Simplified and assignment agreement: understanding the concepts

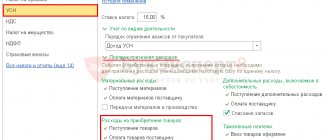

A simplifier is a taxpayer who has chosen a special regime for tax calculations, which allows him not to pay a number of mandatory taxes (income, VAT, with some exceptions, etc.).

You will find a detailed list of taxes that become optional when applying the simplified tax system in the material “Single Tax under the Simplified Taxation System (STS).”

When applying this mode, the simplifier must follow several rules:

- monitor compliance with the restrictions established for the simplified tax system by law (on income, residual value of fixed assets, etc.);

For information on increased limits for simplifiers, see the article “Income limit when applying the simplified tax system in 2022.”

- control expenses (for the simplified person, there is a special closed list of expenses by which he can reduce income when calculating the simplified tax).

You will get acquainted with the list of expenses for simplified people in the material “List of expenses under the simplified tax system “income minus expenses””.

In the course of its activities, a simplifier has the right to enter into all types of contracts not prohibited by law, including an assignment agreement (AC) - an agreement under which one can sell (purchase) the right of claim against the debtor. Such agreements have recently become very common, and simplifiers in this case are no exception.

A simplifier may decide to conclude a DC if the following circumstances coincide simultaneously (for example):

- he acts as a creditor;

- he does not have the opportunity to wait for the debt to be repaid;

- he does not have the opportunity to force the debtor to fulfill the obligation;

- an entity was found who was ready to repurchase this debt and collect it from the counterparty who was unwilling to pay.

We will tell you more about DC in the next section.

The procedure for assigning a right of claim is often accompanied by questions. On our forum you can get an answer to any of them. So, in this thread we discuss how VAT should be calculated during the assignment of the right to claim the supply of goods.

“I’ll buy a receivable”: accounting for income and expenses from the buyer

Money spent on the purchase of the right to claim is not recognized as an expense, since the list of simplified expenses does not include such type of expenses as the cost of acquiring property rights. And when the debtor pays off his debt to the new creditor or this debt is again sold to a third party, the creditor will have to recognize the received amount as income. Letter of the Ministry of Finance dated 08/01/2011 N 03-11-06/2/112.

Let's add one more condition to the example considered. Let’s say the Igrek organization transferred 500 thousand rubles to its new creditor, the Sigma organization. to the account on November 5, 2015 (repaid the debt). Consequently, on this date, Sigma must take into account 500 thousand rubles in its income. This means paying from these 500 thousand rubles. tax under the simplified tax system.

Features of the assignment agreement

DC is regulated by separate norms of civil legislation - Art. 382–390 Civil Code of the Russian Federation.

DC Features:

- the presence of 2 parties to the agreement: the transferor of rights (assignor) and the recipient of rights after their assignment (assignee);

- double responsibility of the assignor (for the authenticity of documents and the validity of transferred rights);

- the optionality of obtaining the debtor's consent to the assignment, provided that written notification of this procedure is absolutely necessary;

- other features (impossibility of regressive claims against the assignor if the debtor evades fulfillment of his duties, etc.).

DC cannot be concluded in relation to rights that are inextricably linked with the identity of the creditor (Article 383 of the Civil Code of the Russian Federation), for example:

- rights to claim alimony;

- compensation for harm caused to life or health.

You will get acquainted with various agreements using the materials posted on our website:

- “Agreement on full individual financial responsibility”;

- “Agreement without VAT: controversial issues and settlements”;

- “Contract agreement and insurance premiums: nuances of taxation”.

What tax consequences arise for a simplifier under an assignment agreement?

When concluding a transaction contract, the simplifier needs to pay attention to 2 important points:

- For the amount of income from DC. Funds received under an agreement for the assignment of a claim to a third party are income from the sale of property rights. For the simplifier, the specified income is taken into account in the amount actually received from the assignee.

- Date of recognition of income from DC. It is necessary to recognize income on the day of receipt of money from the assignee to the bank account or cash desk of the assignor (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

Find out about the structure of simplified income from the material “What income is recognized (accounted for) under the simplified tax system?”

For tax purposes, income from DC is recognized according to the rules of the cash method of accounting. For the “income minus expenses” and “income” modes they are identical.

The material “What is the procedure (conditions) for recognizing income and expenses using the cash method?” will tell you about the features of the cash method of accounting for income and expenses.

The absence of payment received from the buyer for the goods (work, services) sold to him for the simplified means the absence of revenue. As a result of the sale of the buyer's debt, the simplifier-assignor receives income in the amount received from the assignee under the DC, and expenses include the cost of goods (work, services) sold to the buyer.

If, as a result of the DC, the assignor receives a loss, the simplified assignor does not have the right to take it into account in expenses due to the absence of this type of expense in the closed list when applying the simplified tax system.

The assignee may not be in a better position if he applies the simplified tax system “income minus expenses”: he also cannot include the amount he paid to the assignor under DC as expenses for the same reason.

Is it possible for a simplifier to take into account advertising and entertainment expenses? For the answer, see the material “Acceptable expenses under the simplified tax system in 2020-2021.”

The above accounting scheme is typical for the assignment of debt under a supply agreement and does not apply in the case of DC under a loan obligation.

ConsultantPlus experts explained in detail how to reflect the sale of receivables under an assignment agreement in accounting. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Find out how to easily determine your tax obligations under DC associated with borrowed obligations in the next section.

Simplified tax system and assignment of claims

In a liquidity crisis, our business partners often let us down. Monetary obligations are not respected or are fulfilled but not in a timely manner. One of the possible options under such conditions is the sale of debt (accounts receivable) at a discount. Since the simplified tax system has its own specifics, the transition of the right of claim from a “simplified” to a “simplified” gives rise to its own characteristics in accounting.

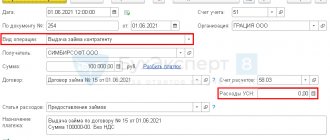

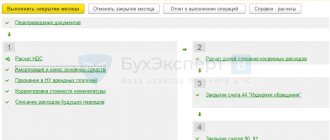

So, reflection in accounting and tax accounting of transactions of assignment of claims when selling receivables in organizations using the simplified tax system.

Purchase and sale, supply, provision of services are still assignment

When buying and selling, the seller undertakes to transfer ownership of the goods to the buyer, and the buyer undertakes to accept the goods and pay a certain amount of money (price) for it (clause 1 of Article 454 of the Civil Code of the Russian Federation). The right of claim belonging to the creditor organization on the basis of the buyer’s obligation under the purchase and sale agreement may be transferred by it to another person under a transaction (assignment of the claim) or may be transferred to another person on the basis of law (clause 1 of Article 382 of the Civil Code of the Russian Federation). The assignment of a claim to another person is called an assignment (regardless of the type of obligation), the one who assigns (the original creditor) is called the assignor, the one who acquires (the new creditor) is the assignee.

Accounting with the assignor

Goods purchased by an organization for resale are accounted for as part of inventories (MPI) at the actual cost, formed from the amount of costs incurred for the acquisition of goods (clauses 2, 5, 6 PBU 5/01 “Accounting for inventories”, approved by order of the Ministry of Finance dated 06/09/01 No. 44n).

Revenue from the sale of goods is recognized in accounting on the date of shipment of goods to the buyer, as part of income from ordinary activities in the amount of the cost of goods established by the contract. It is reflected in the debit of account 62 “Settlements with buyers and customers” and the credit of account 90 “Sales”, subaccount 90-1 “Revenue”.

In the debit of account 90, subaccount 90-2 “Cost of sales”, the cost of goods sold is written off (clauses 5, 6, 6.1, 12 PBU 9/99 “Organizational Income”, approved by order of the Ministry of Finance of Russia dated 05/06/99 No. 32n, p 5, 16 PBU 10/99 “Expenses of an organization”, approved by order of the Ministry of Finance of Russia dated 05/06/99 No. 33n, Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated 10/31/2000 No. 94n) .

The claim against the buyer is not extinguished, but is disposed of, i.e., transferred to the assignee. Therefore, in this case, the amount of the assigned claim is reflected in accounting in the same manner as the sale of other assets. The amount of the assigned claim (receivables from the buyer of goods) is written off as other expenses. Proceeds from the disposal of this claim are included in other income.

To reflect other income and other expenses in accounting, the Instructions for using the Chart of Accounts prescribe the use of subaccounts 91-1 “Other income” and 91-2 “Other expenses”. They can be opened to account 91 “Other income and expenses” (clauses 11, 14.1, 16 PBU 10/99, clauses 7, 10.1, 16 PBU 9/99).

"Simplified" tax

When determining the object of taxation according to the simplified tax system, proceeds from the sale of goods are taken into account as income on a cash basis, i.e. on the date of receipt of payment for this product (clause 1 of article 346.15, clause 1 of article 346.17 of the Tax Code of the Russian Federation). At the same time, expenses for the acquisition of goods for further sale and expenses in the form of VAT on these goods are recognized after their payment to the supplier as the goods are further sold, regardless of the fact of payment for the sold goods by the buyer (subclause 8, 23 clause 1 of article 346.16, subclause 2 clause 2 article 346.17 of the Tax Code of the Russian Federation).

In accordance with these standards, the organization, on the date of sale of goods, recognizes the costs of their acquisition and expenses in the amount of VAT paid to the supplier of the goods. The taxpayer does not recognize income from the sale of goods, because payment for the goods has not been received.

Now regarding the reflection of the assignment results in tax accounting. Income from the assignment of a claim to a new creditor is reflected on the day when funds were actually received from him (according to the general rules of clause 1 of Article 346.15, clause 1 of Article 346.17 of the Tax Code of the Russian Federation). In this case, the organization did not incur expenses in the form of the cost of the retiring property right. The right arose from the purchase and sale agreement, and the organization is the original creditor. In addition, the list of expenses recognized as “simplified” for tax purposes does not include expenses for the acquisition of property rights. So they do not reduce the object of taxation under the simplified tax system (letters from the Ministry of Finance of Russia dated 12/09/13 No. 03-11-06/2/53599, dated 10/12/11 No. 03-11-06/2/142, dated 12/09/09 No. 03- 11-06/2/261, clause 2 of the letter of the Ministry of Finance of Russia dated 02/27/09 No. 03-11-06/2/30). This conclusion is confirmed by judicial practice (see the ruling of the Supreme Arbitration Court of Russia dated January 27, 2012 No. VAS-15173/11).

Example 1 The contractual cost of goods shipped to the buyer is 300,000 rubles. The cost of purchasing these goods by an organization from a supplier is 200,000 rubles. (including VAT). The organization’s right of claim against the buyer was assigned for 150,000 rubles.

In the accounting of an organization (assignor) that applies the simplified tax system with the object of taxation “income reduced by the amount of expenses”, its assignment to a new creditor (assignee) of the buyer’s debt for goods shipped to it by the organization should be reflected as follows:

Debit 62 Credit 90-1

— 300,000 rub. — revenue from the sale of goods is reflected (base: delivery note);

Debit 90-2 Credit 41

— 200,000 rub. – the actual cost of goods sold is written off (basis: accounting certificate-calculation);

Debit 76 Credit 91-1

— 150,000 rub. — income from the assignment of a claim to a new creditor is reflected (basis: act of acceptance and transfer of documentation);

Debit 91-2 Credit 62

— 300,000 rub. - the claim to the buyer to pay for the goods was transferred to the new creditor by way of assignment (ground: act of acceptance and transfer of documentation);

Debit 51 Credit 76

— 150,000 rub. - payment was received from the assignee for the right of claim transferred to him (basis: bank statement on the current account).

Accounting with the assignee

Receivables acquired on the basis of an assignment agreement at a price less than the amount of the debt are taken into account as part of the organization’s financial investments, since they satisfy the established conditions (clauses 2, 3 of PBU 19/02 “Accounting for financial investments”, approved by order of the Ministry of Finance of Russia dated 12/10/02 No. 126n). Investments made by the organization are accounted for in account 58 “Financial Investments” (as prescribed by the Instructions for using the Chart of Accounts).

A financial investment in the form of receivables acquired under an assignment agreement is accepted for accounting at its original cost, which is determined based on the price of its acquisition, and after acceptance for accounting is not subject to recalculation (clauses 8, 9, 18, 21 PBU 19 /02).

The initial cost of the financial investment includes the amount paid to the seller under the agreement for the assignment of claims (assignment).

To reflect settlements with the assignor under the assignment agreement, as well as settlements with the debtor, account 76 “Settlements with various debtors and creditors” can be used, to which the corresponding analytical accounts are opened.

Thus, the initial cost of financial investments is reflected in the debit of account 58 in correspondence with the credit of account 76, analytical account 76-tsed “Settlements with the assignor”. When the debtor repays a monetary obligation arising from a supply agreement, the organization’s accounting records the disposal of the financial investment.

In this case, the amounts received from the debtor are taken into account as part of the organization’s other income, which is reflected in the accounting entry as the debit of account 76, analytical account 76-dol “Settlements with the debtor”, and the credit of account 91 “Other income and expenses”, subaccount 91-1 “Other income."

At the same time, the initial cost of the disposed financial investment is taken into account as part of other expenses (clause 27 of PBU 19/02, clause 11, 14.1, 6, 16 of PBU 10/99).

In this case, an accounting entry is made to the debit of account 91, subaccount 91-2 “Other expenses”, in correspondence with the credit of account 58.

If the debtor repays the debt in parts, then if the debt is partially repaid, the organization retains the right to claim the remaining part of the debt. Consequently, the financial investment is written off partially as payments are received and is finally disposed of only when the last payment is received (clause 25 of PBU 19/02). In this case, the initial cost of the disposed right of claim is recognized as an expense in proportion to the amount repaid by the debtor.

Other income is recognized as funds are received from the debtor (clause 34 of PBU 19/02, clauses 7, 10.1, 6, 16 of PBU 9/99).

Expenses for the acquisition of the right of claim are not taken into account for tax purposes (expenses are not specified in clause 1 of Article 346.16 of the Tax Code of the Russian Federation, see also letters of the Ministry of Finance of Russia dated 12/09/13 No. 03-11-06/2/53599, dated 06/20/13 No. 03-11-06/2/23302, dated 07/24/12 No. 03-11-06/2/93, dated 12/15/11 No. 03-11-06/2/172, Ministry of Taxes of Russia dated 04/16/2004 N 22-1 -14/705). A similar position is reflected in arbitration practice (see the ruling of the Supreme Arbitration Court of Russia dated January 27, 2012 No. VAS-15173/11).

During the period of receipt of funds from the debtor, the organization - the new creditor recognizes income from the sale of property rights (clause 1 of Article 346.15, clause 1 of Article 249, clause 1 of Article 346.17 of the Tax Code of the Russian Federation). At the same time, the taxable income of the organization includes the entire amount of money received from the debtor in repayment of receivables (letters of the Ministry of Finance of Russia dated 08/01/11 No. 03-11-06/2/112, dated 04/28/11 No. 03-11-11/107 ).

If the debtor fulfills the obligation to repay the debt in parts, for example, over two reporting (tax) periods, then, based on the above, the organization recognizes income from the sale of property rights in the amount of funds received from the debtor in the periods of their receipt.

Let us note that the Ministry of Finance expressed a similar opinion on the procedure for determining the tax base for income tax in the same situation (letters dated 07/29/13 No. 03-03-06/2/30028, dated 11/08/11 No. 03-03-06/1/ 726).

Example 2 Under an agreement on the assignment of a claim, the right of claim arising from a supply agreement was acquired from the original creditor at a price of 400,000 rubles. The amount of the assigned claim (accounts receivable) is 500,000 rubles.

According to the terms of the supply agreement, payment must be made before November 30. The debtor repaid the obligations on time in three payments: September 10 and October 15 - 150,000 rubles each, November 25 - 200,000 rubles.

In the accounting of an organization that applies the simplified tax system (the object of taxation is “income minus expenses”), the acquisition under an assignment agreement and the subsequent disposal of the debtor’s obligation arising from the supply agreement, if the debtor repays this obligation in installments, before the expiration of the payment period should be reflected as follows. So, when purchasing receivables:

Debit 58 Credit 76 “Settlements with the assignor”

— 400,000 rub. — the monetary claim has been accepted for accounting (grounds: assignment agreement, documentation acceptance and transfer certificate);

Debit 76 “Settlements with the assignor” Credit 51

— 400,000 rub. — payment has been made to the assignor (basis: bank statement on the current account).

Upon receipt of the first payment (September 10):

Debit 51 Credit 76 “Settlements with the debtor”

— 150,000 rub. — partial repayment of the obligation is reflected (basis: bank statement on the current account);

Debit 76 “Settlements with the debtor” Credit 91-1

— 150,000 rub. — other income is recognized in the amount of payment received from the debtor (basis: assignment agreement, accounting certificate);

Debit 91-2 Credit 58

— 120,000 rub. (400,000: 500,000 x 150,000) - part of the value of the disposed financial investment is written off (basis: accounting certificate-calculation).

Upon receipt of the second payment (October 15):

Debit 51 Credit 76-dol “Settlements with the debtor”

— 150,000 rub. — partial repayment of the obligation is reflected (basis: bank statement on the current account);

Debit 76 “Settlements with the debtor” Credit 91-1

— 150,000 rub. — other income is recognized in the amount of payment received from the debtor (basis: assignment agreement, accounting certificate);

Debit 91-2 Credit 58

— 120,000 rub. (400,000: 500,000 x 150,000) - part of the value of the disposed financial investment is written off (basis: accounting certificate-calculation).

Upon receipt of the last payment (November 25):

Debit 51 Credit 76 “Settlements with the debtor”

— 200,000 rub. — partial repayment of the obligation is reflected (basis: bank statement on the current account);

Debit 76 “Settlements with the debtor” Credit 91-1

— 200,000 rub. — other income is recognized in the amount of payment received from the debtor (basis: assignment agreement, accounting certificate);

Debit 91-2 Credit 58

— 160,000 rub. (400,000: 500,000 x 200,000) - the remaining part of the value of the retired financial investment is written off (basis: accounting certificate-calculation).

Loan as assignment of claim

Under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality (Clause 1 of Article 807 of the Civil Code of the Russian Federation).

The lender has the right to receive interest from the borrower on the loan amount in the amount and in the manner determined by the agreement, unless otherwise provided by law or the loan agreement (Clause 1 of Article 809 of the Civil Code of the Russian Federation).

The right (claim) belonging to the creditor on the basis of an obligation may be transferred by him to another person under a transaction (assignment of the claim) (clause 1 of Article 382 of the Civil Code of the Russian Federation).

At the same time, in order to transfer the rights of the creditor to another person, the consent of the debtor is not required, unless otherwise provided by law or agreement (Clause 2 of Article 382 of the Civil Code of the Russian Federation).

A creditor who has assigned a claim to another person is obliged to transfer to him documents certifying the right of claim and provide information relevant for the implementation of the claim (clause 2 of Article 385 of the Civil Code of the Russian Federation).

Unless otherwise provided by law or agreement, the right of the original creditor passes to the new creditor to the extent and on the conditions that existed at the time of transfer of the right.

In particular, the rights ensuring the fulfillment of the obligation, as well as other rights related to the claim, including the right to unpaid interest are transferred to the new creditor (Article 384 of the Civil Code of the Russian Federation).

Accounting with the assignor

A loan provided by an organization with the condition that the borrower pay interest for the use of funds is classified as a financial investment, since it meets the conditions for their recognition in accounting (clauses 2, 3 of PBU 19/02).

To account for the movement of the amount of the loan provided, accounting provides for account 58 “Financial investments”, subaccount 58-3 “Loans provided” (clauses 7, 8 PBU 19/02, Instructions for the use of the Chart of Accounts for accounting financial and economic activities of organizations ).

The amount of interest due to the organization on the loan provided is taken into account as part of other income (clause 34 of PBU 19/02, clause 7, 10.1 of PBU 9/99).

For accounting purposes, interest is accrued for each expired reporting period in accordance with the terms of the agreement (paragraph 2, clause 16 of PBU 9/99).

That is, despite the fact that the agreement may provide for the payment of interest when repaying the loan, the organization must monthly accrue and record the borrower's interest debt (based on the amount (rate) of interest established by the agreement).

This option for accounting for interest corresponds to the principle of assuming temporary certainty of the facts of economic activity, which must be observed when forming the accounting policy of the organization for accounting purposes (clause 5 of PBU 1/2008 “Accounting policy of the organization”, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n ).

Recognized income in the form of interest on a loan is reflected in the credit of account 91 “Other income and expenses”, subaccount 91-1 “Other income”, in correspondence with the debit of account 76 “Settlements with various debtors and creditors”.

Since the organization’s claim to the borrower is not repaid, but is disposed of (transferred to the assignee), the amount of the assigned claim represents the borrower’s receivables in the form of the loan amount and interest accrued on it, the receipt date of which has not yet arrived.

Proceeds from the disposal of the organization's claim are included in other income, while the initial cost of the financial investment (loan amount), as well as the amount of unearned interest, are written off as other expenses of the organization.

To reflect other expenses in accounting, the Instructions for using the Chart of Accounts provide for the use of subaccount 91-2 “Other expenses”, opened to account 91 (clause 25, 27 PBU 19/02, clause 7, 10.1, 16 PBU 9/99, p 11, 14.1, 16 PBU 10/99).

"Simplified" tax

The amount of interest due to the lending organization on the loan provided is recognized in tax accounting as non-operating income (clause 1 of article 346.15, clause 6 of part 2 of article 250 of the Tax Code of the Russian Federation).

When determining the object of taxation according to the simplified tax system, income is taken into account on a cash basis, that is, on the date of receipt of funds into bank accounts and (or) the cash desk, receipt of other property (work, services) and (or) property rights, as well as repayment of debt (payment ) in another way (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

Since in this case the borrower does not repay his debt, and the organization sells the right to claim the entire amount of the debt to a new creditor for the price established by the assignment agreement, income in the form of unearned interest on the loan is not taken into account for tax purposes.

As for the reflection of the assignment results in tax accounting, the income from the assignment of a claim to a new creditor is reflected on the day of the actual receipt of funds from him (according to the general rules of paragraph 1 of Article 346.15, paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation, see also Letter of the Ministry of Finance Russia dated 10/12/11 No. 03-11-06/2/142).

Funds provided to the borrower on a repayable basis are not an expense of the organization (as are amounts that are not expenses subject to repayment). The amount of the loan provided becomes the cost of acquiring property rights on the date of exercise of these rights to the new lender, that is, on the date when the return of the funds provided to the borrower becomes impossible.

However, expenses for the acquisition of property rights are not taken into account when calculating the object of taxation when applying the simplified tax system, since they are not included in the closed list of expenses (see paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation).

Consequently, when assigning rights arising from a loan agreement to a new creditor (assignee), the organization recognizes income in the amount received from the assignee and does not recognize expenses associated with the disposal of property rights (see also letter of the Ministry of Finance of Russia dated December 9, 2013 No. 03- 11-06/2/53599).

Example 3 Loan amount - 250,000 rubles. The amount of interest accrued on the date of assignment is 50,000 rubles. The organization's claim to the borrower was assigned for RUB 200,000. According to the terms of the accounting policy, the organization prepares interim financial statements on a monthly basis. In the accounting of an organization (assignor) applying the simplified tax system, the assignment by it to a new lender (assignee) of the borrower's debt on the funds provided to him and the interest accrued on the loan amount (the loan agreement has not expired, the interest is payable by the borrower at a time when repaying the loan amount) should be reflected as follows way.

On the day of transfer of funds to the borrower:

Debit 58-3 Credit 51

— 250,000 rub. — a financial investment in the form of a loan provided in cash is reflected in the accounting (basis: loan agreement, bank statement on the current account).

During the term of the loan agreement:

Debit 76 Credit 91-1

— 50,000 rub. — interest accrued for the use of borrowed funds (grounds: loan agreement, accounting statement).

On the date of assignment to the assignee of property rights under the issued loan:

Debit 76 Credit 91-1

— 200,000 rub. — income from the assignment of a claim against the borrower to a new lender is reflected (ground: act of acceptance and transfer of documentation);

Debit 91-2 Credit 58-3, 76

— 300,000 rub. (250,000 + 50,000) - the amount of the loan provided and accrued interest in connection with the assignment of the claim was written off as expenses (based on the document acceptance and transfer certificate);

Debit 51 Credit 76

— 200,000 rub. - payment was received from the assignee for the right of claim transferred to him (basis: bank statement on the current account).

Accounting with the assignee

The right of claim acquired from the original creditor, arising from the loan agreement, is reflected by the organization in accounting as a financial investment, since it satisfies the conditions listed in clause 2 of the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, approved by Order of the Ministry of Finance of Russia dated 10.12 .2002 N 126n, and is directly named in paragraph 3 of PBU 19/02.

Financial investments are accepted for accounting in account 58 “Financial investments” at their original cost, which in this case is the amount paid by the organization for the acquired right of claim (clauses 8, 9 PBU 19/02, Instructions for the use of the Chart of Accounts for Financial Accounting -economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

The amounts of interest due to the organization under the loan agreement in accordance with the terms of the agreement are recognized as other income of the organization and are reflected in the debit of account 76 “Settlements with various debtors and creditors” and the credit of account 91 “Other income and expenses”, subaccount 91-1 “Other income ", on the last day of the month and on the date of repayment of the loan (date of disposal of the financial investment) (clause 34 PBU 19/02, clause 7, 10.1, paragraph 2 clause 16 of the Accounting Regulations “Income of the organization” PBU 9 /99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n, Instructions for the use of the Chart of Accounts).

On the date of repayment by the debtor of the monetary obligation, the organization reflects in its accounting the disposal of the financial investment (clause 25 of PBU 19/02).

Accordingly, it recognizes:

- other income in the amount of the principal amount of the loan received from the debtor (400,000 rubles) and the amount of interest, which is reflected in the accounting records as an entry in the debit of account 76 and the credit of account 91, subaccount 91-1 (clause 34 of PBU 19/02 , clauses 7, 10.1, 16 PBU 9/99);

- other expense in the form of the initial cost of the retiring right of claim, at which it is reflected in accounting, which is reflected by an entry in the debit of account 91, subaccount 91-2 “Other expenses”, and the credit of account 58 (clause 27 PBU 19/02, clause clauses 11, 16, 18, 19 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated 06.05.1999 N 33n, Instructions for the use of the Chart of Accounts).

"Simplified" tax

When determining the object of taxation, taxpayers using the simplified tax system take into account:

- income from sales (determined in accordance with Article 249 of the Tax Code of the Russian Federation)

- non-operating income (determined in accordance with Article 250 of the Tax Code of the Russian Federation)

and do not take into account the income specified in Article 251 of the Tax Code of the Russian Federation (clause 1, subclause 1, clause 1.1 of Article 346.15 of the Tax Code of the Russian Federation).

When determining the tax base for income tax and, accordingly, when applying the simplified tax system, income in the form of funds or other property received to repay borrowings is not taken into account (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation).

Based on this, according to the explanations of the Ministry of Finance of Russia, when returning the loan amount, the assignee organization does not take into account the funds received to repay the debt obligation under the agreement for the assignment of the right of claim, when determining the tax base for the tax paid in connection with the application of the simplified tax system (letters from 05.11.13 No. 03-11-06/2/47088, dated 10.05.12 No. 03-11-06/2/65, dated 22.01.07 No. 03-11-05/5).

However, if the money received from the debtor upon repayment of the loan exceeds the price paid for the acquired right of claim, then the assignee organization must take into account the amount of such excess in income (letter of the Ministry of Finance of Russia dated 07/09/12 No. 03-11-06/2/85, dated 02.11 .11 No. 03-11-06/2/151).

Therefore, when determining the tax base for the tax paid in connection with the application of the simplified tax system, an organization can only ignore the amount of the repaid debt only within the limits of the price of the claim paid to the original creditor.

The amount of interest, the right to receive which was transferred to the organization from the original creditor) is taken into account by the organization as part of non-operating income on the date of receipt of funds from the borrower (based on paragraph 1 of Article 346.15, paragraph 1 of Article 250, paragraph 1 of Article 346.17 Tax Code of the Russian Federation).

Example 4 On February 28, an organization, under an assignment of claim agreement, acquired the right to claim under a loan agreement for RUB 300,000.

The funds under the agreement on assignment of claims were transferred on the same day. The debtor was notified in writing of the transfer of rights.

The principal loan amount under the agreement is 365,000 rubles, interest is accrued and paid monthly on the last day of the month at a rate of 10% per annum.

The loan repayment period is April 30.

At the time of assignment of the claim, the borrower has no outstanding interest payments due to the original creditor.

In accounting, interest on loans granted is accrued monthly.

The debtor fulfilled its obligations under the loan agreement to the new creditor on time in full.

In this case, the amount of interest will be:

- as of March 31 - 3100 rubles. (RUB 365,000 x 10%: 365 days x 31 days);

- as of April 30 - 3000 rubles. (RUB 365,000 x 10%: 365 days x 30 days).

In the accounting of an organization applying the simplified tax system (taxable object “income reduced by the amount of expenses”), the acquisition of a right of claim against a third party arising under an interest-bearing loan agreement should be reflected as follows.

As of February 28:

Debit 58 Credit 76 “Settlements with the seller under the acquired right of claim”

— 300,000 rub. — the acquisition of the right of claim is reflected (basis: assignment agreement,

certificate of acceptance and transfer of documentation);

Debit 76 “Settlements with the seller under the acquired right of claim” Credit 51

— 300,000 rub. — settlement has been made with the seller of the right of claim (basis: bank statement on the current account).

As of March 31:

Debit 76 “Settlements with the debtor under a loan agreement” Credit 91-1

— 3100 rub. — interest accrued under the loan agreement for March (base: loan agreement,

accounting certificate-calculation);

Debit 51 Credit 76 “Settlements with the debtor under a loan agreement”

— 3100 rub. — the amount of interest under the loan agreement was received from the debtor (basis: bank statement on the current account).

As of April 30:

Debit 76 “Settlements with the debtor under a loan agreement” Credit 91-1

— 3000 rub. — interest accrued under the loan agreement for April (base: loan agreement,

accounting certificate-calculation);

Debit 76 “Settlements with the debtor under a loan agreement” Credit 91-1

— RUB 365,000 — other income from the disposal (redemption) of a financial investment is recognized (basis: assignment agreement, accounting certificate);

Debit 91-2 Credit 58

— 300,000 rub. — the initial cost of the financial investment is recognized as another expense (grounds: assignment agreement, accounting certificate);

Debit 51 Credit 76 “Settlements with the debtor under a loan agreement”

— 368,000 rub. (365,000 + 3000) - funds were received from the debtor to repay the principal amount of the loan and interest for April (base: bank statement on the current account).

In this case, the organization must recognize non-operating income in the amount of the difference formed between the indicated amounts - 65,000 rubles. (365,000 rubles - 300,000 rubles (clause 1 of article 346.15, part 1 of article 250 of the Tax Code of the Russian Federation).

Tengiz BURSULAYA , Lead Auditor of RIGHT WAYS LLC

Nuances of calculating the simplified tax system under an assignment agreement for borrowed obligations

If the simplifier (income minus expenses) has fulfilled the requirement arising from the loan agreement, then his income from the DC is determined based on the following:

- as a result of DC, the claim on the loan is acquired by the assignee (new creditor);

- the payment received by the assignor (the original creditor) under the DC is the proceeds from the sale of property rights, and not the repayment of the loan;

- The assignor receives taxable income.

Read about the intricacies of accounting for borrowed obligations in the material “Accounting for loans and borrowings in accounting.”

The new creditor’s accounting scheme for the DC is somewhat different (we are talking about the repayment of the loan by the debtor to the new creditor):

- income from the DC is recognized only as the amount of interest on the loan and amounts received in excess of borrowed funds;

- the amount received to repay the loan is not taken into account when calculating the single simplified tax (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation).

The material “List of income not taken into account when establishing the profit base in accordance with Art. 251 of the Tax Code of the Russian Federation."

How can the assignee formalize and record the acquisition of the right to claim under an assignment agreement?

Money received by the assignee from the debtor to repay the debt (i.e., the amount of receivables that was acquired as part of the assignment of the right of claim from the original creditor (assignor)) is recognized as income from the sale of financial services (clause 1 of Article 346.15, clause 1 of article 249, clause 3 of article 279 of the Tax Code of the Russian Federation). Therefore, when calculating the single tax, take it into account as part of income from sales (clause 1 of Article 346.15, Article 249 of the Tax Code of the Russian Federation). At the same time, include income in the calculation of the taxable base on the date the debtor repays his debt (for example, on the date of crediting funds to the current account) (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). Such clarifications are contained in letters of the Ministry of Finance of Russia dated August 1, 2011 No. 03-11-06/2/112, Federal Tax Service of Russia for Moscow dated January 18, 2005 No. 18-09/01679.

We recommend reading: Who can become a guardian of a minor child

The general conditions for deducting VAT on acquired property rights are specified in subparagraph 1 of paragraph 2 of Article 171 and paragraph 1 of Article 172 of the Tax Code of the Russian Federation. In particular, a necessary requirement is the use of acquired property rights in transactions subject to VAT. Since both the further repayment of the obligation and the assignment of the right of claim are taxable transactions, if other conditions are met (availability of an invoice and acceptance of the received accounting right), the use of the deduction is legal.