General information

Plantings are written off when they lose their production value. This usually occurs after the period of biological fruiting has expired. Also, write-off is carried out if the plantings are not practical to use: there have been natural disasters or severe thinning has been recorded (more than 70%).

Drawing up the act falls on the shoulders of a special commission. It is formed by the head of the company by his order. The team must include a foreman or agroforestry specialist, accountant, lawyer or other employees performing similar functions.

The document contains information about plantings, planting time, cost, etc. On the back, the results of uprooting are noted.

All members of the commission must sign the document. Then it is approved by the head of the company, and then the act is sent to the accounting department, where the accountant makes his part of the records.

Important! Perennials should be written off from the balance sheet only after they have been completely uprooted.

Lawn and shrub seedlings: one or two main products

Question: In accordance with the acceptance certificate for construction and other special work performed, presented by the contractor, landscaping work was carried out on the territory of the organization. The work performed included installing a lawn and planting shrub seedlings.

Does the customer organization have the right to accept these seedlings and lawn as any one fixed asset item, reflecting in the OS-1 act the number of seedlings included in this object?

Answer: The organization has the right to take into account lawns and shrub seedlings as separate objects of fixed assets.

Rationale: The organization accepts for accounting as fixed assets assets that have a tangible form, while simultaneously meeting the recognition conditions specified in Part 1, Clause 4 of Instruction No. 26.

Note Perennial wild plants that grow on the territory of the organization in natural conditions are not accepted for accounting as fixed assets (Part 3, Clause 4 of Instruction No. 26).

Law No. 205-Z provides the following definitions:

wild plants - plants found in their natural habitat and capable of forming populations and plant communities;

plantings are a collection of trees and (or) shrubs growing in a certain area, both forming and not forming a plant community.

Objects of flora located on the lands of settlements are divided into the following groups according to their functional purpose (clause 9 of Instruction No. 40):

public plantings - include multifunctional and specialized parks, squares, boulevards, forest parks, hydroparks and meadow parks, short-term recreation areas near the water, green areas of public centers at the city and district levels, intended for organizing various forms of mass recreation for the population;

plantings of limited use - include green areas in residential buildings for everyday recreation of the population, plantings on individual development sites, as well as green recreation areas as part of industrial and mixed development areas, plantings on the territory of research, educational, medical, administrative, cultural and educational , sports institutions intended for a limited number of visitors (children, students, athletes, production personnel, etc.);

plantings for special purposes - include decorative nurseries, plantings of sanitary protection zones of enterprises, noise protection, wind protection, coastal and bank protection strips, cemeteries, etc., intended to perform engineering, sanitary, hygienic, scientific research and other functions;

other groups.

Accordingly, the totality of shrub seedlings on the territory of the organization is defined as plantings of limited use.

The technical code of established practice TKP 45-3.02-69-2007 (02250) provides the following term with the corresponding definition:

lawn is a grass cover created by sowing seeds of specially selected grasses, which are the background for plantings and park structures and an independent element of the landscape composition.

Regardless of the use (non-use) of fixed assets in business activities, the organization determines their standard service life (hereinafter referred to as NSS) in accordance with Resolution No. 161, depending on the types of fixed assets in accordance with their classification (Part 1, Clause 17 of Instruction No. 37/ 18/6).

Thus, according to the appendix to resolution No. 161:

limited-use plantings are classified as fixed assets with code 80101, NSS 20 years;

lawn - to fixed assets with code 80205, NSS 3 years.

The accounting unit for fixed assets is an inventory item (Part 1, Clause 6 of Instruction No. 26).

The inventory item of fixed assets is:

object with all fixtures and fittings;

a separate structurally isolated object designed to perform certain independent functions;

a separate complex of structurally articulated objects that represent a single whole and are intended to perform a specific job (Part 2, Clause 6 of Instruction No. 26).

In this case, a complex of structurally articulated objects is one or more objects that have common devices and accessories, common control, mounted on the same foundation, as a result of which each object included in the complex can perform certain functions only as part of the complex (part 3, paragraph 6 of the Instructions No. 26).

At the same time, if a fixed asset consists of parts that have different useful lives and are capable of performing independent functions, then each such part is accepted for accounting as a separate inventory item of fixed assets (Part 4, Clause 6 of Instruction No. 26).

Thus, taking into account the non-compliance with the NSS and the requirements of Part 4, Clause 6 of Instruction No. 26, planting bush seedlings (limited-use plantings) and the established lawn are subject to recording as separate inventory items of fixed assets with the appropriate classification.

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service

About Form 405-APK

Form 405-APK for the act of writing off perennial plantings was approved by order of the Ministry of Agriculture dated May 16, 2003 No. 750 and agreed upon by letter of the State Statistics Committee dated April 10, 2003 No. KL-01-21/1381. It was mandatory for use, but in 2013, in connection with the release of Federal Law No. 402 of December 6, 2011 (“On Accounting”), all unified forms became only recommended for use.

Since that time, companies have received the right to use forms in their work that were created independently to suit their needs. To be valid, primary accounting documents must have a number of mandatory details (they are listed in paragraph 2 of Article 9 of Federal Law No. 402), therefore forms developed by organizations independently must include them in full.

For your information! Any decision you make regarding the use of certain forms will need to be written down in the organization’s accounting policies.

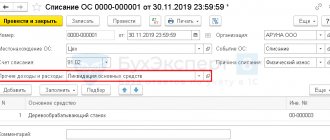

Accounting for perennial plantings

Often accountants come to the conclusion that perennial trees, shrubs and flowers are not objects of OS. The reason is that although the useful life is more than 12 months, the cost of each plant, as a rule, does not exceed 40,000 rubles. On this basis, the amounts spent on planting are written off as current expenses.

According to paragraph 5 of PBU 6/01 “Accounting for fixed assets,” plants should be assessed not individually, but as a single object. It says that fixed assets include, among other things, perennial plantings. In accordance with the classification of fixed assets, approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1, property in the form of perennial decorative landscaping plantings is assigned to the tenth depreciation group.

If the cost of perennial plantings is more than 40,000 rubles, then they must be included as a single inventory object in the OS and in the property tax base.

note

If an organization decides to write off the cost of perennial plantings in tax accounting, then this must be done through depreciation (Resolution of the Moscow District Administration of February 24, 2015 No. A40-59510/13).

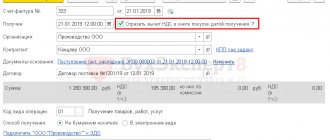

Perennial plants worth more than 40,000 rubles are reflected in the same way as any other fixed assets. First, the initial cost is formed on account 08 “Investments in non-current assets”. After completion of planting work, the object is reflected in account 01 “Fixed assets”. The amount of “input” VAT and monthly depreciation are written off as the debit of account 91.

EXAMPLE

An example of the formation of the initial cost of perennial plantings.

The company purchased tree seedlings in the amount of 118,000 rubles.

(including VAT 18% - 18,000 rubles). A contractor was hired to carry out the planting work. The cost of his services was 59,000 rubles. (including VAT 18% - 9,000 rubles). In May of this year, the work was completed and the facility was put into operation. Its useful life is 32 years (10th depreciation group). The accountant made the following entries: DEBIT 08 CREDIT 60

- 100,000 rubles 0) - reflects capital investments in perennial plantings for the cost of seedlings;

DEBIT 19 CREDIT 60

– 18,000 rub.

— reflected “input” VAT; DEBIT 08 CREDIT 60

– 50,000 rub.

(59,000 - 9,000) - reflects capital investments in perennial plantings for the cost of planting work; DEBIT 19 CREDIT 60

– 9,000 rub.

— reflected “input” VAT; DEBIT 91 CREDIT 19

– 27,000 rub.

(18,000 + 9000) - “input” VAT is written off as other expenses; DEBIT 01 CREDIT 08

– 150,000 rub.

(100,000 + 50,000) - perennial plantings are put into operation. The accountant determined that the annual depreciation rate is 3.125% (100%: 32 years). The annual amount of depreciation is 4687.50 rubles. (RUB 150,000 × 3.125%), and monthly - RUB 390.63. (RUB 4,687.50: 12 months). In June, the accountant made the following entry: DEBIT 91 CREDIT 02

– RUB 390.63. - depreciation has been calculated.

note

Seedlings and saplings of annual plants are reflected in accounting on account 10 “Materials”.

Upon completion of planting work, the cost of plantings is written off to the debit of account 91 “Other income and expenses.” How to correctly acquire fixed assets under a commodity exchange (barter) agreement, see the berator

Is it possible to recognize expenses in tax accounting?

A huge number of companies and entrepreneurs spend their own money on landscaping the area around offices, warehouses and other service buildings. Do they have the right to write off the cost of plants and planting work as expenses in tax accounting? This issue has been and remains one of the most controversial.

Officials invariably take a “prohibiting” position. The Russian Ministry of Finance regularly issues letters in which it states that the costs of improving the adjacent territory are in no way related to activities aimed at generating income. As a result, it is impossible to recognize such amounts in current costs. If the plantings are classified as fixed assets, then they cannot be depreciated on the basis of subparagraph 4 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation. Once again, such clarifications were given in a recent letter dated 04/01/16 No. 03-03-06/1/18575 (see “Ministry of Finance: expenses for landscaping do not reduce taxable profit”).

However, courts often express the opposite point of view. An example is the resolution of the Federal Antimonopoly Service of the North Caucasus District dated January 17, 2011 No. A32-53267/2009. It emphasizes that landscaping work is for profit and can be included in operating costs.

As for subparagraph 4 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation, it allows for an interpretation that is different from the interpretation of officials. Let us remind you: according to this standard, “external improvement objects (forestry facilities, road facilities, the construction of which was carried out with the involvement of sources of budgetary or other similar targeted funding, specialized navigation facilities) and other similar objects are not subject to depreciation.” Hence, many experts conclude that the ban on depreciation applies only to objects financed from budget funds. If the taxpayer paid for the plantings out of “his own pocket,” then depreciation can be calculated. This is precisely the position that the judges supported (resolution of the Federal Antimonopoly Service of the Moscow District dated December 5, 2012 No. A40-47856/10-107-250).

Let us add that the chances of winning increase for those organizations and individual entrepreneurs who planted not voluntarily, but at the insistence of supervisory authorities (for example, the local administration, the improvement committee, the State Construction Inspectorate, etc.). The presence of a document containing the relevant instructions is a huge help in disputes with tax authorities.

But if there is no such requirement, the taxpayer, in our opinion, needs to weigh all the pros and cons before deciding to write off expenses. The fact is that claims from inspectors are almost inevitable. And if we are talking about a small amount, then waiving the costs, although it will lead to an increase in the amount of tax, will save time and effort on legal proceedings.