Accounting statements: features of accounting for the cost of finished products

The value of the balances of finished products listed in the warehouse as of the reporting date in the balance sheet is included in the amount reflected in line 1210 “Inventories”. That is, finished products are an integral part of inventories, the total value of which consists of (clause 20 of PBU 4/99, approved by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n):

- raw materials and supplies;

- costs in work in progress;

- finished products, goods and goods shipped;

- expenses of future periods.

To learn about what sections the balance sheet consists of and how to fill it out correctly, read the article “Balance sheet (assets and liabilities, sections, types)” .

Being an integral part of inventories, finished products must be taken into account at actual cost.

From 2022, the procedure for assessing finished products is determined by the new FSBU 5/2019 “Inventories”. It is discussed in detail in the Ready-made solution from ConsultantPlus. If you do not already have access to this legal system, get a free trial and proceed to the material.

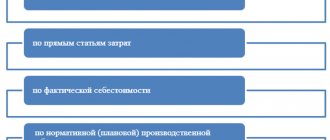

Upon disposal, it is valued in accordance with one of the methods chosen for this, i.e., based on the cost:

- each unit;

- average;

- first acquisitions.

Both of these valuation procedures (input and output) affect the cost at which the balance of available finished goods is reflected in the balance sheet.

The actual cost of the finished product is determined based on the actual costs incurred for its production. Finished products, as they are manufactured, are accepted for accounting in the warehouse, which is reflected by posting to the debit of account 43, intended for accounting for these products. However, due to the fact that at the time of receipt the actual cost has not yet been formed (the month is not closed), the receipt is registered at the accounting price, chosen by the taxpayer independently from several possible options. At the end of the month, when the actual cost of creating each type of finished product becomes clear, the accounting value is adjusted to the actual value.

Finished product accounting

After the products have gone through all stages of production, they are shipped to the warehouse for subsequent sale to customers. In this case, the accounting department of the enterprise needs to determine the cost of finished products.

Let's consider accounting and tax accounting of finished products.

Accounting

In accounting, the cost of finished products in the warehouse is reflected in account 43 “Finished products” at actual cost. This is stated in clause 5 of the Accounting Regulations “Accounting for Inventories” (PBU 5/01), approved by Order of the Ministry of Finance of the Russian Federation dated 06/09/01 No. 44n.

However, in analytical accounting, an enterprise can use accounting prices. The following can be used as a discount price:

- actual cost of finished products;

- standard cost of finished products;

Let's look at these options in more detail.

Accounting at actual cost

In this case, finished products in the warehouse are reflected based on the cost of raw materials, materials, semi-finished products, energy used in their production, accrued depreciation of equipment, workers' wages, etc. When selling products, an enterprise can write them off the books:

- at the cost of each unit;

- at average cost;

- at the cost of the first units of product received at the warehouse (FIFO method);

- at the cost of the most recent units of product received at the warehouse (LIFO method). By Order of the Ministry of Finance of the Russian Federation dated March 26, 2007 No. 26n “On Amendments to Regulatory Legal Acts on Accounting”, the LIFO method was excluded from January 1, 2008.

All these methods are provided for in clause 16 of PBU 5/01 “Accounting for inventories”.

Example 1

< The organization produces televisions. As of 01/01/07, there were 2 televisions in the enterprise’s warehouse, the actual cost of each of which was 350,000 rubles. The cost of manufacturing televisions in January 2007 amounted to 1,800,000 rubles. During this month, 6 TVs were released. Thus, the actual cost of one TV was 300,000 rubles. (RUB 1,800,000: 6 pcs.).

In January, 7 televisions were sold. To determine the cost of televisions sold, the company uses the FIFO method. This means that the actual cost of sold TVs was 2,200,000 rubles. (350,000 rub. x 2 pcs. + 300,000 rub. x 5 pcs.).

In January, the company’s accountant will make the following entries: Dt43 - Kt20 - 1,800,000 rubles. — reflects the actual cost of televisions manufactured in January 2007; Dt90 subaccount “Cost of sales” - Kt43 - 2,200,000 rubles. — the actual cost of TVs sold is written off.

At the end of January 2007, there will be one TV left in the warehouse, the cost of which is 300,000 rubles. (this is account balance 43). >

Accounting at standard cost

With this method, a cost lower than the actual cost is usually used as a standard cost. The difference between actual and standard costs is called variance. It can be reflected either on account 43 or on account 40 “Output of products (works, services)”.

To account for finished products at standard cost using account 43, the company needs to open two separate sub-accounts for account 43. One of them reflects the standard cost of finished products, and the other shows the deviation of the actual cost of finished products from the standard.

By writing off finished products from account 43, the company needs to calculate the amount of deviations that accounts for the balance of finished products in the warehouse. This can be done using the following formula:

Os = (He + Op): (Nn + Nn) x But,

where Oc is the amount of deviations attributable to the balance of finished products in the warehouse;

It is the amount of deviations attributable to the balance of finished products in the warehouse at the beginning of the reporting month;

Op - the amount of deviations attributable to products received at the warehouse in the reporting month; Нн - standard cost of the balance of finished products in the warehouse at the beginning of the reporting month;

Нп - standard cost of finished products received at the warehouse in the reporting month; But - the standard cost of the balance of finished products in the warehouse. Then the amount of deviations attributable to the shipped products is calculated using the formula:

Oo = He + Op - Os,

where Оо is the amount of deviations attributable to the shipped products.

Example 2

<At the beginning of February 2007, the company had 10 finished products (bicycles) in stock. The standard cost of one bicycle is 2000 rubles. Consequently, the standard cost of finished products in the warehouse at the beginning of the month was 20,000 rubles. (2000 rub. x 10 pcs.). The amount of deviations is 4000 rubles.

In February 2007, the company produced 100 bicycles, the production costs of which amounted to 250,000 rubles. In the same month, 105 units of finished products were sold. In accounting, the accountant makes the following entries:

Dt43 subaccount “Finished products at standard cost” - Kt20 - 200,000 rubles. (2000 rub. x 100 pcs.) - reflects the standard cost of finished products released in February;

Dt43 subaccount “Deviations of the actual cost of finished products from the standard” - Kt20 - 50,000 rubles. (250,000 - 200,000) - reflects the deviation of the actual cost of finished products produced in February from the standard;

Dt90 subaccount “Cost of sales” - Kt43 subaccount “Finished products at standard cost” - 210,000 rubles. (RUB 2,000 x 105 pcs.) - the standard cost of bicycles sold is written off for sales.

The standard cost of the balance of finished products in the warehouse at the end of February 2007 will be 10,000 rubles. (20,000 + 200,000 – 210,000).

Let's calculate the amount of deviations that accounts for the balance of finished products in the warehouse at the end of February: (4,000 rubles + 50,000 rubles): (20,000 rubles + 200,000 rubles) x 10,000 rubles. = 2454.55 rub. Thus, the balance on account 43 at the end of February 2007 will be 12,454.55 rubles. (10,000 + 2454.55).

Let's calculate the amount of deviations that account for the shipped products: 4,000 rubles. + 50,000 rub. — 2454.55 rub. = 51,545.45 rub.

In accounting, the accountant must make the following entry for this amount:

Dt90 subaccount “Cost of sales” - Kt43 subaccount “Deviation of the actual cost of finished products from the standard” - 51,545.45 rubles. — the deviation of the actual cost of finished products from the standard cost is written off as sales. >

If the enterprise takes into account the deviation of the actual cost of finished products from the standard one in a separate account 40 “Product output (work, Cost of sales” - Kt40), the excess of the actual cost of finished products over the standard one is written off.

If it is revealed that the standard cost exceeds the actual cost, then the following posting is made:

Dt90 subaccount “Cost of sales” - Kt40 - the excess of the standard cost of finished products over the actual one was reversed.

Example 3

<Let’s change the conditions of example 2. Let’s assume that the accounting policy states that finished products in the warehouse are accounted for at standard cost, using account 40 “Product output (work, Cost of sales” - Kt43 - 210,000 rubles (2000 rubles). x 105 pcs.) - the standard cost of bicycles sold is written off; Dt90 subaccount "Cost of sales" - Kt40 - 50,000 rubles (250,000 - 200,000) - the deviation of the actual cost of bicycles from their standard cost is written off (for products shipped in February) .

The balance on account 43 at the end of February 2007 will be 10,000 rubles. (2000 rub. x 5 pcs.). >

Tax accounting

To calculate the cost of finished products in a warehouse in tax accounting, you need to know two quantities: the quantity of finished products and the amount of direct costs attributable to these products.

This is established in paragraph 2 of Art. 319 of the Tax Code of the Russian Federation. Indirect expenses in tax accounting are completely written off as expenses of the current period (clause 2 of Article 318 of the Tax Code of the Russian Federation).

Algorithm for calculating the cost of finished products in a warehouse in tax accounting

1. First, let's calculate the quantity of finished products that remained in the warehouse at the end of the month (K4):

K4 = K1 + K2 - K3,

where K1 is the balance of finished products at the beginning of the month; K2 - the quantity of finished products received at the warehouse in the reporting month; K3 - the quantity of finished products that were shipped to customers in the reporting month.

2. Next, we determine the amount of direct costs related to finished products manufactured in the current month (P4):

P4 = P1 + P2 - P3,

where P1 is direct costs related to work in progress at the beginning of the month; P2 - direct expenses incurred in the current month; P3 - direct expenses related to work in progress at the end of the month.

3. Then the amount of direct expenses related to the balance of finished products in the warehouse at the end of the month (P5) will be determined as follows:

P5 = P4 x (K4 : K3).

4. And finally, let’s calculate the amount of direct costs that relate to shipped products (P6):

P6 = P7 + P4 - P5,

where P7 is the amount of direct expenses related to the balance of finished products at the beginning of the month. Let us illustrate the above with a numerical example.

Example 4

<The organization produces microwave ovens. At the beginning of February 2007, there were 100 microwave ovens in the warehouse. Their cost in tax accounting is 9,000 rubles. Within a month, 1,950 microwave ovens were manufactured, and 2,000 microwave ovens were shipped to customers. Consequently, at the end of February 2007, there were 50 microwave ovens left in the warehouse (100 + 1950 - 2000).

The amount of direct expenses related to work in progress at the beginning of the month amounted to 16,000 rubles, and at the end of the month - 14,000 rubles. For the month, the amount of direct expenses amounted to 175,000 rubles.

Consequently, the amount of direct costs attributable to microwave ovens manufactured in February 2007 is RUB 177,000. (16,0000).

The amount of direct expenses that falls on the balance of microwave ovens in the warehouse at the end of the month will be 4,538.46 rubles. (RUB 177,000 x (50 pcs: 1950 pcs)). This is the tax value of finished products in the warehouse.

The amount of direct costs related to shipped products will be RUB 181,461.54. (9000 + 177,000 – 4538.46) >

Financial statements

Information on the balances of finished products at the end of the reporting year is reflected in the balance sheet in the group of items “Inventories” of Section II “Current Assets”. The indicator for the article “Finished products and goods for resale” is determined by summing the balance at the end of the reporting year in accounts 43 “Finished products” and 41 “Goods”. Finished products as part of inventories at the end of the reporting year are reflected in the balance sheet at a cost determined on the basis of the methods used to evaluate them.

Thus, when using account 40, the assessment of finished products is formed on the basis of a planned calculation of a unit of finished products approved in the current period. The amount of deviations in the actual cost of finished products transferred from the workshop to the warehouse in the current period from the amount of its estimate based on planned calculation is written off to the cost of goods sold.

Consequently, the amount of deviations does not participate in the assessment of finished product balances reflected in line 214 of the balance sheet asset. This accounting procedure is established by the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. Thus, finished products are reflected in the balance sheet at the planned cost, and the deviation of the actual cost from the planned one is reflected in the cost of goods sold.

Finished products that are obsolete, have completely or partially lost their original quality, or the current market value of which has decreased, are reflected in the annual balance sheet minus the reserve for a decrease in the value of material assets (clause 25 of PBU 5/01 “Accounting for inventories” , approved by Order of the Ministry of Finance of the Russian Federation dated 06/09/01 No. 44n).

If the finished product is intended for further use in the production process, its cost must be taken into account in account 10 “Materials” and reflected in the balance sheet in the line “Raw materials, materials and other similar values” of the group of items “Inventories” of Section II “Current assets”.

The actual cost of products sold is reflected in the income statement (form No. 2) in the line “Cost of goods, products, works, services sold.”

In practice, situations often occur when products have not been produced and the enterprise does not have work in progress. At the same time, the costs of the current period (wages, depreciation, etc.) cannot be attributed to finished products. And here the question arises: how should these current costs be reflected?

In this case, the costs of the period in which production is not expected are reflected in the same accounts that were used during the period of production activity. However, at the end of the month, the amount of costs for the downtime period should be attributed to future expenses: Dt97 subaccount “Activities in the absence of production” - Kt20 - costs for the downtime period are written off.

The procedure for writing off these expenses to the cost of finished products in subsequent months must be determined in the accounting policy. In tax accounting, such expenses are not distributed between reporting periods, but are recognized in the period of their occurrence.

The following documents were used in preparing the article:

- Tax Code of the Russian Federation (part two) dated 05.08.00 No. 117-FZ (adopted by the State Duma of the Federal Assembly of the Russian Federation on 19.07.00).

- Order of the Ministry of Finance of the Russian Federation dated 06/09/01 No. 44n “On approval of the Accounting Regulations “Accounting for Inventories” PBU 5/01″. In ed. dated 11/27/06.

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and instructions for its application.” In ed. from 09.18.06.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Accounting accounts 43 and 45 to reflect finished products

Thus, all products manufactured for sale within a month are recorded as a debit to account 43 at their book value. At the end of the month, this cost must be adjusted to the actual cost. Moreover, within a month, some of the products have already been sold. What is the algorithm for accounting for deviations?

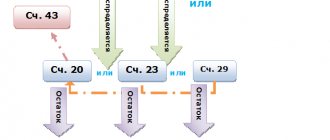

Deviations in value can be collected in 2 ways: on account 40 or on a separate sub-account of account 43. The accounting value will be calculated as follows:

- with the first method: Dt 43 Kt 40;

- with the second: Dt 43 Kt 20 (23, 29).

The deviation will be formed by:

- accrual of actual cost with receipt of the difference on account 40 - with the first method: Dt 40 Kt 20 (23, 29);

- additional accrual (with plus or minus) of the adjustment amount - in the second method: Dt 43 Kt 20 (23, 29).

To learn about what costs form the cost of manufactured products, read the material “Composition of costs included in the cost of production.”

Write-off of the cost of manufactured products when they are shipped during the month of manufacture is reflected by posting Dt 90 Kt 43 at book value. At the end of the month, the cost of shipped products is adjusted by postings Dt 90 Kt 40 or Dt 90 Kt 43, depending on the selected deviation account.

When taking into account deviations on account 40 for products that remained unshipped, at the end of the month you will have to make a posting Dt 43 Kt 40 for the amount of deviations associated with these products, so that the balance on account 43 shows its actual cost.

For shipments of finished products or goods with a special transfer of ownership (the shipment takes place, and recognition of the sale occurs later), an interim account 45 “Goods shipped” is used, i.e. in the correspondence of transactions reflecting such a shipment, instead of account 90, account 45 is used: Dt 45 Kt 41 (43). Recognition of the sale will subsequently be reflected by posting Dt 90 Kt 45.

What goods are included in account 45? These are, for example, goods transferred for commission. Also, account 45 “Goods shipped” is used in case of export of products. The use of account 45 when exporting is due to the fact that ownership remains with the seller for some time until all customs procedures are completed.

You can see an example of how finished products are reflected in the balance sheet in the Guide from ConsultantPlus. Trial access to the system is provided free of charge.

Volume of production in the balance sheet

Information about the volume of products produced is generated on account 40. It is used to record the amounts of the planned cost of production, or to reflect transactions at actual cost. Accounting features are fixed in the company's accounting policy. Most often, count 40 is used in companies specializing in mass production of goods with an extensive range. To calculate the actual cost value, the account accumulates data on the cost of raw materials, contractor services, employee wages, fuel and energy costs, as well as other production expenses.

To reflect the planned cost, the company uses information about the cost of homogeneous products produced in the previous period, or it is calculated based on average values. By posting D/t 43 K/t 40, the recorded cost of manufactured products and reflected in the composition of the actual finished products is recorded.

In some, it is used without generating the 40th account. With this accounting algorithm, in the debit of account 43, the cost of production is formed from the production accounts, which is recorded by posting D/t 43 K/t 20, 23, 29.

There is no special line in the balance sheet for production volume data, since this information is included in the block of industrial inventories, for which line 1210 is allocated. Finished products in the balance sheet are reflected in the same line - in the structure of inventories along with other working capital.

Results

Finished products remaining in the warehouse on the reporting date will appear in the balance sheet line reflecting the amount of inventory and will become its component.

The cost of finished products is formed by 2 rules: acceptance for accounting at the actual costs of its creation and disposal in the assessment chosen by the taxpayer (at the cost of a unit, average or first acquisitions). Accounting for the movement of products during the month of production, when the actual cost has not yet been formed, is carried out at the accounting cost, which is then adjusted for the amount of deviations. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of reflecting information about finished products in the balance sheet

The PBU, approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n, states that financial statements must include information that has factual and material confirmation. When preparing a balance sheet or any other financial statements, the responsible person must be guided by the specified accounting provisions. accounting or other standards.

Based on existing rules, at the end of the calendar year, the company’s financial statements must reflect data on the volume of production and material inventories based on cost accounting determined using special methods. The accounting rules indicate that the assessment of inventories at the end of the reporting period should be carried out using the disposal method.

When manufacturing a product, its actual cost is determined taking into account the expenses incurred. As a result, in line 1210 of the balance sheet, finished products can be reflected at actual or accounting cost. The choice of accounting methodology depends on the nuances of the company’s work and should subsequently be reflected in the accounting policy of the enterprise. Information on the volume of finished products is reflected in the article “Inventories”, section II “Current assets”:

As we have already said, the line “Finished products and goods for resale” must be filled out. The formation of the general indicator occurs by balancing all data at the end of the reporting year on accounts 43 “Finished products” and 41 “Goods”. Before obtaining accurate data, the information indicated on accounts 45 and 40 is additionally taken into account.

If the product is outdated, has partially or completely lost its original qualities, or its price has decreased, then the indicator will be reflected in the balance sheet minus reserves for reducing the price of the product.