State control over money circulation

Changes made to the procedure for cash and non-cash payments in 2022

State control over cash transactions of legal entities

Exclusion from control over the exchange of banknotes

Control of transactions on accounts and deposits

Specifics of changes in control over transactions with movable property

Control over payments for real estate

Changes in operations under state defense orders

At the beginning of 2022, amendments and additions were made to the Federal Law of August 7, 2001 No. 115-FZ “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism.” The changes concern cash and non-cash payments, which are subject to mandatory control.

Let's look at the main innovations and give examples of documents confirming the legality of controlled transactions.

State control over money circulation

Payments on the territory of the Russian Federation are made by cash and non-cash payments[1].

These forms of payment have legal equality, i.e., none of them, on the basis of the law, is primary or secondary in relation to the other.

Individuals can make payments among themselves, payment for goods, works and services in any of these forms[2].

Cash transactions form cash transactions for legal entities and individual entrepreneurs. The Ministry of Finance of Russia, the Bank of Russia, and the Federal Tax Service of Russia have developed a large volume of documentation and explanations on the rules for conducting cash transactions. One of the main ones is Bank of Russia Directive No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” (as amended on October 5, 2020).

Legal entities and individual entrepreneurs can make payments in cash, subject to regulatory restrictions[3]. One of the main ones: if the amount under one contract exceeds 100,000 rubles, it (or part of it in excess of the specified limit) must be transferred by bank transfer[4]. This limit applies to transactions between:

• legal entities;

• individual entrepreneurs;

• a legal entity and individual entrepreneur (if the agreement is related to the implementation of entrepreneurial activities).

For your information

If one of the parties to the agreement is an individual who is not an individual entrepreneur, the limit on cash payments does not apply (clause 1 of Article 861 of the Civil Code of the Russian Federation).

Non-cash form of payment is the main one for legal entities and individual entrepreneurs. When making non-cash payments, you must be guided by Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds” (as amended on October 11, 2018; hereinafter referred to as Regulation No. 383-P).

Non-cash payments are carried out by banks and other credit institutions by transferring funds with or without opening bank accounts (clause 3 of Article 861 of the Civil Code of the Russian Federation).

Banks transfer both cash and non-cash funds across bank accounts as follows[5]:

• write off funds from the bank accounts of payers and credit them to the bank accounts of recipients of funds;

• write off funds from bank accounts of payers and issue cash to recipients - individuals;

• write off funds from the bank accounts of payers and increase the balance of electronic funds of recipients.

Credit organizations transfer funds without opening bank accounts, including using electronic means of payment[6].

Regulation No. 383-P is in many ways a universal document on the rules for conducting settlements, since it also provides for the rules of subordination between settlement participants. In particular, according to clause 1.25 of this Regulation, banks do not interfere in the contractual relations of clients. Mutual claims between the payer and the recipient of funds are resolved in accordance with the procedure for resolving disputes established by law without the participation of banks, except in cases of claims arising due to the fault of banks.

Cash payments between legal entities, as well as individual entrepreneurs, are a fairly large segment in the total volume of settlement transactions.

According to official data from the Bank of Russia, in 2022 the volume of cash in circulation increased by 26.4%, i.e. by more than a quarter. As of 01/01/2021, this volume amounted to 13.4 trillion rubles, which is 2.8 trillion rubles. more than the year before.

The main reasons for this growth are the difficult economic situation of the past year and the desire of businesses to maintain the financial and legal ability to operate by all means, not always completely legal.

In order to ensure state control over money circulation and minimize illegal transactions on the territory of the Russian Federation, back in 2001, Federal Law No. 115-FZ dated August 7, 2001 “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism” was adopted ( hereinafter referred to as Law No. 115-FZ), in which:

• reflects the rules of relationships between individuals and organizations carrying out transactions with funds or other property, as well as government bodies exercising control over these operations in order to prevent, identify and suppress acts related to the legalization (laundering) of proceeds from crime;

• a list of operations subject to mandatory control has been established, as well as organizations that are obliged to inform the authorized body about these operations;

• a uniform threshold has been defined for individuals and legal entities, above which transactions are subject to mandatory control.

For your information

This indicator is systematically updated depending on the level of inflation, the volume of cash turnover, and other economic factors.

Particular attention is paid in Law No. 115-FZ to mandatory internal control within the organization. Organizations carrying out transactions with cash or other property are required to conduct internal control to identify transactions subject to mandatory control. In particular, these organizations are obliged to send to the authorized body information about transactions regarding which they have suspicions that these transactions are carried out for the purpose of legalizing (laundering) income.

Law No. 115-FZ has been in force since 02/01/2002. Additions are systematically made to it, which allows users of the Law to see the operational position of the state on issues of combating the legalization of illegal income.

Offsetting in 1C:BGU 8

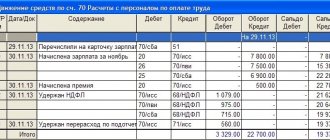

There is no specialized document to reflect debt offset in 1C:BGU 8. Therefore, transactions can be reflected using the Transaction (accounting) .

In the Transaction (accounting) , you need to clear the Use standard transactions . A new line is created using the Add . The tabular section indicates the corresponding entry for debt offset.

After posting the document, you can print the Accounting Certificate (f. 0504833).

More on the topic: How to reflect inventory results in an institution’s records?

Published 06/30/2021

Changes made to the procedure for cash and non-cash payments in 2022

Significant changes to Law No. 115-FZ regarding the procedure for cash and non-cash payments were made by Federal Law No. 208-FZ dated August 13, 2020 (hereinafter referred to as Law No. 208-FZ). Most of these changes are effective from January 10, 2021 and relate to transactions subject to mandatory control. Let's look at the main ones.

All cash transactions of legal entities in the amount of 600,000 rubles or more will be monitored.

According to paragraph 1 of Art. 6 of Law No. 115-FZ, a transaction with funds or other property is subject to mandatory control if the amount for which it is carried out is equal to or exceeds 600,000 rubles. either equal to or exceeds an amount in foreign currency equivalent to RUB 600,000.

The same article provides a specific list of operations that are subject to this rule. For example, in sub. Clause 1, paragraph 1 refers to transactions with funds in cash, including in the form of withdrawal from an account or crediting to the account of a legal entity of funds in cash.

What is the innovation in this control method?

Until January 10, 2021, there was a rule for checking transactions of legal entities for the same amount, but only if it was not due to the nature of the economic activity of the legal entity. That is, cash payments that arose during transactions related to the type of activity used by the organization on a systematic basis and enshrined in the Charter of this organization did not come under control[7].

Now all operations involving the receipt and debit of cash from a legal entity in the amount of 600,000 rubles. and above will be the object of control of the credit institution through which this operation is carried out.

Despite the fact that the document on control over these operations was not adopted by the Bank of Russia, the state controller will be the credit institution, i.e., the bank branch that has entered into a service agreement with this legal entity.

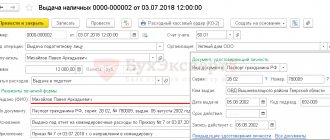

Thus, the organization must be ready to justify conducting a cash transaction in the amount of 600,000 rubles. How to do it? Provide the bank with a written explanation and, if necessary, attach copies of documents justifying the legality of the payments (example 1).

Exchange of banknotes excluded from control

Law No. 208-FZ repealed the effect of paragraph. 6 subp. 1 clause 1 art. 6 of Law No. 115-FZ, which led to the exclusion directly from the scope of control of the exchange of banknotes of one denomination for banknotes of another denomination.

This change is of a technical nature, since such an exchange is necessarily accompanied by the withdrawal from the account or crediting to the account of a legal entity of funds in cash. Therefore, if the limit of 600,000 rubles is exceeded. You will need to indicate the source of this amount.

The state will control transactions on accounts and deposits

From January 10, 2021, the following are removed from mandatory control:

• transfer of funds abroad to an account or deposit opened in the name of an anonymous owner;

• receipt of funds from abroad from an account or deposit opened in the name of an anonymous owner.

In this case, the following operations fall under mandatory control:

• crediting funds to an account or deposit or debiting funds from an account or deposit of a foreign structure without forming a legal entity, the period of activity of which does not exceed three months from the date of registration (incorporation);

• crediting funds to an account or deposit or debiting funds from an account or deposit of a foreign structure without forming a legal entity, if transactions on this account or deposit have not been carried out since its opening.

Control of transactions with movable property has changed

You need to pay attention to the following points:

1. In subclause 4 of clause 1 of Art. 6 of Law No. 115-FZ lists the types of transactions with movable property that are subject to mandatory control . At the same time, transactions with this type of property come under control. This is explained by the fact that, based on business customs, the concept of “operation” includes the concept of “transaction”.

Previously, the payment of insurance compensation to an individual or the receipt of an insurance premium from him for life insurance or other types of savings insurance and pension provision were already under control[8]. Now controlled transactions also include the payment of insurance compensation to a legal entity and the receipt of an insurance premium from it.

Please note: this rule also applies to all other types of insurance listed in subparagraph. 1–3 p. 1 tbsp. 32.9 of the Law of the Russian Federation dated November 27, 1992 No. 4015-I “On the organization of insurance business in the Russian Federation” (as amended on December 30, 2020), payments for which exceed 600,000 rubles. For example:

• life insurance in case of death, survival to a certain age or period, or the occurrence of another event;

• on pension insurance;

• life insurance with the condition of periodic insurance payments (rents, annuities) and (or) with the participation of the policyholder in the investment income of the insurer.

2. Transactions in the amount of 600,000 rubles or more were removed from control. or for an equivalent amount in foreign currency:

• upon receipt of property under a leasing agreement.

Before the amendments were made, the transaction for the receipt or provision of movable property under a financial lease (leasing) agreement was controlled[9]. Now this rule will apply only to the provision of movable property under a financial lease (leasing) agreement;

• transfer of funds by non-credit organizations on behalf of the client.

3. A postal money transfer operation is subject to mandatory control if the amount for which this operation is performed is equal to or exceeds 100,000 rubles. either equal to or exceeds an amount in foreign currency equivalent to 100,000 rubles. Response to a request from the post office when transferring an amount over 600,000 rubles. presented in example 2.

The operation to return the unused balance of funds paid as an advance for communication services is subject to mandatory control if the amount for which this operation is performed is equal to or exceeds 100,000 rubles. either equal to or exceeds an amount in foreign currency equivalent to 100,000 rubles.

Control over payments for real estate

From January 10, 2021, a transaction with cash or non-cash money as part of a real estate transaction falls under mandatory control if the amount for which it is made is equal to or exceeds 3 million rubles. either equal to or exceeds an amount in foreign currency equivalent to 3 million rubles.

The legislator provides for control not over the transaction, but over the turnover of settlements, regardless of the status of the recipient or sender of this money supply.

What is new in this norm is expressed in the following. Previously, transactions with real estate were controlled taking into account the amount barrier, the result of which is the transfer of ownership of such property.

The new version of Law No. 115-FZ will control operations on any real estate transaction.

Thus, if an intermediary company, based on the conditions of participation in settlements for a real estate transaction, carries out settlement operations exceeding the above-mentioned amount, without being the seller or buyer of real estate, then requests from the regulatory authority will also be sent to it. The answer to such a request is presented in example 3.

As part of the application of this norm, it is necessary to take into account the Information message of Rosfinmonitoring dated 08/04/2020, which explains what has changed in the procedure for complying with the requirements of the legislation on combating income laundering and the financing of terrorism (AML/CFT) for realtors.

For organizations and individual entrepreneurs providing intermediary services in transactions for the purchase and sale of real estate, from January 10, 2021, the obligation to submit to the Service information on operations (transactions) with real estate that are subject to mandatory control has been abolished. Other obligations to comply with the requirements of AML/CFT legislation are retained in full, including:

• upon registration with Rosfinmonitoring before the start of implementation of the specified details;

• development of internal control rules;

• appointment of a special official;

• identifying and studying the client;

• conducting a risk assessment of clients and their transactions;

• identifying transactions that raise suspicion of ML/TF and submitting information about them to Rosfinmonitoring, etc.

Changes in operations under the state defense order (GOZ)

For the purposes of mandatory control from 50 million rubles. up to 10 million rubles the minimum amount of the second and subsequent transfers of funds to separate accounts opened in an authorized bank for the main contractor for the supply of products under the state defense order and the contractor participating in the supply of products under the state defense order has been reduced.

In this case, control of the second and subsequent charges is carried out if the amount of the first deposit is equal to or exceeds 600,000 rubles. either equal to or exceeds an amount in foreign currency equivalent to RUB 600,000.

Mutual settlements with suppliers

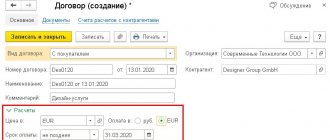

This time we’ll complicate the example a little - first, let’s enter an advance payment to the supplier:

In this case, we will leave the calculation object empty:

In purchasing reports we will use the Statement of settlements with suppliers

:

Now we create an order for the supplier (we will conduct mutual settlements by order). To assign payment to it, you need to offset the advance:

In the payment offset assistant window that opens, find the advance payment, adjust the offset amount if necessary, and click Offset/Transfer advance payment

:

Now we see that the advance has been credited, click Execute

at the top of the form:

As a result, the order becomes fully paid:

Now in the report you can see that part of the advance payment remained undistributed, and for the order, in order to bring the calculations to zero, it remains to issue an invoice:

Other innovations

Informing Rosfinmonitoring

Clause 4 of Art. 6 of Law No. 115-FZ provides a list of types of organizations and a list of transactions performed by them, which should be reported to Rosfinmonitoring from 01/10/2021.

For example, these are credit organizations, professional participants in the securities market, insurance organizations (with the exception of medical insurance organizations operating exclusively in the field of compulsory health insurance) and insurance brokers, leasing companies, federal postal organizations - and this is not a complete list.

Tightening internal control rules

In paragraph 3 of Art. 7 of Law No. 115-FZ clarifies the provision regarding the obligation of organizations to inform the authorized body about suspicions of legalization (laundering) of criminal proceeds that arose as part of the implementation of internal control rules.

According to these clarifications, if employees of an organization carrying out transactions with cash or other property, during internal control, suspect that any one-time operation or a set of operations and (or) actions of the client related to the conduct of any operations, his representative within the framework of customer service, are carried out for the purpose of legalization (laundering) of proceeds from crime or financing of terrorism, this organization no later than three working days following the day of detection of such transactions and (or) actions is obliged to send information about such operations. This information includes available information about the beneficial owner. These changes came into force on 03/01/2022.