KBK for taxes for 2022: VAT, personal income tax, income tax, transport tax, property tax

| Payment Description | KBK |

| Income tax, which is charged to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| VAT, excluding import | 182 1 0300 110 |

| Tax on property not included in the Unified Gas Supply System | 182 1 0600 110 |

| Tax on property included in the Unified Gas Supply System | 182 1 0600 110 |

| Simplified tax with the object “income” | 182 1 0500 110 |

| Simplified tax with the object “income minus expenses”, including the minimum tax | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Personal income tax for a tax agent | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax from plots of Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 |

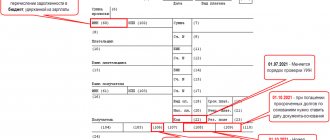

Payment procedure for 2022

In order to become a person insured by the FSS, it was necessary to submit an application in a timely manner, as well as copies of identification documents. It was in this case that the FSS authorities considered the application, and if the payment was made on time, they accepted it for registration under this insurance.

Payment of the fee had to be made voluntarily, but obligatory. In the event that payment was not made, the insurance act was considered invalid.

When insuring, the amount of the insurance premium itself is of great importance. Because it has different meaning from year to year.

This difference is due to the fact that the minimum wage indicator changes annually, which in 2022 was 6,205 rubles. Regarding the second indicator, which has a clear impact on the amount of the insurance premium, namely the interest rate, in 2022 it corresponded to 2.9%. her condition for 2022 has not changed, but the amount of the minimum wage has again undergone correction.

The amount of the insurance premium is fixed and will be the same for all persons. It is equal to the minimum wage multiplied by the interest rate and multiplied by the number of months in a year.

This voluntary contribution is paid at one time.

An important point is that whenever an application is submitted by someone who wishes to insure himself, he will still pay the premium for 12 months.

In 2022, voluntary premium payers were released from the obligation to provide certain types of reporting for this insurance. The trend continues into 2022.

KBK for payment of penalties on taxes for 2022

The KBK budget classification codes for 2022 were approved by Order of the Ministry of Finance of Russia dated 06/08/2021 No. 75n. These codes must be indicated in payment orders when paying penalties on taxes in 2022.

| Payment Description | KBK |

| Income tax, which is charged to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Tax on property not included in the Unified Gas Supply System | 182 1 0600 110 |

| Tax on property included in the Unified Gas Supply System | 182 1 0600 110 |

| Simplified tax with the object “income” | 182 1 0500 110 |

| Simplified tax with the object “income minus expenses” | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Personal income tax for a tax agent | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax from plots of Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 |

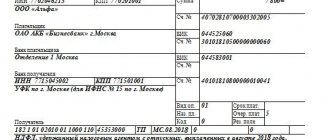

How to issue a payment order

Social contributions are transferred to the Social Insurance Fund monthly no later than the 15th day of the month following the billing month. Bank details of the Social Insurance Fund must be requested from your territorial branch of the Fund.

As for any payment transferred to the budgetary system of the Russian Federation, contributions for injuries are assigned a BCC. The BCC for injuries in 2022 for employees is set to be uniform and does not depend on the rate:

KBC of contributions for injuries: 39310202050071000160.

In addition, when filling out a payment order, you must fill in the fields in a special way.

| Payment order field | Meaning |

| 101 - payer status | 08 |

| 104 - KBK | 39310202050071000160 |

| 106 — 109 | 0 |

| 24 — purpose of payment | In this field you should indicate the type of social contribution, the period for which it is paid, and the registration code of the company in the Social Insurance Fund |

Sample of filling out a payment order to the Social Insurance Fund

KBC for payment of tax fines for 2022

BCC for 2022 was approved by order of the Ministry of Finance of Russia dated 06/08/2021 No. 75n. These codes must be indicated in payment orders when paying tax fines in 2022.

| Payment Description | KBK |

| Income tax, which is charged to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Tax on property not included in the Unified Gas Supply System | 182 1 0600 110 |

| Tax on property included in the Unified Gas Supply System | 182 1 0600 110 |

| Simplified tax with the object “income” | 182 1 0500 110 |

| Simplified tax with the object “income minus expenses” | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Personal income tax for a tax agent | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax from plots of Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 |

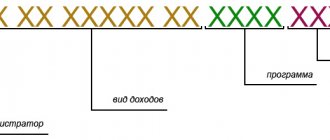

KBK table on insurance premiums for 2022

The Ministry of Finance, by its order No. 230n dated December 7, 2016, amended the budget classification codes for 2022. The same changes apply in 2021. The changes concern the following sections:

1. Corporate income tax - changes apply to enterprises working with foreign partners and receiving income from them.

2. Simplified tax system – changes affected organizations using the taxation object “income minus expenses”. The minimum tax and advance payments will be made to a separate BCC.

3. Insurance premiums - starting from 2022, administration has passed to the Federal Tax Service, with the exception of insurance premiums for industrial accidents and occupational diseases. This caused a change in the KBK codes.

Changes have been made to the list of budget classification codes. In particular, the changes concern individual entrepreneurs, namely: KBK 18210202140061200160 “Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation ...” was excluded from the list, while KBK 18210202140061100160 was renamed and is now called “Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension.” In this case, accrued and paid amounts previously reflected under the excluded BCC 18210202140061200160 should be reflected on BCC 18210202140061100160.

The changes are related to the publication of Order No. 245n of the Ministry of Finance of Russia dated November 30, 2018 “On amendments to the Procedure for the formation and application of budget classification codes of the Russian Federation, their structure and principles of assignment, approved by Order of the Ministry of Finance of the Russian Federation dated June 8, 2022 No. 132n.”

A table summarizing the budget classification codes for insurance premiums is presented below.

| Purpose | KBK 2022 | |

Pension contributions | ||

| for insurance pension – for periods up to December 31, 2016 | 18210202010061000160 | |

| – for the periods 2022 - 2022 | 18210202010061010160 | |

| for funded pension | 18210202020061000160 | |

| for additional payment to pensions for flight crew members of civil aviation aircraft: – for periods before December 31, 2016 | 18210202080061000160 | |

| – for the periods 2022 - 2022 | 18210202080061010160 | |

| for additional payment to pensions for employees of coal industry organizations: – for periods before December 31, 2016 | 18210202120061000160 | |

| – for the periods 2022 - 2022 | 18210202120061010160 | |

| in a fixed amount for an insurance pension (from income not exceeding the limit): – for periods before December 31, 2016 | 18210202140061100160 | |

| – for the periods 2022 - 2022 | 18210202140061110160 | |

| in a fixed amount for an insurance pension (from income above the limit): – for periods before December 31, 2016 | 18210202140061200160 - excluded, you must pay at kbk 18210202140061100160 | |

| – for the periods 2022 - 2022 | 18210202140061210160 | |

| for the insurance part of the labor pension at an additional rate for employees on list 1: – for periods before December 31, 2016 | 18210202131061000160 | |

| – for the periods 2022 - 2022 | 18210202131061010160, if the tariff does not depend on the special assessment; 18210202131061020160, if the tariff depends on the special estimate | |

| for the insurance part of the labor pension at an additional rate for employees on list 2: – for periods before December 31, 2016 | 18210202132061000160 | |

| – for the periods 2022 - 2022 | 18210202132061010160, if the tariff does not depend on the special assessment; 18210202132061020160, if the tariff depends on the special estimate | |

Contributions to compulsory social insurance | ||

| for insurance against industrial accidents and occupational diseases | 39310202050071000160 | |

| in case of temporary disability and in connection with maternity: – for periods before December 31, 2016 | 18210202090071000160 | |

| – for the periods 2022 - 2022 | 18210202090071010160 | |

Contributions for compulsory health insurance | ||

| in FFOMS: – for the periods from 2012 to 2016 inclusive | 18210202101081011160 | |

| – for the periods 2022 - 2022 | 18210202101081013160 | |

| in the Federal Compulsory Medical Insurance Fund in a fixed amount: – for the periods from 2012 to 2016 inclusive | 18210202103081011160 | |

| – for the periods 2022 - 2022 | 18210202103081013160 | |

KBC for payment of insurance premiums for 2022

The Ministry of Finance of Russia approved new budget classification codes for payment orders for insurance contributions by order No. 75n dated 06/08/2021.

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0220 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0220 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Rates

The interest rate at which the payer calculates social contributions from accidents at work is set annually depending on the professional risk of the company’s main activities in accordance with Federal Law No. 179-FZ of December 22, 2005. It varies from 0.2 to 8.5%. To find out what the rate of insurance premiums for injuries will be according to OKVED, you need to refer to Order of the Ministry of Labor dated December 30, 2016 No. 851n.

Your main activity must be confirmed annually. To do this, you must provide the FSS with:

- Statement.

- Certificate confirming the main type of activity.

- A copy of the explanation to the financial statements (small businesses do not submit).

If this is not done, the FSS will set the maximum possible rate based on the OKVED codes registered in the Unified State Register of Legal Entities for the organization.

See application and certificate samples at the end of the article.

KBC for payment of penalties on insurance premiums for 2022

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0200 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0200 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

What BCCs for insurance premiums are established for the Social Insurance Fund in 2022

Payments to the Social Insurance Fund are classified into 2 types:

- paid towards insurance for sick leave and maternity leave;

- paid towards insurance for accidents and occupational diseases.

Individual entrepreneurs working without hired employees do not list anything in the Social Insurance Fund.

Individual entrepreneurs and legal entities working with hired personnel make payments for them:

- for sick leave and maternity insurance - using KBK 18210202090071010160 (if we are talking about accruals made since 2017) and KBK 18210202090071000160 (if accruals were made before 2017) - contributions are administered by the Federal Tax Service;

- for insurance against accidents and occupational diseases - in the amount determined taking into account the class of professional risk by type of economic activity, using BCC 393 1 0200 160 - contributions are transferred directly to the Social Insurance Fund.

Individual entrepreneurs and legal entities concluding civil contract agreements with individuals pay only the second type of contributions, provided that this obligation is specified in the relevant agreements.

A sample payment order for contributions to OSS from VNiM for employees can be found in ConsultantPlus. You can get a trial full access to K+ for free.

Read more about the specifics of calculating insurance premiums when signing civil contracts in this article .

KBC for payment of fines on insurance premiums for 2022

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0200 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0200 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Payers

Insurance premiums for injuries in 2022 are paid by all employers operating in the Russian Federation:

- Russian organizations and individual entrepreneurs;

- foreign organizations if they involve Russian citizens in their work;

- individuals if they hire persons subject to compulsory accident insurance.

At the same time, Russian organizations pay contributions both in relation to citizens of the Russian Federation and in relation to foreigners. The rules for their calculation are established by Federal Law No. 125-FZ of July 24, 1998.

After registering a new company with the Federal Tax Service, information about this is transmitted to the territorial body of the Social Insurance Fund. From this moment, the newly created organization automatically becomes a payer of contributions and is assigned a registration number. To find out it, as well as determine how much interest to pay to the Social Insurance Fund for injuries in 2022, you need to contact the Social Insurance Fund. You can find out the registration number by requesting an extract from the Unified State Register of Legal Entities from the tax office.

BCC for individual entrepreneur contributions for 2022

Individual entrepreneurs pay the BCC on their own. If an individual entrepreneur simultaneously works as an employee, he still must pay contributions for himself - as an individual entrepreneur.

Entrepreneurs are required to pay mandatory contributions to their own pension and health insurance until they are “listed” as an individual entrepreneur and there is a Unified State Register of Entrepreneurs (USRIP) entry about them. The age of the entrepreneur and occupation does not matter. And most importantly, contributions must be paid even if the individual entrepreneur does not receive any income.

Accrual procedure and reporting

Contributions for insurance against industrial accidents and occupational diseases are calculated monthly on the last date using the formula:

The calculation base includes all payments to employees accrued under employment contracts. As well as payments under civil and copyright contracts, if under the terms of the contract the customer is obliged to pay them to the Social Insurance Fund. There is no maximum accrual base for contributions for injuries, so they are accrued from all payments during the year.

Payers submit a quarterly report 4-FSS to the Social Insurance Fund about the amounts of accruals. The deadlines for delivery are as follows:

- for a paper report - no later than the 20th day of the month following the reporting quarter;

- for electronic - no later than the 25th day of the month following the reporting quarter.