Why does overpayment occur and how to find out about it

An overpayment may occur due to an error by the taxpayer, or due to an error by the tax authorities. Most often this happens for the following reasons:

- The accountant used the wrong tax rate and therefore calculated the tax incorrectly.

- The taxpayer mistakenly indicated an inflated amount or an incorrect budget classification code (BCC) in the payment.

- The legislation introduced a tax benefit, the effect of which extends to past periods. The accountant should have recalculated the tax, but he did not.

- Sometimes accountants deliberately contribute more money when paying taxes in order to protect themselves and the company.

Whatever the reason for the overpayment, the tax code establishes the right of a company or individual entrepreneur to offset or return the excess amount.

Both an accountant and the tax inspectorate can identify the fact of excessive payment of taxes.

If the tax authorities were the first to discover the overpayment, they are obliged to report it within ten working days, in accordance with clause 3 of Art. 78 Tax Code of the Russian Federation. The tax authorities will send a message about the overpayment either by registered mail or through the taxpayer’s personal account.

In practice, tax authorities do not always report overpayments. Therefore, it is better not to wait for their mercy and check it yourself. You can check the presence of debts or overpayments using a joint reconciliation report with the tax office. If there is a discrepancy between accrued and paid taxes, the act will show this.

To request a reconciliation, you must file a tax application. There is no approved application form; the main thing is to indicate in it the name of the company, TIN, address and telephone number, as well as taxes that need to be verified.

The total period for reconciliation of calculations is ten days. If during the reconciliation discrepancies in the figures are discovered, the period is extended to 15 working days.

The taxpayer can agree with the act and sign it “without disagreement”, or disagree and sign it “with disagreement”. The reconciliation will continue until it becomes clear who made the mistake: the accountant or the tax office.

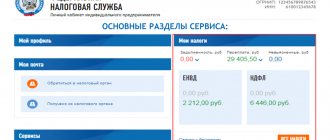

To save time, it is better to order a reconciliation report through your personal account. There is no need to write an application, and the document will be ready in a couple of days. To do this, in the taxpayer’s personal account, click on “Reconciliations with the budget” → “Submit an application to initiate the procedure for conducting a joint reconciliation of calculations with the budget.”

What to do with overpaid taxes

If you discover an overpayment, you have two options:

- Set it off against future payments or existing debt.

- Return it to your current account.

How to offset an overpayment against debt or future payments

By overpayment you can cover debts on taxes, fines, penalties, or direct it towards future payments.

Until October 1, 2022, the rule was in force: federal tax - to the federal budget, regional tax - to the regional budget, local tax - to the local budget. And it was impossible to offset the overpayment of regional tax against local tax.

Important. From 10/01/2020, overpayments can be offset against any tax, regardless of whether it is federal, regional or local. Overpayments can also be offset against fines and penalties that apply to any taxes.

For example

, IP Sobolev overpaid 6 thousand rubles according to the simplified procedure. He also must pay property tax in the amount of 4 thousand rubles. Sobolev can write an application to offset the overpayment. Despite the fact that the simplified tax system is a regional tax, and property tax is a local tax, offsets are allowed.

However there are two exceptions:

- Overpayments cannot be offset against arrears or future personal income tax payments.

- It will not be possible to count the overpayment against the fine established by the Code of Administrative Offenses (for example, for violating the procedure for using cash register equipment). The Tax Code does not provide for this possibility.

To offset the overpayment against future payments, submit an application to the tax office at the place of registration using the KND form 1150057. You can submit it in person, by mail, or through your personal account.

The tax authorities will make a decision on crediting the amount within ten days.

How to return an overpayment to a bank account

Step 1. Write

an application using the KND form 1150058

. The application can be submitted in paper form in person or by mail, or electronically via TKS or through your personal account. As a general rule, no additional documents need to be attached to the application. However, if the overpayment was due to an error in the declaration, submit the corrected declaration first.

Step 2. Wait for the tax office to respond. The inspectorate will consider the application within ten working days. Then he will either return the money or refuse a refund. The tax office will notify you of the refusal within five days from the date of the decision.

Important.

Refusal to return can be appealed to a higher tax authority and then to court.

Step 3. Check if the money has arrived.

If the tax authorities make a positive decision, they will return the money within a month from the date of receipt of the refund application. The money will go to the bank account you indicated in the application.

If the overpayment follows from the declaration, including the updated one, then the tax authorities will return the money no earlier than a month after the end of the desk audit of this declaration.

If the tax inspectorate violates the specified deadlines, then interest will be charged on the unrefunded amount for each calendar day of delay.

Important. If you have debts on other taxes or debts on penalties and fines, the tax office will first offset the debt, then return the rest of the overpayment. If there are no debts, the tax office will refund the overpayment in full.

Refund of overpaid tax

The procedure for returning an overpaid “simplified” tax is no different from the procedure for returning any other tax “overpaid” to the budget.

note

Currently there are standard samples of applications for tax credits and refunds. They were approved by order of the Federal Tax Service dated March 3, 2015 No. ММВ-7-8/ [email protected] Until this time, we would like to remind you that companies and entrepreneurs submitted applications for offset or refund of tax payments in free form.

You can return the overpayment under the simplified tax system in two cases:

- if you yourself overpaid the tax;

- if the tax authorities made additional charges to you, and you challenged them with the Federal Tax Service or in court and proved that they were illegal.

In such situations, you can only return the overpaid amounts to your current account. Overpayments are not refunded in cash.

And entrepreneurs have the right to indicate in the application for a tax refund the account of their personal bank card (determination of the Supreme Arbitration Court of the Russian Federation dated September 17, 2013 No. VAS-12390/13). In this case, three years must not pass from the date of payment of the excess amount of taxes (Clause 7, Article 78 of the Tax Code of the Russian Federation). Calculate three years from the date of filing the declaration for the year, but no later than the deadline established for its submission (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 28, 2011 No. 17750/10, letter of the Ministry of Finance of Russia dated June 15, 2012 No. 03-03-06 /1/309).

To return the overpayment, submit an application to the Federal Tax Service in the form approved in Appendix No. 8 to the order of the Federal Tax Service of Russia dated March 3, 2015 No. ММВ-7-8/ [email protected]

In the application, indicate the name of the inspection and your details: name of the company or surname, first name, patronymic of the entrepreneur.

Also fill out the basis for the return - the article of the Tax Code in accordance with which the return is made. For overpaid amounts this is Article 78 of the Tax Code, and for overcharged amounts - Article 79. And mark the type of overpayment - what amount you want to return: overpaid or overcharged.

Then indicate the tax for which the overpayment was incurred and the period to which it relates, KBK and OKTMO, as well as the amount you are asking to be returned, in full rubles, in numbers and in words.

Here is a sample application for a “simplified” tax refund:

Inspectors will return the overpayment only to the current account. Therefore, be sure to indicate in the application the details of this account to which the tax authorities must transfer money to you: name of the bank, correspondent account, BIC, INN, KPP, the account number of the company or businessman. In addition, be sure to indicate in the application who exactly is returning the overpayment - the taxpayer, the payer of the fees or the tax agent. Include the date the application is completed and the signature of the person who is returning the overpayment.

Submit the application to the Federal Tax Service on paper or electronically (clauses 4, 6 of Article 78 of the Tax Code of the Russian Federation). Within 10 days from the date of receipt of your application for a tax refund or from the date of signing the act of joint reconciliation of taxes paid, if such a joint reconciliation was carried out, the tax office must make a decision on the return of overpaid or collected tax (clause 8 of article 78 of the Tax Code of the Russian Federation) . Within five working days from the date of the decision, tax authorities are required to inform you about the decision made (clause 9 of Article 78 of the Tax Code of the Russian Federation).

The inspection will return the overpayment within a month after it receives your application (Clause 6, Article 78 of the Tax Code of the Russian Federation). But if you have tax arrears identified during the tax reconciliation, those will be paid first. And the controllers will return the remaining funds to you. If the tax inspectors violate the one-month deadline, then you will be entitled to interest for the delayed return. They are accrued for each calendar day of delay based on the refinancing rate of the Bank of Russia (Clause 10, Article 78 of the Tax Code of the Russian Federation).

How to return an overpayment of “simplified” tax to your current account, read in the berator “STS in practice”

What to do if you missed the three-year deadline

As a general rule, the period for offset or refund of overpayment is three years from the date of payment of the tax. If three years have passed, the tax office will refuse.

However, the three-year period is not always counted from the date of payment. For example, an overpayment arose due to the payment of advance payments for income tax. And the accountant found out about it when he filed a declaration at the end of the year.

Therefore, if the tax office refused you, check whether you knew about the overpayment at the moment it arose. Or, for objective reasons, you found out about it later.

If three years have not yet elapsed from the day the taxpayer actually learned about the surplus, you can go to court. The court considers the period to be three years from the moment the company learned or should have known about the overpayment. In this case, the judge will check the reasons why the company or individual entrepreneur could not find out about the overpayment earlier.

For example

, filed an income tax return and paid tax for 2016 on March 13, 2022. On March 20, 2022, the company filed an updated declaration for 2016. In it, it added expenses that it could not reflect in the initial declaration due to a legal dispute with the counterparty. As a result, after submitting the updated declaration, an overpayment arose. On July 10, 2022, the company filed an application for a refund of overpaid taxes. The inspectorate refused to refund the tax because more than three years had passed since its payment (March 13, 2022). However, the organization can obtain a tax refund through the court, since it became aware of the overpayment only on March 20, 2022, when the accounting data was adjusted. If we count three years from this date, then at the time of filing the application the return period has not yet passed.

How to use an overpayment to a legal entity or individual entrepreneur: refund, offset against payment

If the option of leaving an overpayment under the simplified tax system to reduce future payments for the same tax is not suitable for the taxpayer for some reason, then he can deal with it as with an overpayment for any other tax payment:

- return to your current account;

- offset against payment of another tax. Budget levels no longer matter. Moreover, from 01/01/2022 it will be possible to make payments not only between taxes, but also between taxes and contributions. To find out more, read our news .

ConsultantPlus experts explained how to properly apply for a tax offset. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

To implement each of these procedures, you will need to fill out an application in the prescribed form.

Read about the preparation of such statements in the following materials:

- “Application for refund of payments: recommendations for preparation and submission”;

- “Application for offset of the amount of overpaid tax”.

The latest material also describes the regulations for the offset procedure (when it will be done and how the taxpayer will be notified about it).

How can a self-employed person return an overpayment of taxes?

For the self-employed, the general procedure for refunding overpayments applies: you need to submit an application to the tax office. However, since a self-employed person pays tax based on the income that he himself declared, he can only detect the overpayment on his own.

For example, Marina is a translator. She pays NAP. Marina paid the tax for December, and then noticed that she had made a mistake on one check for 3 thousand rubles. Marina canceled the check with an error, generated a new check and transferred the data to the tax office. Then I wrote an application to offset the overpayment against the next NAP.

If you are self-employed and notice you have overpaid your taxes, first void the erroneous check, then create a new check with the correct amount. Then decide what is best to do with the overpayment: return it (write a statement) or offset it (against the future NAP).