example, the column “Purpose of payment” can be filled in as follows: financial assistance to A. A. Ivanov in connection with the birth of a child, paid on the basis of the order of the director of Iris LLC dated July 12, 2020 No. 1.

The need to indicate the correct purpose of the payment is also related to taxation. Some types of financial assistance, in accordance with Art. 217 of the Tax Code of the Russian Federation are not taxed. The purpose of the payment will serve as proof that the money was spent specifically on the payment of financial assistance.

Important! Hint from ConsultantPlus Types of financial assistance that are partially (in the deduction amount) or completely exempt from personal income tax, and the grounds for such exemption are given in Art. 217 Tax Code of the Russian Federation. For a complete list of such payments, as well as cases and procedures for paying personal income tax on financial assistance, see K+.

What about taxes?

Since 2010, most reasons for social payments are not exempt from contributions to the Pension, insurance and other funds. Exempt from deductions:

- any help up to 4 thousand rubles. per year per employee;

- assistance related to the death of a close relative;

- accrual in case of emergency circumstances, including natural disasters;

- support for the birth of a newborn in an amount not exceeding 50 thousand rubles. for both parents.

Personal income tax is not charged if the amount of assigned payments does not exceed 4 thousand rubles. during a year.

Income tax has nothing to do with material assistance, since it has nothing to do with remuneration for work.

Results

Thus, the answer to the question of how to arrange financial assistance for employees may be different.

This is due to the fact that depending on the local documentation adopted by the organization, the procedure for processing payments may vary. At the same time, in all cases, payment is made on the basis of the employer’s order. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is material assistance subject to personal income tax?

In order to find out whether financial assistance to an employee is taxable, you should analyze Art. 217 Tax Code of the Russian Federation. As a general rule, financial assistance is taxed if its amount exceeds 4,000 rubles. (clause 28 of article 217 of the Tax Code of the Russian Federation). In this case, the tax on financial assistance is withheld when it is paid.

Otherwise, you should check the list of exceptions to determine whether financial aid is taxable in 2022. Thus, tax-free financial assistance in 2020 is payments in connection with:

- a natural disaster or other emergency circumstance (clause 8.3 of Article 217 of the Tax Code of the Russian Federation). Proof of the occurrence of such an event will be a certificate confirming force majeure, for example, from the Ministry of Emergency Situations (Letter of the Ministry of Finance dated 08/04/2015 No. 03-04-06/44861);

- a terrorist act on the territory of Russia (clause 8.4 of Article 217 of the Tax Code of the Russian Federation);

- retirement, to pay for medical services, which is confirmed by documents. The condition for this to be a tax-free amount of financial assistance for 2022 is that the source of its payment is the net profit of the employing company (Clause 10, Article 217 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated January 17, 2012 No. ED-3- 3/ [email protected] );

- retirement or death of a former employee for his family members. If we are talking about a one-time payment, then taxes on material assistance in 2022 are not withheld (clause 8 of Article 217 of the Tax Code of the Russian Federation).

In addition, one-time financial assistance paid to an employee in connection with the birth (adoption) of a child is not subject to personal income tax - during the first year after his birth (adoption) in the amount of no more than 50,000 rubles. for each child based on both parents (clause 8 of Article 217 of the Tax Code of the Russian Federation). That is, if one of the parents received financial assistance in full, then the financial assistance paid to the other parent should already be subject to personal income tax (Letter of the Ministry of Finance dated February 24, 2015 No. 03-04-05/8495).

Financial assistance, tax-free in 2022 – postings:

Dt 91.2 Kt 73(76) – accrual of financial assistance to an employee (relatives of a deceased employee);

Dt 73 (76) Kt 50 (51) – issuance from the cash register (payment to the current account) of material assistance to an employee (relatives of a deceased employee).

Many taxpayer questions are answered in ConsultantPlus:

If you don't have access to the system, get a free trial online.