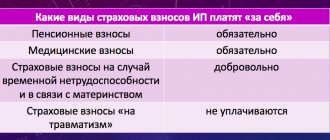

Voluntary insurance payments of individual entrepreneurs to the Social Insurance Fund for themselves

Individual entrepreneurs, by law, are not insured persons for the purposes of receiving social benefits from the Federal Social Insurance Fund of Russia. They have the right to “buy” social benefits for themselves by entering into a voluntary legal relationship with social insurance. To do this, they pay voluntary insurance fees. Until December 31, 2020, the voluntary payment to the Social Insurance Fund for individual entrepreneurs was 4,200 rubles. Since it depends on the minimum wage, it will increase in 2022. The annual contribution to the Social Insurance Fund for individual entrepreneurs is calculated using the formula:

Minimum wage x 12 x 2.9%

This means that in 2022, entrepreneurs will voluntarily pay 4,427.60 rubles to the Social Insurance Fund in order to be able to receive temporary disability benefits.

From 01/01/2021, the calculation formula will change for individual entrepreneurs registered in areas where the regional coefficient is applied. To calculate the minimum wage, it is increased by this factor. Individual entrepreneurs from regions with a regional coefficient will pay more than their colleagues from other constituent entities of the Russian Federation.

Use free instructions from ConsultantPlus experts to correctly calculate and pay all individual entrepreneur contributions.

Results

In order to receive paid sick leave, the self-employed need to either work in parallel under an employment contract (not GPC), or register as an individual entrepreneur and then enter into a voluntary insurance agreement with the Social Insurance Fund. The amount of insurance contributions to the Social Insurance Fund must be paid before the end of the current year, while the right to benefits will arise only in the next calendar year.

Find out more about the special NAP regime in our “Self-Employed” .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Mandatory insurance premiums for individual entrepreneurs for themselves

Regardless of the chosen taxation system, payment of insurance premiums for individual entrepreneurs for themselves in 2022 is provided for all entrepreneurs. Fixed amounts of fees are established annually, but according to Federal Law No. 322-FZ of October 15, 2020, the amount of fixed insurance premiums in 2022 for individual entrepreneurs has not changed, the total amount has remained in the amount of 40,874 rubles, of which:

- for compulsory pension insurance - 32,448 rubles;

- for compulsory medical insurance - 8426 rubles.

If the amount of an individual entrepreneur’s annual income exceeds 300,000 rubles, the amount of the contribution to compulsory pension insurance increases by 1% of the amount of excess income. But the mandatory insurance premiums of individual entrepreneurs for themselves, paid to the Pension Fund of the Russian Federation, are limited to a maximum value of 259,584 rubles. taking into account excess annual income. They do not pay more than this amount for OPS. Under compulsory medical insurance, such an insurance limit is not established, since it is paid in a fixed amount.

KBK IP: fixed payment “for yourself” in 2022

Please note that in 2022, a single code has been established for paying a fixed amount of pension insurance contributions and the amount of excess income.

Fixed payments for individual entrepreneurs in 2022 must be paid according to the following BCCs (regardless of the regime applied).

Table: BCC for payment of insurance premiums for individual entrepreneurs in 2020

Pay insurance premiums for compulsory pension and health insurance in separate payment orders. Payment orders: samples

You can find a sample payment order for the payment of fixed pension contributions using the link .

You can use the link for payment of medical premiums.

Reporting on fixed contributions is not submitted, even if the entrepreneur’s income exceeds 300,000 rubles. for 2020.

Insurance premiums of individual entrepreneurs in 2022 for themselves: terms of transfer

The fixed amount of insurance premiums for individual entrepreneurs for 2022 must be paid by December 31, 2021. But this is a day off, so the deadline is postponed to the first working day in January. Individual entrepreneurs divide insurance premiums into several transfers, transferring them quarterly. The amount can be any, the main thing is to have time to transfer the entire fixed insurance fee in full before the last day of the term.

For incomes exceeding 300,000 rubles, individual entrepreneurs must transfer insurance premiums to themselves for 2022 no later than 07/01/22.

For the absence of a mandatory insurance payment, individual entrepreneurs will be punished according to the norms of the Tax Code:

- a fine of 20% of the unpaid amount (Article 122 of the Tax Code of the Russian Federation);

- a penalty in the amount of 1/300 of the refinancing rate of the Bank of Russia for each day of delay (Article 75 of the Tax Code of the Russian Federation).

Deadlines for payment of insurance premiums

Individual entrepreneurs transfer pension contributions within the following periods:

- the fixed part of the contributions (RUB 26,545 for 2022) must be paid no later than December 31 of the current year;

- the additional part of the contributions, calculated from an amount exceeding 300,000 rubles, must be transferred no later than July 1 of the following year (i.e. this part of the contributions for 2022 must be paid no later than July 1, 2022).

Medical contributions must be transferred no later than December 31 of the current year. And those individual entrepreneurs who voluntarily insured themselves in case of temporary disability and in connection with maternity must pay contributions for this type of insurance no later than December 31 of the current year.

If the last date for payment of contributions falls on a weekend or holiday, then the money can be transferred on the next business day following it, and this will not be considered late.

Payments for pension and medical contributions, as well as contributions in case of temporary disability and in connection with maternity, must be made in whole rubles (an amount of less than 50 kopecks is discarded, and an amount of 50 kopecks or more is rounded up to the full ruble).

There is no need to submit reports on insurance premiums “for yourself”.

Fill out payments in the web service for individual entrepreneurs for free

Insurance premiums paid for employees

The rules for calculating these mandatory payments are the same for all business entities that hire employees and pay them remuneration for their work. Individual entrepreneurs pay insurance premiums at the same rates as a legal entity, regardless of the tax system applied. In addition to transfers to social, medical and pension insurance, a tax for insurance against industrial accidents must be calculated and paid from employees' wages.

Table of insurance premium rates for individual entrepreneurs in 2022:

| Insurance type | Rate | Base limit 2022 | Tariff for an amount exceeding the limit |

| SS in case of VNiM | 2,9 | 912 000 | No |

| OPS | 22 | 1 292 000 | 10% |

| Compulsory medical insurance | 5,1 | There is no maximum base, payments are made on all income for the billing period | |

| From industrial accidents and occupational diseases | 0.2–8.5% depending on the type of activity | There is no maximum base, payments are made on all income for the billing period | |

The procedure for determining the amount to be paid to the budget:

The transfer deadline is no later than the 15th day of the month following the billing month.

Contributions to the Pension Fund and Social Insurance Fund for individual entrepreneurs who have employees

For employees employed by an entrepreneur under an employment contract, it is necessary to make contributions to all extra-budgetary funds - these are the social insurance fund, the pension fund and the Compulsory Medical Insurance Fund.

But those who do business under the simplified tax system pay twenty percent of the funds earned by the company’s employees to the Russian pension fund.

And the rest of the backgrounds do not list anything. This is another positive principle of “simplification” in the opinion of many.

But the transferred amount also has its own nuances. To calculate it correctly, you need to understand what is included in the calculation and what income is not.

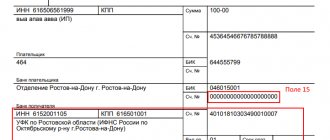

KBK for individual entrepreneurs in 2022

The budget classification code (BCC) must be indicated in payment documents for the transfer of mandatory payments to the budget. It is very important to indicate this indicator correctly for correct enrollment. If a mistake is made, the tax authorities will not be able to correctly classify the payment, as a result of which the entrepreneur will be in debt.

BCCs for employees are indicated in the table.

| Insurance type | KBK |

| OPS | 182 1 0210 160 |

| Compulsory medical insurance | 182 1 0213 160 |

| VNiM | 182 1 0210 160 |

| For injuries | 393 1 0200 160 |

Current BCCs for insurance premiums of individual entrepreneurs for themselves in 2022:

| Type of mandatory fee | KBK |

| Fixed payment for OPS | 182 1 0210 160 |

| Fixed payment for compulsory medical insurance | 182 1 0213 160 |

When making insurance payments calculated on income exceeding 300,000 rubles, the same BCC for compulsory insurance is applied as for a fixed payment.

If the individual entrepreneur did not transfer the mandatory fee on time, he will be charged a penalty. When paying them, you must indicate the correct BCC. To do this, it is enough to change the 14th character of the BCC of the corresponding transfer to the budget to “2”. So, when transferring penalties for a fixed payment to compulsory medical insurance, we indicate KBK 182 1 0213 160.

KBC of voluntary insurance contributions in 2022 to the Social Insurance Fund

Voluntary contributions of individual entrepreneurs for themselves to the Social Insurance Fund in 2022 continue to be administered by the corresponding state fund, as well as contributions for injuries (in contrast to the mandatory contributions of employers for sick leave and maternity leave, which are now collected by the Federal Tax Service). Thus, the procedure for transferring contributions to the Social Insurance Fund for themselves by entrepreneurs has not changed.

At the same time, the amount of the payment has increased - in 2022 it is 4,221.24 rubles, in 2022 - 4,312.42 rubles, and in 2022 - 4,833.72 rubles. This is the amount of contributions paid for the entire year. It is determined by the formula (clause 3 of article 4.5 of the law “On compulsory social insurance” dated December 29, 2006 No. 255-FZ):

Minimum wage (at the beginning of the calculation year) × 12 (number of months of the year) × 2.9% (standard rate for contributions to the Social Insurance Fund).

Individual entrepreneurs have the right to pay the specified amount of voluntary contribution to the Social Insurance Fund either at once or in several payments. The main thing is to transfer it before December 31 of the year for which payment is made (Clause 4, Article 4.5 of Law No. 255-FZ).

In the payment slip, the individual entrepreneur indicates the KBK starting with 393 to transfer the contribution to the FSS for himself (this is the FSS code, reflecting the fact that the fund continues to administer contributions), i.e. 39311706020076000180.

Read about how the BCC has changed since 2022.

Find out how an employer can pay additional insurance contributions for a funded pension in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

How to find transfer details

Mandatory transfers to compulsory medical insurance, compulsory medical insurance and VniM since 2022 are administered by the tax authorities. From this moment on, when filling out a payment order, it is necessary to indicate the details of the tax office with which the individual entrepreneur is registered. To find out the details for insurance transfer, you can contact the Federal Tax Service directly or use the website nalog.ru, which contains the details of all Federal Tax Service Inspectors. In 2022, the PFR details for paying insurance premiums, as well as the details of other departments, did not change.

Transfers for injuries are transferred to the territorial branch of the Social Insurance Fund. Its details can be found using the official website. For example, for St. Petersburg they are listed on the website https://rofss.spb.ru.

Contributions to the Pension Fund and Social Insurance Fund for individual entrepreneurs without employees

If the individual entrepreneur is not an employer, he is still obliged to pay to extra-budgetary funds. Unless you have to do it only for yourself.

Following Article 14 of 212-FZ, you can derive several options for calculating contributions.

Contribution to the Pension Fund

If the income of an individual entrepreneur is less than three hundred thousand rubles, the contribution to the pension fund is calculated using the following formula:

Minimum wage * 26% * 12

The minimum wage is 7,800 rubles from June 1, 2022. This means that by applying the formula, we get an amount of 24,336 rubles. This will be the payment to the fund.

If the entrepreneur’s income exceeds the mark of 300 thousand rubles, then in addition to the amount calculated using this formula, an additional 1 percent of the amount by which the fixed amount of three hundred thousand is exceeded is paid.

Contribution to the Compulsory Medical Insurance Fund

The formula for calculating the contribution to the compulsory health insurance fund is different:

Minimum wage * 5.1% * 2017

If we take the same minimum wage in force at the time of writing, the amount comes out to 4,773.60 rubles.

Contribution to the Social Insurance Fund

As for the social insurance fund, payment to this structure for individual entrepreneurs without employees is optional, but possible. To exercise this possibility, you need to submit documents separately (regulations of Article 14, paragraph 5, 212-FZ.

Important! You also need to know that these contributions are paid before the last day of the reporting year (that is, until December 31). This applies to a fixed fee for income not exceeding 300 thousand. One percent of what is allowed to be paid in excess until the beginning of April next year.

Why are contributions to the Social Insurance Fund paid if they are not obligatory? You, as an entrepreneur, can use them to reduce your tax base. The reduction is based on the amount of contributions paid to the social insurance fund.