In what cases is it possible to return goods?

The right of the parties to a transaction to return goods may be based on law or contract.

Civil legislation provides for the buyer’s right to return goods to the supplier if they do not comply with the requirements for quality (clause 2, article 475 of the Civil Code of the Russian Federation), assortment (clause 3, article 468 of the Civil Code of the Russian Federation), and packaging (clause 2, article 480 of the Civil Code of the Russian Federation). RF), packaging (clause 3 of Article 482 of the Civil Code of the Russian Federation).

The common belief that there are no other reasons for a return is incorrect: civil law does not prohibit the return of quality goods delivered in whole or in part, even if the delivery was paid for by the buyer. Consequently, the contract (or an additional agreement to it) may provide for other grounds for the return of goods:

- expiration date;

- impossibility of implementation;

- delay of payment;

- inconsistency of a quality product with the production goals of the buyer;

- updating the assortment, etc.

What documents to use to formalize refusal of acceptance and return of goods?

The buyer is obliged to check the quantity, completeness and quality of goods directly upon acceptance or after it within the period established by the contract or law (clause 2 of article 513, clause 2 of article 474 of the Civil Code of the Russian Federation). If deficiencies are identified during the acceptance process, before capitalization, it is enough to draw up a report on discrepancies in the quantity and quality of the received inventory items in the TORG-2 form or another document of similar content.

For more information on drawing up an act using the TORG-2 form, read the article “Unified form TORG-2 - form and sample” .

If the grounds for a return arose after receipt, including for temporary storage, it must be documented with a shipping document - a return invoice.

Care must also be taken to document the reasons for the return. When returning low-quality or incomplete goods, acts on the identification of hidden defects, letters of claim may be suitable for these purposes; when returning quality goods under the terms of the contract or by additional agreement of the parties to the transaction, acts, letters and other documents provided for in the agreement. These documents should be referred to on the return note and enclosed if necessary.

The procedure for drawing up a return invoice does not depend on the reason for the return. All additional circumstances must be set out in the documents on the basis of which the buyer returns the goods, including quality ones, to the supplier.

Visit our forum if you have any questions. For example, here we discuss how to correctly process the return of goods in the case of a previously received advance payment.

Theoretical basis

The moment of transfer of ownership of goods is the main issue in concluding transactions. Most often, this happens when signing the invoice. It is this point that we will take as the basis for considering issues of discrepancies.

To switch to electronic document management, you must enter into an agreement with an EDF operator and obtain an electronic signature on a certified medium.

We will select the optimal EDI tariff

Let us immediately note that it is not recommended to formalize the transfer of rights using the TORG-12 form. The previously existing Order of 2012 has been abolished, and now the documentation for TORG-12 is not formalized. It is not possible to transmit an electronic version of this format at the request of the Federal Tax Service.

Together with it, a document on the transfer of goods is used, which was adopted by the Order of 2015 of the same Federal Tax Service. The second option is a universal transfer document - UPD. Until 2019 ends, it remains possible to use electronic UPD in two formats from Order of the Federal Tax Service of Russia dated March 24, 2016 No. ММВ-7-15/ [email protected] and Order of the Federal Tax Service of Russia dated December 19, 2018 No. ММВ-7-15/ [email protected]

From 2022, the only acceptable format will be the approved type of UPD from Order of the Federal Tax Service of Russia dated December 19, 2018 No. ММВ-7-15 / [email protected] This is what is allowed to be used for transmitting reports via the Internet to the tax office.

Nuances of filling out a return delivery note

You can download a sample return invoice on our website.

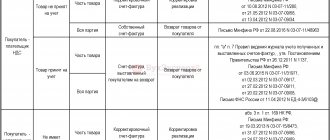

When returning goods, the supplier and shipper are the buyer under the contract. Its name, address and bank details are indicated in the appropriate columns. At the same time, filling in the data on the shipper is not mandatory (letter of the Federal Tax Service of Russia dated November 25, 2014 No. ED-4-15 / [email protected] ).

In the column “Consignee” the name and details of the supplier under the contract are indicated. He is also the payer if the buyer returns paid products and intends to get the money back. When cash payments are not expected, the “Payer” column may not be filled in.

The “Base” column is the most important in the return invoice. Here you need to indicate the content of the operation - “Return of goods”, and also list in detail:

- numbers and dates of invoices for which returned goods and materials were received;

- number and date of the contract;

- names and details of acts, defective statements, letters and other documents provided for by law or contract.

The return invoice is assigned a number in accordance with the numbering system adopted by the organization. If the goods are sent by road, the number and date of the waybill are indicated.

The product section is filled out in full accordance with the data of the invoices, according to which the goods were accepted for accounting. The invoice must make it possible to unambiguously establish the correspondence between the previously delivered and the returned property. Therefore, the name, units of measurement and packaging, and cost must match those indicated in the original invoice. In other words, the product is returned under the same conditions under which it was purchased.

Important! Recommendation from ConsultantPlus The procedure for the buyer to account for the return of goods depends on what kind of goods he is returning - high-quality or defective. The return of quality goods to the supplier is recognized when calculating income tax... (for more details, see K+).

Read about how VAT is calculated on returns and invoices are issued here.

The manager (deputy) and the chief accountant authorize the shipment according to the return invoice with their signatures. The fact of shipment is recorded with the signatures of the financially responsible person and the recipient - a representative of the counterparty or an employee of the transport organization.

Sample of filling out a new waybill for 2021

For your convenience, we have detailed in screenshots the procedure for filling out the new waybill for 2022

Click on the screenshot to enlarge

Attention! The consignment note is not an accompanying document certifying the legality of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products (Explanation of Rosalkogolregulirovanie dated 07/08/2011)

There is no need to certify the TN with a seal. This is not provided for by its form.

The absence of a seal in the waybill does not entail tax risks, but the presence of a seal will not be an error. If the consignee’s stamp is affixed to the TN, then a power of attorney to receive the cargo is not required.

Stamps in TN are given by:

Shipper in points 6 and 16 on the left

Consignee at point 7

The carrier in points 15 and 16 on the right

If you have doubts about the correctness of filling out the bill of lading, then contact our company, we will be happy to transport your cargo, and also fill out all the necessary documents ourselves, you just need to have them certified.

In our company you can:

- Order a truck

- Rent a scow

- Order a manipulator

order transport for transportation by calling +7(812)-317-55-18, chatting with the manager, or simply leaving a request for a call back.

We work throughout Russia.

What changes have appeared in the new waybill for 2022?

- In paragraph “1. Shipper" there is a field for putting o.

- A new item has appeared: “1a. Client (Customer of the transportation organization)", which is filled in if there is a Forwarder in the chain.

- Point “6. Acceptance of cargo" is supplemented with the clarification: "The person from whom the cargo is collected" is a legal entity or individual entrepreneur who loaded the cargo into the vehicle.

- Point “11. Vehicle" is supplemented with a field to indicate the type of vehicle ownership: ownership, rent or leasing.

- Point “15. Signatures of the parties” swapped places with paragraph 16; it retained the indication of the shipper, but excluded the “cargo owner”.

- Point “16. The cost of carrier services and the procedure for calculating carriage charges” was previously clause 15. Now the carrier’s expenses include other expenses.

- Paragraphs 1, 2, 10 are supplemented with the TIN of the relevant persons.

A significant difference between the new invoice is the appearance of a new participant – “ Forwarder ”, as well as a new procedure for filling it out, in the case of an intermediary. At the same time, the method of issuing a waybill directly depends on whether the Contractor owns the vehicle under the contract for organizing the carriage of goods.

1. If the vehicle (clause 11) is owned and the driver is on the Contractor’s staff, then the Contractor acts as the Carrier and the invoice is filled out in the following order:

- The shipper (clause 1) indicates the Client under the contract, clause 1a is not filled in;

- The Carrier (clause 10) indicates the Contractor under the contract;

- The person from whom the cargo is collected (clause 6) is the Client or the shipping warehouse (with details of the legal entity).

2. If the Contractor engages third-party transport for transportation, then this service is issued as a forwarding service:

- The Client under the contract is indicated in “clause 1a” Client (Customer of the transportation organization);

- The Consignor (clause 1) indicates the Contractor and is marked with o;

- The carrier (clause 10) indicates the owner of the vehicle (clause 11) with whom the Forwarder has entered into a transportation agreement;

- The person from whom the cargo is collected (clause 6) is the Client or the shipping warehouse (with details of the legal entity).

Since in both cases the Client (Client's warehouse) issues the Bill of Lading on his own, it is necessary to obtain from the Contractor in advance information about the type of ownership of the vehicle, along with evidence of this ownership and availability of labor resources, as well as information about the direct carrier.

SibAvtoTrans company recommends supplementing the application for cargo transportation with the appropriate items, including the mandatory details approved in accordance with Appendix No. 5 to the Rules.

We draw your attention to the fact that, regardless of whether the Contractor is a forwarder in each specific transportation or not, the forwarding service includes the transportation service (is a reimbursable expense). In this regard, incorrect execution of the primary document (bill of lading) carries the risk of non-recognition of expenses incurred in the amount of the entire cost of the service, which is not supported by documents. Therefore, it is important for the customer of a transport service to find out the entire chain of performers and eliminate the presence of additional intermediaries, requiring the Forwarder to conclude direct contracts with Carriers or an agency agreement to search for carriers (with the attachment in this case of all supporting documents). The indication, as before, in clause 10 of the new waybill of an “intermediary” is essentially aimed at distorting a business transaction, and therefore carries unjustified tax risks in accordance with Art. 54.1 Tax Code of the Russian Federation.

Results

The buyer has the right to return goods by law (when a low-quality or incomplete product is returned) or under the terms of the contract (for example, when returning goods that were not sold before the expiration date). If deficiencies are identified during the acceptance process, then in order to return it is enough to issue a report on discrepancies in quantity and quality.

When returning goods that have been capitalized, a delivery note is issued. Particular importance is attached to documents justifying the return. They will be referenced in the return invoice, and they will also serve as an attachment to this invoice. The information about the product in these documents is identical to that received upon delivery.

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to make corrections to a waybill

Corrections can be made to the waybill. If an error is made when filling out the waybill, it is corrected as follows (Part 7, Article 9 of Law No. 402-FZ, clauses 4.2, 4.3 of the Regulations on Documents and Document Flow in Accounting, clause 16 of Regulation No. 34n, clause 11 Rules for the carriage of goods by road):

1) an erroneous entry is crossed out with one line so that it can be read;

2) Make a correct entry;

3) Make a reservation “corrected” and indicate the date of correction;

4) The corrections are certified by the signatures of the persons who compiled it, indicating their last names and initials (other details necessary to identify these persons).