How to endure losses: basic rules

If a company suffered a loss based on the results of past periods, in the future it can reduce the tax base of the reporting periods by these amounts (Article 283 of the Tax Code of the Russian Federation).

The amounts of loss in tax and accounting most often do not coincide due to the fact that the financial result is formed differently. There are a number of expenses that are reflected in accounting in full, and in tax accounting - within limits. For example, when calculating income tax, restrictions are established for advertising expenses, compensation to employees for the use of personal vehicles, entertainment expenses, and losses from the assignment of claims (clause Article 264 of the Tax Code of the Russian Federation, clause 264 of the Tax Code of the Russian Federation). And in accounting, the costs incurred are reflected in full.

To cover losses, reserve and additional funds or retained earnings from previous years are used in accounting. In tax accounting, losses from activities are carried forward to the future, thereby reducing the tax base of subsequent periods.

The loss can be written off in the tax (reporting) period when the company made a profit.

Carrying forward losses from previous years to future periods is a right, not an obligation. To exercise this right, you need to decide at the general meeting of founders or shareholders whether you include previously received losses in the calculation of the current year’s tax. This decision of the founders will be the basis for accounting entries. If there is only one founder, he makes the decision alone.

But there are also a number of rules.

Report profit via Extern

You can only compensate up to 50% of current profits annually. And so on until 2024.

Federal Law No. 305-FZ dated July 2, 2021 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation” extended until 2024 the 50% limitation on accounting for losses of previous years in the current period. The law will come into force in January 2022. According to the version of the Tax Code, valid until the end of 2022, this restriction will expire on December 31, 2021.

According to the rules in force in the Russian Federation, tax losses can be carried forward to future years until they are completely exhausted, but in each year old losses can cover no more than half of the current year’s profit. Let us remind you that you can reduce the income tax base for losses of previous years by no more than 50% for the period from January 1, 2022.

Why did the Ministry of Finance insist on extending this restriction, since its abolition could be an important measure to support business? The state is concerned about regional budgets and this restriction, according to the Ministry of Finance, will help ensure the balanced budgets of the constituent entities of the federation.

Conditions for transferring losses in Russia:

Carrying forward losses to previous periods is not possible,

transfer of losses to future periods - until exhaustion, but not more than 50% of the current year’s profit (for the period from 2022 to 2024).

It is important to note that the 50% limitation on accounting for last year’s losses only applies when calculating income tax starting from 2017. If an update is submitted for periods preceding 2017, for example, for 2014, then the amount of the transferred loss can be limited only by the amount of the profit itself received for the current period.

How much loss can be written off?

If the company's expenses exceed income, a loss arises (clause Art. 274 of the Tax Code of the Russian Federation). In the period when the company made a profit, the loss can be deducted from the tax base. But there are several restrictions:

- The tax base of the reporting (tax) period can be reduced by no more than 50% (clause 2.1 of Article 283 of the Tax Code of the Russian Federation).

- You can write off only those losses that are reflected in the declarations starting from 2007.

- There are no restrictions on the transfer period: you can transfer until the loss amount is completely written off.

- If losses were incurred in several tax periods, they must be transferred strictly in calendar order.

An example of calculating the amount of loss that can be written off

In the reporting for 2012, the company reflected a loss of 78,000 rubles, and for 2014 - 8,000 rubles.

When calculating taxes for 2012-2020, the company did not take into account the losses received. In 2022, the company made a profit of 165,000 rubles. Let's calculate the maximum amount of loss that an organization can write off at the end of 2022 (subject to the 50% limit).

165,000 × 50% = 82,500 rubles.

The tax base for income tax in 2022, taking into account the transferred loss, will be 82,500 rubles.

Thus, in 2022, the organization took into account losses from previous periods in the following amount:

- loss in 2012 in the full amount of 78,000 rubles;

- loss in 2014 partially in the amount of 4,500 rubles.

The organization can transfer the remainder of the loss for 2014 in the amount of 3,500 rubles (8,000 - 4,500 = 3,500 rubles) to 2022 if it makes a profit.

Accounting loss and tax loss - postings

When, according to accounting and tax accounting data (hereinafter - NU), a profit is obtained and both values are equal, then there are no difficulties in calculating and reflecting income tax (hereinafter - IR) in accounting. If in one of the accounting systems - BU or NU - one financial result was obtained, and in the other - another, then when closing the period, attention should be paid to PBU 18/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n. In our article we will look at cases where discrepancies in losses arise in accounting and accounting records.

ConsultantPlus experts explained how to apply PBU 18/02 when receiving a loss in accounting and tax accounting:

Get trial access to the K+ system and upgrade to the Ready Solution for free.

Read about the obligation to apply PBU 18/02 in the article “PBU 18/02 - who should apply and who should not?” .

According to Art. 283 of the Tax Code of the Russian Federation, an organization has the right to transfer losses received in the current tax period to the future, that is, to reduce the tax base by the amount of these losses in subsequent periods in full or in parts.

Read more about tax loss here.

Therefore, even if in the current period the financial results according to accounting and accounting standards are equal, then in subsequent periods, other things being equal, accounting and tax profits will differ, thus, a deductible temporary difference will arise (clause 11 of PBU 18/02). Please note that the loss carry forward rule only works for the tax period (year); it does not apply to losses for the reporting period.

Let's consider 3 cases of losses and related transactions.

The same loss in accounting and financial accounting

According to clause 20 of PBU 18/02, after the accountant determines the financial result according to the accounting data, he must calculate and reflect in accounting the conditional income or expense for the NP. This must be done because the tax loss for the reporting period is reset to zero (clause 8 of Article 274 of the Tax Code of the Russian Federation), and the financial result according to the accounting system remains unchanged. The amount is calculated by multiplying the accounting loss by the IR rate and is reflected by posting:

- Dt 68 Kt 99 - for the amount of conditional income for income tax.

Further, in case of a loss, a deferred tax asset (DTA) for the same amount should be reflected:

- Dt 09 Kt 68 - SHE.

Thus, if a loss is recorded in NU and ACC, then account 68, subaccount “NP” will have a zero balance, and the declaration for payment will also reflect 0. In this case, the resulting difference between 0 in NU and the amount of loss in ACC should be reflected in accounting (form SHE).

Loss in NU, profit in accounting

If a loss was formed in the NU, and a profit in the accounting book, then in the NU the expenses were greater or the income was less, which means that in the current period deferred tax liabilities (DTL) should be reflected for taxable temporary differences or permanent tax income (PTI) for permanent differences . When closing the period, the accountant reflects the conditional expense for the IR, which is compensated by previously made entries for IT or PND, thereby bringing the current IR to 0.

Let's look at this situation with an example.

Example

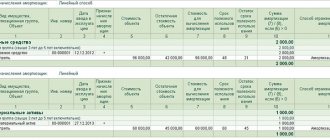

In Kaleidoscope LLC, the profit according to the accounting book is equal to 250 thousand rubles, the loss according to the accounting book is 500 thousand rubles. The difference arose due to the write-off by Kaleidoscope of the depreciation premium on the new fixed asset - 350 thousand rubles. (IT). Also, Kaleidoscope LLC received equipment free of charge from the founder - an individual who has a share in the authorized capital equal to 70%. The cost of the equipment was 400 thousand rubles. In the accounting system, this income is reflected as other income; in the tax accounting system, it is not recognized as taxable income (subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation). The following entries were made in the accounting of Kaleidoscope LLC:

| Dt | CT | Amount, thousand rubles | Description |

| 68 | 77 | 70 (350 × 20%) | Shown is IT for depreciation bonus |

| 68 | 99 | 80 (400 × 20%) | IPA shown for equipment received free of charge |

| 90.9 (91.9) | 99 | 250 | Profit determined according to accounting data |

| 99 | 68 | 50 (250 × 20%) | The conditional consumption for NP has been determined |

| 09 | 68 | 100 (500 × 20%) | ONA determined by tax loss |

On account 68 at the end of the period a zero balance is formed, which corresponds to the value of the NP according to the NU data, because there was a loss there. Accordingly, the tax is 0.

To learn whether an accountant should worry while awaiting tax inspections if a loss is shown in the tax return, read the article “What are the consequences of reflecting a loss in the income tax return?” .

If the tax office has asked you for an explanation of a loss in reporting, use a sample explanation from ConsultantPlus and receive free trial access to the system.

The following situation assumes that in BU the expenses were higher or income was lower than in NU, so this time the loss was formed in BU, and profit in NU.

Loss in accounting, profit in NU

In this situation, in the current period, there were deductible temporary differences, which led to the reflection of VTA, and/or permanent differences, as a result of which a permanent tax expense (PTR) was shown. Let's look at an example.

Example

In Karusel LLC, the profit according to accounting is equal to 150 thousand rubles, the loss according to accounting is 300 thousand rubles. Previously, the organization recognized ONA for a loss carried forward; the amount of the transferred loss is 400 thousand rubles. In the current tax period, Karusel LLC can repay part of the loss in the amount of 150 thousand rubles. at the expense of the profit received at NU. In addition, in the current year, a temporary difference arose in the accounting of Karusel LLC due to the excess of depreciation amounts according to the accounting book of the depreciation amounts according to the accounting book by 450 thousand rubles. The following entries were made in the accounting of Karusel LLC:

| Dt | CT | Amount, thousand rubles | Description |

| 09 | 68 | 90 (450 × 0,2) | SHE is shown for the difference in depreciation amounts |

| 68 | 09 | 30 (150 × 0,2) | ONA is written off for the repaid loss |

| 99 | 90.9 (91.9) | 300 | Loss determined according to accounting data |

| 68 | 99 | 60 (300 × 20%) | Conditional income for NP determined |

Thus, the turnover on the debit of account 68 is equal to 90 thousand rubles. and on the loan - 90 thousand rubles, that is, the current NP is 0 rubles. According to the tax return for the year, the tax amount for the year is also 0, since the tax profit was reset to zero by paying off the loss of previous years.

When losses cannot be taken into account

It is impossible to take into account losses that were incurred when using other tax regimes . Only losses calculated according to the rules of Chapter 25 of the Tax Code of the Russian Federation (clause Art. 283 of the Tax Code of the Russian Federation) can reduce the tax base for profits.

If a company using the simplified tax system suffered a loss in 2022, and in 2022 switched to OSNO and recorded a profit at the end of the year, it cannot write off the losses of 2022 (letter of the Ministry of Finance of the Russian Federation dated September 25, 2009 No. 03-03-06/1/617) .

It is impossible to take into account losses from the sale of shares, bonds, investment shares or shares in the authorized capital of a company (clause Art. 283 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated November 24, 2017 No. 03-03-06/2/77738).

It is impossible to take into account a loss from participation in an investment partnership if it was received in the year the taxpayer joined other participants in the investment agreement (clause Article 283 of the Tax Code of the Russian Federation).

It is impossible to take into account the loss if the company uses a 0% income tax rate and is a medical or educational organization, an agricultural producer or fishing enterprise, a regional solid waste management operator, or is engaged in social services for citizens (letter of the Ministry of Finance of Russia dated June 26, 2012 No. 03 -03-06/1/320).

Take a course in financial analysis to establish management accounting in your company and work without cash gaps

How does a loss occur?

It arises differently in three types of accounting: accounting, tax and management (MA). What is the difference between reflecting transactions:

- The moment of reflection of operations. In accounting, as a rule, the accrual method is used, i.e. transactions are carried out at the time of their completion, regardless of the actual receipt of funds, but the cash method is rarely used. This is possible in accordance with the last paragraph of paragraph 12 of PBU 9/99 and paragraph two of paragraph 18 of PBU 10/99, if the company has the right to use simplified accounting methods.

In NU, both methods can be used depending on the taxation system. On OSNO it is traditionally the accrual method, on the simplified tax system it is always cash.

Management accounting reflects all real expenses, including those that for some reason were not included in official reports.

- Goals. Accounting is maintained for all documented transactions; its data forms reporting of interest to the Federal Tax Service, auditors, founders, shareholders, investors, i.e. external and internal users.

The tax office creates the basis for the preparation of declarations, calculations of insurance premiums, etc. It determines the amount of taxes to be accrued and paid to the budget.

Managerial is necessary for internal use, to provide an idea of the real picture of expenses and income; for external users it is useless, because cannot always be documented and justified.

- By use. Accounting data is used for inventory, reconciliation of calculations, analysis of warehouse balances, settlements with employees, participants, and other counterparties. With complete, transparent accounting, its information will form the basis for planning and strategic development of the enterprise.

NU transmits information to government bodies - the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund, on the basis of which conclusions are drawn about the financial condition of the organization, reductions in certain types of costs or, conversely, about their increase, data from different reports are compared to identify unreliable or distorted data.

Management serves as a planning tool if accounting does not fully show real costs and resources.

Based on the foregoing, losses arise in each type of accounting in different ways. In NU it appears only in some taxation systems, when forming the tax base:

- BASIS for income tax.

- The simplified tax system is “income minus expenses” for a single tax.

- Unified Agricultural Tax under the unified agricultural tax.

In the operating system it is displayed almost similarly to accounting, maintained by the cash method. In general, the formula is simple: the balance of funds in the accounts (at the organization's cash desk) at the beginning of the period minus actual costs plus revenues. Sometimes forecast indicators are also added.

Accounting

In accounting, a loss occurs if one of the following situations occurs:

- An inventory was taken and shortages were identified, including cash. As a result, write-off occurs due to the norms of natural loss (this applies, for example, to products - fresh vegetables, fruits, etc.), and the guilty persons (storekeeper, cashier, seller).

In other cases, when it is impossible to identify the culprit or as a result of the trial a decision is made not in favor of the organization, operations are carried out with the participation of account 94 in the following way:

- D 20, 25, 23, 44... K 94 - the write-off of the shortage is reflected.

- D 90.2 K 20, 25, 23, 44... - when closing the period, costs are written off as cost.

- D 90.9 K 90.2 – a balance is formed.

- D 99 K 90.9 – the loss is written off to financial results.

Or Debit 91.2 Credit 94, Debit 91.9 Credit 91.2, Debit 99 Credit 91.9 - depending on the type of shortage.

- An increase in expenses while maintaining the same level of income. An increase in costs is associated with situations such as: installation of new fixed assets, when the equipment is launched, depreciation is included in expenses, but the products produced are not yet sold, or office space is rented for a separate division, rent is accrued, but the new office does not yet generate income. Accordingly, cost items (accounts 20, 44, 25, 26 and others) increase, but revenue (account 90.1) does not.

- The same level of expenses remains the same, but sales are falling. Sales have fallen or are nonexistent, as in 2022, due to the coronavirus pandemic, many organizations in the field of trade, catering, tourism, and transportation were forced to suspend work. The reasons may be poor marketing or personnel policies: ineffective advertising, errors in promotion, incorrect selection of personnel, outflow of highly professional personnel, etc. The bills are the same as above, only costs do not increase, but revenue decreases.

- Accounts receivable are written off. The counterparty was liquidated, a court decision denied you the right to collect the debt, or the deadline for filing a claim has passed - in these cases, it is necessary to write off the debt in accounting. Organizations must create a reserve for this case, but it is not always enough, and then the remaining part is written off by posting D 91.2 K 62, 60, 76..., increasing costs.

- New organization. Starting a business is always associated with significant investments, and you can wait a long time for the first sales and money to appear. As a result, there are expenses, but no revenue yet. This situation is normal for a newly registered company and is not a reason for interest even from the Federal Tax Service.

- Inactive organization. There are actually a lot of them. It would seem that you are not working, which means you need to close, but sometimes the organization finds itself in a period of “downtime” for objective reasons: The owner decided to temporarily cease operations, but retain the legal entity (the life of the company is important, and the founder does not want to open a new one in the future) .

- The organization has a status that will be difficult to restore. For example, he has membership in an SRO, a valid license, a certificate of the right to carry out any work, a contract for long-term lease of state property, etc.

- The company's assets are low-profitable at the moment, but will become highly profitable in the future. Let's say that it is now impossible to sell an entire factory building, because... it is located in an inaccessible area, but within a few years a new road will be built next to it, which will improve the infrastructure and allow the building to be sold for much more.

Note! Using faster depreciation write-offs increases the risk of losses. For example, if you purchased equipment belonging to the sixth depreciation group with a useful life of 10 to 15 years and set the minimum SPI to 10 years.

Important! The accounting system must necessarily create a reserve for doubtful debts (clause 70 of the Accounting Regulations approved by Order 34-n); no exceptions are provided.

Moreover, even a non-working organization has expenses: a watchman’s salary, rent, land tax, etc. Some people maintain a bank account and pay for maintenance.

- A new company, trying to conquer its niche, lowers its price to attract a buyer.

Probably the most common question that the chief accountant hears from the owner at the end of the next year and summing up the results is “Why is there money in the account, but there is no profit and I cannot receive dividends?” The points above are often the answer.

How to confirm your right to carry forward losses

It is possible to write off losses of previous years at the expense of current profits only if all primary accounting documents have been preserved that confirm the fact and amount of the loss received (clause Article 283 of the Tax Code of the Russian Federation, Article 313 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated 04/03/2007 No. 03-03-06/1/206).

Until the loss is transferred completely, it is necessary to store the entire “primary” one. If there are no primary documents, expenses of previous years cannot be taken into account in the tax base, even if they are reflected in the reports of on-site tax audits (clause 252 of the Tax Code of the Russian Federation, clause 270 of the Tax Code of the Russian Federation).

It is more convenient to store documents electronically. It's free in Diadoc

The period during which it is allowed to reduce the tax base by amounts of previously received losses is significantly longer than the storage period for accounting documents. Knowing this, Federal Tax Service inspectors often request supporting documents as part of desk audits of income statements where the tax base has been reduced due to losses from previous years.

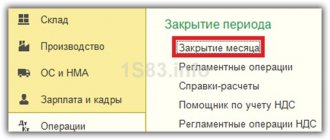

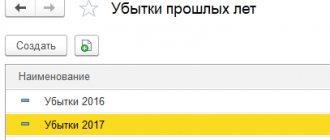

Settlement of loss carried forward

In the previous example, we saw what happens to OTA accrued on the amount of tax loss that the organization decides to carry forward. If an organization in NU makes a profit, then it has the right to repay the loss carried forward to the future in the amount of this profit. Repayment can be made in installments over different periods or in full. In this case, ONA is written off for the following loss: Dt 68 Kt 09.

NOTE! The tax loss is carried forward to the future in accordance with the provisions of Art. 283 of the Tax Code of the Russian Federation and taking into account restrictions.

How to reflect losses of previous years in the declaration

You can reduce the tax base for profits by previously received losses not only when calculating tax for the year, but also when determining advance payments.

For this purpose, the declaration provides Appendix No. 4 to sheet 02. It needs to be filled out only in declarations for the year and for the first quarter. Next, the loss that reduces the profit of the current period is transferred to line 110 of sheet 02. The previous loss is shown similarly in the declarations for 6 and 9 months.

For example, at the end of 2022, a loss of 700,000 rubles was received. In 2021, a profit of 1,200,000 rubles was recorded. The 2022 loss exceeds 50% of the 2022 tax base. Therefore, you can only write off 600,000 rubles. The remainder of the loss of 100,000 rubles remains unaccounted for.

In Appendix No. 4 to sheet 02 of the declaration we make the following entries:

- line 010 of Appendix No. 4 to sheet 02 - 700,000 rubles;

- line 040 of Appendix No. 4 to sheet 02 - 700,000 rubles;

- line 140 of Appendix No. 4 to sheet 02 - 1,200,000 rubles;

- line 150 of Appendix No. 4 to sheet 02 - 600,000 rubles;

- line 160 of Appendix No. 4 to sheet 02 - 100,000 rubles.

This is what it looks like in the declaration itself:

We reflect losses of previous years in the income tax return

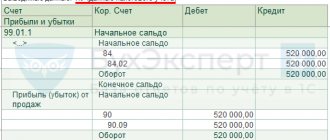

Postings to reduce last year's losses

To reduce losses from previous years, account assignment is required Dt 99.01.1 Kt 68.12 - the entry reflects the accrual of tax with a decrease based on the results of the year. Then the calculation is carried out on the basis of reducing the tax base by the amount of the written-off loss.

To confirm this operation, you can draw up a tax calculation certificate, which will present:

- The maximum amount of loss by which the tax base is allowed to be reduced

- Amount of loss recorded

- Balance of outstanding losses to be closed in subsequent periods

These data are also recorded in Appendix No. 4 of sheet 02 of the declaration.

How to take into account losses from previous years that are identified in the current period

Sometimes losses (expenses) of previous years are identified in the current period. This can happen if the documents confirming the expenses “reached” the accounting department after the end of the tax period. Or another common situation: last year the company supplied customers with low-quality goods, and the money had to be returned (letter of the Ministry of Finance of the Russian Federation dated July 25, 2016 No. 03-03-06/1/43372).

When calculating the current income tax, such amounts can be included in non-operating expenses (clause 2 of Article 265 of the Tax Code of the Russian Federation, paragraph 1 of Article 54 of the Tax Code of the Russian Federation). But this can only be done for three years. The Ministry of Finance and the Federal Tax Service believe that accounting for such expenses (losses) is closely related to the provisions on the return and offset of overpayments of taxes, and therefore cannot exceed 3 years.

For example, in the third quarter of 2022, the company transferred 10,000 rubles to the buyer for low-quality doors delivered in the second quarter of 2022. If in 2022 there were no other non-operating expenses, and at the end of the year a profit was made, then in the income tax return you will need to write down:

- line 300 of Appendix No. 2 to sheet 02 - 10,000 rubles;

- line 301 of Appendix No. 2 to sheet 02 - 10,000 rubles;

- line 040 sheet 02 - 10,000 rubles.

We reflect in the income tax return the losses of previous years that were identified in the current period. We fill out line 040 of sheet 02. We reflect in the income tax return the losses of previous years that were identified in the current period. We fill in lines 300 and 301 of Appendix 2 to sheet 02.