Overpayment of personal income tax: what to do?

According to paragraph 1 of Art.

231 of the Tax Code of the Russian Federation, personal income tax amounts excessively withheld from the taxpayer’s income must be returned by the tax agent. Within 10 working days from the date of discovery of the overpayment, the employer is obliged to inform the employee that the amount of personal income tax was excessively withheld, as well as the amount of the amount itself (clause 6 of article 6.1, paragraph 2 of clause 1 of article 231 of the Tax Code of the Russian Federation). The message is drawn up in any form, since tax legislation does not provide for specific methods for its preparation, and is sent to the taxpayer.

A sample message about over-withheld personal income tax can be downloaded from the link below.

The procedure for sending such a message must be previously agreed with the recipient (letter of the Ministry of Finance of Russia dated May 16, 2011 No. 03-04-06/6-112, clause 1).

A ready-made solution from ConsultantPlus will help you reflect the return of excessively withheld personal income tax in 6-NDFL, 2-NDFL and accounting. Get free trial access to the system and proceed to the material.

There is nothing to withhold personal income tax from - what to do?

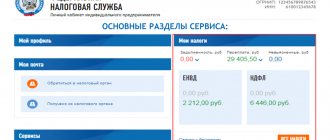

If there is nothing to withhold personal income tax from, the organization must notify the tax office at the place of its registration and the employee himself in writing about this, as well as the amount of tax. This must be done no later than March 1 of the year following the expired tax period (clause 5 of Article 226 of the Tax Code of the Russian Federation). This is reported to the inspectorate in the prescribed form - in the form of a 2-NDFL certificate, in which the sign “2” is indicated. It indicates the amount of income from which tax was not withheld and the amount of tax not withheld (clause 5 of Article 226 of the Tax Code of the Russian Federation).

This rule does not apply if the organization, as a tax agent, had the opportunity to withhold personal income tax when paying income to an employee during the year, but did not do so.

Tax officials noted that the organization, after identifying this fact, is obliged to withhold personal income tax when paying current income in cash and transfer the corresponding amount of tax to the budget. In this case, you need to submit an updated calculation in form 6-NDFL and a corrective certificate in form 2-NDFL.

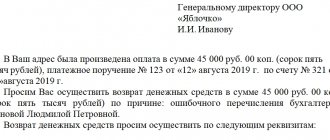

We are waiting for a statement from the employee

In order for the overpayment to be refunded, the taxpayer must contact the tax agent with a corresponding application in writing (clause 1 of Article 231 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 19, 2012 No. 03-04-05/10-1206). You have the right to determine the procedure for its presentation (on paper or in electronic form) yourself (letter of the Ministry of Finance dated 07/08/2019 No. 03-04-06/51172).

The deadline for filing an application is set in clause 7 of Art. 78 of the Tax Code of the Russian Federation and is 3 years from the date of payment of the tax (letter of the Ministry of Finance dated March 1, 2017 No. 03-04-05/11548). If this deadline is missed, the tax agent is not required to return the tax.

In the application, the employee must indicate the details of his bank account, to which the employer will have to transfer funds, since the overpayment is refunded in non-cash form (paragraph 4, paragraph 1, article 231 of the Tax Code of the Russian Federation).

Important! Tip from ConsultantPlus There is no approved form for such an application. You can accept an application from an individual, drawn up in free form, or offer to fill it out according to your sample. . Trial access to the system is provided free of charge.

See also the material “A taxpayer cannot return personal income tax by bypassing the tax agent .

Example

V.P. Smirnov is an employee of April LLC. In March 2020, he was given financial assistance in the amount of 2,000 rubles; from January to February 2022, financial assistance was not accrued or paid. The accountant mistakenly calculated and withheld personal income tax from financial assistance. The next day she discovered the error, recalculated the tax and determined the amount to be refunded. On the same day, the employee was informed about the fact of withholding and the amount of tax that the organization was obliged to return to him.

V.P. Smirnov must write a statement so that April LLC returns to him the excessively withheld amount of personal income tax.

We return the overpayment

So, the tax agent received the taxpayer’s application for a personal income tax refund. Now, within 3 months, he is obliged to return the excessively transferred amount of tax (paragraph 3, paragraph 1, article 231 of the Tax Code of the Russian Federation). If you do not do this within the period established by law, then in addition to the tax itself, the employer will have to pay the employee interest for violating the terms for the return of funds. Interest is accrued for each calendar day of delay, and the interest rate is taken equal to the refinancing rate of the Central Bank of the Russian Federation in force at that time (paragraph 5, clause 1, article 231 of the Tax Code of the Russian Federation). Overpayment of personal income tax in 2020-2021 is returned in a similar manner.

Accountants often ask the question: if there is an overpayment of personal income tax, can it be offset against current personal income tax payments?

The answer to this question was given by the Ministry of Finance of the Russian Federation in letter dated December 5, 2012 No. 03-04-06/4-342. The tax can be returned by reducing in the future the amount of personal income tax calculated from the income of both the taxpayer who has overpaid and other individuals receiving income from this tax agent (paragraph 3, paragraph 1, article 231 of the Tax Code of the Russian Federation). In this case, neither the type of income paid to other individuals nor the tax rate applied to these payments matters.

An example of the return of excessively withheld personal income tax from the income tax of other persons from ConsultantPlus As a result of an accountant’s error, an employee of the organization A.A. Ivanov, for the period January - March, personal income tax was excessively withheld in the total amount of 4,000 rubles. For April A.A. Ivanov received a salary of 15,000 rubles. Personal income tax in the amount of 1,950 rubles. (RUB 15,000 x 13%) was not withheld from his salary... You can view the full example in K+, having received test access for free.

If the tax agent is unable to return the overpaid personal income tax within the prescribed period, then he should contact the tax office with an application for a refund of the overpaid amount of tax within 10 days from the date the employee contacted him (paragraph 6, 8, paragraph 1, article 231 Tax Code of the Russian Federation). The application is accompanied by documents confirming the fact of the overpayment and an extract from the tax register for the period in which it occurred. At the same time, the taxpayer himself no longer needs to apply for a tax refund a second time (letter of the Ministry of Finance of Russia dated May 16, 2011 No. 03-04-06/6-112, clause 2).

It should be noted that the employer may not wait for the return of funds from the budget, but return the overpayment of personal income tax at his own expense (paragraph 9, paragraph 1, article 231 of the Tax Code of the Russian Federation).

Excessively withheld personal income tax - what to do?

Let's study how to return excessively withheld personal income tax in the 1C 8.3 (8.2) program for personnel.

How to return excessively withheld personal income tax in 1C ZUP 8.3 (rev. 3.0)

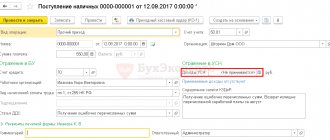

- We generate a tax refund document: section Taxes and contributions – Personal income tax refund:

- A document for payment of salary, in which we already see that the amount is paid in the amount of 1,198 rubles (750 rubles (salary) + 448 rubles (returned personal income tax):

In the payslip we see that an amount of over-withheld personal income tax was generated and in the same month it was offset, that is, returned and paid together in the salary for March 2016:

In the case of a personal income tax refund, you must manually make an entry in the register Calculations of tax agents with the personal income tax budget in order to correctly display personal income tax information for transfer. To do this, we will create a Data Transfers document. In setting up the composition of registers, select the accumulation register Calculations of tax agents with the personal income tax budget. Let’s fill it in as an “expense” with the amount “-448.00”:

Thus, we adjusted the information on the personal income tax transferred to the budget by the amount of the refund.

About possible errors when withholding personal income tax in 1C ZUP 3.0, see our video lesson:

How to return excessively withheld personal income tax in 1C ZUP 8.2 (rev. 2.5)

Let’s say an employee takes leave without saving from 03/01/16 to 03/30/16.

Thus, in March he worked only 1 day:

Let’s calculate his salary for March 2016 and see that a personal income tax amount with a minus sign has been formed, that is, an excessively withheld personal income tax has arisen:

This amount does not increase the amount payable and is stored in a separate personal income tax register for offset. You can view it by clicking on the Go button in the posted Payroll document:

If over-withheld personal income tax occurs, an entry with a “+” sign is placed in the register. In the payslip for March, the debt at the end of the month is 909.45 rubles, of which 364.00 rubles is the amount of excessively withheld personal income tax:

The amount of personal income tax withheld in excess should not increase the amount payable. This is what we see, having generated a document for payment of salary for March 2016. The amount to be paid is 545.45 = 909.45 -364.00 rubles:

When posting a payment document, a zero amount of withheld tax is recorded, and thus a difference arises between the calculated and withheld personal income tax. We can look at the calculated tax in the salary summary or in employee pay slips:

In the summary for March 2016, the amount of personal income tax calculated was 1,716.00 rubles. there is a negative tax amount. You need to transfer to the budget the amount withheld, that is, for March 2016. an amount of 364 rubles must be transferred. more than we see from the vault.

See the amount that must be transferred for March 2016. You can use the report Analysis of accrued taxes and contributions on the date when the salary for March was paid. In our example, this is 04/05/2016. The personal income tax withheld column will indicate the amount to be transferred to the budget:

There are two possible scenarios for working with such personal income tax:

- or read out in the following months;

- or it is returned at the request of the employee.

The amount of excessively withheld personal income tax is counted in the following months

Let's calculate the salary for April 2016. Employee New S.S. taxable income is 12,000 rubles - 1,400 rubles. (deduction) = 10,600 rub. Personal income tax on this income is 10,600 * 13% = 1,378 rubles. – we see this on the personal income tax tab:

When this document is processed, an entry is created in the personal income tax accumulation register for offset, but with a “-” sign, that is, the amount that was previously recorded in this register with a “+” sign in March 2016 was written off by this document:

When paying salary for April, the amount “To be paid” will be more by 364 rubles:

Let's generate a report Analysis of personal income tax on the date of payment of salary for April 2016 (as of 05/04/2016) and see how much needs to be transferred to the personal income tax budget for April 2016. And as can be seen from the report, this amount is 3,094.00 rubles. less than the amount according to the set of 3,458.00 rubles. for 364.00 rub:

Results

The tax agent is obligated to return the personal income tax that was excessively withheld from the employee within 3 months from the date of receipt of the corresponding application from the employee.

Refunds can only be made by bank transfer. If there are not enough funds for payment, the tax agent has the right to request a refund from the tax service. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.