Grounds on which financial assistance can be provided to non-working pensioners

The list of grounds on which financial assistance can be paid to a non-working pensioner may include:

- be defined in a local act or collective agreement (if any are adopted in the organization).

- be arbitrary (if internal acts have not been adopted in the organization).

The list of grounds for payment is not limited by law. These include:

- Illness of a retired employee.

- Death of the applicant's relative.

- Wedding of a former retired employee.

- Birth of grandchildren to a former employee.

- The need for a former employee to purchase medications.

- Causing damage to a former employee, for example, from emergencies, floods, fire, etc.

If the former employer does not have approved internal documents containing the grounds for payment of financial assistance, the former retired employee has the right to submit an application for financial assistance on any basis that he considers sufficient to make the payment.

Financial assistance to an employee in 2022 - for treatment, taxation, postings, without an application

Knowing the specifics of the financial assistance provided to an employee in 2022, it is possible to eliminate the possibility of various misunderstandings with the direct employer.

Numerous life situations force Russian citizens to look for additional channels of financing.

The financial assistance provided by the state to vulnerable citizens cannot satisfy even basic needs.

The most optimal and at the same time reliable option for receiving additional assistance, which does not entail the need for a return, is considered to be the accrual of material support to the hired worker from the company.

It can be accrued due to the occurrence of various life situations. Let’s take a closer look at what exactly financial assistance to an employee means in 2022.

What you need to know

Before starting to consider the main issue, it is initially recommended that you familiarize yourself with basic theoretical information and legislative regulation.

This will eliminate the possibility of various misunderstandings between the employee and the employer.

Required terms

The definition of “material assistance” means one of the types of providing social assistance in the form of cash to a worker.

It is provided regardless of the results of the worker’s employment or the enterprise in general, and is subject to accrual when various situations arise in the worker’s family.

These may mean:

- death of a close relative;

- the birth of a child or the fact of establishing guardianship over minors;

- recovery.

Regardless of the grounds, there is a need to confirm it with documentation. In accordance with the norms of Russian legislation, financial assistance is not regular and can be accrued one-time. Help is voluntary and is of a declarative nature.

What types of financial support are there?

The type of financial assistance under consideration can be classified into the following types:

| Type of assistance | Explanations |

| Target | It must be confirmed by documents and can be accrued on the basis of a generated Management Order. This type of transfer can additionally include compensation for employee expenses incurred due to the performance of their official duties. |

| Non-target | The documentation does not specifically name the main purpose of the application. For example, in connection with the death of a close relative, a difficult financial situation, etc. |

| One-time | To be transferred once due to the occurrence of a specific circumstance |

| Regular or periodic | To be accrued annually (or at specific time intervals) until the circumstances affecting the income of the employee and his family members in particular are eliminated |

Normative base

The financial situation is subject to transfer to hired employees on the basis of Decree of the President of Russia No. 495 of May 1998.

The main provisions of the Law include:

| Material aid | Accrued solely on the basis of the submitted application |

| Money is transferred once a year | In the amount of the monthly salary, but can be adjusted by the provisions of the collective agreement |

Additionally, it is recommended that you read Art. 144 of the Labor Code of the Russian Federation, which includes numerous key features.

Registration procedure

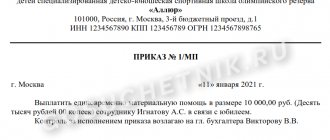

The procedure for applying for financial assistance from an employer is standard, regardless of the institution in which the employees work, in the Ministry of Internal Affairs or in an insurance company and is as follows:

- The emergence of grounds for the purpose of contacting management with a request for the allocation of funds.

- Collection of supporting documentation.

- Drawing up a corresponding application.

- Based on the submitted application, management, for example, represented by the head of the police department, makes an appropriate decision.

- If the answer is positive, an Order must be issued. The employee will need to be familiarized with it.

- At the final stage, financial assistance is awarded to the worker.

Payment can be made by bank transfer or in cash directly at the checkout.

Acceptable grounds

The list of life circumstances in the event of which an officially employed employee has the right to apply for additional financial assistance is subject to approval by the direct employer.

The most common of them are considered to be:

| Occurrence of an emergency event | For example, loss of property or damage caused by natural disasters |

| Presence of medical contraindications | In particular, the occurrence of a disease, assignment to one of the disability groups, or the presence of an urgent need for health improvement |

| Presence of any family circumstances | The birth of a child or the fact of adoption, serious illness or loss of a close relative |

| Personal motivation | Which can include a difficult financial situation, anniversaries, retirement (during the period of registration of a pension) |

| Other circumstances | Established by the employer and recorded in internal documentation |

For your information, the employee must notify in the appropriate application regarding the fact that a basis has arisen for which it is possible to apply for financial assistance.

What amounts can you expect?

The amount of financial assistance to be transferred to an employee is determined by the company itself. It is fixed by the provisions of the collective agreement.

Russian legislation does not provide for any specific rules directly related to the amount of payments due, but in practice they look something like this:

| For relatives of the deceased, the amount of assistance amounts to several monthly salaries | In government agencies and private entrepreneurs, it can vary upward. The size depends on the financial situation of the enterprise |

| Happy holiday to all employees | Often a bonus equal to one month's salary is provided |

| On the occasion of the birth of a newborn | It is established by local regulations of the enterprise. Often the amount of financial assistance does not exceed 50 thousand rubles, since with an increase it will be necessary to withhold a tax fee |

| Financial assistance to a retired former employee may have a fixed amount | Depends on the accrual conditions established by the collective agreement |

| Upon receipt of education | For workers, the amount can be no more than 80% of the amount of payment under the agreement regarding the provision of such services |

| Financial assistance for employee treatment | In the corresponding centers and sanatoriums it is up to 90% of the full price. Additionally, the possibility of partial compensation from the wage fund and the trade union in particular is provided |

Additionally, some employers provide the opportunity to provide assistance to improve living conditions - up to 65% of the full price of the property.

Is an application from the employee required?

Russian legislation does not establish the obligation of officially employed employees to submit an application for financial assistance to their employer.

At the same time, it is necessary to pay attention to possible misunderstandings in the future with the regulatory government agency in the absence of such a document.

For example, the tax authority may suspect an employer of financial fraud. It is for this reason that employers play it safe and require that a statement be drawn up in any case.

Additional documents include confirmation of the basis. Only in this case is the accrual of financial assistance legal.

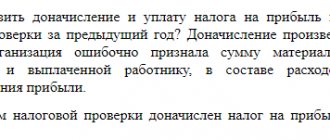

What taxation applies?

The current tax legislation of the Russian Federation, in particular Article 217, provides a detailed list of types of such assistance for which income tax (NDFL) cannot be withheld.

In particular, we are talking about such types of assistance as:

| A type of financial assistance in accordance with Art. 217 Tax Code of the Russian Federation | Limit amount that is not subject to taxation |

| On the occasion of the birth of a child or his official adoption during the first year of the baby’s life | No more than 50 thousand rubles for each child |

| Due to the death of an employee or a former employee dismissed due to retirement In connection with the death of a relative of a regular employee or an employee dismissed due to retirement In case of loss of employees and members of their family in natural disasters In case of suffering caused to employees and members of their family from acts possible terror | The legislation does not establish a maximum amount |

| Payments of a non-targeted nature, defined by internal documents, to full-time or former employees who left due to disability or retirement | No more than 4 thousand rubles |

In all other situations without exception, as well as in the case of accrual of financial assistance, when paying in excess of the maximum established limit, the employer undertakes the obligation to withhold income tax to the state budget.

In case of ignoring the established requirements, a fine in the prescribed amount will be imposed on the direct employer and officials.

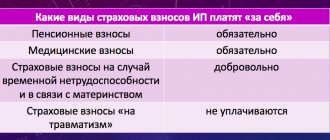

Is it subject to contributions?

In accordance with the requirements of Russian legislation, the amount of calculated financial assistance is subject to mandatory insurance and other contributions transferred to all various funds.

At the same time, it is necessary to pay attention to the fact that some types of financial assistance are exempt not only from taxation, but also from the withholding of insurance and other contributions.

In particular, we are talking about the following:

| Accrual of assistance due to various natural disasters | Resulting in the loss of personal property or a terrorist act |

| Providing financial assistance | Due to the death of a close relative |

| Calculation of cash payment to an employee | Who decided to establish guardianship over a minor child or, on the contrary, a baby was born into the family |

| Providing financial assistance to meet various personal needs | No more than 4 thousand rubles per year |

For all other numerous reasons, the provision of financial assistance for a targeted or non-targeted purpose is subject to insurance and other contributions.

At the same time, it is necessary to pay attention to the very ambiguous regulation of the issue of taxation of social charges.

In particular, the tax authority requires the withholding of contributions and taxes from such payments by entrepreneurs on the simplified tax system and UTII, but the courts say something completely different.

: financial assistance to employees

In this situation, employers must choose the optimal solution - to defend their interests in court or pay contributions.

Reflection of transactions by accounting entries

The process of selecting direct accounting accounts for the purpose of carrying out operations on the issue of accrual and calculation of financial assistance directly depends on the category of employees and the funding channel.

Let's consider this issue with displaying the accounting entries in more detail in the table:

| Citizens who apply for financial assistance | Funding channel for the assistance in question | Postings for the accrual of one of the types of financial assistance |

| Officially employed hired workers of companies | Retained earnings from previous years Expenses of the current reporting calendar year | Debit 84 – Credit 70, 73 Debit 91/2 – Credit 70.73 |

| Former employees of the organization or close relatives of the worker (with documentary evidence of the degree of relationship) | Retained earnings from previous years Costs of the current reporting calendar year | Debit 84 – Credit 76 Debit 91/2 – Credit 76 |

Taking into account the considered features, the employer must make the appropriate entries to eliminate the possibility of problems arising with the state regulatory authority.

How to prepare an application for financial assistance?

The law does not impose requirements for the procedure for filling out the document; accordingly, it can be drawn up in any form, in writing. The application must reflect:

- Name of the former employer's organization.

- Information about the applicant (full name, address, telephone number, position held before dismissal).

- Name of the document (application for payment of financial assistance to a former employee).

- Request for payment of financial assistance.

- Reason for payment.

- A link to a list of documents confirming the existence of grounds for payment of financial assistance.

- Date of signing the application.

- Signature of a former retired employee.

The period for consideration of an application is not established by law, therefore, if there are no provisions in the collective agreement or local act of the organization regarding the period during which the application must be considered, it is considered within a reasonable time.