Reasons why insurance premiums are overpaid

Organizations and individual entrepreneurs with hired employees are payers of insurance premiums according to the norms of the Tax Code of the Russian Federation:

- for compulsory pension insurance;

- for compulsory health insurance;

- for insurance in connection with temporary disability and maternity;

- insurance against occupational diseases and injuries (administered by the Social Insurance Fund).

Additionally, all individual entrepreneurs pay insurance premiums in a fixed amount for themselves. If the amounts transferred are greater than the accrued amounts or a recalculation has occurred, as a result of which the accruals have decreased, an overpayment of compulsory health insurance, VNIM and compulsory health insurance arises, and reimbursement of insurance premiums is required from the Federal Tax Service and the Social Insurance Fund. Insureds have the right to use accruals for VNIM and injuries to pay benefits to employees, and if the amount of funds spent exceeds the accrued amount, an overpayment occurs.

IMPORTANT!

An amount overpaid to the fund budget occurs if errors are made in accounting or in calculating the DAM.

Since funds paid in excess to the fund budget are excluded from circulation for the policyholder, he has a desire to return them. The norms of Article 78 of the Tax Code of the Russian Federation provide for the return of overpaid insurance premiums for compulsory medical insurance, compulsory medical insurance and VNIM. In addition, legal entities and individual entrepreneurs have the right to offset overpaid amounts against other payments.

Healthy:

How to calculate and pay insurance premiums

Filling out a payment slip for SV: form and samples

KBC for insurance premiums

Constitutional Court of the Russian Federation: refund of overpayment of pension contributions is possible

Let's take a closer look.

Set-off and refund of overpayments on insurance premiums

First, let's remember the rules that need to be applied when returning or crediting insurance premiums.

If insurance premiums are overpaid or the tax office has over-collected insurance premiums, they can be returned or offset against future payments.

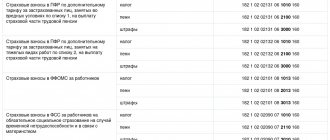

The procedure for offset and return of overpaid amounts of insurance premiums depends on the type of contributions and the period for which the overpayment occurred. From January 1, 2022, the administration of insurance premiums is carried out by the tax inspectorate according to the rules of Articles 78 and 79 of the Tax Code. Let's note the main ones:

- the amount of overpaid insurance premiums is subject to offset against the corresponding type of contributions. That is, overpayment of medical contributions is not allowed to be offset against arrears of pension contributions;

- the overpayment will be returned only after the existing debt has been repaid for the corresponding penalties and fines;

- if overpaid pension contributions are reflected in personalized reporting and posted to the personal accounts of individuals, the tax authorities will not return the overpayment.

Forms of documents for offset or return of overpaid (collected) insurance premiums to the Pension Fund before January 1, 2022 were approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 22, 2015 No. 511p.

When filing a return, you must take into account that this procedure involves a statute of limitations. It is valid for 3 years from the date of payment of contributions. Refunds can only be made during this period.

About an individual personal account with the Pension Fund of Russia

Employers transfer insurance contributions to the Russian Pension Fund - 22% of wages.

An individual personal account (IPA) is information about accumulated points, length of service, earnings and insurance premiums that the insured person has accumulated to date.

The employer submits information to the Pension Fund, and the Pension Fund takes into account the information in the accounts.

Legal dispute

The company disputes the provisions of paragraph 6.1 of Art. 78 Tax Code of the Russian Federation. The dispute reached the Constitutional Court.

Thus, in 2014, the company overpaid contributions to compulsory pension insurance and demanded a refund of the overpayment. The Pension Fund refused because information about overpaid contributions was recorded in the individual accounts of employees.

The courts sided with the Pension Fund of Russia, finding that the return of overpaid funds is impossible, since information about the paid contributions has already been recorded in the individual personal accounts of the insured persons - the company's employees. They refer to the ban on the return of insurance payments, which until January 1, 2022 was provided for in Federal Law No. 212-FZ dated July 24, 2009.

The Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation considered a cassation appeal against the decisions of the courts, which refused to satisfy the company’s complaint and oblige the branch of the Pension Fund of the Russian Federation to return overpaid insurance premiums for compulsory pension insurance.

Rights violation?

The company believes that such an inability to dispose of overpaid insurance premiums raises questions regarding compliance with payers of the right of ownership of their property guaranteed by the Constitution of the Russian Federation.

And the forced seizure of property in the form of amounts of fiscal payments, carried out in an improper procedure, violates the constitutional guarantees for the protection of property rights enshrined in Art. 8 and 35 of the Constitution of the Russian Federation. Therefore, the applicant requests that the challenged norms be checked for compliance with the Constitution of the Russian Federation.

It turns out that this deprivation of payers’ ability to dispose of overpaid insurance premiums for periods before 01/01/2017 should be adjusted.

What does the Constitutional Court “say”

In Resolution No. 32-P dated October 31, 2019, the Constitutional Court of the Russian Federation recognized that organizations and individual entrepreneurs have the right to demand the return of overpaid insurance premiums even if the overpayment was taken into account in the individual personal accounts of employees. In this case, the period of occurrence of the overpayment does not play a role.

The Constitutional Court of the Russian Federation recognized the contested norm as contrary to the Constitution of the Russian Federation and gave instructions that the legislator make the necessary changes. Until such changes are made, the Constitutional Court of the Russian Federation prohibits refusing to return insurance contributions to employers.

We will wait for amendments to the Tax Code.

How to return an overpayment for compulsory medical insurance, compulsory medical insurance and VNiM

Article 78 of the Tax Code of the Russian Federation states that the policyholder has the right to return overpaid funds no later than 3 years from the date of payment. To return the overpayment of contributions for health insurance, compulsory medical insurance and VNiM, the policyholder must contact the Federal Tax Service, which administers them. To do this, use the application form according to KND 1150058, approved by order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected] (as amended by order dated November 30, 2018 No. ММВ-7-8/ [email protected] ). The order specifies what to do if you overpay insurance premiums in 2022 - send a request to the Federal Tax Service.

IMPORTANT!

Before drawing up the application, it is necessary to reconcile with the Federal Tax Service so that there are no discrepancies in the amount.

The document states:

- TIN and KPP of the policyholder;

- name of the organization (full name, individual entrepreneur);

- payer status;

- payment type;

- overpaid amount;

- KBK payment;

- details for transferring money.

No details or explanation of the amount are provided in the document. The document is certified by the signature of the head of the organization.

If the overpayment arose due to an error in the DAM, an updated calculation must be submitted to the Federal Tax Service along with the application. Article 78 of the Tax Code of the Russian Federation specifies how to return the overpayment of insurance premiums from the tax office in 2021 and submit an application in one of the provided ways:

- in paper form in person (through a representative) to the tax authority or by mail;

- via telecommunication channels in electronic form with an enhanced qualified electronic signature;

- through the taxpayer’s personal account on the Federal Tax Service website.

How to offset an overpaid amount against future payments

If the policyholder does not want to return the money, but to offset the overpayment of insurance premiums in 2022, he needs to contact the Federal Tax Service with an application in the form according to KND 1150057, approved by order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8 / [email protected] ( as amended on November 30, 2018). The document states:

- the amount of the overpaid amount;

- the period during which it was formed;

- KBK of the overpaid payment;

- BCC of the payment against which the offset is carried out.

After drawing up the document, it is dated and signed by the policyholder or his representative. The deadline for filing is 3 years from the date of occurrence of excess amounts in the payer’s personal account.

IMPORTANT!

Article 78 of the Tax Code of the Russian Federation specifies how to offset overpayments of insurance premiums against future payments—offset is provided only for the same type of payments. For example, overpaid funds for compulsory medical insurance can only be offset against future payments for compulsory medical insurance; they cannot be transferred to compulsory health insurance.

Tax officials will consider the request within 10 business days from the date of filing the application for offset or from the date of signing the joint reconciliation act. The refusal can be appealed to a higher authority or in court. If arrears arise, tax authorities carry out offsets on their own.

Document forms

In order to implement the provisions of the Federal Law of July 24, 2009 No. 212-FZ, the Ministry of Health and Social Development of Russia, by order of December 11, 2009 No. 979 n, approved 14 forms of documents used when offsetting or returning amounts of overpaid (collected) insurance premiums (these forms documents are given in the relevant appendices to the order that approved them):

- forms 21‑PFR and 21‑FSS of the Russian Federation - an act of joint reconciliation of calculations for insurance premiums, penalties, fines;

- forms 22‑PFR and 22‑FSS of the Russian Federation - application for offset of amounts of overpaid insurance premiums, penalties, fines;

- forms 23‑PFR and 23‑FSS of the Russian Federation - application for the return of amounts of overpaid insurance premiums, penalties, fines;

- forms 24‑PFR and 24‑FSS of the Russian Federation - application for the return of amounts of excessively collected insurance premiums, penalties, fines;

- Forms 25‑PFR and 25‑FSS of the Russian Federation - a decision to offset the amounts of overpaid insurance premiums, penalties, and fines.

Olga Konkova, expert at Consultant magazine

How to get back an overpayment of personal injury contributions

Article 26.12 of Federal Law No. 125-FZ dated July 24, 1998 (as amended on April 5, 2021) provides that the payer of contributions for compulsory social insurance against industrial accidents and occupational diseases has the right to return overpaid amounts from the Social Insurance Fund. The order of the FSS of the Russian Federation dated November 17, 2016 No. 457 contains instructions on how to return the overpayment under the FSS in 2022 and application form 22 of the FSS of the Russian Federation, which is filled out by the payer. Indicate:

- name of the policyholder and his registration number in the Social Insurance Fund;

- address of the applicant organization;

- overpayment amount with breakdown.

The document indicates the details by which the overpayment of insurance premiums to the Social Insurance Fund will be refunded in 2022 in the event of a positive decision.

Rules for filling out applications for refund and offset of overpayments of taxes and fees

An application for a refund of overpayment of tax (insurance premiums, penalties, fines) is submitted in the form approved by Order of the Federal Tax Service of the Russian Federation dated August 17, 2021 No. ED-7-8/ [email protected]

If a company is registered with several inspectorates (for example, at the location of separate divisions or real estate), the application is submitted to the inspection where the overpayment occurred.

An application for a refund of overpaid tax is filled out as follows.

1. In the “TIN” field indicate the TIN assigned to the company.

2. In the “Checkpoint” field indicate the code of the tax office to which the application is being submitted.

3. In the “Application number” field, indicate the serial number of the application, numbering is carried out within a year.

4. In the “Payer status” field you need to enter the following number:

- 1 – taxpayer;

- 2 – payer of the fee;

- 3 – payer of insurance premiums;

- 4 – tax agent

5. In the field “Based on the article” indicate the article of the Tax Code of the Russian Federation under which the refund is made:

- 78 - refund of overpaid tax (penalties, fines);

- 176 — VAT refund;

- 203 - refund of excise tax.

Next, select and enter a number that corresponds to the reason for the overpayment:

- 1 - overpaid,

- 2 - overcharged,

- 3 – subject to reimbursement: VAT, excise tax.

The following indicates what exactly was overpaid:

- 1 - tax;

- 2 - collection;

- 3 — insurance premiums;

- 4 - fines;

- 5 - fine.

6. In the “Amount” field, you need to indicate in numbers the amount of the refund in rubles and kopecks.

7. In the “OKTMO Code” field, indicate the code at the place where the company is registered.

8. In the “Budget classification code” field indicate the payment KBP. Be especially careful here.

9. The second page contains “Account Information”.

Here you need to enter all the bank details for which the Federal Tax Service will return the overpayment.

10. In the “Account type (code)” field, enter one of the values proposed below in the form:

- 01 - current account;

- 07 — account for deposits;

- 09 — correspondent account;

- 13 – correspondent sub-account.

11. Next, enter the BIC of the account in the “Bank Identification Code” field. Then the account number and before it the account number identifier from those suggested in the notes to the form:

- 1 – taxpayer,

- 2 – payer of the fee,

- 3 – payer of insurance premiums,

- 4 – tax agent).

12. In the “Receive” field you need to enter information about the company, having previously entered the identifier:

- 1 – organization (responsible participant in the consolidated group of taxpayers);

- 2 – individual;

- 3 – the body responsible for opening and maintaining personal accounts.

13. The fields “Recipient’s KBK” and “Recipient’s personal account number” are filled in by state employees.

14. Companies do not fill out information about an individual who is not an individual entrepreneur.

When does the Federal Tax Service return money?

After the policyholder has figured out how to return insurance premiums from the Pension Fund and sent a request to the Federal Tax Service, tax officials consider the submitted application within 10 business days from the date of receipt of the request. This is provided for by the regulations. If the decision is positive, the money will be received within 1 month to the bank account specified when submitting documents.

In case of refusal, tax officials send a reasoned refusal within 5 working days from the date of the decision. It can be appealed through a court or a higher tax authority.