Unfortunately, many organizations that are obliged to pay appropriate taxes to the state treasury cannot always boast of well-established accounting. Therefore, situations arise when, due to shortcomings made by specialists in the accounting department, certain fees are not paid. As a result, the tax authority, which does not receive payments on time, imposes sanctions on the company in the form of fines and penalties. Unfortunately, violation of tax laws can lead to more serious consequences, and therefore, you need to try to find out as soon as possible how to pay tax penalties, having first calculated them.

How to pay penalties on taxes?

Why will penalties be charged?

According to the rules, insurance premiums, including penalties, are paid to the territorial tax office using the established details before the 15th day (inclusive) of the month following the reporting month. The exception is those months when the 15th calendar day falls on a weekend, then the deadline is the next working day. To avoid late payments, pay in advance.

To avoid sanctions, we recommend reading articles about when to pay and to whom to transfer insurance premiums.

Payment of all penalties is regulated by the Tax Code of the Russian Federation (Article 34 of the Tax Code of the Russian Federation). The policyholder bears administrative responsibility and pays penalties for non-payment of insurance premiums in 2022 for late principal payments. See the table for what else sanctions will follow:

| Violation | Fine |

| Violation of payment deadlines | Penalty 5% of the amount of unpaid contributions for each overdue month within the following limits: no less than 1000 rubles and no more than 30% of the total amount of deductions (Article 119 of the Tax Code of the Russian Federation). An additional fine for missed deadlines is 300-500 rubles (Article 15.5 of the Code of Administrative Offenses of the Russian Federation) |

| Deliberate understatement of the tax base or erroneous calculation of mandatory payments | 20% of the unpaid amount of SV (clause 3 of article 120, clause 1 of article 122 of the Tax Code of the Russian Federation) |

| Partial payment or non-payment of contributions at all | 40% (clause 3 of article 122 of the Tax Code of the Russian Federation) |

| Deliberate violation of deadlines or complete disregard for the obligation to pay for SV in the Social Insurance Fund | From 20% to 40% of the amount of unpaid deductions (Article 19 125-FZ), an additional 300-500 rubles are collected (15.33 Code of Administrative Offenses of the Russian Federation) |

| Submitting information on paper rather than in an established electronic system | 200 rubles (clause 2 of article 26.30 125-FZ) |

| If the total number of employees is over 100 people, the report is provided on paper and not in an electronic system | 200 rubles (Article 119.1 of the Tax Code of the Russian Federation) |

| Violation of filing deadlines or provision of distorted individual information to the Pension Fund of Russia | 500 rub. for 1 employee (Article 17 27-FZ), an additional 300-500 rubles are charged (Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation) |

| Submission of personalized accounting information in paper rather than electronic form when the number of employees is more than 25 people | 1000 rubles (Article 17 27-FZ) |

Tax violators for non-payment of contributions in especially large amounts (from 5 million rubles) are brought to criminal liability on the basis of Part 1 of Art. 10 of the Criminal Code of the Russian Federation. If an organization deliberately does not pay, then the Investigative Committee opens a criminal case under Art. 199 of the Criminal Code of the Russian Federation for failure to provide reporting or indicating false information in it.

The maximum fine for the above crime is 500,000 rubles, the maximum prescribed criminal term is 6 years. When the total amount is paid along with penalties after the penalty for late payment of insurance contributions in 2022 to the Pension Fund and other authorities is calculated, criminal liability from the offender is removed, but only on the condition that this was the first violation of this nature.

IMPORTANT!

Higher authorities do not have the right to fine an organization for violating deadlines, provided that the established payment forms are submitted on time (letter of the Ministry of Finance of Russia No. 03-02-07/1/31912 dated May 24, 2017). The inspector's duties include only calculating penalties.

When procurement participants do not pay penalties

Contract legislation (Part 9, Article 34 44-FZ) provides the basis for exemption from payment of penalties under 44-FZ: penalties and fines are not assessed in cases where the supplier or customer was prevented from fulfilling the terms of the contract by force majeure circumstances. These do not include breakdowns in agreements between partners, unexpected financial problems, or technical difficulties.

Force majeure is an emergency situation that an organization cannot prevent, like any other company that finds itself in similar conditions (clause 8 of the Resolution of the Plenum of the Supreme Court No. 7 of March 24, 2016).

Letter of the Ministry of Finance No. 24-06-06/21324 dated March 19, 2020 equated coronavirus to emergency, insurmountable circumstances. This means that an organization that has been directly affected by the spread of infection or measures aimed at preventing its spread has the right to contact the customer with a request to write off fines and penalties that were accrued due to a shift in the terms of the contract for reasons beyond the control of the supplier.

How to calculate the amount

Tax officials calculate sanctions for late payments as 1/300 of the refinancing rate for each day of delay (clause 4 of article 75 of the Tax Code of the Russian Federation).

IMPORTANT!

If an organization is overdue for a monthly payment by 1 calendar day, then no sanctions should follow. Tax inspectors assess penalties from the day following the payment deadline, taking into account that the payment day is not a settlement day (letter of the Ministry of Finance of the Russian Federation dated July 5, 2016 No. 03-02-07/39318).

Here's how to calculate penalties for insurance contributions to the Pension Fund and the Social Insurance Fund using the formula:

P = S × D × SR × 1/300,

Where:

- P - penalty;

- C - the amount of deductions payable;

- D - calendar days of delay;

- CP is the key refinancing rate.

How to pay for housing and communal services through “Online Sberbank”: useful information:

Quite often, modern citizens permanently residing in Russia wonder how to pay for housing and communal services through Online Sberbank. This question arises mainly among the generation that is accustomed to working on the Internet.

In online mode, you can not only make purchases, but also pay off certain bills. It is very comfortable. Accordingly, for a similar task, Sberbank has a separate service called Sberbank Online. It allows you to make payments without leaving your home.

But what should everyone know about paying for housing and communal services through this service?

Description of the service

First, it’s worth considering what kind of site you’ll be dealing with. Only after this will it be possible to think about how to pay for housing and communal services through Online Sberbank. What kind of accounts are processed by this service?

That's all, really. The service under study is Internet banking. With it you can:

- top up your mobile device account;

- order bank cards and open them;

- make money transfers to certain accounts;

- pay fines and taxes;

- cover debts (including penalties);

- pay for housing and communal services.

In other words, almost all bank services are offered, but they are processed online. How to use this service? How to pay for housing and communal services through Sberbank Online?

Payment information

Bringing your idea to life is not as difficult as it might seem at first glance. But every citizen must have certain data, without which payment will not take place.

To pay for an apartment online, you need:

- Receipt of payment;

- the amount to be written off;

- a bank card connected to Sberbank Online (you can simply have a Sberbank debit card);

- details of the payment recipient (usually available on the receipt);

- name of the payment (name of the service for which the citizen pays).

Nothing else is needed. With this information, you can easily use the Sberbank Online service and all its capabilities absolutely free.

Registration in the system

An important point is the fact that before taking action, a citizen must connect a bank card to the Sberbank Online service. In return, the person will be given a login password and identification number. Only after this can you think about how to pay for housing and communal services through Online Sberbank.

If you do not want to register, you should use one-time registration data. It is issued at Sberbank ATMs and terminals. In any case, without authorization on the service it will not be possible to bring your idea to life.

To register in Sberbank Online, you need:

- Go to the official page of the service.

- Select “Registration” from the menu (on the left side).

- Enter your bank card number in the designated field and enter the verification code.

- Print a phone number (usually not required) that will be used to confirm authorization in the future. You will receive an SMS with a secret code. It is entered into a specially designated area to confirm registration.

- Receive and remember your login and password to log into Sberbank Online.

In the case of using an ATM and one-time identifiers, you just need to click on “Sberbank Online” in the operations menu of the corresponding machine and select “Get one-time login and password” there. You can pick up the check and use it for authorization.

Payment instructions

How to pay for housing and communal services through Sberbank Online? Instructions for making a payment will help solve the problem. If you follow it, there will be no problems with the operation.

The citizen is offered:

- Log in to the Sberbank Online website.

- Select the “Payments and transfers” item in the menu that appears.

- Then it all depends on personal preferences. You can click on a specific one, and then manually find the recipient. But most often, the TIN of the organization that services the house is entered into the search bar. This way the recipient is discovered faster.

- Set the purpose of the payment. Not in all cases, but a similar scenario does occur.

- Select the card from which funds will be debited (if the citizen has several of them).

- Enter in the appropriate fields the payer’s personal account number (from the receipt), the Criminal Code number (from there), as well as the amount due for payment. In some payments it is necessary to additionally indicate the citizen’s residential address.

- Check the details and confirm the payment. To do this, enter a secret code in the provided field on the screen (it will appear after clicking “Continue”). It will come in the form of SMS.

- Print or save your payment receipt.

This algorithm of actions will help you deal not only with utility bills, but also with all other bills.

Commission

Most citizens are interested in what the commission will be when paying for housing and communal services through Sberbank Online. This is an important point taken into account by the population. It’s just difficult to give an exact answer.

In general, most transactions carried out through Sberbank are not subject to commission. This is why the population pays attention to using the Online Sberbank service. It all depends on the agreement concluded with one or another service company.

What percentage of housing and communal services payments through Sberbank Online is charged in some situations? No more than 2%. Most often, the amount paid is required to give the bank 1% of the transferred funds.

Auto payment

Another interesting option is auto payment for utility bills. On a certain day, the following will be debited from the citizen’s card:

- a fixed amount due;

- as much money as you need to pay for housing and communal services in a given period.

This nuance will depend on the parameters selected by the user. How to connect payment for housing and communal services through Sberbank Online?

To bring your idea to life you need:

- Go to the Sberbank Online website and log in there.

- Visit "Personal Account". It is located in the upper right corner of the page.

- Select “My auto payments” - “Connect”.

- In the menu that appears, click on the required housing and communal services service.

- Search for a recipient.

- Enter information about the apartment for which money is being paid. Usually we are talking about a personal account number.

- Set the autopayment parameters: date of execution, card from which to write off money, type of payment (fixed amount or link to the payer’s account).

- Confirm the action using a one-time password, which will be sent to your mobile phone via SMS.

From now on, it is clear how to pay for housing and communal services through Online Sberbank, and all the features that the payer should know about are also considered.

Source: https://www.syl.ru/article/287489/new_kak-oplatit-jkh-cherez-onlayn-sberbank-poleznaya-informatsiya

Calculation example

Children's and youth sports school SDYUSSHOR "Allur" violated the deadline for payment of CB for January 2022 (02/15/2020 - Saturday, deadline - 02/17) and transferred a sum of money in the amount of 103,420 rubles to the established funds on 02/24/2020.

Breakdown of unpaid amount, in rubles:

- 73,226 - for compulsory pension insurance;

- 22,650 - for compulsory health insurance;

- 7544 - in case of temporary disability and in connection with maternity.

The delay from 02/17/2020 to 02/24/2020 was 7 calendar days - excluding the day of payment. The refinancing rate at the time of funds transfer is 6.0%. Eventually:

- OPS: 73,226 × 7 × 6.0% / 300 = 102.52 rubles;

- Compulsory medical insurance: 22,650 × 7 × 6.0% / 300 = 31.71 rubles;

- VNiM: 7544 × 7 × 6.0% / 300 = 10.56 rubles.

When to pay

The basis for transferring penalties is a notification from the Federal Tax Service. It also stipulates the deadline for paying penalties for late insurance premiums in 2022. There is no legally established period for transferring such a payment.

But there is a statute of limitations. If the taxpayer does not pay the penalty on time, the tax office has the right to sue to recover the penalty amount. The period allotted for filing a lawsuit is the statute of limitations. If representatives of the inspectorate do not begin legal proceedings with the payer, the debt is recognized as uncollectible and written off.

Coronavirus from government procurement: practice of control authorities

With the advent of coronavirus, customers and participants have a lot of questions. Is it possible to cancel a purchase due to force majeure? When is it permissible to conclude a contract with an food supplier to prevent emergencies? Will a participant be included in the RNP if the contract was prevented from being fulfilled by a pandemic? Let's look at some recent examples from practice.

Purchasing from a single supplier due to coronavirus

According to the FAS, the Ministry of Emergency Situations and the Ministry of Finance, the customer can enter into a contract with a single supplier under clause 9 of Part 1 of Art. 93 of Law 44-FZ, if there is a cause-and-effect relationship between the procurement object and its use to prevent the spread of coronavirus.

Thus, the Moscow OFAS recognized the legality of the purchase from the only supplier of portable laboratories for the rapid diagnosis of coronavirus. But the purchase of construction, installation and other works for the school on this basis was recognized by the Tatarstan OFAS as a violation of law 44-FZ: the work under the contract is aimed exclusively at the construction of a new facility.

Read the full review of ConsultantPlus

Also, the write-off of the penalty is provided on the basis of the provisions of Resolution No. 783 of 07/04/2018 and the amendments made to it (Resolution No. 591 of 05/25/2020). The decree applies to contracts concluded in 2015, 2016, 2022 and executed in full. Exceptions:

- the presence of additional agreements that change the main terms of the contract - delivery time, amount, etc.;

- The fulfillment of the contract was prevented by the spread of coronavirus infection.

To what extent is the penalty written off according to Resolution No. 783:

- If the execution of the contract was prevented by the spread of coronavirus infection or the amount of penalties and fines is no more than 5% of the contract price, the debt is written off in full.

- If the amount of penalties and fines is no more than 20% of the contract price, half of the debt is written off. Mandatory condition: the second part of the debt is paid by the supplier before January 1, 2022.

About the author of this article

Ella Zaluzhnaya Project Expert Graduated from the University of the Interparliamentary Assembly of the Eurasian Economic Community with a degree in Finance and Credit. In 2013 - North-Western Institute of Management of the Russian Academy of National Economy and Public Administration under the President of the Russian Federation under the program: “Management of state and municipal orders.” In 2014, he graduated from the National Research University Higher School of Economics in the program “Management of State and Municipal Orders.” In 2020, she underwent professional retraining on the basis of educational and Sberbank-AST under the program “Procurement Management for State and Municipal Needs (44-FZ) and Corporate Procurement (223-FZ).” From 2008 to 2009 she worked as an economist in the purchasing department of an ambulance. Since 2009 - leading economist of government procurement at the Theater named after. N.P. Akimova. In 2011 - specialist in the Exchange Trading Department (trading for Gazprom, Transneft). Since 2012 - Deputy Director for Financial and Economic Activities at the State Budgetary Institution. Currently consulting with customers and suppliers.

Other publications by the author

- 2022.01.31 NMTsKInstructions for justification of NMTsK for procurement of transportation under 44-FZ

- 2022.01.14 Procurement control Instructions for approving procurement with the FAS

- 2022.01.10 Trading platformsInstructions for receiving closing procurement documents from the RTS-tender site

- 2021.12.27EIS Dealing with problems when sending a plan for control

How to pay correctly

The payer has the right to pay the penalty himself (if he knows that he is late in payment) or pay the fine upon request from the tax office. Here's how to pay penalties on insurance premiums in 2020:

- Receive a notification from the Federal Tax Service.

- Check the payment amount - calculate the payment using the formula.

- Fill out the payment order and transfer the required amount to the territorial tax office.

The amount of the penalty must be reflected in the accounting records. In the absence of regulatory documents regulating the type of recording of overdue deductions in accounting, the payer organization has the right to determine the type of accounting entry.

| Postings | Contents of operation | |

| For commercial organizations and non-profits | For budgetary institutions (instructions 157n, 174n) | |

| Dt 99, 91 Kt 68 | Dt 0.401.20.292 Kt 0.303.05.731 | Accrual of penalties and fines on insurance premiums |

| Dt 68 Kt 51 | Dt 0.303.05.831 Kt 0.201.11.610 | Payment of the resulting penalty |

How to collect from a supplier

Instructions on how to receive a penalty from a company that is late in fulfilling its obligations consist of several steps.

Step 1. Calculate the amount. Charge penalties for each day of delay in delivery in the amount of one three hundredth of the Central Bank refinancing rate of the contract price. The amount of obligations does not include those that are fulfilled. The specific formula and calculation rules are laid down in the contract. For example:

Other violations of the terms of execution of a government contract (except for delays in delivery) are punishable by fines. The amount of payments is specified in the provisions of the contract based on the Rules for determining the amount of the fine, which were approved by Government Decree No. 1042 of August 30, 2017.

Step 2. Make a claim that contains:

- name of the customer and supplier;

- details of the contract, its amount and subject of delivery;

- reference to a specific clause of the contract, which contains a date that is the deadline for delivery;

- description of the fact of violation (example - delivery was not made);

- information about the period of delay in fulfilling obligations;

- reference to the clause of the contract, which specifies the supplier’s liability in case of delay in delivery;

- the amount of the penalty as of the date of filing the claim;

- demand for payment;

- application - calculation.

Step 3. Submit a claim that includes a demand for payment. Art. 314 of the Civil Code indicates that the deadline for paying a penalty under 44-FZ, unless otherwise provided by agreement or law, is 7 days from the date of presentation of the claim. Send the document to the supplier in paper and electronic form. When choosing a delivery method, provide the opportunity to receive a stamp of delivery of the correspondence.

Here's what to do if the supplier doesn't pay penalties: withhold this amount from the contract security. To do this, along with the claim, send the organization a statement of offset or a notice of withholding of the amount of the penalty. It is also possible to pay the contract minus the penalty if the goods are delivered and the penalty is not paid. To do this, use the same algorithm as when deducting from collateral.

IMPORTANT!

An indispensable condition under which the penalty is allowed to be offset against the amount payable to the supplier is the presence of this condition in the contract and the presence of confirmation that the supplier has received the application (notification). When foreclosure on collateral, confirmation of the supplier's acknowledgment of its debt is required.

The legislation specifies whether the customer has the right to deduct the amount of the penalty from the counterparty’s remuneration: yes, if all legal requirements for this procedure are met.

When it is impossible to withhold a penalty from the security or the amount due to the supplier for fulfilling the terms of the contract, there are no grounds for write-off, and the supplier refuses to voluntarily pay off the debt, collect the penalty in court.

Instructions on how to place payment of penalties in the Unified Information System if the contract is executed in 2022:

- Upload general information about the contract into the EIS.

- Add payment information.

- In the “Execution (termination) of the contract” block, enter information about the penalty.

- Fill out the section on calculating fines and penalties.

How to fill out a payment form

Payment orders for payment of penalties are practically no different from mutual settlements with counterparties. But there are a number of nuances:

- If sanctions are paid voluntarily, in field 106 we indicate the value of the AP. Payment upon request from the tax office - TR. If the fine is assessed based on the inspection report, we set an AP.

- The situation is similar with field 107 “Tax period”. For self-repayment, 0 is indicated; if payment is made on the basis of a tax warning, then the date specified in the request is indicated.

- Fields 108 and 109 (they contain the number and date of the basis document) are filled in according to the details of the request or verification report from the Federal Tax Service.

Which BCCs to indicate in 2022

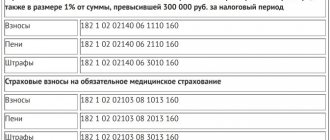

Now let’s look at where to pay penalties on insurance premiums and what budget classification codes to indicate in the payment order. Payment is made as follows: penalties issued for compulsory medical insurance, compulsory medical insurance and for cases related to temporary disability and maternity are credited to the Federal Tax Service. The resulting penalties for deductions “for injuries” are transferred to the territorial social insurance funds.

And here are the BCCs that should be included in the payment slip for the payment of penalties to the tax office:

- for compulsory pension insurance: 182 1 0210 160;

- for compulsory health insurance: 182 1 0213 160;

- for temporary disability and maternity: 182 1 02 02090 07 2110 160.

Transfer penalties for injuries to the Social Insurance Fund using the following code: 393 1 02 02050 07 2100 160.

If penalties are accrued and paid with errors

The payer made an incorrect calculation and transferred the wrong amount to the budget. What to do next? Check with the inspector whether you overpaid or underpaid. If there is an overpayment, write a letter about offsetting the excess for a future period. If you have underpaid penalties for late payment of insurance premiums, calculate and pay the balance to the Federal Tax Service.

In case of technical errors (incorrect TIN or checkpoint, fields 104, 106-109 filled in incorrectly), you will not have to do anything. The system will automatically clarify the payment and send it to the correct budget account.

If you have made a mistake in your payment details, payment will not be accepted. Write a letter about canceling the transaction to the bank or about returning the incorrectly paid amount to the Federal Tax Inspectorate. Instead of waiting for a refund, resubmit the correct payment.

Why is it better to go directly to the budget?

It is gratifying when, if necessary, the director can pay off the company’s obligations to the budget directly. Sometimes it is simply more profitable (you can save on fees for withdrawing funds, depositing them into an account and transferring them to the budget) and faster (which is especially important if payment deadlines are running out).

It happens that there is a “card index” hanging in the bank and the taxpayer is not sure whether the payment will go to the Federal Tax Service and not to pay off the debt on the “card index”, even if it is deposited into the account. For example, a payment in favor of an employee (such as compensation for vacation upon dismissal, which the employee sued from the organization) may be written off as a priority.

Remember that you cannot pay administrative fines and other non-tax payments for the company (Article 45 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated May 21, 2022 No. 23-01-06/34205). You should also remember that payment is only possible in cashless form.

You can transfer money in the following ways:

Via mobile banking

As a rule, all modern businessmen have a mobile bank. So all you have to do is go to your personal account or mobile application, find the tab regarding payment of taxes and find a sub-item or icon that allows you to pay taxes for a legal entity. All that remains is to fill in the data, the amount and click the “Finish” or “Pay” button.

You can also use a translation with all details filled in completely or read the QR code from the document (if, for example, a receipt is attached to the payment request), as well as the UIN (although tax authorities and bailiffs say that sometimes confusion arises with the unique number - it is better not to fill out document on it).

On the website of the Federal Tax Service of Russia

We must pay tribute to the tax authorities: they have created all the conditions on their website to make payments easy.

Once logged in, go to the menu item: “Payment of tax for third parties.”

Everything is simple and transparent here; you can generate payment documents and make payments. It must be remembered that if you, as an individual (director), make a mistake by incorrectly indicating, for example, the basis, type, attribute of the payment, period, etc., then although the money will arrive, the company will have to clarify the payment (see clause 7 of Art. 45 of the Tax Code of the Russian Federation).

Note! When paying, you first need to fill in information about yourself (Information about the person making the payment), and only then about the organization for which you will make the payment (Information about the person whose payment obligation is being fulfilled). Don't mix up the details!

Likewise, it is the company, and not the director, who will have to resolve the issue of overpayment (you will not be able to demand a refund, see clause 1.8 of Article 45 of the Tax Code of the Russian Federation). Avoiding this scourge is simple (and difficult, depending on who you choose): fill out payments carefully and accurately.

All of the above is the technical side. And the most interesting thing is the registration of the company’s debt to the manager, and this point cannot be neglected.

Submit reports to the tax service and other regulatory authorities through the convenient Online Sprinter service. Use it for free for a whole month and appreciate all its benefits.