The founders create a commercial organization for the sake of profit, which means that dividends are an obligatory part of the life of the Company. In the article, we will look at the regulatory regulation of dividends in 2022 and how to correctly formalize the accrual and payment of dividends in 1C Accounting 3.0.

Let's answer these and other questions:

- Can an LLC pay dividends?

- How to report dividends?

- Do I need to fill out an income tax return if a member of the Company is an individual?

- Which account to use in 1C postings for dividends (70 or 75) if the founder is an individual employee?

Dividend reporting in 2021

What are dividends?

The concept of dividends is enshrined in Art. 43 Tax Code of the Russian Federation. These include any income paid to the founders from the profits of the Company (LLC), with the exception of:

- payments upon liquidation of an LLC, not exceeding the contribution of the founder;

- transfer of company shares to shareholders;

- payments to a non-profit organization for its statutory activities.

The joint stock company (JSC) pays dividends (clause 9 of article 42 of the Federal Law of December 26, 1995 N 208-FZ). And the LLC pays part of the net profit (clause 4, article 28 of the Federal Law of 02/08/1998 N 14-FZ). But in colloquial speech we call all payments “dividends”. This is what we will do in the article.

The procedure for filling out and submitting reports depends on the composition of the founders of the Company:

- only individuals;

- only legal entities;

- individuals and legal entities.

Let's figure out how to submit dividend reports in 2022 in each of these cases.

Participants - individuals only

Personal income tax reporting is submitted (clause 2 of article 230 of the Tax Code of the Russian Federation):

- for 2022: 6-NDFL - after actual payment based on the results for the quarter;

- 2-NDFL based on the results for the year.

- 6-NDFL according to the results for the quarter;

Dividends paid only to individuals are not reflected in the income tax return.

Participants are legal entities only

The organization paying dividends submits a profit tax return, regardless of the taxation system:

- Sheet 03;

- Subsection 1.3 of Section 1.

Mixed participants (legal entity and individual)

If an LLC (JSC) includes both legal entities and individuals among its participants, then:

- personal income tax reporting is submitted: similar to the list specified in the section Participants only individuals.

- Sheet 03 - in addition to data on legal entities, information on the payment of dividends to individuals is indicated for reference.

Calculation of dividends

The accrual of dividends payable to the founders is reflected in accounting as follows.

The allocation of part of the profit of the reporting year to the payment of income to the founders (participants, shareholders, owners of property) of the company is reflected in the accounting on the date of the decision on the distribution of net profit (clauses 3, 5, 10 of PBU 7/98).

In this case, the accountant makes the following entries:

- Debit 84 “Retained earnings (uncovered loss)” Credit 75 “Settlements with founders”, subaccount “Settlements for payment of income”

- if the founder is a legal entity or individual who is not an employee of the organization;

- if the founder is an employee of the company.

The tax agent, that is, the company that pays dividends, is obliged to withhold and transfer income tax or personal income tax to the budget.

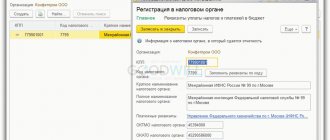

Dividend calculation scheme in 1C 8.3

Accrual and payment of dividends

Accounting for personal income tax purposes

Using an example in 1C, let’s look at how to formalize business transactions for the accrual and payment of dividends.

The company pays interim dividends.

At the end of the first half of the year, retained earnings amounted to RUB 300,000.

By decision of the general meeting, it was determined to pay dividends to the LLC participants according to their shares:

- Soloviev K. A. (not employee - 90%) - 270,000 rubles.

- LLC "COZY HOUSE" (10%) - 30,000 rubles.

On July 22, dividends were accrued to the founders.

On July 23, dividends were paid to LLC participants.

On the same day, the Company paid taxes on dividends.

How to calculate dividends in 1C

The LLC is obliged to accrue dividends no later than 60 days after the decision on their accrual is made (Clause 3, Article 28 of Federal Law No. 14-FZ of 02/08/1998).

Dividends are income, and, therefore, they are subject to either personal income tax or income tax, regardless of the taxation system of the company that pays or receives them. The company is a tax agent and is obliged to pay taxes on dividends when they are paid.

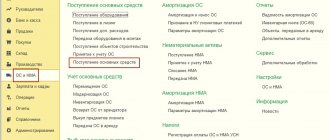

Go to the Salaries and Personnel and enter the document Accrual of dividends for each LLC participant.

LLC participant is an individual (not an employee)

The personal income tax rate depends on the conditions:

- whether the individual is a resident - 13%; whether the recipient's income from dividends 5 million rubles. (Letters of the Federal Tax Service of the Russian Federation dated 06/22/2021 N BS-4-11/ [email protected] , Ministry of Finance of the Russian Federation dated 06/07/2021 N 03-04-05/44556) did not exceed - 13%;

- exceeded - 15%;

- is not - 15%.

More details:

- Changes to personal income tax 2022: progressive scale (from the broadcast recording dated February 26, 2022)

- 15% personal income tax has been introduced: the law has been signed

- The Federal Tax Service gave an example of how to show dividends over 5 million rubles in 6-personal income tax.

Select the founder, fill in the period for calculating dividends and their amount. Personal income tax will be calculated automatically.

How is the status of an individual determined - resident or non-resident for personal income tax purposes?

The status of an individual is set on the date of the event (dividend payment) by the user manually, depending on how many days the individual is actually in Russia for the next 12 consecutive months (clause 2 of Article 207 of the Tax Code of the Russian Federation): go to the individual’s card and go Click on the link Income Tax .

Postings

How to calculate and pay dividends to the founder - employee of an LLC

LLC participant - legal entity

The income tax rate depends on the ownership of the organization (Russian, foreign) and the volume of the share of the authorized capital:

- Russian organization: 0% - ownership share in the management company of at least 50% for 365 consecutive days;

- 13% - for other organizations.

- foreign organization:

15% except for organizations for which other rates are established, defined in clause 3 of Art. 284 Tax Code of the Russian Federation.

Draw up a document for a legal entity in the same way.

Please note that, unlike personal income tax, the amount of calculated income tax can be edited. Change it if necessary: the tax is automatically calculated based on the rate for Russian organizations - 13%.

Postings

Dividend tax rates

The types and amounts of taxes depend on who is the recipient of the dividends.

If the recipient is a Russian legal entity, then when paying dividends, income tax is withheld:

- at a general rate of 13% (subclause 2, clause 3, article 284 of the Tax Code of the Russian Federation);

- at a rate of 0%, if the payment is made to the parent company, and on the day the decision on payment is made, it owns 50% of the authorized capital of the company for at least a year (subclause 1, clause 3, article 284 of the Tax Code of the Russian Federation).

Personal income tax is withheld from Russian individuals at the following rates:

- 13% (clause 1 of article 224 of the Tax Code of the Russian Federation);

- 15% - when paying dividends in the amount of 5,000,000 rubles or more (paragraph 2, clause 1, article 224 of the Tax Code of the Russian Federation).

Read in the berator “Practical Encyclopedia of an Accountant”

Unclaimed dividends

Unreceived dividends

Dividend payment

Create payment documents from the Dividend Accrual : click the Pay to generate payment orders and click Send to Bank .

Here you can also complete the payment of taxes (personal income tax or income tax).

Open all Bank statements the Bank and cash .

LLC participant – individual (not employee)

Postings

LLC participant - legal entity

Draw up a document for a legal entity in the same way.

Postings

What are dividends

This is any income received by a shareholder (participant) from an organization when distributing profits on shares (shares) owned by him in proportion to his share in the authorized capital of this organization. An important detail: dividends are always paid from profits that remain after taxation. This is directly stated in paragraph 1 of Article of the Tax Code of the Russian Federation.

REFERENCE. What is profit remaining after tax (often called net profit)? The answer depends on the tax regime that the organization applies. Under the general system, profit is less income tax. Under the Unified Agricultural Tax - profit minus the unified agricultural tax. Payment of dividends to the founder of an LLC using the simplified tax system is made from the profit remaining after paying a single “simplified” tax.

Maintain accounting and tax records for free in the web service

Personal income tax

The calculated personal income tax on the amount of dividends paid is paid no later than the next day after their actual payment.

Personal income tax payment

More details Payment of personal income tax on dividends.

Postings

Calculation of 6-NDFL

Starting from 2022, all personal income tax reporting is reflected in Calculation 6-NDFL (Order of the Federal Tax Service of the Russian Federation dated October 15, 2020 N ED-7-11/ [email protected] ).

Section 1

In the example, dividends are paid on July 23, so in 6-NDFL this operation will be reflected in the report for 9 months. Do not reflect accrued but unpaid dividends in 6-NDFL.

In section 1, personal income tax on dividends is reflected if the dividends are actually paid and the tax is withheld in the reporting period.

The deadline for tax remittance is indicated, but does not affect the need to be reflected in Section 1 in this particular reporting period.

Section 1 will be filled in:

- line 020 - the amount of tax withheld in the third quarter;

- line 021 - deadline for transferring personal income tax to the budget;

- line 022 - amount to be transferred on the specified date.

Section 2

Section 2 reflects indicators on income paid by the tax agent since the beginning of the tax period:

- page 100 - rate at which personal income tax is calculated on the sheet (for each rate - a separate sheet);

- line 110 - amount of income accrued; p. 111 - incl. in the form of dividends;

- page 141 - incl. from dividends;

Annex 1

At the end of the year, the organization submits to the Federal Tax Service a Certificate of income and tax amounts for each individual, instead of 2-NDFL.

According to our example, in Appendix 1 Sections 1, 2 and Appendix are filled out.

Reflection of dividends in financial statements

Let's summarize. The amounts of dividends are reflected in the financial statements as follows:

- If they are accrued but not paid, then: in the balance sheet they reduce the amount of profit reflected in line 1370 “NP”;

- in the UDC in line 3327 “Reduction of capital - dividends” (when compiled by the company);

- in the ODDS on line 4322 “Payments for the payment of dividends and other payments for the distribution of profits in favor of owners (participants).”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Income tax

Payment of income tax

Read more Payment of income tax on dividends.

Postings

Income tax return

If the members of an LLC include only individuals, dividends are not reflected in the declaration.

Sheet 3 Section A of the income tax return is filled out automatically based on the document Accrual of dividends . Data on all dividends paid is indicated here, regardless of whether the founder is a legal entity or not. If dividends were paid to an employee during the reporting period, enter this data into the declaration manually.

In the breakdown of amounts, indicate data only for legal entities. Fill in the yellow fields manually.

Don't forget about Subsection 1.3 of Section 1. Fill it out according to the deadline for paying income tax on dividends.

In our example, the transfer is from 07/24/2021 to 07/26/2021, since the day following the payment is a day off.

Definition of “dividends”

Dividends are the income that a shareholder or member of a company receives in the form of a share of net profit distributed by the company.

Not only the accounting of dividends, that is, the method of reflecting the payment of dividends in the entries, but also the very possibility of the occurrence of this event - the distribution of profits - is subject to certain rules. In other words, the company cannot distribute profits and pay dividends at any time at will.

Both JSC and LLC can pay dividends quarterly, semi-annually or at the end of the year, subject to certain conditions.

We must not forget that dividends, like almost any income, are taxed. For individuals this is personal income tax (insurance premiums are not paid on dividends), for legal entities it is income tax. In addition, the organization that pays dividends is a tax agent for these taxes when paying dividends.

Tax rates:

If the participant is an LLC employee

Calculation of dividends

If the founder is an employee, then traditionally, when making payments with him, account 70 is used (Instructions for the chart of accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n).

However, guided by the principle of rationality, and taking into account that the taxation of dividends and reporting for individuals-employees and non-employees has no special features, in the accounting policy it is possible to approve an account for settlements with an employee for the accrual and payment of dividends - 75 “Settlements with founders”.

Accountants who adhere to the traditional approach can use the following reflection algorithm in 1C.

Go to the Operations and fill out the Manually Entered Operation document.

Dividend payment

Register the actual payment of dividends using the document Write-off from the current account. To do this, go to Bank statements from the Bank and cash .

Install:

- Type of transaction - Other write-off ;

- Recipient - do not fill in, despite the fact that the field is underlined in red: it is optional and does not affect the data;

- Amount - the amount of dividends, minus personal income tax;

- section Reflection in accounting - analytics similar to those indicated when calculating dividends: Debit account - 70;

- Employees of the organization - founder-employee.

Postings

Personal income tax accounting

Since the accrual of dividends in 1C 8.3 to an employee is completed through manual operations, and there is no auto-filling of registers, for personal income tax accounting purposes, enter the document Personal Income Tax Accounting Transaction. Go to the Salaries and Personnel and create it using the link All personal income tax documents .

On the Income , reflect the date of payment of dividends and their accrued amount, as well as calculated personal income tax.

To reflect personal income tax in Appendix 1 to Calculation 6-NDFL, do not check the Respective checkbox. Art. 226.1 Tax Code of the Russian Federation .

Also fill out the Held tab for all bets .

tab for all bets does not need to be filled out, because Personal income tax paid to the budget will be reflected in the registers when drawing up the document Write-off from the current account for the transfer of this tax.