How to organize accounting of the volume of work performed in food shops?

What forms of documents should I use?

How to build management accounting and cost control for remuneration of production personnel based on primary documents?

Accounting for wages begins in the shop with the preparation of primary documents to account for production, the volume of work performed by individual workers or a team.

The main tasks of accounting for production and wages of workers at food industry enterprises:

- complete timely documentary reflection and provision of reliable data in the primary and accounting records of operations related to the payment of personnel;

- control over the expenditure of funds on labor costs;

- correct calculation of taxes and fees related to wages;

- obtaining accurate data on the cost of finished products;

- monitoring the implementation of finished product production plans;

- monitoring the compliance of actual indicators with established time and production standards.

Organization of payroll accounting

The calculation items “Basic wages” and “Additional wages” of production workers include for each type of product the wages accrued at piece rates, with all additional payments to workers directly involved in the production of semi-finished meat products.

The wages of auxiliary workers, engineering and technical workers, employees are taken into account in the cost accounts “Shop expenses”, “General”, “Non-production expenses”, etc.

Payroll for main production workers is documented using accounting sheets . Then the data is grouped into reporting accumulative statements .

Note!

Accounting for output, volumes of work performed and wages is organized depending on the technological process, type of production, system of labor organization and payment, level of accounting automation and other conditions.

To organize payroll accounting, an economist must have an understanding of the technological process.

The technological process of manufacturing semi-finished meat products can be simplified into several stages:

1. Preparation of ingredients according to the recipe (meat, flour, eggs, cheese, onions, mushrooms, salt, etc.).

2. Preparation of semi-finished products - minced meat, dough, etc.

3. Forming products from prepared minced meat and dough.

4. Freezing semi-finished meat products in low-temperature refrigeration chambers.

5. Packaging and labeling of frozen semi-finished products.

6. Storing products in refrigerated chambers until they are shipped.

Each stage requires labor costs. The economist needs to agree with management how each stage of the technological process will be formalized:

- an individual document for accounting production - if the operation and the equipment on which it is performed are separated from others, the quantitative result is measurable, one employee who is easily identified is responsible for the operation;

- team document - if technological operations are performed in a complex manner (for example, preparing minced meat and immediately molding).

For your information

Typically, on production lines, the amount of work performed is assigned to the team.

Documentation for accounting of personnel, labor and their payment

Forms of primary accounting documentation for recording labor and its payment are mandatory for use by legal entities of all forms of ownership, with the exception of budgetary organizations.

To record personnel, calculate and pay wages, unified forms of primary accounting documents are used, approved by Decree of the State Statistics Committee of the Russian Federation dated April 6, 2001 No. 26.

— The order for hiring an employee (form No. T-1 and -1a) is used for registration and accounting of employees hired under an employment contract. Compiled by the person responsible for admission for all persons hired by the organization. The orders indicate the name of the structural unit, profession, probationary period, as well as the conditions of employment and the nature of the work to be performed. An order signed by the head of the organization or an authorized person is announced to the employee against signature. Based on the order, a record of hiring is made in the work book, a personal card is filled out, and the employee’s personal account is opened in the accounting department.

— An employee’s personal card (Form No. T-2) is filled out for persons hired on the basis of a hiring order, a work book, a passport, a military ID, a document on graduation from an educational institution, an insurance certificate of state pension insurance, a certificate of employment registration with the tax authority of other documents required by law, as well as information provided by the employee about himself.

— The staffing table (Form No. T-3) is used to formalize the structure, staffing and staffing levels of the organization. The staffing table contains a list of structural units, positions, information on the number of staff units, official salaries, allowances and monthly payroll. Approved by order of the head of the organization or a person authorized by him.

— An order to transfer an employee to another job (form No. T-5 and -5a) are used to formalize and record the transfer of an employee to another job in the organization. They are filled out by a personnel service employee, signed by the head of the organization or a person authorized by him, and announced to the employee against signature. Based on this order, marks are made in the personal card, personal account, and an entry is made in the work book.

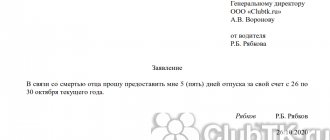

— An order for granting leave to an employee (form No. T-6 and -6a) is used to formalize and record leaves granted to an employee in accordance with the law, a collective agreement, regulations of the organization, and an employment contract. They are drawn up by a personnel service employee or an authorized person, signed by the head of the organization or his authorized person, and announced to the employee against signature. Based on the order, marks are made in the personal card, personal account and the calculation of wages due for leave is made according to form No. T-60 “Note-calculation on granting leave to the employee.”

— The vacation schedule (Form No. T-7) is intended to reflect information about the time of distribution of annual paid vacations to employees of all structural divisions of the organization for the calendar year by month. Vacation schedule - summary schedule. When drawing it up, the current legislation, the specifics of the organization’s activities and the wishes of the employee are taken into account. The vacation schedule is endorsed by the head of the personnel service, heads of structural divisions, agreed with the elected trade union body and approved by the head of the organization or his authorized person.

— An order to terminate an employment contract with an employee (Form No. T-8 and 8a) is used to formalize and record the dismissal of an employee. They are filled out by a personnel service employee, signed by the head of the organization or a person authorized by him, and announced to the employee against signature. Based on the order, an entry is made in a personal card, personal account, work book, and a settlement is made with the employee using form No. T-61 “Note for settlement upon termination of an employment contract with an employee.”

— An order to send an employee on a business trip (form No. T-9 and No. T-9a) are used to formalize and record the employee’s assignments on business trips. Filled out by a personnel service employee and signed by the head of the organization or his authorized person. The order for sending on a business trip indicates the surnames and initials, structural unit, professions of the travelers, as well as the purposes, time and place of the business trip. If necessary, the sources of payment for travel expenses and other conditions for sending on a business trip are indicated.

— A travel certificate (form No. T-10) is a document certifying the time an employee spent on a business trip. Issued in one copy by a personnel service employee on the basis of an order to be sent on a business trip. At each destination, notes are made on the time of arrival and departure, which are certified by the signature of the responsible official and seal. After returning from a business trip to the organization, the employee draws up an advance report with attached documents confirming the expenses incurred.

— An official assignment for sending on a business trip and a report on its implementation (form No. T-10a) are used to draw up and record an official assignment for sending on a business trip, as well as a report on its implementation. The official assignment is signed by the head of the department in which the posted employee works. It is approved by the head of the organization or a person authorized by him and transferred to the personnel service for issuing an order to be sent on a business trip. A person arriving from a business trip draws up a short report on the work performed, which is agreed upon with the head of the structural unit and submitted to the accounting department along with a travel certificate and an advance report.

— The order to reward an employee (form No. T-11 and -11a) is used to formalize and record incentives for success at work. They are compiled based on the submission of the head of the structural unit of the organization in which the employee works. Signed by the head of the organization or a person authorized by him, announced to the employee against signature. Based on the order, a corresponding entry is made in the employee’s work book.

— The timesheet for the use of working time and the calculation of wages (form No. T-12) and the timesheet for the use of working time (form No. T-13) are used to carry out timekeeping and control of labor discipline. Form No. T-12 is intended for recording the use of working time and calculating wages, and Form No. T-13 is intended only for recording the use of working time. When using form No. T-13, wages are calculated in the personal account (form No. T-54), payroll (form No. T-51) or payroll (form No. T-49).

Form No. T-13 is used in conditions of automated data processing. Time sheet forms with partially filled in details can be created using computer technology. In this case, the form of the report card changes in accordance with the adopted data processing technology.

Time records cover all employees of the organization. Each of them is assigned a specific personnel number, which is indicated in all labor and wage accounting documents. The essence of the time sheet is the daily registration of employees’ attendance at work, from work, all cases of lateness and absences, indicating their reasons, as well as hours of downtime and hours of overtime work. Timesheet accounting is carried out by an accountant, foreman or foreman in a timesheet recording the use of working time. To simplify timekeeping, you can limit yourself to only registering deviations from the normal working day.

A note about absences or lateness is made in the time sheet on the basis of the relevant documents - certificates of summons to the military registration and enlistment office, court, certificates of temporary incapacity for work, etc., which employees hand over to timekeepers; downtime is determined based on downtime sheets, and overtime hours are determined based on the lists of foremen.

Completed primary documents for accounting production and work performed, along with all additional documents, are transferred to the accountant.

To determine the amount of wages to be paid to employees, it is necessary to determine the amount of employees’ earnings for the month and make the necessary deductions from this amount. These calculations are usually made in the payroll sheet (form No. 49), which, in addition, serves as a document for the payment of wages for the month.

Payroll statements are used by small and medium-sized enterprises where the number of employees is not large and where they prefer not to maintain personal accounts in addition to these statements, believing that all the necessary information is contained in the tax card. At large enterprises, pay slips (form No. 51) are used to calculate wages, and pay slips (form No. 53) are used for payment. However, in these enterprises, where wages can be calculated on 20 bases, only the employee’s personal account reflects all types of wages. And often a personal account is the form that most fully reflects information that allows you to sample wages for calculating a pension or prepare a certificate to the employment fund to assign unemployment benefits. In addition, personal accounts are stored for 75 years, and often serve as the only basis for issuing archival certificates of wages received by employees.

If wages are issued according to Payrolls (Form No. T-53), then such payrolls are registered in the registration journal (Form No. T-53a), which is maintained by accounting employees.

However, in practice, using payroll statements to calculate the average salary for any previous period is inconvenient, since it is necessary to make labor-intensive selections from various statements. Therefore, the organization opens personal accounts for each employee (form No. T-54 and form No. T-54a), in which the necessary information about the employee, all types of accruals and deductions from wages for each month are recorded. Using these data, it is easy to calculate the average earnings for any period of time. It is filled out on the basis of primary documents recording production and work performed, time worked (sheets for recording the use of working time, forms No. T-12 and No. T-13). Information is reflected from orders on incentives for employees, forms No. T-11 and No. T-11a, notes and calculations on granting leave to an employee (Form No. T-60) and upon termination of an employment contract with an employee (Form No. T-61), an act on acceptance of work performed under an employment contract concluded for the duration of a specific job (form No. T-73), sheets and certificates for additional payment, sick leave, etc.

At the same time, all deductions from wages are calculated, taking into account the tax deductions and benefits due to this employee, and the amount to be paid in person is determined.

— A note-calculation on granting leave to an employee (form No. T-60) is intended to calculate the wages due to the employee and other payments when he is granted annual paid or other leave.

— A note-calculation upon termination of an employment contract with an employee (form M T-61) is used to record and calculate the wages due and other payments to the employee upon termination of the employment contract. Compiled by a human resources employee or an authorized person. The calculation of due wages and other payments is made by an accounting employee.

To receive an advance for the first half of the month, the following documents are submitted to the bank: a check, payment orders for the transfer of funds to the budget for withheld taxes, for the transfer of amounts withheld under executive documents and personal obligations, as well as for the transfer of payments for social needs (to funds - pension, social insurance, compulsory health insurance).

Forms of primary accounting documentation for recording labor and its payment are mandatory for use by legal entities of all forms of ownership, with the exception of budgetary organizations.

To record personnel, calculate and pay wages, unified forms of primary accounting documents are used, approved by Decree of the State Statistics Committee of the Russian Federation dated April 6, 2001 No. 26.

— The order for hiring an employee (form No. T-1 and -1a) is used for registration and accounting of employees hired under an employment contract. Compiled by the person responsible for admission for all persons hired by the organization. The orders indicate the name of the structural unit, profession, probationary period, as well as the conditions of employment and the nature of the work to be performed. An order signed by the head of the organization or an authorized person is announced to the employee against signature. Based on the order, a record of hiring is made in the work book, a personal card is filled out, and the employee’s personal account is opened in the accounting department.

— An employee’s personal card (Form No. T-2) is filled out for persons hired on the basis of a hiring order, a work book, a passport, a military ID, a document on graduation from an educational institution, an insurance certificate of state pension insurance, a certificate of employment registration with the tax authority of other documents required by law, as well as information provided by the employee about himself.

— The staffing table (Form No. T-3) is used to formalize the structure, staffing and staffing levels of the organization. The staffing table contains a list of structural units, positions, information on the number of staff units, official salaries, allowances and monthly payroll. Approved by order of the head of the organization or a person authorized by him.

— An order to transfer an employee to another job (form No. T-5 and -5a) are used to formalize and record the transfer of an employee to another job in the organization. They are filled out by a personnel service employee, signed by the head of the organization or a person authorized by him, and announced to the employee against signature. Based on this order, marks are made in the personal card, personal account, and an entry is made in the work book.

— An order for granting leave to an employee (form No. T-6 and -6a) is used to formalize and record leaves granted to an employee in accordance with the law, a collective agreement, regulations of the organization, and an employment contract. They are drawn up by a personnel service employee or an authorized person, signed by the head of the organization or his authorized person, and announced to the employee against signature. Based on the order, marks are made in the personal card, personal account and the calculation of wages due for leave is made according to form No. T-60 “Note-calculation on granting leave to the employee.”

— The vacation schedule (Form No. T-7) is intended to reflect information about the time of distribution of annual paid vacations to employees of all structural divisions of the organization for the calendar year by month. Vacation schedule - summary schedule. When drawing it up, the current legislation, the specifics of the organization’s activities and the wishes of the employee are taken into account. The vacation schedule is endorsed by the head of the personnel service, heads of structural divisions, agreed with the elected trade union body and approved by the head of the organization or his authorized person.

— An order to terminate an employment contract with an employee (Form No. T-8 and 8a) is used to formalize and record the dismissal of an employee. They are filled out by a personnel service employee, signed by the head of the organization or a person authorized by him, and announced to the employee against signature. Based on the order, an entry is made in a personal card, personal account, work book, and a settlement is made with the employee using form No. T-61 “Note for settlement upon termination of an employment contract with an employee.”

— An order to send an employee on a business trip (form No. T-9 and No. T-9a) are used to formalize and record the employee’s assignments on business trips. Filled out by a personnel service employee and signed by the head of the organization or his authorized person. The order for sending on a business trip indicates the surnames and initials, structural unit, professions of the travelers, as well as the purposes, time and place of the business trip. If necessary, the sources of payment for travel expenses and other conditions for sending on a business trip are indicated.

— A travel certificate (form No. T-10) is a document certifying the time an employee spent on a business trip. Issued in one copy by a personnel service employee on the basis of an order to be sent on a business trip. At each destination, notes are made on the time of arrival and departure, which are certified by the signature of the responsible official and seal. After returning from a business trip to the organization, the employee draws up an advance report with attached documents confirming the expenses incurred.

— An official assignment for sending on a business trip and a report on its implementation (form No. T-10a) are used to draw up and record an official assignment for sending on a business trip, as well as a report on its implementation. The official assignment is signed by the head of the department in which the posted employee works. It is approved by the head of the organization or a person authorized by him and transferred to the personnel service for issuing an order to be sent on a business trip. A person arriving from a business trip draws up a short report on the work performed, which is agreed upon with the head of the structural unit and submitted to the accounting department along with a travel certificate and an advance report.

— The order to reward an employee (form No. T-11 and -11a) is used to formalize and record incentives for success at work. They are compiled based on the submission of the head of the structural unit of the organization in which the employee works. Signed by the head of the organization or a person authorized by him, announced to the employee against signature. Based on the order, a corresponding entry is made in the employee’s work book.

— The timesheet for the use of working time and the calculation of wages (form No. T-12) and the timesheet for the use of working time (form No. T-13) are used to carry out timekeeping and control of labor discipline. Form No. T-12 is intended for recording the use of working time and calculating wages, and Form No. T-13 is intended only for recording the use of working time. When using form No. T-13, wages are calculated in the personal account (form No. T-54), payroll (form No. T-51) or payroll (form No. T-49).

Form No. T-13 is used in conditions of automated data processing. Time sheet forms with partially filled in details can be created using computer technology. In this case, the form of the report card changes in accordance with the adopted data processing technology.

Time records cover all employees of the organization. Each of them is assigned a specific personnel number, which is indicated in all labor and wage accounting documents. The essence of the time sheet is the daily registration of employees’ attendance at work, from work, all cases of lateness and absences, indicating their reasons, as well as hours of downtime and hours of overtime work. Timesheet accounting is carried out by an accountant, foreman or foreman in a timesheet recording the use of working time. To simplify timekeeping, you can limit yourself to only registering deviations from the normal working day.

A note about absences or lateness is made in the time sheet on the basis of the relevant documents - certificates of summons to the military registration and enlistment office, court, certificates of temporary incapacity for work, etc., which employees hand over to timekeepers; downtime is determined based on downtime sheets, and overtime hours are determined based on the lists of foremen.

Completed primary documents for accounting production and work performed, along with all additional documents, are transferred to the accountant.

To determine the amount of wages to be paid to employees, it is necessary to determine the amount of employees’ earnings for the month and make the necessary deductions from this amount. These calculations are usually made in the payroll sheet (form No. 49), which, in addition, serves as a document for the payment of wages for the month.

Payroll statements are used by small and medium-sized enterprises where the number of employees is not large and where they prefer not to maintain personal accounts in addition to these statements, believing that all the necessary information is contained in the tax card. At large enterprises, pay slips (form No. 51) are used to calculate wages, and pay slips (form No. 53) are used for payment. However, in these enterprises, where wages can be calculated on 20 bases, only the employee’s personal account reflects all types of wages. And often a personal account is the form that most fully reflects information that allows you to sample wages for calculating a pension or prepare a certificate to the employment fund to assign unemployment benefits. In addition, personal accounts are stored for 75 years, and often serve as the only basis for issuing archival certificates of wages received by employees.

If wages are issued according to Payrolls (Form No. T-53), then such payrolls are registered in the registration journal (Form No. T-53a), which is maintained by accounting employees.

However, in practice, using payroll statements to calculate the average salary for any previous period is inconvenient, since it is necessary to make labor-intensive selections from various statements. Therefore, the organization opens personal accounts for each employee (form No. T-54 and form No. T-54a), in which the necessary information about the employee, all types of accruals and deductions from wages for each month are recorded. Using these data, it is easy to calculate the average earnings for any period of time. It is filled out on the basis of primary documents recording production and work performed, time worked (sheets for recording the use of working time, forms No. T-12 and No. T-13). Information is reflected from orders on incentives for employees, forms No. T-11 and No. T-11a, notes and calculations on granting leave to an employee (Form No. T-60) and upon termination of an employment contract with an employee (Form No. T-61), an act on acceptance of work performed under an employment contract concluded for the duration of a specific job (form No. T-73), sheets and certificates for additional payment, sick leave, etc.

At the same time, all deductions from wages are calculated, taking into account the tax deductions and benefits due to this employee, and the amount to be paid in person is determined.

— A note-calculation on granting leave to an employee (form No. T-60) is intended to calculate the wages due to the employee and other payments when he is granted annual paid or other leave.

— A note-calculation upon termination of an employment contract with an employee (form M T-61) is used to record and calculate the wages due and other payments to the employee upon termination of the employment contract. Compiled by a human resources employee or an authorized person. The calculation of due wages and other payments is made by an accounting employee.

To receive an advance for the first half of the month, the following documents are submitted to the bank: a check, payment orders for the transfer of funds to the budget for withheld taxes, for the transfer of amounts withheld under executive documents and personal obligations, as well as for the transfer of payments for social needs (to funds - pension, social insurance, compulsory health insurance).

Individual record of work performed

It is used to account for production and payroll separately for each worker. Issued for any convenient (accepted by the company) period.

An individual statement allows you to take into account the volume of work performed by type of product.

In turn, each product has its own recipe, technological process, and piece rates. The statement indicates the amount of work performed (columns 4–11) by dates (column 2).

Thus, on May 2, 2017, the workshop produced “Okhotnichye” meat cutlets, “Slavyanskie” meat cutlets and minced zrazy with mushrooms. The volume of minced meat prepared is indicated in columns 4, 5, 10. The volume of work for each day is summarized in the “Total” column. In total, as of 05/02/2017, the volume of work was 300 kg.

The amount of wages (line “Amount, rub.”) is obtained by multiplying the data in the “Total” column by the data in the “Rate” column.

For example, on 05/05/2017, worker A.P. Vetrova prepared 140 kg of minced meat according to the “Rural” meat-containing cabbage rolls recipe. The price for this work is 2.4 rubles. Then the piecework wage is 336 rubles.

For your information

Since business is now focused on the needs of customers, products are launched into production in limited quantities.

The size of the batch of products to be released, in terms of product names, and the quantity of each type, is often kept according to work orders (or simply orders).

An order is a grouped order from several wholesale buyers, retail outlets, collected by sales department managers or sales representatives of the company.

For management accounting purposes, to calculate the actual cost of each order, the cost code (order) is indicated in the individual statement of work performed. So, for order 120/25-04, the economist will assign a direct salary in the amount of 319 rubles. for preparing minced meat in the amount of 110 kg of minced meat for sausages for the “Shashlychny” grill, as well as 299 rubles. for preparing 130 kg of minced meat for Khabarovsk meatballs.

For your information

In this example, work is performed at piece rates. The same form of individual statement can be used to record work on a time-based wage system. To do this, indicate “time-based” in the “Type of payment” column; the “Rate” and “Amount” columns are not filled in. Shop staff are paid based on time sheets.

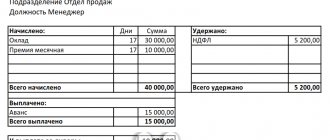

Rules for generating a payslip

According to Part 1 of Article 136 of the Labor Code of the Russian Federation, the following information is indicated on the payslip:

- on the components of the employee’s salary for the relevant period;

- on the amounts of other accrued amounts. These include, in particular, monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments, etc.;

- on the amounts and grounds for deductions made;

- about the total amount of money to be paid.

Attention!

Even if the salary is always paid on time, the pay slip must contain details, a field or place for indicating information about the amount of accrued compensation for the employer’s violation of the payment deadline. After all, this information is included in the leaflet due to the direct indication of Article 136 of the Labor Code of the Russian Federation. If the approved form of the payslip does not contain such details (fields, places), this circumstance may become the basis for the application of a fine provided for in Part 1 of Article 5.27.1 of the Code of Administrative Offenses (Decision of the Supreme Court dated 03.08.17 No. 73-AD17-2).

Salary by product type

Based on the results of processing primary documents, the PEO generates accumulative statements that:

- used as a basis/reconciliation when creating calculations;

- display consolidated direct costs by type of product;

- are used to calculate the percentage of compliance with standards, control time standards, control and reconciliation of volumes of manufactured products.

The best option is that the required form is printed automatically at the user’s request after entering statements of work performed into the database.

The cumulative list of labor costs by type of product is useful for analyzing wages by type of product and calculating costs.

In the column “Basic salary” the piecework salary from the accounting sheets (individual, team) is indicated; in the “Additional salary” column - bonuses, surcharges for harmful activities, etc.

What is a pay slip?

This is a document that provides a complete breakdown of accruals in favor of the employee and deductions from wages.

The legal basis for the preparation and issuance of a pay slip is Article 136 of the Labor Code of the Russian Federation. It states that when paying wages, the employer must notify the employee: about its components; on the amount of other accrued amounts (including compensation for violation of deadlines for payment of amounts due to the employee); about deductions and the total amount to be paid. And below, Article 136 of the Labor Code of the Russian Federation says that the form of the pay slip is approved by the employer. Thus, you need to notify employees about accruals and deductions using a payslip.

Maintain timesheets and calculate salaries in the web service Try for free

Control of time standards

In enterprises, it is important to monitor how time standards are observed, especially in conditions of piecework wages.

The time standards control sheet is formed on the basis of the team sheets as a whole for the department (shop, section, team) and allows you to calculate the percentage of time standards fulfilled.

The standard time per unit of production (in our case, per 100 kg, column 4) is indicated according to piece rate cards.

Since the volume of production is recorded (column 2), it is possible to calculate the standard time for the amount of work that was performed by the team - column 5. The actual time worked is known from the timesheet.

The percentage of standards fulfilled is calculated for the entire shift (working day). So, for 05/02/2017, based on the volume of work performed, the standard time was 108.75 hours. In fact, the team completed the volume in 73 hours. Savings were 35.75 hours.

Let's calculate the percentage of compliance with standards:

108.75 / 73 × 100 = 148.97% - quite high.

This may indicate high-quality organization of work in the team, small losses of preparatory and final time when switching from one product to another.

But the economist should pay attention to the fact that when producing three types of products - zrazy with cheese, exotic meat lula kebab, Tatar meat cutlets - there is always a high percentage of compliance with the standards. This means it is necessary:

- revise standards;

- standardize the work again;

- find out whether there were any changes in technology after the approval of piece rate cards;

- take other measures taking into account the specifics of production to regulate production standards.

In general, for the month the percentage of exceeding standards was 115.33%. The economist needs to check whether this percentage fits into the limits on the permissible percentage of over-fulfillment (or under-fulfillment) of standards.

The percentage of compliance with the norms of 115.33% is usually considered normal.

Note!

Documentary verification of compliance with time standards by individual workers is possible only if the worker performs a separate operation, for example, preparing minced meat, and his scope of work is covered by individual records of work performed.

Vetrova A.P. spent 8 hours (column 5) on the completed amount of work (preparing minced meat for “Hunter” meat cutlets, “Slavyanskie” meat cutlets, immediately chopped with mushrooms) (column 5) with a time norm of 9.9 hours (column 7). The percentage of compliance with standards for 05/02/2017 is 123.75%. In general, for the month Vetrova A.P. fulfills the time standards by 109.33%.

Based on the results of monitoring standards, it is clear that both with individual and team accounting of product production, labor standards are exceeded. This indicates a high level of labor organization:

- the time for transition from one product to another is within the established preparatory and final time;

- there are no interruptions in the supply of raw materials;

- production operates in a rhythmic mode;

- the equipment functions normally, there is no loss of time for unplanned repairs;

- the rhythm of the team’s work corresponds to the rhythm of the production line (when performing a complex technological operation).

Of course, it is necessary to exclude the situation with erroneous or outdated time standards.