Legislation provides for a mandatory requirement to provide company employees with personal protective equipment when working in harmful or hazardous conditions. In dirty industries, it is necessary to provide personnel with physical protection equipment. Let us dwell on the theoretical aspects of organizing accounting operations and carrying out the subsequent write-off of workwear, taking into account both accounting and tax requirements, focusing on the practical use of 1C: Accounting 8.3.

Accounting and tax accounting of workwear

The term “working clothes” is used in relation to the individual protection of company employees. This category includes both clothing and safety shoes and other devices that perform a protective function.

Regulatory acts regulating the issue:

- Tax code;

- Order of the Ministry of Finance No. 135n;

- Certificate on the standards for issuing protective clothing and other protective equipment to employees free of charge;

- Labor Code in articles 221 and 209;

- Order of the Ministry of Labor No. 997n;

- Code of Administrative Offences.

Current legal documents provide for fines for non-compliance with the rules for issuing protective clothing. For officials, sanctions are provided in the amount of 20,000 - 30,000 rubles, and for companies themselves in the amount of 130,000 - 150,000 rubles, calculated on a per-employee basis.

Representatives of certain types of professions (for example, builders) and employees of a number of enterprises receive protective clothing in accordance with current legislative standards. The regulations regulate both the terms of use of items and the amount of uniform workers receive. The issuance procedure is determined by current industry regulations or existing model rules. The basic requirement is the free provision of protective clothing. At the same time, the items continue to remain the property of the company and are listed on the balance sheet of the enterprise, which bears the costs of cleaning and washing. Certification of clothing is mandatory.

The basic document regulating the issue was the order of the Ministry of Finance numbered 135n. Within the framework of this regulatory act, accounting for workwear should have been carried out similarly to working capital. To do this, it was necessary to open two subaccounts for materials in the warehouse (10.10) and for those used by employees (10.11).

Then the regulations changed and today it is allowed to use PBU 6/01, which applies to “Accounting for fixed assets”. It is important to consider that we are talking about workwear used for more than a year. In addition, the cost criteria must correspond to the requirements of fixed assets.

For a detailed consideration of the rules for registration and write-off, we will focus on the standards used in the “traditional” approach. We are talking about adding special clothing to the 10th account. Understanding the cost of items and planned terms of use allows you to correctly write off. Thus, you can choose from several options:

- When operating for less than a year, expenses in accounting are included in expenses when transferred to employees;

- When used for more than a year, accounting is carried out using linear write-off methods over the time of use of the clothing.

Tax accounting rules provide that the cost of workwear is immediately included in expenses, in accordance with Article 254 in paragraph 1. Thus, when calculating income tax, a temporary difference arises.

It is important to understand that the taxpayer retains the right not to immediately write off the cost in tax accounting. Expenses can also be reflected in several reporting periods. When maintaining accounting records, it is also possible to write off the cost of workwear not immediately. Such postings are possible when items have been used for less than a year. In this case, the linear method is applied and costs are incurred over the entire period of use. But the chosen procedure is necessarily fixed in the accounting policy.

How are overalls taken into account when dismissing an employee in accounting - postings

Important! If a set of workwear per employee costs more than 40 thousand rubles, the clothing should be taken into account simultaneously with the company’s fixed assets. The cost of such expensive items is written off in equal installments over 12 months (this is the optimal period of use).

Working clothes are purchased by an enterprise for the purpose of issuing them to employees who are required to wear them due to the specific nature of their activities. The delivery of the kit is carried out on the basis of the demand invoice. At the same time, the accountant must make the appropriate entries.

If the accountant is going to write off the cost of workwear partially (in equal shares for the full period of use of the workwear by the employee), the following entries are made:

| Wiring | DEBIT | CREDIT |

| The uniform was issued to the employee | 10-11 | 10-10 |

| The cost of workwear is written off every month in equal shares, distributed over the entire period of operation | 20, 23, 25 | 10-11 |

| The remainder of the cost of workwear is written off as other costs if it is damaged, lost, or returned upon dismissal of an employee. | 91-1 | 10-11 |

If it was decided to write off the cost of workwear at a time, other entries are made:

| Wiring | DEBIT | CREDIT |

| Special clothing issued to the employee | 10-11 | 10-10 |

| The total cost of workwear was written off as expenses. | 20, 23, 25 | 10-11 |

A specialized solution for accounting for workwear in construction organizations

BIT.CONSTRUCTION/Workwear

- Accounting for issuance, return, write-off;

- Maintaining a nomenclature of workwear and personal protective equipment indicating sizes and other characteristics;

- Formation of a personal account card;

- Planning for the provision of special clothing and equipment.

Read moreTry for free

Workwear used by employees for over a year is registered on account 10.11. In this case, depreciation is written off as expenses on a monthly basis. It is mandatory to maintain off-balance sheet accounting for each unit issued. Write-offs may be due to wear and tear or other factors. The organization of off-balance sheet accounting in 1C is organized on account MTs.02, called Overalls in operation.

After writing off the cost of materials from accounting to expenses, the cost of items on account 10.11 is written off due to wear and tear. If an employee is fired or transferred to another position, the workwear is handed over to the responsible persons of the company.

Return and write-off of unclaimed workwear

How can an organization record the return of unclaimed workwear that has a residual value to a warehouse by a resigned employee, its write-off and use as rags?

Situation

Upon dismissal, the employee handed over special clothing with a residual value of 150 rubles. Due to the lack of demand for workwear (there are no employees who need it), the organization decided to write it off. As a result of the write-off, rags were formed. It was entered into the warehouse at the price of possible use in the amount of 50 rubles.

According to the accounting policy, the cost of workwear is transferred to cost accounts in the amount of 50% when issued to an employee and 50% when written off.

General provisions

Personal protective equipment (hereinafter referred to as PPE, workwear) (except for rented equipment) is the property of the employer (clause 23 of Instruction 209). In this case, the employer is understood as a legal or natural person who is granted by law the right to conclude and terminate an employment contract with an employee (paragraph 6, part 1, article 1 of the Labor Code).

Based on the norms of paragraph 3 of Art. 214 of the Civil Code, property acquired by a legal entity is owned by this legal entity. The owner of such property has all rights of ownership, use and disposal of this property (Clause 1 of Article 210 of the Civil Code).

In this regard, we believe that workwear that is not in use for any reason, including if there are no employees who need it, can be written off by the employer’s decision.

Accounting

PPE issued to employees is accounted for in subaccount 10-11 “Special equipment and special clothing in use” (part 14, clause 16 of Instruction No. 50).

The cost of personal protective equipment is written off in the manner established by the organization’s accounting policies. This is reflected by an entry in the debit of the cost accounting accounts depending on which category of workers was issued special clothing (20, 25, etc.), and in the credit of subaccount 10-11 (paragraph 5 of clause 107 of Instruction No. 133). In our situation, according to the accounting policy, the cost of personal protective equipment is transferred to accounting accounts as follows: 50% when issued to an employee and 50% when written off.

In this regard, the resigning employee returns the workwear to the warehouse at its residual value in the amount of 150 rubles. In this case, an entry is made on the debit of subaccount 10-10 “Special equipment and special clothing in the warehouse” and the credit of subaccount 10-11 (part 13, 14, clause 16 of Instruction No. 50). This operation is recorded in the personal PPE record card (part 4, clause 43 of Instruction No. 209).

After the return of the workwear, a specially created commission for quality control of PPE, authorized by the employer, determines the actual condition of the workwear and its suitability for further use. The commission's decision is recorded in the PPE inspection report. Most often (clause 42 of Instruction No. 209):

— suitable protective clothing is repaired and used for its intended purpose;

— unsuitable PPE is written off and sent for production needs, repair of other PPE, or recycled as recyclable materials. If decommissioned PPE cannot be used as recyclable materials, it is disposed of.

But there are situations like ours, when there is simply no one to give used workwear to, or no one wants to wear it. Then you should take into account some features regarding write-off.

As is known, depending on the reason for write-off, the cost of personal protective equipment may be reflected in the cost or income and expense accounts. Our workwear is written off due to lack of demand (there is no one to issue it to). Therefore, we believe that the residual value of these personal protective equipment is reflected as part of other expenses for current activities, taken into account in subaccount 90-10 “Other expenses for current activities” (paragraph 2 of clause 13 of Instruction No. 102).

The rags obtained as a result of write-off are brought to the warehouse at the price of their possible use. This operation is reflected by an entry in the debit of subaccount 10-6 “Other materials” and the credit of subaccount 90-7 “Other income from current activities” (paragraph 2, paragraph 13 of Instruction No. 102; paragraph 45 of Instruction No. 133; parts 9, 17 clause 16 of Instruction No. 50).

The above operations must be confirmed by the PUD. This could be, for example, an act for writing off special clothing (clause 1, article 10 of Law No. 57-Z; clauses 66, 68 of Instruction No. 133).

Sample act for writing off workwear The organization shows the cost of rags used in its activities on the credit of subaccount 10-6 in correspondence with the debit of cost accounting accounts (23, 25, 26, etc.) (part 18, clause 16, clause 26, 27, 28 Instructions No. 50).

VAT

Write-off of workwear is not subject to VAT (clause 1, article 31, clause 1, article 115 of the Tax Code).

Income tax

Since in the situation under consideration, the workwear returned to the warehouse was written off due to lack of demand by the organization’s employees and is not related to workwear that is unsuitable for use, we believe that its residual value cannot be taken into account in non-expenses and, as a consequence, when taxing profits (clause 1, subclause 3.16 Clause 3 of Article 175 of the Tax Code).

The cost of rags generated from writing off workwear is reflected as non-income and is taken into account when taxing profits (clauses 1, 2, subclause 3.43, clause 3, Article 174 of the Tax Code).

Accounting Entry Table

| Contents of operation | Debit | Credit | Amount, rub. | Primary document |

| The return to the PPE warehouse at the residual value is reflected | 10-10 | 10-11 | 150 | Personal PPE registration card, invoice for internal movement |

| The write-off of personal protective equipment is reflected at the residual value <1> | 90-10 | 10-10 | 150 | PPE inspection report, PPE write-off report |

| The rags received as a result of the write-off of personal protective equipment were capitalized <2> | 10-6 | 90-7 | 50 | Invoice for internal movement (acceptance and delivery note), act of receipt of waste, etc. |

| The rags used for the business needs of the organization are written off | 23, 25, 26, etc. | 10-6 | 50 | Material write-off act |

| ——————————— <1> Not taken into account when taxing profits (clause 1, subclause 3.16, clause 3, article 175 of the Tax Code). <2> Taken into account when taxing profits as part of non-income (clauses 1, 2, subclause 3.43, clause 3, Article 174 of the Tax Code). | ||||

Read this material in ilex >>* * following the link you will be taken to the paid content of the ilex service

Accounting and write-off of workwear in 1C 8.3

The arrival of workwear after delivery occurs in accordance with the provisions applied when registering other types of material assets. The main requirement is the correct choice of the type of materials in the nomenclature directory, where you need to find Workwear. In this case, the receipt will immediately be issued to the account on 10.10.

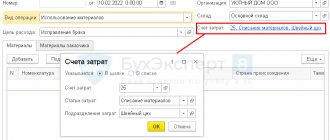

Registration of the transfer of workwear to employees is carried out by going to the desired menu item. To do this, you need to open the “Warehouse”, select “Workwear and equipment” and go to the “Transfer of materials for operation” item. How this is done is shown in Figure 4. In the future, menu items and working with them will be discussed in more detail.

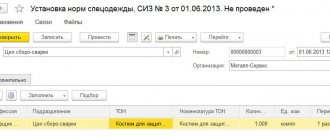

Correct completion of the “Purpose of Use” section allows you to receive correct transactions. It is important to enter each type of item separately. Don't think that this is a mistake, these are the rules.

To carry out the calculations, items are selected from the directory “Linear method of paying off costs” and additionally “Method of reflecting expenses”. In the latter case, you can choose account 20.01 or options from accounts 23, 26, 25, 44.

For safety glasses, you must choose a different payment method. In this case, the “during commissioning” option is used.

If a pair of gloves is issued in excess of the norm, expenses are recorded in another account - 91.02. It is important to understand that this parameter will not be used when calculating income tax. Thus, a permanent difference of 30 rubles will appear in the accounting department and the calculations will look like this: 150 rubles x 20%.

The next step will be to add another item to the “Method of reflecting expenses” category with expenses for workwear used in excess of the norm. In this case, you must indicate the type of expenses, and then uncheck the box next to the item Take into account in tax accounting.

To account for costs, account 91.02 is used

After filling out the document, all that remains is to check the correctness of the entered data. The transactions performed will reflect the following points:

- Initially, all positions are recorded on account number 10.11.1;

- Positions written off at a time are written off in accounting to the indicated accounts 20.01 and 91.02;

- In tax accounting, the cost of protective suits is written off and temporary differences are formed;

- There was no write-off in accounting for protective suits;

- For clothes above the norm, a constant difference is calculated. At the same time, an off-balance sheet account with number МЦ.02 was filled in.

After entering all the data, you can create a balance sheet for a specific month before it closes.

If necessary, you can view the analytics of the off-balance sheet account.

The cards allow you to see which employee received a special uniform, making it easier and simpler to control material assets.

The cards allow you to see which employee received a special uniform, making it easier and simpler to control material assets. At the close of the month, an IT amount of 400 rubles is fixed, formed as follows: 2,000 rubles x 20%.

At the same time, no write-offs have yet been made for the costs associated with the use of protective suits. Thanks to the use of standard 1C: Accounting functionality, linear depreciation for various types of workwear is written off every month, starting from the next month after the start of use. However, such subtle methodological issues are not reflected in the legislation. Therefore, an accountant can simply use the proposed solution by fixing the algorithm. In this way, it will be possible to avoid possible disagreements with representatives of inspection authorities.

Let's look at how to close the next month. To do this, open the “Month Closing” form. Now in this menu there is an item about the need to repay the cost of the special form.

All required amounts will be debited to account 20.

The next step will be to write off IT in accordance with the calculations: 111.22 rubles x 20% = 22.22 rubles.

At the same time, the special form is listed on the company’s off-balance sheet account under number МЦ.02 all the time until it is written off. This occurs at the end of 18 months.

We will write off the form that has become unusable or has passed its depreciation period.

To make filling out documentation easier, you can create the document “Decommissioning of materials.” The form is created on the basis of previously received reports on the transfer of items to employees. So glasses and gloves can be written off after a year of use. However, in order to clearly show the posting of this process, we will reflect the write-off of all positions within one base document.

You can fill out the data table by selecting “By balances”.

After completion, all transactions will be available

In this case, the off-balance sheet account will be reset to zero.

When using the “Workwear” and “Supply and Warehouse” modules of the integrated solution BIT.CONSTRUCTION, a report on the availability/write-off of workwear can be generated in two modes: according to accounting data or according to operational accounting data. Data selection can be carried out by organization, type of personal protective equipment and financial institution, and a specific employee. The report displays the following information: “In stock of the employee” (the number of pieces of workwear in use), “Needs to be written off” (the number of pieces of workwear to be written off), “Needs to be issued” (the number of pieces of workwear according to issuance standards).

Accounting for workwear and special equipment in 1C:ERP: how to bypass the limitations of standard functionality

A segment of special attention, especially in large production and industrial organizations, is the accounting of workwear and special equipment with the need to quickly obtain information about their availability and condition, not only in total, but also in quantitative terms.

Taking into account the number of departments and the employees included in them, the production or purchase of workwear constitutes a significant expense item. Accordingly, incorrect accounting has a negative impact on the financial condition of the company.

There are a number of limitations in typical ERP functionality:

- There are no tools for inventory of inventory items in operation, which is a mandatory procedure for large companies.

In principle, the system does not have the ability to generate documents for conducting an inventory of inventory items in operation. Because of this, the accountant has to create statements in xls, which increases the likelihood of errors, and also increases the time for preparing the necessary information.

- There is no single report that would accumulate all the summary data on the accounting of workwear.

Quantitative and summary data is scattered across multiple reports. For example, in order to obtain information about the quantity and cost of inventory items in operation, you need to generate a SALT (turnover balance sheet) for the account and a standard report “Inventory items in operation,” and then compare the report data into a single one. With large volumes of data, such a process naturally complicates the work of users and increases the number of errors.

In addition, the standard “Inventory in Operation” report does not reflect those inventory items for which the service life has expired, but the inventory itself has not yet been written off, which in turn affects the completeness of the reflection of accounting data.

- The movement of workwear in the MC and 10.11 accounts within one month is not reflected if it was put into operation in the same month.

Accounting has its own specifics. Let's imagine that in April special clothing was put into use. The employee used it for several days and passed it on to someone else. Or another common situation - the clothes were found to be defective and had to be written off. And all this happened within one month.

The limitation of the standard 1C:ERP functionality in this case is that the MC and 10.11 accounts will not display the movement of workwear in the same month in which the transfer occurred and the write-off or transfer was made. Users will not be able to obtain complete information on the use of clothing in April, in which it was transferred; the data will be displayed only in May. This format contradicts the completeness of data display.

- Calculation of the residual value of inventory items, the cost of which was repaid upon transfer to operation.

In addition to the missing information for correct accounting, many companies are faced with the need to determine the residual value that arises when inventory items are written off from service during sale or other reasons.

Now in the standard 1C:ERP system, all workwear and special equipment (according to FSBU 5), which is put into operation, is written off as expenses immediately, regardless of service life. The problem is that with a complete write-off, when the actual service life of the workwear is not taken into account (in accounting for 2022, such documents are not included in the system), it is impossible to automatically calculate the residual value, which is important for generating a refund for the workwear and the financial result upon sale.

Can automation of processes in 1C solve pressing accounting problems?

In our work, we encounter completely different industries, the scale of organizations, and the attitude of employees towards the introduction of new mechanisms and rules. But 90% of companies are similar in two respects: accounting departments need maximum convenience and time savings during a rush of tasks, and management needs a complete and transparent financial picture of production processes and control over the condition of assets.

Considering these goals in the context of accounting for workwear in 1C:ERP, to achieve them it is necessary to automate inventory accounting. To resolve the issue of efficiency, completeness and reliability of data on inventory items in operation, a report “Inventory items in operation” was developed based on the standard 1C:ERP report.

This report allows you to:

- see summary and quantitative indicators in one report, in the context of all necessary analytics;

- work without restrictions on reflecting inventory items whose service life has expired. The report reflects all inventory items listed in accounting, but using the settings, the user can set the selection himself, whether to show such inventory items or not;

- see the total indicators for movements and write-offs of inventory items in the period in which they are reflected in the documents, regardless of the date of their transfer into operation;

- work with full detail down to the primary document, which allows you to open documents directly from the report and make adjustments to it if necessary.

Important point

: the report connects to 1C as an external tool and does not disrupt the current processes of the system in which the company operates.

Dealing with inventory

Just above we said that 1C:ERP, in principle, does not have inventory documents. But this process cannot be ignored. A successful alternative to manual labor would be to refine the 1C system itself, taking into account the nuances of the company itself, since everything is individual.

In our practice, as part of the accounting automation process, we improved the system where we created documents that reflect the inventory, which facilitated data entry and eliminated errors that appear during manual intervention.

The document “Inventory sheet for inventory items in operation” is filled out automatically according to the data of the off-balance sheet account of the inventory center in terms of amount and quantity, taking into account the data of the operational circuit, which allows you to obtain up-to-date data after posting transfer and write-off documents, regardless of the formation of transactions in accounting. At the same time, the document has the ability to generate printed forms INV-3 and INVE-19.

Automatic filling of details in documents for accounting of inventory items in operation

As part of the development of the report, mechanisms were improved to automate:

- filling in the cost of inventory items when returning from service, if at the time of return the service life has not expired or, in principle, there is a residual value on account 10.11;

- filling in the details “Individual recipient” when moving.

Of course, alternative automation solutions can be considered. For example, if a company generates a turnover and then uploads the completed Excel file into its system. But given the volume of work, we can say with confidence that this method will affect the increase in the number of errors.

In this case, automation of inventory accounting will become an effective method that will protect the company from errors that affect the financial condition of the organization, and will also help to quickly make informed management decisions based on correct and up-to-date information on the accounting of workwear and special equipment.

Interested in new functionality? Leave a request on the website, our specialists will contact you!

Accounting for workwear when dismissing employees

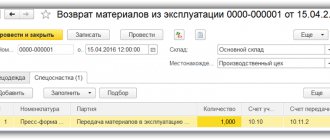

Situations where an employee stops performing duties or moves to another department and must hand over his clothes arise regularly. However, the depreciation period for the uniform has not yet expired. In this case, it is necessary to prepare “Return of materials from service.” A convenient moment will be the ability to automatically fill out the tabular part by selecting the “By balances” menu. Then all that remains is to indicate the names of the dismissed employees.

The system will automatically make a refund and the workwear will be credited to your account on 10.10. Then all that remains is to transfer the form to another employee using the algorithm already described.

At the same time, the question: what to do with special clothing in the event of an employee’s dismissal, provided that the residual value of the special uniform has not yet been written off, is not spelled out in the methodological recommendations. Sometimes it is possible to use the algorithm used when an employee moves to a new position and depreciation is not written off. However, in some cases, the form cannot be transferred to a new employee for several reasons:

- Based on hygienic reasons;

- Due to physical wear and tear;

- Provided that the tailoring was carried out for a specific employee.

Quite often other situations arise when an employee is fired but does not return the work clothes. In this case, the residual value of the form will remain on the balance sheet. There is also no single methodological solution for this situation. On the one hand, tax authorities and other inspectors are interested in increasing the tax burden on enterprises. However, judicial practice shows that decisions are often made in favor of enterprises that did not charge additional taxes. Let's consider possible options for action in such a situation. At the same time, there is no single correct solution. The chief accountant should choose a specific strategy of action and consolidate it for subsequent use in accounting policies.

If we assume that at the time of the employee’s dismissal the situation is as follows: the capitalized cost of the suit was 1,800 rubles, the capitalized VAT was 324 rubles, then this amount was taken as a deduction, and the suit was put into operation for 18 months. Over the course of 10 months, depreciation of 1,000 rubles was written off, and at the time of dismissal, the residual value was 800 rubles.

In this situation, several solutions are possible. Let's consider what accounting employees can do. Provided that the form has been handed over to the warehouse, but cannot be issued to a new employee, the inventory commission generates a write-off report due to wear and tear. Thus, after write-off, the residual value of the form of 800 rubles is taken into account in non-operating expenses.

Provided that the employee has not submitted the form and has not yet received the final payment upon dismissal, the accountant can calculate the residual value of the workwear from the accrued wages. Thus, 800 rubles from the residual value are transferred to settlements with employees, and then this amount is paid off when calculating wages.

However, if the accounting department decides to shift the payment of the residual value to the employee after payment of wages, this amount can only be recovered through the court. Since in this case we are talking about a kind of theft of property. At the same time, it is important to correlate the cost of costs and the existing shortage.

Another option for resolving the situation would be the employee’s voluntary decision to keep the overalls. In this case, an application is submitted with a request to withhold the residual value of the equipment from the salary. The debt is then taken into account when paying wages.

If an employee agrees to voluntarily purchase a uniform, disagreements may arise with the inspection authorities. The fact is that tax representatives are inclined to believe that when transferring ownership rights there is a sale and for this reason VAT must be paid. At the same time, in judicial practice the situation is viewed from a different angle, considering that we are talking about reimbursement of the company’s costs.

Having presented the transfer of workwear as a sale, one cannot approach the price issue completely unambiguously. The fact is that in most examples the residual value of the special mold was used. However, if market prices are used, this may change. It is probably necessary to make a certain markup. This approach, provided that VAT is charged to the form, will eliminate possible claims from inspectors. However, it is difficult to say how beneficial such a decision will be for the enterprise and the resigning employee.

Having made the cost of clothing without VAT equal to 1,000 rubles, it is necessary to make a number of transactions. In this case, VAT will be 180 rubles, and the company’s non-operating income will be 1,180 rubles. As a result, the employee’s debt to the company will amount to 1,180 rubles and will be taken into account when receiving the final payment.

In some cases, it is possible to register the transfer of workwear to employees as a gratuitous transfer. However, then you need to pay VAT. The payment of personal income tax by an employee who has received a material benefit, which is calculated at a rate of 35%, will also become mandatory.

The peculiarities of writing off the residual value for protective equipment are such that there is no single algorithm of actions. Therefore, the optimal solution is to gradually write off the cost of the uniform as an expense, even when it comes to items used for less than a year. In companies with significant staff turnover, this approach will be most effective.

Accounting

Accounting for special clothing must be kept on account 10 “Materials”, broken down into subaccounts 10-10 “Special equipment and special clothing in warehouse” and 10-11 “Special equipment and special clothing in operation.”

The purchase of workwear is reflected on the date of its acceptance for accounting by the following entries:

Debit 10 “Materials”, subaccount “Special equipment and special clothing in warehouse”, Credit 60 “Settlements with suppliers and contractors”

— the purchase of workwear is reflected;

Debit 19 “Value added tax on acquired assets” Credit 60

— reflects the amount of VAT presented by the seller of workwear;

Debit 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT”, Credit 19

— the amount of VAT presented by the seller is accepted for deduction;

Debit 60 Credit 51

— settlement has been made with the seller of workwear.

EXAMPLE 1. HOW TO ACCOUNT FOR SPECIAL CLOTHING

He is engaged in car washing.

In January, 10 pairs of rubber gloves were purchased for car wash employees at a price of 590 rubles. (including VAT - 90 rubles) and 10 pairs of rubber boots at a price of 4720 rubles. (including VAT - 720 rubles). In the same month, clothes and shoes were issued to the car wash employees. The manager's order established a useful life: for gloves - two months, for boots - 18 months. The accountant in January must do the following postings: Debit 10-10 Credit 60

- 500 rub.

(590 – 90) – gloves received; Debit 10-10 Credit 60

- 4000 rub.

(4720 – 720) – boots received; Debit 19 Credit 60

- 8100 rub.

((90 rub. + 720 rub.) × 10 pairs) – VAT reflected; Debit 60 Credit 51

- 5310 rub.

(590 + 4720) – special clothing is paid for; Debit 68 Subaccount “Calculations for VAT” Credit 19

- 810 rub.

– tax deduction has been made; Debit 10-11 Credit 10-10

- 500 rub.

– gloves were provided to employees; Debit 10-11 Credit 10-10

- 4000 rub.

– boots were issued to employees; Debit 20 (26) Credit 10-11

- 500 rub.

– the cost of the gloves issued is written off. Every month for 18 months, the accountant will make the following entries: Debit 20 (26) Credit 10-11

- 222.22 rubles. (4000 rubles: 18 months) – the cost of boots has been partially written off. Thus, by the end of the year 2666.64 rubles will be written off. (222.22 rubles × 12 months). The cost of workwear listed on account 10 at the end of the year will be 1333.36 rubles. (500 + 4000 – 500 – 2666.64). This amount will be indicated in the annual balance sheet on line 1210.

Transfer into operation

The commissioning of workwear is reflected depending on whether its cost is written off as expenses at a time or not.

The transfer of workwear into service with a one-time write-off on the date of issue to employees is reflected as follows:

Debit 20 “Main production” (08 “Investments in non-current assets”, 23 “Auxiliary production”, 25 “General production expenses”, 44 “Sales expenses”) Credit 10, subaccount “Special equipment and special clothing in warehouse”

— special clothing was issued to employees;

Debit 012 “Working clothes put into operation”

— protective clothing issued to employees is reflected on the balance sheet.

The transfer of workwear into service with a straight-line write-off on the date of issue to employees is as follows:

Debit 10, subaccount “Special equipment and special clothing in operation”, Credit 10, subaccount “Special equipment and special clothing in warehouse”

— special clothing was issued to employees.

Then in equal monthly installments during the wearing period:

Debit 20 “Main production” (08, 23, 25, 44) Credit 10, subaccount “Special equipment and special clothing in use”

— the repayment of part of the cost of workwear is reflected.

In case of disposal (for example, damage or loss) - on the date of disposal:

Debit 94 “Shortages and losses from damage to valuables” Credit 10, subaccount “Special equipment and special clothing in use”

— the residual value of the workwear is written off.

Accounting for uniforms in 1C

Please note that uniforms are somewhat different from special clothing. The latter serves as a means of protection, and accounting standards are clearly stated in many legislative documents. The situation with uniforms is somewhat different. This special form format is used to identify employees of a certain profession or working in a certain company. A number of companies use uniforms in their workplaces to enhance their image or speed up the speed and quality of customer service.

However, issues of accounting for uniforms are not covered in the tax code. For this reason, the position of the inspection bodies may not always be coherent. It is important to highlight two main points:

- The form is the property of the company and is issued for the duration of work;

- When issued to an employee, the uniform becomes the property of the employee and remains at his disposal after dismissal.

Moreover, when the uniform is considered as the property of the enterprise, we are talking about material costs, whereas when transferring clothes to an employee, it is necessary to enter this parameter in parallel with wages and be sure to accrue personal income tax. Provided that the issuance of the form is provided for by law, insurance charges will not be necessary. However, if such rules do not apply to the enterprise, insurance premiums must be calculated.

Do you have any questions about accounting and writing off workwear in 1C? Book a consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter