Legal requirements

Article 124 of the Labor Code states: you cannot work for more than 2 years without rest. And this does not depend on the employee’s wishes - the employer must literally force him to go on vacation.

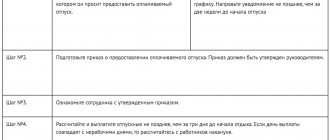

We have already written that the vacation schedule (form T-7) is a binding document - this applies to both the employer and the employee. These are the norms of Article 123 of the Labor Code of the Russian Federation. In other words, if you include a workaholic employee in the vacation schedule, then he will not be able to “get out” of it. But it should be remembered that 2 weeks before the start of the vacation, the employee must be notified about it - in writing, signed. You also need to calculate vacation pay and pay it. If all these conditions are met, then there will be no claims against the employer during a labor inspection.

However, in practice, everything usually happens differently - previously ungranted leave must be issued urgently.

Is it possible to transfer

If, due to any circumstances, employees have unused annual leave for the previous period, then they retain the right to use all due annual leave. This right is reserved to them by Art. 114, 122, 124.

According to Rostrud letter No. 1921-6 of 2007, annual paid leave for the previous period can be provided as part of the vacation schedule for the next year or by agreement between the employee and the employer. Several vacations may be taken during a calendar year.

In Rostrud Letter No. 473-6-0 of 2007, department specialists point out that labor legislation does not contain provisions that would provide for the use of vacations in chronological order. That is, annual leave can be granted in any order: for example, first for the current year, then for the previous one.

Last year's vacation on schedule

How to properly grant last year's leave? At the request of the employee or by inclusion in the schedule? There are supporters of both methods.

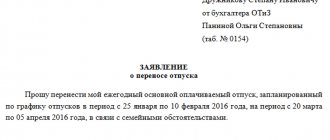

The first refer to Article 124 of the Labor Code of the Russian Federation: it states that the transfer of vacation is carried out upon application .

Download Application for transfer of leave

Another part of accountants and personnel officers believe that this does not exclude the need to include “overdue” vacation in the schedule. After all, the employee may not write a statement, and then there will be no other grounds to send him on leave.

Article 124 deals with a situation where the employer did not warn the employee 2 weeks in advance and did not give him vacation pay. In this case, indeed, the employee should receive a leave application.

How to calculate compensation for unused vacation: formula for calculating average salary

The formula for calculating the average salary of an employee per working day in order to determine the amount of compensation for non-vacation leave upon dismissal is as follows:

SRdnZr = ZP /12 × 29.3,

where: ZP is the salary that was accrued to the employee for the last 12 months;

29.3 is the average number of days in a month.

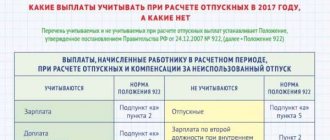

Important! For the purpose of calculating the average salary per day, all payments received by the employee and provided for by the labor or collective agreement are taken into account. In this case, payments made outside the framework of labor relations (social benefits, financial assistance, etc.) are not taken into account (paragraphs 2, 3 of Resolution No. 922).

If an employee, according to the Labor Code of the Russian Federation, is entitled to vacation not in calendar days, but in working days, then in order to correctly calculate compensation , the average earnings per day should be calculated differently:

SRdnZr = ZP / K6-day. slave. weeks,

Where:

SRdnZr - employee’s earnings on average for 1 working day;

Salary - the salary that was accrued to the employee for the last 12 months;

K6-days slave. weeks = the number of days an employee has worked based on a 6-day workweek calendar.

If for the 12 months preceding the day of dismissal the employee was not paid a salary, then the average salary for one day will be determined on the basis of data on earnings accrued for the previous period of a similar length (clause 6 of Resolution No. 922).

The calculation methodology has not changed in recent years, therefore compensation for leave upon dismissal in 2022 should be calculated according to the above formulas and rules.

In order to correctly determine what amount in monetary terms should be reimbursed to an employee for not having time to take his entire allotted vacation, it is important to find out exactly how many days he has left. However, doing this in practice is not always easy.

Current and overdue leave: what is the frequency?

What kind of vacation should be provided first - the one due in the current year or for the previous period? And here in practice 2 approaches are used:

- Current leave is granted first , since it is due annually. The possibility of such an approach is confirmed by Rostrud’s letter No. 473-6-0 dated March 1, 2007, which states that there are no provisions in the Labor Code for granting vacations in chronological order. Therefore, there is no violation in going on “current” vacation first.

- Last year's leave is granted first . If several of them have accumulated, for example, over the period from 2022, then the sequence is as follows: vacation for 2022, then for 2022, and lastly - for the current 2022. This does not contradict the above-mentioned letter from Rostrud; the requirement of Article 122 of the Labor Code of the Russian Federation to provide leave this year is also being fulfilled. In addition, in this case the employer takes steps to reduce the scope of its violation.

The choice remains with the employer - it should be reflected in an order or other local act.

How to calculate compensation upon dismissal: counting the days

First of all, you need to find out what the “vacation” length of service of the employee who decided to quit is. That is, for how many full months of performing his duties in the company he is entitled to the corresponding number of vacation days.

Rarely does anyone have an exact number of months worked at the time of dismissal. Much more often in practice, a different situation is common: on the day of dismissal, a month has not been fully worked. How to calculate compensation upon dismissal in this situation is described in paragraph 35 of the Rules:

- if more than half a month has been worked, you need to count such a month as a full month;

- if less than half a month is worked, such period is not taken into account.

For calculation purposes, a month is understood not as a separate calendar month, but as the month of actual performance of labor functions by an employee in a specific company from the moment he was hired by the company (for example, from June 16 to July 16).

A practical example prepared by ConsultantPlus experts will help you correctly calculate your length of service. You can watch it right now by getting free online access to the system.

After determining the “vacation” period, the accountant must calculate the number of days of unused vacation. How to calculate compensation upon dismissal depends on which days the employee’s vacation was accrued—calendar or working days.

If leave was granted in calendar days, then you need to proceed as follows.

For each month of work, the employee is accrued 2.33 days of vacation (letter of Rostrud dated October 31, 2008 No. 5921-TZ). Next, by multiplying the value of 2.33 and the “vacation” experience, the total number of vacation days is calculated. After this, those days that the employee has already taken off work before are subtracted from the total value.

This is discussed in more detail in the article “How to calculate the number of vacation days upon dismissal.”

Important! The exception is those persons who managed to work in the company for more than 11 months, but decided to leave it without working for the company for a year. In such cases, the organization pays compensation in full annual amount, i.e., as if the entire year had been worked.

The formula for calculating unused vacation days looks like this:

Number of non-users days = Number of months slave. × 2.33 – Disp.,

Where:

Number of non-users days _ — number of unused vacation days;

Number of months slave. — the number of months during which the employee was registered with the company;

Disp. — the number of vacation days used by the employee.

Important! When calculating compensation, the days remaining from vacation must be rounded in favor of the employee (up), and not according to arithmetic rules. For example, an employee was hired by the organization on March 27, 2021, and left on June 4, 2021. In this case, the number of days of unused vacation is 4.66 calendar days (2.33 calendar days for the period from 03/27/2021 to 04/26/2021 and 2.33 calendar days for the period from 04/27/2021 to 05/26/2021. Period from 05/27/2021 to 04.06 is not taken into account, since it is less than half a month).

Let's look at how to calculate vacation compensation upon dismissal if an employment contract was concluded with the employee for the period of seasonal work. In this case, vacation is accrued according to the Labor Code of the Russian Federation in working days (Article 295). For 1 month of work, in this case, not 2.33 calendar days are required, but 2 working days of vacation (Article 139 of the Labor Code of the Russian Federation).

Therefore, the formula for calculating the remaining vacation days will be slightly different:

Number of non-users days = Number of months slave. × 2 – Disp.

How long can you not go on vacation?

Every employee can take advantage of the right to paid vacation after six months of working in the company. According to the provisions of current legislation, the standard duration of vacation is at least 28 days . In the event that during the first year of work an employee did not go on vacation, the rest days are automatically transferred to the next year, but they never expire.

Compliance with the vacation schedule is mandatory for both the employee and the employer. An employee does not have the right to unilaterally refuse to comply with the vacation schedule approved by the employer. An employee’s refusal to take regular leave can be considered a violation of labor discipline, which entails disciplinary action.

The responsibilities of the organization’s HR department include tracking the duration of the required vacation using employees’ personal cards and notifying the company’s management about cases when an employee has not taken vacation for a long time. For its part, the company’s management must take measures to ensure that the employee has the opportunity to take advantage of the days of paid rest allotted to him.

Will a new law on unused vacation for the previous year be adopted in 2022 and will the vacation expire?

Among the innovations in legislation that have become relevant in 2022, we note the change in the provisions of Art.

262.2 of the Labor Code of the Russian Federation, which gives employees with many children the right to choose their vacation time at their request. From March 20, 2021, employees who have three or more children under the age of 18 (previously up to 12 years) must be provided with annual leave at any time upon request. A parent with many children will be able to choose a convenient vacation time until the youngest child turns 14 years old. As for the contradictions that exist regarding the question of whether unused vacation from previous years expires, there are no innovations here. Let us recall that the essence of the contradictions lies in the fact that the mutually exclusive provisions of Article 124 of the Labor Code of the Russian Federation and paragraph 1 of Article 9 of the ILO Convention “On Paid Leaves...” of June 24, 1970 No. 132 apply to this situation. The new law regarding whether vacation that was not given time off, was not accepted; legal regulation remains the same.

Part 4 of Article 124 of the Labor Code of the Russian Federation establishes a ban on non-provision of leave for 2 years in a row, as well as on minor employees working in hazardous conditions.

At the same time, the norms of the Labor Code of the Russian Federation do not indicate that vacation unused for any reason for previous years is burned out.

In turn, paragraph 1 of Article 9 of the Convention indicates that the balance of annual leave must be used within 18 months from the end of the year in which it was due to the employee.

However, this rule does not mean that 18 months after the past year in which the employee was not granted leave, the right to it is canceled. It should be interpreted to mean that the employer grants leave to the employee as early as possible. This is confirmed by the Constitutional Court of the Russian Federation.

What to do if an employee has not gone on vacation for 2 years in a row? The answer to this question is in the ConsultantPlus system:

If you don't have access to K+, get a free online trial.

Length of overdue leave

Let's say an employee hasn't had a vacation for 4 years. How long can his vacation last? What if he rests for the accumulated period in a row - and this is more than 100 days?

Employers in such a situation are sometimes afraid to provide such a long vacation. Meanwhile, this is exactly the best way to reduce the risk of receiving a claim from the labor inspectorate. You can safely send an employee on vacation for the entire period - this does not contradict the Labor Code.

Does unused vacation expire?

According to the provisions of the Labor Code of the Russian Federation, which regulates the rules for granting employees the next vacation, if during the reporting period the employee did not fully exercise the right to the next vacation, then next year he has the right:

- Take advantage of the right to take an unpaid vacation, and then, by writing a separate application, go on vacation at the expense of the vacation for the new period;

- Combine unpaid vacation with the vacation period for the new reporting period.

If an employee resigns , but on the date of termination of the employment relationship he has unused vacation days, then he has the right to pay off all accumulated vacation before the date of termination of the employment contract. Otherwise, the employee must be paid monetary compensation.

One way or another, annual leave does not expire; it is retained by those who continue to work in the organization and by those who quit.

Another situation occurs when there is a reorganization of the company or a reduction in staff in the event of termination of the company’s activities:

- Employees can exercise their right to take their allotted vacation days before the procedure for changing the company’s status begins;

- Employees can exercise their rights to receive monetary compensation for unused vacation;

- If none of the above methods were used, the right to leave is canceled.

ATTENTION ! In the case of additional leave, the rule comes into force according to which the employee has the right to either take advantage of the right to rest or receive 100% monetary compensation for them.

When going on maternity leave, the employee has the right to take another vacation until she goes on sick leave, or after canceling the certificate of incapacity for work issued for pregnancy. Another option would be to cancel unused leave after the woman returns from maternity leave.

IMPORTANT! There are no statutes of limitations for such vacations, in accordance with the provisions of the current legislation of the Russian Federation.

If an employee does not exercise his right to vacation, it continues to accumulate, which threatens the employer with penalties.

Which days are taken into account?

You can understand how to calculate compensation for unused vacation by determining the principle for calculating vacation days that are reimbursed in money. The number of such days depends on how long the person worked before leaving. Days worked per year are rounded up to months. If more than half a month has been worked, the length of service for calculating payments is rounded up, if less than half, vice versa. To receive payments in 28 days, it is enough to work a full 11 months (without rounding). They also compensate all 28 days for citizens who worked from 5.5 to 11 months and were dismissed due to the liquidation of an enterprise, conscription into the army or staff reduction. But if an employee works for less than half a month, he will not receive compensation.

Example: Panfilov I.L. has been working at the company since April 10, 2014. Each working year of Panfilov begins on April 10. He will retire on August 15, 2022. Over the last working year, he worked for 4 months and 5 days. Rounding down occurs since less than half the month was worked. Provided that Panfilov has already used rest days for previous periods, compensation is accrued for 4 months. During this time of work he is entitled to 9.33 days of rest. See below for the formula we used to calculate unused days.

Important! There is no rounding of unused days. The management of the company has the right to decide to round days to whole numbers, but they must do this not in an arithmetic way, but in favor of the employee. So the number 9.33 is rounded to 10 whole days, and not to 9 (letter of the Ministry of Health and Social Development of Russia dated December 7, 2005 N 4334-17).

Is unused vacation beneficial to the employer?

For employees, missing another vacation means losing the opportunity to rest. This situation may threaten the employer with a dispute with the labor inspectorate. If the employee does not have the opportunity to exercise his right to another vacation next year, then the employer will be subject to liability measures for violation of labor law (Article 5.27 of the Code of Administrative Offenses of the Russian Federation), namely:

- An organization can be fined from 30 to 50 thousand rubles;

- The organization's work may be suspended for up to 90 days.

ATTENTION! The employee does not bear any responsibility for unused vacation! All responsibility automatically falls solely on the employer!

It should be noted that for an organization, the fact that employees are accumulating vacations is an unfavorable sign. This factor may become a reason for inspections by the labor inspectorate, and also have an impact on the financial factor.

If a case of prolonged non-use of vacation by any employee is detected, the labor inspectorate will have a legal basis to investigate and determine the reasons for this event. The management of the organization will have to prove that this factor did not arise through the fault of the employer, and also prove that there were no artificial obstacles created when applying for leave.

Even if there is no evidence of the employer’s fault in having one or more employees have unused vacations for 2 or more years, a fine will be imposed on the company. From the financial side of the organization, it is unprofitable to allow vacation accrual for the following reasons:

- In the event that a person wants to go on vacation for 2 years or more at once, the employer will be forced to look for reserves to redistribute his work functions to other employees;

- In the event of termination of the employment relationship, the employee may demand monetary compensation for unused vacation days, and this can become a significant financial burden for the enterprise;

- If a violation provokes an inspection by the state labor inspectorate, the organization will be included in the list of violators of labor law provisions, which will entail additional material costs to pay off fines.

Replacing vacation with compensation

Article 127 of the Labor Code of the Russian Federation provides for situations in which an employee has the right to demand payment of compensation amounts for unspent vacation days. For example:

- the employee has already submitted a letter of resignation and intends to work the remaining days as usual;

- the duration of vacation exceeds the standard (28 calendar days).

Annual additional paid leave (over 28 days) is provided to employees engaged in work with harmful and (or) dangerous working conditions, employees with a special nature of work, employees with irregular working hours, employees working in the Far North and equivalent areas , as well as in other cases provided for by the Labor Code of the Russian Federation and other federal laws.

Citizens from this category, according to the law of the Russian Federation, also have the opportunity to replace additional leave with monetary compensation; a written application is sufficient for this.

Download a sample application for compensation for unused vacation

Sample application for compensation for unused vacation

Another vacation cannot be replaced by material benefits. As an exception, the Labor Code distinguishes dismissed persons. They can initiate payment for the entire duration of vacations not taken.

Personnel services and the management of the employing enterprise do not have the right to approve an application to replace vacation with financial compensation if the applicant is:

- pregnant employee;

- minor employee;

- an employee engaged in work with harmful and (or) dangerous working conditions.

Tax consequences of paying compensation for leave without dismissal

Cash payments instead of unused vacation days are undoubtedly payments related to the existence of an employment relationship between the company and the specialist.

As a general rule, all payments from an employer to an employee are subject to personal income tax. The Tax Code of the Russian Federation contains special exceptions in this part: a list of payments not subject to personal income tax. The compensation in question is not mentioned among them. Consequently, personal income tax will have to be charged (paragraph 6, 7, paragraph 3, article 217 of the Tax Code of the Russian Federation).

In addition, the corresponding amount of insurance contributions should be added to the amount of compensation to working employees for unused vacation days (clause 2, clause 1, article 422 of the Tax Code of the Russian Federation, clause 2, clause 1, article 20.2 of Law No. 125-FZ).

But the situation with income tax is better: the amount of such compensation can be taken into account in expenses, since this is provided for in clause 8 of Art. 255 Tax Code of the Russian Federation. However, it must be taken into account that only a part of the annual paid leave exceeding 28 calendar days can be taken into account in expenses (letters of the Ministry of Finance of the Russian Federation dated January 24, 2014 No. 03-03-07/2516, dated November 1, 2013 No. 03-03-06/1 /46713).

Application for leave

An application for regular leave is a document that allows an employee to go on a legal vacation subject to all the rules prescribed in the labor legislation of the Russian Federation. Such a document is usually drawn up in two cases:

- the employee goes on another paid vacation;

- the employee expressed a desire to receive extraordinary leave (the reason may be study, pregnancy or other personal circumstances).

If you want to go on an unscheduled vacation, it is advisable to document its necessity ; otherwise, the employer may refuse, citing the subordinate’s indispensability in the workplace.

If an employee goes on vacation in accordance with the schedule, it is not necessary to submit an application. If the schedule indicates only a month, then writing an application for the next vacation is mandatory. Such an application must be submitted no later than 2 weeks before the start of the vacation . This is due to the fact that the accounting department needs time to calculate and accrue vacation pay.

An application for the next vacation is written by an employee, as a rule, in any form. There are no standard templates for writing an application for regular leave for an employee.

The application can be written by hand or typed on a computer. The main condition is that it must have a “living” signature on it.

Download Leave Application

Sample application for leave

Design features

Requirement of Art. 122 of the Labor Code of the Russian Federation establishes that paid leave is provided to the employee annually on the basis of the vacation schedule (Article 123 of the Labor Code of the Russian Federation). During the vacation, the “vacationer” retains his place of work (position) and average earnings (Article 114 of the Labor Code of the Russian Federation), but he cannot be fired.

An employee can be dismissed only when he: has begun to perform his official duties; wrote an application for leave with subsequent dismissal, in this case the last working day will be considered the last working day, and the day of dismissal will be the last day of rest (Article 127 of the Labor Code of the Russian Federation).

The number of documents to be completed depends on whether the employer uses the following forms:

- unified (for the case under consideration - on the basis of Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1);

- own (approved independently in accordance with the law of December 6, 2011 No. 402-FZ);

- for public sector organizations (by order of the Ministry of Finance dated March 30, 2015 No. 52n, as well as departmental ones, for example, by order of the Federal Antimonopoly Service of the Russian Federation dated July 1, 2016 No. 887/16).

If unified ones are used, the personnel service prepares two orders: on providing rest to the employee (Form No. T-6); on termination of an employment contract with an employee (form No. T-8).

The same principle applies to settlement documents.

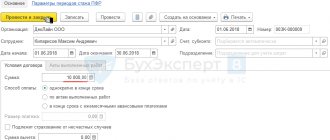

If the employer uses unified forms, the accounting service prepares two documents:

- note-calculation on the provision of rest (form No. T-60);

- settlement note upon termination of an employment contract (form No. T-61).

In public sector organizations and extra-budgetary funds, document forms of class 05 (order No. 52n) are used, in particular, the OKUD form 0504425. If unified forms are not used, then the documents are drawn up in the manner established by the budget legislation of the Russian Federation (for the public sector) or by the organization itself in accordance with Law No. 402-FZ.