What is included in other income?

Accounting for other income is regulated by PBU 9/99 “Income of the organization” (approved by order of the Ministry of Finance dated May 6, 1999 No. 32n). The regulation divides the organization's income into income from ordinary activities and other income. Income from ordinary activities means revenue from the sale of goods and services (work), that is, income from the daily activities of a commercial organization. It is important to note that ordinary activities are not limited to the main activities (which are indicated in the application when registering a company and require annual confirmation). The main criterion for classifying an activity as a regular type is that it:

- carried out systematically;

- is of an entrepreneurial nature (the goal is to generate income);

- the income received as a result of the activity meets the criterion of materiality in the total income of the company (5% or more) - this is explained by the Ministry of Finance, in particular, in a letter dated September 24. 2001 No. 04-05-11/71 on the application of PBU 9/99.

Everything that is not classified as income from ordinary activities is included in other income. The regulation provides a list of income that must be included in the “other” category:

- income from leasing property, if leasing is not the subject of the organization’s activities;

- income as patent payments for the provision of intellectual property rights (license payments), if this is not the subject of the organization’s activities;

- income from ownership of shares in the authorized capital of a third-party organization, including interest income on securities, if this is not the subject of the organization’s activities;

- income from joint activities (under a simple partnership agreement);

- income from the sale of company property;

- income in the form of interest accrued by the bank for the use of company funds;

- penalties due under the contract;

- gratuitous receipts of property;

- funds received as compensation for losses caused to the organization;

- income from previous periods (discovered in the current year);

- debt to creditors with an expired statute of limitations;

- positive exchange rate difference;

- results of property revaluation.

Example from ConsultantPlus: An organization has entered into a lease agreement, under the terms of which it leases equipment it owns for a period of 1 month. Providing property for rent is not the main activity of the organization. The rental price is 37,200 rubles, including 20% VAT... Get trial demo access to the K+ system and find out for free how the organization displays other income in accounting and tax accounting.

Composition of other expenses

Other expenses in accounting are a list of costs defined in paragraph 11 of PBU 10/99. Thus, other expenses of the enterprise include:

- expenses associated with the sale, disposal and other write-off of fixed assets and other assets other than cash, goods, products;

- interest paid on loans and borrowings received;

- bank expenses;

- contributions to valuation reserves created in accordance with the requirements and rules of accounting legislation, in particular reserves for doubtful debts;

- fines, penalties, penalties imposed on a company if it violates the terms of contracts;

- compensation for damages caused;

- losses of previous years recognized in the reporting year;

- amounts of receivables with an expired statute of limitations;

- exchange differences;

- the amount of asset depreciation;

- transfer of funds to charity, as well as costs associated with holding sporting events, recreation, entertainment, cultural and educational events;

- other expenses.

By analogy with other income, other expenses in some cases can be determined alternatively, that is, included in the costs of ordinary activities. We are talking, in general, about identical points: costs associated with leasing the organization’s property, providing for a fee the rights to use various types of intellectual property and participating in the authorized capital of other organizations. Such costs are either expenses for ordinary activities or other, depending on whether the corresponding line of business of the company is declared as a priority.

Other expenses in accordance with paragraph 18 of the same PBU 10/99 are usually also recognized in the reporting period in which they occurred, regardless of the date of actual payment of funds for them. For companies maintaining simplified accounting, there is a traditional exception - they can reflect expenses both for main activities and others, based on the date of repayment of the relevant debt.

At what cost should other income be taken into account?

Receipts recognized as other income are taken into account at actual cost, except for the following cases:

- property transferred free of charge is accounted for at market value, and the value must be confirmed by documents or by an independent appraiser;

- accounts payable with an expired statute of limitations are taken into account in the same terms in which they were reflected in accounting;

- revaluation of property is accounted for according to the method approved in the accounting policy;

- penalties for non-compliance with contractual terms, compensation for the company's losses are taken into account at the cost approved by a court decision or accepted by the violating counterparty;

- proceeds from the sale of property are accounted for in the same way as proceeds from sales (clause 10.1 of PBU 9/99).

When can other income be recognized?

The conditions for accepting other income into account vary depending on the specific type of income:

- proceeds from penalties from the counterparty are recognized on the date of the court decision or recognition by the counterparty-debtor;

- debt to creditors - as of the date of expiration of the limitation period;

- proceeds from positive revaluation of property - on the date of the revaluation procedure.

To accept proceeds from the sale of assets as other income, the following conditions must be met:

- there is a purchase and sale agreement or other documentary evidence of the company’s right to this receipt;

- you can determine the amount of income in monetary terms;

- the sale brought economic benefit to the company;

- there has been a transfer of ownership from the seller to the buyer;

- you can determine the amount of expenses associated with the sale.

If at least one of the listed criteria is missing, the received payment cannot be recognized as income; instead, accounts payable are formed.

Analysis of the effectiveness of operating expenses

In addition to the purposes of recording monetary transactions, accounting for operating expenses helps to solve additional tasks to improve the efficiency of business activities. This type of cost, along with capital costs, makes up a significant part of the financial costs of any organization.

What can you learn from operating expense metrics?

By comparing these costs with revenue from sales of products, we can draw a conclusion about how expensive it is for the enterprise to produce these types of goods. This ratio is called the operating expense ratio .

It allows you to understand how much percent of the income received goes to support the current activities (operations) of the organization, that is, how effective it is.

If you study this coefficient over time, you can track the potential to increase production and/or sales without unnecessary costs. A decreasing ratio indicates a decrease in operating expenses with a constant or even increasing sales volume. This indicates an increase in revenue, and therefore a net increase in the profit of the enterprise.

What factors influence the operating expense ratio?

The reasons that influence the increase or decrease in operating costs can be either external (independent of the organization itself) or internal.

External factors influencing operating costs:

- the level of inflation in the state: the more intense the inflationary processes, the greater will be the operating costs associated with the recalculation of wages, loan payments, costs for contractors’ services, etc.;

- changes in mandatory payments, as well as tax rates - the higher the taxes, the higher the operating costs.

Internal factors (those that can be changed through the efforts of the company itself):

- volume of production of products and their sales - even if, as a result of an increase in volumes, operating expenses increase, the cost per unit of production will significantly decrease, since operating expenses in their constant part will not change;

- duration of the production cycle - the shorter it is, the faster the assets will turn over, as a result of which operating costs will be reduced due to, for example, storage of goods, its natural loss, management costs, etc.;

- labor productivity - the more products each worker produces per unit of time, the lower the operating costs for settlements with personnel will be;

- state of production assets - less worn-out equipment requires less money for maintenance and repairs;

- the number of current assets owned by the organization - a company that owns more property will spend less on rent, leasing and contracts, which will also reduce operating costs.

RESULT. Operating expenses—the day-to-day expenses to keep the business running—are classified as “other expenses.” Reducing these costs leads to increased profits for the organization.

Differences in income classification in accounting and tax accounting

In tax accounting, the division into operating and non-operating income is practiced, and this classification does not entirely correspond to the division used for accounting purposes. Thus, some income recognized in accounting cannot be accepted in tax accounting, resulting in permanent differences. Such income will supplement accounting profit, but will not affect the tax indicator. For example:

- the difference between the value of property received as a contribution by a company participant and its value when allocating a share (when a participant leaves the company);

- interest income received from budget funds;

- debt to the budget, written off by decision of the authorities;

- positive revaluation of securities.

You can read about the features of accounting for non-operating income for tax profit in the material “How to take into account non-operating income when calculating income tax?”.

Reflection of balance accounting for other indicators

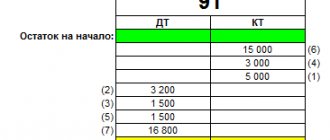

In the system for planning accounts for additional financial transactions, there is a special account numbered 91 “Other income and expenses”. The logical component of this part of the plan clearly displays the result of the movement of money for each transaction performed separately. Each direction has its own open sub-account:

- 91.1 – the figure reflects all the company’s income from other operations

- 91.2 – similar value, only the analysis is carried out according to the criterion of financial outflow

- 91.9 – general balance indicator, which is included in the criteria based on the results of the overall financial result

For a complete analysis of activity, you need to calculate the difference monthly according to the following values:

the amount of credit turnover 91.1 and debit 91.2

Further, the final action is determined according to 91.9 and in accordance with the score 99.

At the end of the movement of working capital, when generating the final report, the 91 accounts themselves and their subsystems must be empty without any remainder.

Attention! Indicators of financial settlements as a result of accidents of a natural nature are not included, but are immediately transferred to account 99 “Profits and losses”.

Why is other income an important component of the income statement?

Other income may affect the financial result of the enterprise. Thus, in case of losses from ordinary activities in combination with other income, the financial result may turn out to be positive.

For example, an organization can issue invoices in dollars and receive payment in rubles at the exchange rate on the day of payment. When the ruble falls, as, for example, during the recent crisis, a significant positive exchange rate difference is formed, which can cover the loss on the usual type of activity.

The opposite situation may arise when accounting for expenses related to other income. Despite the profitability of the main business during the year, due to the high importance of other expenses (related to other income), the income statement will give a negative result. The final report will form a negative impression about the state of affairs at the enterprise for third-party users (bankers, investors, shareholders, potential counterparties).

What other income can be classified as other and how to correctly display them in the financial statements, ConsultantPlus experts explained in detail. Get trial access to the K+ system and go to the Tax Guide for free.

You can read about the features of accounting for other income and expenses in the material “Accounting for other income and expenses (nuances).”

New type of other income and expenses

According to paragraph 11 of FSBU 5/2019, the actual cost of inventories includes the amount of the estimated liability for dismantling, disposal of inventories and environmental restoration arising in connection with the acquisition (creation) of inventories.

An estimated liability must be formed in relation to future costs if the criteria for its recognition are met:

- the obligation is established by the contract;

- expenses will be incurred;

- For evaluation, you can use prices on the market for similar services.

In accordance with FAS 5/2019, the estimated liability is capitalized in the value of inventories.

But the amount of the estimated liability may not coincide with actual expenses. Their excess over the recognized estimated liability should be included in the organization’s other income. And the excess of the estimated liability over expenses should be included in the organization’s other expenses.

The cost of inventory does not change.

Results

The list of income that an accountant must classify as other is given in PBU 9/99, Ch. 3. Among them, in business one often has to deal with income from the sale of assets, from the rental of property, positive exchange rate differences and positive revaluation of property. In most cases, income is taken into account in the amount of actual cash receipts.

To recognize other income, a number of conditions must be met, the main ones being confirmation of the right to income and the measurability of income. There are nuances between accounting and tax accounting of income, when income is recognized in accounting, but does not in any way affect tax profit, as a result of which permanent differences appear.

Recognizing and accurately classifying income is important for correctly determining a company's profit and, as a result, correctly assessing its financial health.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Formula for calculating the balance indicator

The final report of the financial flow of an enterprise can be calculated monthly in order to clearly see the profitability of a particular activity.

To calculate the difference between income and expenses, you need to apply the following formula for other areas of the enterprise:

Kt 91.1 – Dt 91.2

The final value will be the guarantor of the success and well-being of the enterprise. A positive value, even if minimal, is the company’s profit; a figure with a minus sign means that the company’s business is not going so smoothly.

Attention! According to the report for each month, 91 accounts themselves cannot have a balance, but its subaccounts throughout the year are vice versa. The magnitude of their value will increase with each new month.