The minimum wage is the minimum wage of federal significance, which is fixed at the legislative level throughout the entire state space of the Russian Federation. This indicator may also have regional significance, which is taken depending on the economic situation in the region, but not lower than the federal one. The parameter under consideration is used to fix the lower salary threshold and determine the amount of various types of social benefits (including for temporary disability).

Return to content

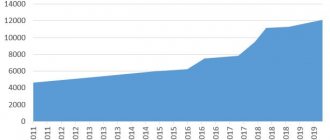

Dynamics

Let's take a closer look at how this indicator has changed over the past twenty-plus years. It should be noted that in the 98th year of the last century there was a denomination of the currency, which led to the cutting off of some zeros in the monetary currency of our country.

Schedule. Minimum wage changes by year:

Table. Minimum wages by year in Russia:

| Dated | Monthly minimum wage, in rubles. | Regulated by document |

| 1 Jan 2019 | 11280 | |

| May 1, 2018 | 11163 | FZ-41 (March 7, 2018) |

| 1 Jan 2018 | 9489 | FZ-421 (28 Dec 2017) |

| 1 Jul 2017 | 7800 | FZ-460 (Dec 19, 2016) |

| 1 Jul 2016 | 7500 | FZ-164 (June 2, 2016) |

| 1 Jan 2016 | 6204 | FZ-376 (14 Dec 2015) |

| 1 Jan 2015 | 5965 | FZ-408 (1 Dec 2014) |

| 1 Jan 2014 | 5554 | FZ-336 (2 Dec 2013) |

| 1 Jan 2013 | 5205 | FZ-232 (December 3, 2012) |

| June 1, 2011 | 4611 | FZ-106 (June 1, 2011) |

| 1 Jan 2009 | 4330 | FZ-91 (June 24, 2008) |

| 1 Sep 2007 | 2300 | FZ-54 (April 20, 2007) |

| May 1, 2006 | 1100 | FZ-198 (29 Dec 2004) |

| 1 Sep 2005 | 800 | FZ-198 (29 Dec 2004) |

| 1 Jan 2005 | 720 | FZ-198 (29 Dec 2004) |

| 1 Oct 2003 | 600 | FZ-127 (Oct 1, 2003) |

| May 1, 2002 | 450 | FZ-42 (April 29, 2002) |

| 1 Jul 2001 | 300 | FZ-82 (Aug 19, 2000) |

| 1 Jan 2001 | 200 | FZ-82 (Aug 19, 2000) |

| 1 Jul 2000 | 132 | FZ-82 (Aug 19, 2000) |

| 1 Jan 1998 | 83,49* | |

| 1 Jan 1997 | 83490 | FZ-6 (9 Jan 97) |

| 1 Apr 1996 | 75900 | FZ-40 (22 Apr 96) |

| 1 Jan 1996 | 63250 | FZ-159 (1 Dec 95) |

| 1 Dec 1995 | 60500 | FZ-159 (1 Dec 95) |

| 1 Nov 1995 | 57750 | FZ-159 (1 Dec 95) |

| 1 Aug 1995 | 55000 | FZ-116 (27 Jul 95) |

| May 1, 1995 | 43700 | FZ-43 (20 Apr 95) |

| 1 Apr 1995 | 34400 | FZ-43 (20 Apr 95) |

| 1 Jul 1994 | 20500 | FZ-8 (Jun 30, 94) |

| 1 Dec 1993 | 14620 | Decree 2115 (05 Dec 93) |

| 1 Jul 1993 | 7740 | RF Law 5432-1 (Jul 14, 93) |

| 1 Apr 1993 | 4275 | RF Law 4693-1 (Mar 30, 93) |

| 1 Jan 1993 | 2250 | RF Law 3891-1 (13 Nov 92) |

| 1 Apr 1992 | 900 | RF Law 2704-1 (21 Apr 92) |

| 1 Jan 1992 | 342 | RF Law 1991-1 (06 Dec 91) |

| 1 Dec 1991 | 200 | Decree of the RSFSR number 5 (15 Nov 91) |

| 1 Oct 1991 | 180 | Law of the RSFSR 1028-I (19 April 91) |

* - this year the ruble was devalued, according to which the number of zeros on banknotes was reduced.

Return to content

Table of minimum wages by year

There will be no more spring/summer minimum wage increases. Now all changes will occur from January 1 of each subsequent year.

| Date of introduction of the minimum wage | Minimum wage amount |

| January 1, 2022 | 13 890 ₽ |

| January 1, 2022 | 12 792 ₽ |

| January 1, 2022 | 12 130 ₽ |

| January 1, 2022 | 11 280 ₽ |

| May 1, 2022 | 11 163 ₽ |

| January 1, 2022 | 9 489 ₽ |

| July 1, 2022 | 7 800 ₽ |

| July 1, 2016 | 7 500 ₽ |

| January 1, 2016 | 6 204 ₽ |

| January 1, 2015 | 5 965 ₽ |

| January 1, 2014 | 5 554 ₽ |

| January 1, 2013 | 5 205 ₽ |

| June 1, 2011 | 4 611 ₽ |

| January 1, 2009 | 4 330 ₽ |

The table shows the minimum wage values at the federal level. Regions of Russia may set their own minimum wages, which should not be lower than the federal one (Article 133.1 of the Labor Code of the Russian Federation).

Who installs it and how?

According to Federal Law 82, which was adopted in 2000, this parameter throughout the Russian Federation can be established by the federal or regional government. In this case, the federal parameter is established only by the federal government, and the regional one - at a tripartite meeting of a special regional commission (Article 133.1).

In accordance with the content of the law, the exact date of change in the minimum wage does not have a fixed value and is set to any date during the calendar year. And the very intention to change it is announced by a special decree of the government of the Russian Federation.

Return to content

Minimum wage and living wage

Until January 1, 2022

In accordance with Article 1 of the Federal Law of June 19, 2000 N 82-FZ “On the minimum wage”, from January 1, 2022 and from January 1 of subsequent years, the minimum wage will be set in the amount of the subsistence level for the second quarter of the previous year:

Starting from January 1, 2022 and thereafter annually from January 1 of the corresponding year, the minimum wage is established by federal law in the amount of the subsistence level of the working-age population as a whole in the Russian Federation for the second quarter of the previous year.

If the cost of living of the working-age population as a whole in the Russian Federation for the second quarter of the previous year is lower than the cost of living of the working-age population as a whole in the Russian Federation for the second quarter of the year preceding the previous year, the minimum wage is established by federal law in the amount established from January 1 of the previous year.

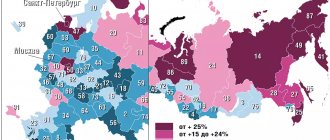

What's in the regions?

According to the legislation of the Russian Federation, regional legislators, depending on their economic development and intraregional social conditions, have the right to set their own minimum wage, which may differ from the federal one.

The regional minimum wage is legally fixed at a meeting at which the value is agreed upon between the three responsible participants in the region: the regional government, the association of trade unions and the association of employers. After its adoption, all regional employers will be required to pay no less than this established value, unless they send an official refusal to the regional administration within 30 days. Information on the currently valid regional minimum wage can be obtained from the state labor inspectorate of the region.

Return to content

Why is the “minimum wage” in Moscow so different from the level in the regions?

According to analytical studies, the minimum wage in Moscow is the highest in the country, moreover, it exceeds the cost of living even at capital prices. For example, the cost of living in Moscow is 10,000 rubles with an average monthly salary of 60,000 rubles.

And the minimum wage increases almost 1-2 times a year. So, from January 1, 2014 it amounted to 12,600 rubles, and from July 2014 - 12,850 rubles.

In comparison, the “minimum wage” in the country is less than the established subsistence level in the regions, on average by 20% (5,554 rubles is the minimum wage, 7,911 rubles is the subsistence minimum). That is, many people will earn a salary for which unable to live on their own, let alone raise children.

The living wage in the capital is established thanks to a tripartite agreement between the Moscow government, trade union organizations and employers on the basis of Article 133.1. Part 11 of the Labor Code of the Russian Federation.

The Russian government has repeatedly raised the issue of bringing the minimum wage to the national subsistence level, but experts and political scientists believe that this is impossible in the next few years.

If you look at the situation from the employer’s side, it turns out that he must pay the employee a minimum of 4,831 rubles (after tax deduction), pays personal income tax and a pension contribution for each employee of 722 rubles, and sends 1,666 rubles to the Social Fund and the Mandatory Health Insurance Fund.

Thus, one employee costs the employer 7,220 rubles, not counting the costs of organizing a workplace.

If there is a sharp increase in the minimum wage to the subsistence level, then employers simply will not be able to cope with this level, which could lead to the bankruptcy of many enterprises and unemployment.

What is it used for?

The minimum wage is intended to be able to influence the lower salary threshold in Russia, as well as to establish various social benefits (pregnancy, temporary disability, and so on). The minimum threshold gives a signal to all Russian employers that they must pay their employees a salary not lower than the minimum wage.

This parameter is also used to calculate on its basis tax deductions, penalties and other levies that are established by law in the territory of the Russian Federation. Employers do not have the legal right to pay an employee a monthly salary below the minimum wage, but there are exceptions. Such an exception is the employee’s part-time or part-time work - in this case, the salary may be lower than the minimum wage.

Return to content

Minimum wage and increase in benefits

Due to the increase in the minimum wage, the amounts of several social benefits to the population are increasing. Namely: sick leave, for pregnancy and childbirth and for caring for a child up to one and a half years old. This is due to the fact that average daily earnings are increasing.

If the bill is not adopted, in 2022 the average daily earnings will be 407.41 rubles. It is guaranteed to be paid for every day of illness or maternity leave, even if the employee’s standard salary is lower or did not exist at all in the pay period. This amount is also used as a guide when issuing sick leave - if an employee received more than the minimum wage, but violated the treatment regimen or fell ill due to intoxication, then the calculation will be carried out according to the minimum wage.

What are the fines?

According to the Code of Administrative Offenses (clause 6 of Article 5.27), employers, if the salary they pay to an employee is less than the minimum wage, they face the following penalties:

- from 10 thousand to 20 thousand rubles - for persons holding responsible positions;

- from 30 thousand to 50 thousand rubles - for legal entities;

- from 1 thousand to 5 thousand rubles - for individuals carrying out entrepreneurial activities without legal registration.

History in the world and in the USSR

In the world, minimum wage mechanisms began to be established at the legislative level at the turn of the 19th-20th centuries to resolve conflicts with trade unions. The first such act was passed by the New Zealand Parliament in 1894. In most countries, the minimum wage is set not in monthly, but in hourly terms. For example, in the USA, since 2015, the minimum wage is $7.25 per hour, which, with an eight-hour working day and a five-day working week, corresponds to an average of $1.3 thousand per month (about 75 thousand rubles at the current exchange rate).

In the RSFSR, the concept of “obligatory minimum wage” for labor was first introduced by the Labor Code of 1922. By the Decree of the Central Committee of the CPSU, the Council of Ministers of the USSR and the All-Union Central Council of Trade Unions dated December 12, 1972, the minimum wage for workers and employees was set at 70 rubles. per month and did not change until 1991.

Regulatory acts and planned innovations

Regulations on certain procedures are established in the Labor Code, Article 133. According to the current provisions of the law, the monthly payment for the work of an employee who has fully worked for a given period cannot be lower than the minimum wage.

The establishment of the optimal indicator is carried out within the framework of federal legislation. If we talk about the data for 2015, then this parameter was 5965 rubles, and from the next year it increased by 250 rubles. In 2022, this criterion has increased even more. In 2022, in January the minimum wage was 9,489 rubles, from May 1 - 11,163 rubles.

According to Part 1 of Art. 133, the minimum wage established throughout the country cannot be less than the subsistence level.

If an employer pays employees wages that do not exceed the minimum wage, then this may lead to administrative liability in the future.

Federal minimum wage

From January 1, 2016, the minimum wage will increase to 6,204 rubles. per month.

Minimum wage (minimum wage) is a legally established minimum used to regulate wages (including influencing salary increases), as well as to determine the amount of temporary disability benefits, minimum maternity benefits, benefits, etc. The minimum wage depends to some extent degrees from the subsistence level.

Growth dynamics of the minimum wage 2000-2016

| 7500 | 20,89% | |

| from 01/01/2016 | 6204 | 4% |

| from 01/01/2015 | 5965 | 6,6% |

| from 01/01/2014 | 5554 rub. | 6,71% |

| from 01/01/2013 | 5205 rub. | 12,88% |

| from 06/01/2011 | 4611 | 6,49% |

| from 01/01/2009 | 4330 | 88,26% |

| from 01.09.2007 | 2300 | 109,09% |

| from 05/01/2006 | 1100 | 37,50% |

| from 01.09.2005 | 800 | 11,11% |

| from 01/01/2005 | 720 | 20% |

| from 01.10.2003 | 600 | 33,33% |

| from 05/01/2002 | 450 | 50% |

| from 01.07.2001 | 300 | 50% |

| from 01/01/2001 | 200 | 51,23% |

| from 01.07.2000 | 132 | — |

Dynamics of Inflation in Russia 2000-2016

| 11%(forecast) | |

| 2015 | 12,9% |

| 2014 | 11.4% |

| 2013 | 6,7% |

| 2012 | 7,0% |

| 2011 | 6,1% |

| 2010 | 8,8% |

| 2009 | 8,8% |

| 2008 | 13,3% |

| 2007 | 11,9% |

| 2006 | 9,0% |

| 2005 | 10,9% |

| 2004 | 11,7% |

| 2003 | 12,0% |

| 2002 | 15,1% |

| 2001 | 18,6% |

| 2000 | 20,2% |

See also: Regional coefficients and northern allowances.

Using this online service, you can keep accounts for OSNO (VAT and income tax), simplified tax system and UTII, generate payments, personal income tax, 4-FSS, SZV-M, Unified Account 2022, and submit any reports via the Internet, etc.( from 350 RUR/month). 30 days free (now 3 months free for new users). With your first payment (via this link) three months free.