Calculating personal income tax in 1C 8.3 Accounting should start with the basic program settings. This stage is important, since it is at this stage that the structure of registers for personal income tax is formed in 1C. When wages and other income are accrued, data will be collected in these registers, which will then be used for tax reports for individuals. You will learn how to correctly configure the register in 1C 8.3 Accounting in this material.

Personal income tax is withheld from the income received by employees of the employing organization. In this case, the company acts as a tax agent. The organization itself must calculate the tax of its employee and submit the appropriate declarations.

To take into account different types and sources of income of individuals, special codes for these incomes are provided. Code 2000 is a designation of income received as a result of wages, and code 2010 is used to account for income received under civil contracts. In turn, code 2012 is used for vacation pay. These codes can be found in a special reference book in 1C 8.3 called “Types of personal income tax”. You can learn about accounting for deductions in the “Types of personal income tax deductions” directory. Throughout the year, personal income tax registers accumulate all the information that can subsequently be used to create tax reports. The following sections of the article provide instructions on how to find and configure personal income tax registers in the 1C 8.3 system.

Primary settings for personal income tax accounting

Decide which payroll accounting options you need

The 1C 8.3 system provides a special program that allows you to keep track of wages. It is called “1C Salary and HR Management (ZUP)”. It allows you to record complex salary payment schemes and automatically determine sick leave and other benefits. Thus, the ZUP provides everything for successful accounting of salaries and employees in medium and large organizations. For a smaller number of frames (less than 60), you can use the 1C 8.3 Accounting program. Before you start calculating wages, you should indicate in the settings which program will be used to calculate wages. To do this, you need to go to “Administration” (step 1) and click on “Accounting Settings” (step 2).

In a new window, open the “Salary Settings” link (step 3), then the settings will open.

In the settings you need about (step 4) if you plan to use 1C 8.3 Accounting. If you use the 1C 8.3 ZUP system for payroll accounting, you should do (step 5).

We'll configure 1C to suit your needs right now!

- Any settings, reports in 1C, 1C exchanges

- A specialist will arrive the next day

- We accept your applications 24/7

- Receive a gift when purchasing any 1C programs and services in the amount of 33,000 rubles or more!

To get a consultation

Accounting for accruals: make settings

When you select the “In this program” checkbox, you should continue with the settings. To do this, you need to click on “Payroll calculation” in the salary settings (step 1) and configure the following parameters:

- Keep records of sick leave, vacations and executive documents (step 2). Check this box if these deductions are planned;

- Salary calculation for separate divisions (step 3). Provides for those who have separate units;

- Automatically recalculate the “Payroll” document (step 4). If you want the taxes to be recalculated in the “Payroll” document immediately after changes are made;

The process of setting up payroll accounting methods

It is recommended that you familiarize yourself with the additional salary settings and, if necessary, make changes to individual items. This refers to the order in which salaries are displayed on accounting accounts.

Each organization, due to its specifics, can charge wages to different accounting accounts. For example, trading companies use account code 44 “Sales expenses”. And in production organizations, wages will be reflected in the following accounts:

- 20 “Main production”;

- 23 “Auxiliary production”;

- 25 “General production expenses”;

- 26 “General business expenses”;

It is important to note that even one enterprise can use several accounting methods for different departments, groups of employees or nomenclature groups.

To set up accounting methods, you need to click on “Reflection in accounting” in the salary settings (step 1). Then go to “Salary accounting methods” (step 2). As a result, a directory of accounting methods will be opened.

The directory has several ways to record salaries. If necessary, you can add new items. To do this, click on the “Create” window (step 3). Next, a window will open for adding a new method.

In this window you need to specify:

- Name of the new method (step 4);

- Accounting account (step 5);

- Nomenclature group (step 6);

- Cost item (step 7);

- To take into account consumption under the simplified tax system or not (step 8);

- Cost item for UTII (step 9);

You can save the new method by clicking on “Save and close” (step 10). As a result, a new method will be created and can be immediately used when calculating salaries.

Postings for personal income tax

Depending on the business transaction, account 68.1 may correspond with different accounts - with account. 70 for wages, with account. 75 for dividend payments to founders, etc. Personal income tax is accrued on the credit side of account 68, and its payment is carried out on the debit side. The postings themselves are generated at the time the tax is withheld and when it is transferred to the treasury account.

Personal income tax is accrued on the date of actual receipt of income (determined in accordance with Article 223 of the Tax Code of the Russian Federation) and is withheld at the time of actual payment of funds to an individual.

Let us give examples of what wiring is used for specific cases.

Personal income tax on wages

When paying wages to employees and withholding personal income tax from them, accounting account 68 corresponds with account 70. In addition to wages, the same entry is drawn up for tax on vacation payments, sick leave benefits, compensation for unused vacation, bonuses and allowances - any payments related to the employee’s performance of his official duties and accrued in accordance with the accepted remuneration system. Posting D70 - K68.1 is also used when paying dividends to the founders-employees of the enterprise.

Example

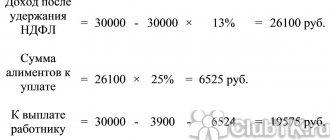

Manager Petrov is paid a salary accrued in the amount of 30,000 rubles. The employee does not have standard deductions. The personal income tax rate is 13%, the withheld tax is 3,900 rubles from the salary.

The accountant reflected the calculation of salaries:

D26 – K 70 – 30,000 rub.

When tax is withheld, the following entry is made:

D70 - K68.1 - 3900 rub.

Petrov receives the amount minus tax: 30,000 – 3900 = 26,100 rubles.

D70 – K51 – 26,100 rub.

Personal income tax for other settlements with employees

If the employee’s charges are not related to wages, account 73 is used. For example, when tax is withheld from material assistance or the cost of gifts. If a non-taxable limit is established for such income, personal income tax is taken from the amount exceeding such a limit. Correspondence: D73 – K68.1.

Example

The organization decided to pay financial assistance to Secretary Vasina in the amount of 5,000 rubles. Personal income tax is assessed on amounts over 4,000 rubles at a rate of 13% (clause 28, article 217 of the Tax Code of the Russian Federation).

The accountant calculated the amount of financial assistance:

D91.2 – K 73 – 5000 rub.

Tax was calculated on the amount exceeding the limit: (5000 – 4000) x 13% = 130 rubles.

When tax is withheld, the posting is as follows:

D73 – K68.1 – 130 rub.

Issued in Vasina’s hands: 5000 – 130 = 4870 rubles.

D73 – K50 – 4870 rub.

Tax under GPC agreements

Personal income tax is also withheld from income paid to performers for works and services of a civil nature. Accounting account for GPC agreements – . Correspondence for personal income tax withholding: D76 – K68.1.

Example

A contract was concluded with citizen Ivanov for installation work for 15,000 rubles.

Remuneration accrued under the GPC agreement:

D26 – K76 – 15,000 rub.

When paying for work under the GPC agreement with Ivanov, personal income tax was withheld at 13% - 1950 rubles (15,000 x 13%). In this case, the wiring is drawn up:

D76 – K 68.1 – 1950 rub.

Ivanov will receive in his hands: 15,000 – 1950 = 13,050 rubles.

D76 – K50 – 13,050 rub.

Personal income tax on payments to founders

Dividends due to the founders are taken into account on account 75 (on account 70 if the founder works in the same company). When funds are transferred to participants, personal income tax is always withheld from them by the dividend payer (tax agent). Wiring: D 75 (70) – K68.1.

Example

A decision was made to pay dividends to participants from the LLC’s net profit for 2022. The founder Solovyov, who does not work in the LLC, received dividends of 2,000 rubles:

D84 – K75 – 2000 rub.

After withholding tax at a rate of 13% (2000 x 13% = 260 rubles), you must pay the remaining amount: 2000 - 260 = 1740 rubles.

On the day the specified amount was transferred to Solovyov’s bank account, the following entries were made:

D75 – K68.1 – 260 rub.

D75 – K51 – 1740 rub.

Accounting policy for personal income tax registers: detailed setup

Also, before you start calculating wages, you must correctly set up your accounting policy for personal income tax or insurance contributions. To do this, go to the “Main” section (step 1) and click on “Accounting Policy” (step 2). As a result, the system will open the settings.

In the new window, you should indicate your organization (step 3) and click on the link “Set up taxes and reports” (step 4). Next, the settings window will open again.

Open the “Personal Income Tax” (step 5) and o (step 6) tabs. From now on, personal income tax will be displayed and taken into account in tax registers on an accrual basis for the year.

Then click on the “Insurance premiums” tab (step 7), decide on the insurance premium rate (step and mark the Social Insurance Fund rate for accidents (step 9).

The accounting policy has been set up, and you can begin displaying personal income tax in registers.

Entering data on tax deductions for employees

In order to correctly calculate personal income tax, you should indicate in 1C 8.3 for each employee deductions for children and other related deductions (property and social). You can enter these deductions in “Salaries and Personnel” (step 1) and click on the “Employees” link (step 2). The employee directory will be opened.

After opening the window, click on the previously defined employee (step 3). As a result, the system will open the employee’s card.

In the open employee card, you need to click on the link next to “Income Tax” (step 4). The deductions setting will open.

In a new window, open the link “Enter a new claim for standard deductions” (step 5). A new window will open where you need to enter a deduction application.

To apply for a personal income tax deduction for children, you can download it for free from the link.

In the new window, you need to click “Add” (step 6), decide on the desired deduction (step 7) and click on “Post and close” (step 8). As a result, personal income tax for the selected employee will be calculated with a tax deduction.

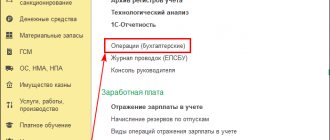

Complete payroll and personal income tax calculations in 1C 8.3

To calculate wages, open “Salaries and Personnel” (step 1) and click on “All accruals” (step 2). The system will open a window for creating a new accrual.

Then in the window, click “Create” (step 3) and go to “Payroll” (step 4). The following window will open.

Click on “Fill” (step 5). The document will be filled out with all accruals for employees. Personal income tax (step 6) and insurance premiums (step 7) will be displayed in separate fields.

To save these accruals, click on “Record” (step 8), and then “Post” (step 9). To view all accounting entries and entries in personal income tax registers, click on “DtKt” (step 10). The accounting and tax records section will appear.

The “Tax Calculations” tab (step 11) shows entries in the personal income tax registers.

How to find and correct an error if the balance of an undistributed payment appears in the register?

To fix this error you need to:

- Find the first register in which the undistributed amount appears. For documents Transferring personal income tax to the budget, the chronological sequence is important, so if there is an error in one document, then all subsequent registers will be formed incorrectly.

- Then you need to cancel all documents Transfer of personal income tax to the budget following the one in which the error was discovered.

- Then correct the error directly in the original document.

- And then again put the documents in chronological order.

Let's look at an example:

Salary for May 2022 paid on 06/05/2020:

Personal income tax was transferred on June 10, 2020, for which the document Transfer of personal income tax to the budget :

However, the distribution does not appear in the Register of transferred personal income tax amounts ; the entire amount is attributed to the balance of the undistributed advance payment:

The balance of the undistributed advance payment is reflected in the report Analysis of personal income tax by month .

However, unfortunately, it is impossible to analyze why the undistributed amount appeared on this report.

You can analyze the movements under the document Payment of personal income tax by tax agents (for distribution) , thus finding out to what period the paid amount was allocated.

Let's look at the movements of the document Transfer of personal income tax to the budget dated June 10, 2020:

In the movements in the register Payment of personal income tax by tax agents (for distribution), we see the details of the PP for February 2019.

Let's move on to the document Transfer of personal income tax to the budget , formed according to PP No. 37 of 02/05/2019:

Currently, in the Register of transferred personal income tax amounts, a transfer for February 2022 and for May 2022 is being formed according to this document:

Having checked the program data with the data of the primary documents, we find an error: this document was formed in ZUP 3 incorrectly, an incorrect amount was entered: instead of 48,456, 84,456 rubles were indicated.

We will cancel the Personal Income Tax Transfer to the budget dated 06/10/2020 and correct the error in the document dated 02/05/2019:

Then we will check the document dated June 10, 2020 and see that now the Register of listed personal income tax amounts has been formed correctly, only personal income tax for May 2022 is included in it:

Create a tax return

This action can be performed in the “Salaries and Personnel” section (step 1). In it you need to go to “2-NDFL for transfer to the Federal Tax Service” (step 2). A window will open where you can create a declaration.

In the new window, indicate your organization (step 3) and click “Create” (step 4). The declaration form will be displayed.

In this form, indicate the reporting year (step 5) and click “Fill out” (step 6). Part of the table will be filled with data from tax accounting registers for personal income tax, namely:

- Employee (clause 7);

- Rate (clause 8);

- Income (item 9);

- Taxable income (clause 10);

- Tax (clause 11);

- Held (clause 12);

- Listed (clause 13);

If you need to correct the data for one of the employees, just double-click on it. 2-NDFL will be opened.

In the new window, you can make all the necessary adjustments, for example, change the “Hold” (step 14) or “Transferred” (step 15) field. After completion, click on “OK”.

To save your tax return, click Record (step 17) and post (step 18). To download and send the file to the tax office, click on “Upload”. You can then print the declaration by clicking on “Print” (step 20).

Do you have any questions about accounting for personal income tax in 1C? Book a consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Application for refund of overpayment of personal income tax

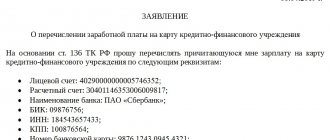

If funds are transferred incorrectly using personal income tax details, the company must fill out an application for a refund of the amount of overpaid tax in the KND form 1150058 as follows.

1. In the “TIN” field, enter the number assigned to the company.

2. In the “KPP” field - the code assigned to the tax office to which the application is submitted.

3. In the “Application number” field - the serial number of the current year’s application.

4. In the “Payer Status” field, enter the following number:

- 4 - tax agent.

5. In the field “Based on the article” - the article of the Tax Code of the Russian Federation, on the basis of which the refund is made:

- 78 - refund of overpaid tax (penalties, fines).

Next, indicate the reason for the overpayment:

- 1 - excessive payment.

Reflect the type of payment for which the overpayment occurred:

- 1 - tax.

6. In the “Amount” field, show in numbers the amount of the refund in rubles and kopecks.

7. In the “OKTMO code” field - the code of the municipality at the place where the company is registered.

8. In the “Budget classification code” field - the budget classification code of the payment (182 1 01 02010 01 1000 110).

9. In the “Account Information” section - details of the account to which the tax authority will return the payment.

10. In the “Account type (code)” field, select the value:

- 01 - current account.

11. The fields “Recipient's BCC” and “Recipient's personal account number” are filled in only by participants in the budget process.

12. Organizations do not fill out information about an individual who is not an individual entrepreneur.

13. In the field “The application is drawn up on __ pages,” indicate the number of pages on which the application is drawn up.

14. In the field “With the attachment of supporting documents or their copies on __ sheets”, if appropriate, enter the total number of sheets.

15. In the section “I confirm the accuracy and completeness of the information”, indicate the value “1” if the application is submitted by a manager, if the application is submitted by a representative.

16. In the next field write your full name. representative - an individual or the head of a representative organization, and in the field behind him - a contact phone number.

17. When submitting an application by a representative, in the “Name and details of the document confirming the authority of the representative” field, indicate the power of attorney and its details.