Accounting for profit generation

There are 4 types of profit in accounting:

- operating room;

- from other operations;

- clean;

- unallocated.

Retained earnings must be reflected on the balance sheet. ConsultantPlus experts explained in detail how to do this correctly. To avoid mistakes, get trial access to the system and go to the Tax Guide. It's free.

Operating profit is defined as the positive difference between credit and debit turnover on account 90, which at the end of the month is transferred to account 99:

Dt 90-9 Kt 99.

Profit from other operations is formed in the same order as operating profit. Only amounts for calculation are taken from account 91:

Dt 91-9 Kt 99.

Net profit is calculated on a monthly basis after closing the balance between credit and debit turnover in account 90 and account 91 and charging income tax:

Dt 68 Kt 99.

The formation of retained earnings is carried out once a year when the balance formed at the end of the year on account 99 is written off to account 84:

Dt 99 Kt 84.

You will find detailed explanations on determining the amounts of each type of profit and reflecting them in accounting in our articles:

- “Calculation and formation of operating profit (formula)”;

- “How to calculate net profit (calculation formula)?”;

- “How to calculate accounting profit (formula)?”;

- “Retained earnings in the balance sheet (nuances)”;

- "Accounting and analysis of financial results."

Types of accounting

The amount of retained earnings can be accounted for in different ways. There are two options:

- Cumulative.

- Yearly.

With a cumulative accounting system, separate sub-accounts are not opened for profits from previous periods and the current year. The entire amount is reflected in account number 84. It accumulates starting from the first year of operation of the organization. If a loss occurs, it is covered by previously created savings.

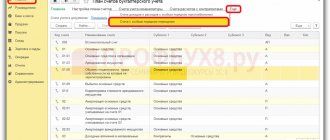

The cumulative accounting system is most often found in small enterprises. The weather approach is more detailed. In this case, there are separate sub-accounts for accumulating amounts for previous reporting periods. Second order accounts can come in different formats. For example, there are accounts 84.1 and 84.3. The first of them is used to account for profit before distribution for the reporting year, and the second - for previous periods.

To obtain detailed information, data is taken from the explanatory note of the annual report (attached to the balance sheet by large and medium-sized organizations) or from accounting entry account 84. Reporting from previous periods is also used for analysis. If errors are identified from previous years, they will be taken into account in the current year's results.

Accounting for the use of profit in an organization

The use of profit in an organization should be carried out only on the basis of the decision of its founders (participants). All transactions for spending profits recorded in accounting, but not confirmed by the specified decision, will be considered illegal, and the financial statements will be considered unreliable.

The use of profit can be represented schematically:

Let us consider in more detail the reflection in the postings of each of the areas of profit use indicated in the diagram.

Key differences between retained and net earnings

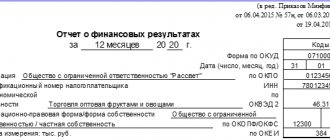

NP is often confused or completely identified with net profit (NP). Very often you can hear the following phrase: NP is an emergency that was not divided between the founders. What is noteworthy is that both profits are indeed very similar, and, at times, can coincide, and often differ only in the amount of deferred tax liabilities. For comparison, let's look at some of the distinctive features of reproducing them in booze. reporting.

NP is displayed in the account. balance sheet (on p. 1370) and has a value different from net profit. An account with an NP is called active-passive. The amount of NP for a specific period is the profit received throughout the entire period of the company’s existence. Defined as the amount of profit minus taxes. In the bay. the balance sheet displays IR not only for each reporting period, but also in general, for the entire period of existence of the LLC (JSC) on the simplified tax system.

The state of emergency is that part of the profit that remains after paying all obligatory budget payments (fees, taxes, etc.). It is recorded in the financial report (on line 2400) at the end of the year, and is displayed on the CT account. 84 (“NP”). The form of this report is the same as the accounting. balance, approved The Ministry of Finance of the Russian Federation, in particular, by Order No. 66n dated July 2, 2010. The company organizes analytical accounting for it autonomously. The payment of dividends for the year or quarter to the founder-employee can be shown with the following entry: DT 84 CT 70. When directing an emergency to increase the capital, they show: DT 84 CT 80, etc.

External use of profits

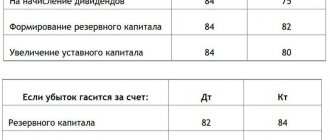

| Operation | Dt | CT |

| Profit generated at the end of the year | 99 | 84 |

| Dividends and bonuses accrued based on the results of the year | 84 | 75, 70 |

| Interim dividends, bonuses (for a quarter, half a year, 9 months). Note! This entry is not recorded in the chart of accounts, but from a logical point of view, interim dividends can only be paid out of net profit (account 99), since retained earnings (account 84) are formed only at the end of the year | 99 | 75, 70 |

| Charitable payments to citizens and organizations | 84 | 76 |

| Financial assistance to employees | 84 | 73 |

Find out how to correctly account for incentives to employees at the expense of net profit in the material from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Calculation technology

Own capital and reserves can be replenished from net profit. To calculate it correctly, simple technology is used. To do this, you will need to determine the amount of net profit, income before distribution at the beginning of the year, as well as the amount of dividends. If the company is a joint-stock company, payments are made to the owners of the relevant securities. For an LLC, dividends are paid to the founders.

The corresponding data is presented in the balance sheet in line 1370 and in the income statement in line 2400. If the company received net profit, the calculation looks like this: NP = NPn.g. + PE – D. Where:

- NPN.g. – profit before distribution at the beginning of the year.

- PE – net profit.

- D – dividends paid to owners.

If no income was received in the current period, it will not be able to replenish capital and reserves. In this case, the calculation is made using the following formula: NP = NPn.g. – U – D. Where:

- Y – the amount of the company’s net loss.

The loss may be greater than the amount of accumulated net profit at the beginning of the year. In this case, a negative value is indicated in the balance sheet. It is placed in parentheses. This is already an uncovered loss that reduces the balance sheet currency.

Internal active use of profits

When using profits for the development of the organization and covering losses for previous years, its movement is taken into account only in analytical accounts. This movement is not reflected in any way in synthetic accounting. This fact is due to the fact that the profit received is not withdrawn from current turnover, but continues to work.

The purchase of fixed assets, intangible assets and other costs for optimizing the organization’s activities, made at the expense of profits, are accounted for in the usual manner without using account 84.

And in order to understand how much of the profit received is aimed at optimizing activities, and what remains unclaimed, it is recommended to open at least the following sub-accounts for account 84 “Retained earnings”:

- subaccount 1 “Profit received”;

- subaccount 2 “Profit in circulation”;

- subaccount 3 “Loss of previous years”.

And when the organization’s participants make a decision on the use of profits, record them with internal postings to account 84:

- Dt 84-1 Kt 84-2 - the profit received is used to purchase new equipment.

- Dt 84-1 Kt 84-3 - the profit received is used to cover the losses of previous years.

“Prohibited” payments from retained earnings

Sometimes the owners of an organization make decisions to pay bonuses to employees, financial assistance, and the acquisition of fixed assets at the expense of profits. Some decide to create so-called consumption and accumulation funds and charitable foundations.

The laws on JSC and LLC do not provide for any payments from profits to anyone other than the owners. And account 84 “Retained earnings (uncovered loss)” is the account of the owners, and only they have the right to receive dividends.

The Russian Ministry of Finance has also repeatedly indicated that account 84 is not intended to reflect all kinds of social and charitable expenses, payments of material assistance and bonuses (see, for example, letters of the Russian Ministry of Finance dated June 19, 2008 No. 07-05-06/138, dated December 19, 2008 No. 07-05-06/260).

Expenses of an organization are recognized as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities, leading to a decrease in the capital of this organization, with the exception of a decrease in contributions by decision of participants (owners of property) (clause 2 of PBU 10/99 ).

Organizational expenses for sporting events, recreation, entertainment, cultural and educational events and other similar events, as well as transfers of funds to charity, are other expenses and should be accounted for in account 91 “Other income and expenses.” In other words, any disposal of assets (except for dividends) is an expense of the current period (clause 2 of PBU 10/99). Such costs have nothing to do with the organization’s net profit. They cannot be debited to account 84; this is contrary to current accounting regulations.

Results

When profits are paid to the founders, employees of the organization or third-party citizens and organizations, it is written off to the accounts of settlements with recipients of funds.

When the profit is attributed to the increase in the reserve and authorized funds of the organization, it is written off to the capital accounts. And when profit remains in the organization’s turnover, its movement is recorded only in analytical accounting. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of displaying retained earnings in accounting. balance using standard situations as an example

NP is displayed in accounting. balance sheet, taking into account all changes that occurred based on the results of each reporting period. This is a cumulative total for the entire existence of the organization. Since today the updated form of accounts is used. balance sheet No. 1 (according to OKUD - 0710001), then the amount of NP is shown on line 1370 (in liabilities). The updated balance sheet was approved and introduced by Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010. As an illustrative example, let's consider two typical situations related to the calculation and display of accounting income. balance.

Situation 1. Suppose that an LLC using the simplified tax system (6%) received a profit in the total amount of RUR 500,000 during the year of its activities. rub. Consequently, the company must pay tax in the amount of: RUR 500,000. rub. x 6% = 30,000 RUR. rub. Due to the tax paid, the size of the NP for the same year is reduced: RUR 500,000. rub. – RUR 30,000 rub. = RUR 470,000 rub. Thus, in the bay. In the balance sheet on line 1370 (liabilities), at the end of the year under review, retained earnings in the amount of RUR 470,000 should be displayed. rub.

Situation 2. Let’s assume that an LLC on the simplified tax system (15%) was charged 200,000 rubles for the provision of certain services. rub. In addition, he received non-operating income in the amount of RUR 100,000. rub. The total profit of the company by the end of the reporting year amounted to RUR 300,000. rub. During the year under review, there were production expenses (250,000 Russian rubles), as well as expenses that are not taken into account for tax purposes (35,0000 Russian rubles).

The amount of tax payable, taking into account all expenses and profits received for the year, was: (300,000 – 250,000) x 15% = 7,500 RUR. rub. It follows that the NP at the end of the reporting year is 7,500 (300,000 – 250,000 – 35,000 – 7,500). According to page 1370 in the book. the balance sheet will need to show exactly this amount (7,500).

It should be noted that many economists separate NP indicators for the current year and for previous ones. For this purpose, two separate lines are allocated in the ledger. balance. What is noteworthy: NP for previous years can be distributed and divided at any time, and not only at the end of the year. But the distribution of NP for the just past year is possible only taking into account the summed up results of the organization’s activities.