What does payment of a company's debt by a third party mean? This means that the company's debt is repaid by another company. As a rule, she herself is a debtor of the enterprise, and therefore the funds paid to her go towards repaying her debt.

In what cases is it relevant to pay a debt by a third party? Almost every company that has been operating for some time is both a creditor and a debtor. That is, it both lends funds and gives them to third-party companies. All this makes it possible to pay off your debt to one organization with the funds of another. This will be relevant if the company currently does not have the required amount of funds. This can be a convenient way for a third party paying off someone else's loans to pay off their debt.

How to account for payment for goods (work, services) by a third party ?

Main features of the operation

The Civil Code of the Russian Federation does not say anything about the procedure for processing debt payment by a third party. The algorithm used was formed by practice. It consists of the following stages:

- The company sends a letter to its debtor with a request to pay his debt.

- The debtor transfers his funds to the main creditor. The order specifies the appropriate purpose of the payments - payment for the debtor.

How or for a third party under the simplified tax system

A letter of request and an order with an appropriate note are all confirmation that the company has paid the debt for another organization. The presence of these documents is important, since without them, the company that paid off the debt can begin to collect the paid funds from the recipient. The basis is the enrichment of the creditor resulting from an erroneous payment. Without supporting documents, both the main debtor and his creditor bear the risks. If the company begins to collect funds, the debtor will have to pay the debt to the creditor himself.

How to reduce the risk of collecting client tax debts from the bank as a third party?

IMPORTANT! An entrepreneur cannot control what a third party indicates in his payment order. Therefore, it is doubly important to draw up a letter of request and take confirmation of its receipt. The paper will serve as proof of the operation. Proper documentation is a way to reduce all possible risks.

Tax loan

One of the options for repaying taxes for a third party would be to issue a loan for the amount of taxes. The text of the loan agreement must directly stipulate that the loan is issued by transferring funds in the agreed amount to the account of the relevant Federal Tax Service.

In this case, the taxpayer does not have any tax consequences until the third party pays interest on the loan. Interest, if provided for in the contract, will be considered income of the taxpayer. The third party itself also does not have tax consequences until the payment of interest, which will be considered its expenses. This payment option is suitable for businesses due to the absence of tax consequences when formalizing the relationship with an interest-free loan agreement.

Rules for writing a letter of request for debt repayment

The request letter must include the following information:

- Name of the legal entity entrusted with covering the debt. This is so important because even if the legal entity does not put the required mark in the payment order, using the details it will be possible to prove the purpose of the payment.

- An obligation that is transferred to a third party. In particular, you need to disclose its details: details of the agreement on the basis of which the debt arose, its amount.

- If the third party is a debtor of the enterprise (as is the case in most cases) and the funds paid by him go towards his debt, it is recommended to also indicate this in the letter. This is beneficial to both the first and second parties. The company has a greater chance that the counterparty will agree to such a transaction. The debtor can be sure that the payment will actually go towards the obligations and the creditor will not oblige him to repay the debt.

- The debtor to whom the letter is sent may not know all the intricacies of drawing up a payment order. It is also advisable to mention them. In particular, specify the need to indicate the purpose of the payment - repayment of the debt of another company.

ATTENTION! The letter of request must be signed by the head of the enterprise or a person with appropriate authority. The presence of a signature is of interest to the debtor, since it proves that the order actually took place.

IMPORTANT! The payment is made by a third party, and therefore the company does not have direct access to documents confirming the payments made. However, their presence is necessary to prove repayment of the entire amount of debt. Therefore, it makes sense to request a copy of the payment order from the debtor. The paper must be marked with execution from the financial institution.

Example of a letter of repayment of obligations

General Director of Prodvizhenie LLC I.P. Ufimtsev Chelyabinsk, st. Kirova 1, no. 1 From the General Director of Oliva LLC V.V. Ripak Chelyabinsk, st. Vorovskogo, 6

Ref. dated June 20, 2016 No. 363

LETTER about transferring money towards debt

We have a debt to Oliva LLC in the amount of 200,000 rubles. We ask you to pay off the debt of Oliva LLC in the amount of 200,000 rubles. Details for payments: TIN 11133355443 KPP 7657488956 OGRN 10754754785 r/s 407657776544878558654 in the Chelyabinsk branch of the Sberbank of Russia K/s 6655999996665555700088 BIK 066468888886

Transfer of payment using these details will mean the termination of the debt of Prodvizhenie LLC to Oliva LLC in the amount of 200,000 rubles.

In the order, we ask you to mention the purpose of the funds: “Payment for the rental of premises for Oliva LLC under agreement No. 10 dated July 10, 2016 in the amount of 200,000 rubles is not subject to VAT.” We also urge you to send us a copy of the payment order. The document must bear a mark from the banking institution regarding execution.

General Director of Oliva LLC Ripak /V.V.Ripak/

Free transfer

Let us note that the financial department has expressed such an opinion more than once. Earlier, the Ministry of Finance voiced a similar position, but on a different issue. In letter dated June 28, 2022 No. 03-03-06/1/40668, financiers consider the situation when taxes are paid for a third party free of charge in the absence of counter-debt to the counterparty. In practice, it is not recommended to pay taxes for another person, registering it as a gratuitous transfer, because in addition to the fact that the amounts of taxes paid cannot be included in expenses, the third party will have non-operating income, on which it is also necessary to pay tax.

Thus, paying taxes free of charge for a third party is not the best option both for a company that is ready to help a business partner, and for an enterprise for which another legal entity is ready to pay off tax obligations.

Accounting

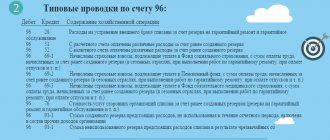

Let's look at the postings used using the example from the above letter of request. Oliva rents premises for 200 thousand rubles excluding VAT. She shipped products to Prodvizhenie LLC in the amount of 200,000 rubles. The cost of the goods was 160,000 rubles. A letter requesting payment of Oliva's debt was sent. The payment has been made. Both parties chose the simplified tax system, and therefore they do not pay VAT. Let's look at the entries in the accounting book of Oliva LLC:

- DT62 KT90-1. Amount: 200,000 rubles. Explanation: total debt of Promotion.

- DT90-2 KT41. Amount: 160,000 rubles. Write-off of the cost of goods transferred to Promotion.

- DT44 KT60. Amount: 200,000 rubles. Reflection of debt to the lessor of Oliva.

- DT60 KT62. Amount: 200,000 rubles. Amortization .

ATTENTION! The last entry is made only after receiving the primary document, that is, a copy of the payment order. The records should mention primary documentation confirming the operations performed.

Registration procedure

The process of repaying a debt for a third party is divided into successive stages:

- initially, the company acting as a debtor sends a letter to a partner or counterparty, and the text includes a request to repay the debt against its own debt or on other terms;

- the organization that received the letter decides to fulfill the obligations of another enterprise;

- After the funds are transferred, a payment letter is sent along with the payment slip.

A company that has repaid someone else’s debt is obliged to keep documentation confirming this operation for at least 5 years, since it can be requested at any time by representatives of the Federal Tax Service. These include letters sent between companies, as well as a payment slip in which a note indicating the purpose of payment is placed.

Attention! The debtor is obliged to keep papers proving that his debt was repaid by a third party, since the lack of documentation leads to negative tax consequences, since the company may demand a refund if it can prove that the money transfer was erroneous.

Possible risks

Such almost circular debt repayment is characterized by a considerable number of risks:

- The primary debtor sending the letter will refuse to acknowledge his request and that the debtor has made payment on his debt. The counterparty will have to repay the debt again.

- The counterparty will make the payment, however, after the creditor writes off his debt, he will return the funds on the basis of an erroneous payment. You will have to pay the debt amount again.

- The creditor files a claim with the primary debtor that payments have not been made even though payment was made by a third party.

You can easily protect yourself from all these troubles. This requires proper documentation. Based on the available papers, it is possible to confirm all the details of the transaction that the other party denies. The main documents that will be required: a letter of request with all the details and a payment order.

Debt recovery

There is another option to pay taxes for another company with minimal risks for the business. This algorithm of actions is mirror in relation to the third one and involves paying taxes on behalf of a third party in payment of debt under a loan agreement issued by a third party. Tax accounting in this case depends on whether the principal of the loan or the interest on it is repaid. When paying taxes on the principal amount, no tax consequences arise based on paragraph 12 of Article 270 of the Tax Code. If the payment goes towards interest, then it can be included in expenses, while the third party must record income for the amount of taxes paid.

Thus, an interest-free loan allows you to profitably formalize relations for paying taxes for a third party, regardless of who is the lender and who is the borrower.

Legal basis

The debtor's right to transfer the obligation to pay for it to a third party is provided for by the Civil Code. This is stated in Article 313. A reservation is also made that this is legal in the event that any other laws or conditions of the paid obligation do not require that the debtor fulfill them strictly independently. Such conditions, for example, may be included in the contract. But most often there are no obstacles to attracting a third party to pay.

How safe is it in terms of audits of the paying organization? Will the Federal Tax Service inspectors have any complaints that the company made payments for another legal entity? Practice shows that if the operation is properly executed, inspectors usually do not have any questions. And if they do arise, they are very quickly “closed” with supporting documents.

Rules for filling out a payment form

To repay the debt of another company, a payment slip is drawn up, when filling it out the following nuances are taken into account:

- in the field intended to indicate the payer, information about the organization or individual who actually repays the debt is entered;

- details of the debtor enterprise are provided, provided by TIN, KPP and other data from the constituent documentation;

when filling out the field in which the purpose of the payment is indicated, the initial data of the payer is given, followed by two dashes //, after which the data of the debtor for whom the payment is being made is given;- data is entered on the purpose of the payment, its name, type and period for which the money is paid;

- if the payer is a company, then the code “01” is entered.

Attention! Possible questions and claims from the Federal Tax Service depend on the correctness of filling out the payment form.

When is it possible to pay for another organization?

Repayment of the debt of one company by a third legal entity is possible in certain cases at the request of the head of the “debtor”. Such cases include:

- difficulties associated with replenishing a current account, or lack of funds from the debtor company;

- debt of a third party to the debtor company.

Any business entity has the right to ask its debtor to make a payment to repay a debt to a third company. But in this case, the following condition must be met: the debt of the debtor company is due for payment.

Important! Receipt of funds into the current account will mean proper fulfillment of obligations to pay the debt. Moreover, obtaining the consent of another company is not required.

The legislative framework

The procedure for debt repayment by a third legal entity is carried out in accordance with civil legislation (313 Civil Code of the Russian Federation):

- The creditor accepts funds from a third company as fulfillment of the debtor's obligations. The exception is cases when the contract specifies a condition that the fulfillment of obligations is carried out directly by the debtor company.

- The debtor has the right to attract a third organization to cover its debt. The legal basis in this case is the agreement between the debtor and this third party.

- The creditor's right passes to this third party, who repays the creditor's debt. Moreover, this right cannot be used to the detriment of the creditor.

- If the obligation was not of a monetary nature, then the third party will be liable to the creditor for possible shortcomings in performance.

Important! The Civil Code of the Russian Federation does not provide for a specific procedure for repaying obligations by another company, as well as a list of documents that are required for this. However, in practice, companies use a letter of payment for another organization.